I. The Welfare Trade-Off of Innovation

In the Northern Pacific decision, Supreme Court Justice Hugo Black declared that the Sherman Act “rests on the premise that the unrestrained interaction of competitive forces will yield the best allocation of our economic resources, the lowest prices, the highest quality and the greatest material progress.”[1] And it was during the Northern Pacific litigation that Kenneth Arrow and Gérard Debreu laid a theoretical foundation on which this premise now rests by demonstrating that a perfectly competitive economy optimally allocates resources.[2] A few years after the Northern Pacific decision, however, Kenneth Arrow also explained that the peculiar economics of information-based commodities, including inventions, prevent a perfectly competitive economy from optimizing the resources allocated to innovation.[3]

Information is a public good in that there is no rivalry in consumption; when one person “consumes” a piece of information, no less information is available to others. Information also can be reproduced at a marginal cost approaching zero,[4] so achieving a socially optimal utilization of information requires making information freely available to everyone without charging anyone. While giving information away optimizes the utilization of information, it undermines the production of information, since no one has a profit incentive to produce information that will be given away.

Although governments provide substantial funding for basic research, the production of information is funded mostly out of fees paid by users of the information, and reliance on such fees precludes efficient utilization of the information. Moreover, the distribution of information can be limited because information derives value from the fact that relatively few people possess it; indeed, a piece of information can have the greatest value when possessed by a single person. Thus, “the unrestrained interaction of competitive forces” cannot be relied upon to “yield the best allocation of our economic resources” with respect to information generally, and with respect to innovation in particular.

Inventors typically are compensated with a share of the proceeds from the sale of goods and services incorporating their inventions.[5] A man who builds a better mousetrap might manufacture it himself and sell it at a premium over inferior mousetraps, or he might license it to a mousetrap manufacturer and receive a royalty on the sale of mousetraps that embody his invention. In either event, the inventor’s reward is a wedge separating the price consumers pay from the marginal cost of production. The existence of that wedge prevents inventions from being utilized as fully as is socially desirable, even if the use of the technology is restricted in no other manner.

Public policy toward innovation confronts a trade-off: Increasing the compensation of successful inventors spurs technical progress but reduces the efficiency of static resource allocation by enlarging the wedge between the prices of goods and services and their marginal costs of production. A key economic insight that guides public policy with respect to this trade-off is that economic growth is the prime driver of social welfare gains. More than a century ago, John Bates Clark and his son John Maurice Clark observed that:

It is not a large present social income that is the chief desideratum but a constantly enlarging income. Progress is in itself the summum bonum in economics, and that society is essentially the best which improves the fastest. No state can be good if it is stationary, or fundamentally bad if it is now advancing at a satisfactory rate. It is the direction and the rate of social progress which afford the supreme test of the quality of an economic system.[6]

More recently, Robert Solow explained that: “Adding a couple of tenths of a percentage point to the growth rate is an achievement that eventually dwarfs in welfare significance any of the standard goals of economic policy.”[7]

Solow was awarded the 1987 Nobel Prize for his contributions to the theory of economic growth. Decades earlier, he presented evidence suggesting that technical progress accounted about seven-eighths of the growth in U.S. GDP between 1909 and 1949.[8] Later research, using different methods, focused on later periods when productivity increased more slowly. That research typically found that technological change accounted for half of GDP growth.[9] And the welfare gains from new technologies surely are undercounted by the GDP, which totes up sales value of goods and services, and not the consumer benefits derived from their consumption.[10]

Capitalist economies, and the United States in particular, have a remarkable track record for developing and implementing new and improved methods of production and new and improved goods and services. The central reason is that innovation is the key to success in marketplace competition. John Bates Clark might have been the first economist to make this observation:

There is a law of survival which, when competition rules, eliminates poor methods and introduces better ones in endless succession. . . . In order to survive, any producer must keep pace with the aggressive and growing ones among his rivals in the march of improvement, whether it comes by improved tools of trade or improved generalship in the handling of men and tools.[11]

Joseph Schumpeter similarly explained that:

The fundamental impulse that sets and keeps the capitalist engine in motion comes from the new consumers’ goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates. . . . This process of Creative Destruction is the essential fact about capitalism.[12]

More recently, William Baumol declared that: “Under capitalism, innovative activity—which in other types of economy is fortuitous and optional—becomes mandatory, a life-and-death matter for the firm . . . The capitalist economy can usefully be viewed as a machine whose primary product is economic growth.”[13]

Another reason for the technological track record of capitalist economies is that inventors are rewarded in rough proportion to their social welfare contributions.[14] Most inventions are neither implemented to any significant extent nor spawn other useful inventions; they generally yield little social benefit and little compensation for inventors. The bulk of the social benefits are associated with the relatively few inventions that are widely utilized, and they generate the bulk of the compensation to inventors. The relationship between social value and compensation is imperfect, however, especially for basic inventions.[15] Basic inventions often are not implemented commercially during the patent term, but follow-on inventions are implemented.[16]

Despite the technological track record of capitalist economies, empirical research generally finds too little investment in research and development.[17] The main reason is that inventors appropriate far less than the entire social value of their inventions. Much of the value of inventions is realized as consumers’ surplus because new and improved goods and services are sold for significantly less than many consumers would be willing to pay for them. In addition, important inventions often lead to other inventions for which the original inventors get no compensation. Finally, patent rights have limited duration and might not prevent all copying during the patent term.

Other factors tend toward overinvestment in research and development. First, competition among inventors results in duplicative efforts, although the competition has the value of introducing inventions sooner. Second, introducing inventions sooner might be all an inventor can achieve, yet the reward system presumes that the invention would not have been introduced at all. Third, new products and new production methods destroy value in assets dedicated to the old products and production methods, and those investing in research and development account for this destruction of value only to the extent that they own assets that are destroyed.

II. Economic Rationale of the Patent System

The public policy of the United States has always been to aide inventors and authors. The Constitution granted Congress the power “[t]o promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries.”[18] By defining intellectual property rights, patent and copyright law have helped inventors and authors appropriate a significant share of the value of their inventions and writings.

The U.S. patent system “promote[s] the Progress of Science and useful Arts” in two distinct ways: 1. Protecting inventors’ property rights increases the rewards to invention, thereby increasing research and development and enhancing the pace of technical change. 2. To further stimulate invention, patent protection is given only in exchange for immediate disclosure of inventions, many of which otherwise would be kept secret.[19] The patent system’s plan to facilitate invention by encouraging disclosure was premised on the historical observation that scientists and inventors have built on the work of those who came before them. Sir Isaac Newton famously wrote: “If I have seen further it is by standing on the shoulders of giants.”[20]

The Supreme Court has always recognized both rationales. In 1829 Justice Joseph Story declared that “one great object” of the Patent Act was “to stimulate the efforts of genius” by providing “a reasonable reward to inventors,” while the “main object” was “to promote the progress of science and useful arts” by “giving the public at large a right to make, construct, use, and vend the thing invented, at as early a period as possible,” which requires that an inventor not be permitted “to hold back from the knowledge of the public the secrets of his invention.”[21] In 1998, the Supreme Court more succinctly stated that “the patent system represents a carefully crafted bargain that encourages both the creation and the public disclosure of new and useful advances in technology, in return for an exclusive monopoly for a limited period of time.”[22]

Mainstream economic thought has long held that some protection from copying is essential to incentivize applied research and development.[23] John Bates Clark declared: “Not only on a priori grounds, but on grounds of actual experience and universal practice, we may say that patents are an indispensable part of a dynamic system of industry.”[24] He explained:

Why should one entrepreneur incur the cost and the risk of experimenting with a new machine if another can look on, ascertain whether the device works well or not, and duplicate it if it is successful? Under such conditions the man who watches others, avoids their losses, and shares their gains is the one who makes money; and the system which gave a man no control over the use of his inventions would result in a rivalry in waiting for others rather than an effort to distance others in originating improvements. This fact affords a justification for one variety of monopoly. The inventor in any civilized state is given an exclusive right to make and sell an economical appliance for a term of years that is long enough to pay him for perfecting it and to pay others for introducing it. Patents stimulate improvement, and the general practice of the nations indicates their recognition of this fact.[25]

Clark observed that patents act as both a shield and a sword in the competitive arena:

While a patent may sometimes sustain a powerful monopoly it may also afford the best means of breaking one up. Often have small producers, by the use of patented machinery, trenched steadily on the business of great combinations, till they themselves became great producers, secure in the possession of a large field and abundant profit.[26]

This is not to say that the stream of new inventions would dry up without patent protection. The authors of the classic study, The Sources of Invention, stressed the variety of paths taken by inventions.[27] Major inventions sometimes are made without incurring large costs; secrecy sometimes is preferred to disclosure; and imitation sometimes is difficult. But patent protection certainly attracts resources into research and development, which is bound to increase the pace of invention. Nevertheless, some economists doubt that patents do much to increase the pace of invention,[28] and others argue that aspects of the patent system have the opposite effect.[29]

III. The Patent-Antitrust Intersection

In the mid–20th Century, patent and antitrust law generally were understood to work at cross purposes. The Supreme Court rationalized the two bodies of law by reading patent law to create a statutory antitrust exemption,[30] which like all antitrust exemptions was construed narrowly.[31] The Supreme Court explained that: “The patent laws . . . are in pari materia with the antitrust laws and modify them pro tanto.”[32] But a modern view of the patent-antitrust intersection emerged with the work of Ward Bowman. His influential 1970s monograph began by explaining:

Antitrust and patent law are frequently viewed as standing in diametric opposition. How can there be compatibility between antitrust law, which promotes competition, and patent law, which promotes monopoly? In terms of the economic goals sought, the supposed opposition between these laws is lacking. Both antitrust law and patent law have a common economic goal: to maximize wealth by producing what consumers want at the lowest cost.[33]

Although the Supreme Court has not yet adopted the modern view,[34] the Federal Circuit, which exercises exclusive jurisdiction over patent appeals, did so in the 1980s: “The patent system, which antedated the Sherman Act by a century, is not an ‘exception’ to the antitrust laws, and patent rights are not legal monopolies in the antitrust sense of that word.”[35] “[T]he aims and objectives of patent and antitrust laws may seem, at first glance, wholly at odds. However, the two bodies of law are actually complementary, as both are aimed at encouraging innovation, industry and competition.”[36] The patent-antitrust intersection is the locus of tension in antitrust law, but it is the inherent tension between static and dynamic competition, and between static and dynamic economic efficiency.

A patent holder normally requires no exception from Section 2 of the Sherman Act because it prohibits neither monopoly nor charging monopoly prices. As Justice Scalia explained:

The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system. The opportunity to charge monopoly prices—at least for a short period—is what attracts “business acumen” in the first place; it induces risk taking that produces innovation and economic growth. To safeguard the incentive to innovate, the possession of monopoly power will not be found unlawful unless it is accompanied by an element of anticompetitive conduct.[37]

And patent licensing does not offend Section 1 of the Sherman Act just by failing to create competition. Judge William Howard Taft explained in 1898 that, “to promote the free purchase and sale of property,” the common law permitted a man to guard against an “increase of competition of his own creating.”[38] Antitrust law has operated on much the same principle: Only conduct that harms the competitive process can be redressed.[39]

The “antitrust laws do not negate the patentee’s right to exclude others from patent property.”[40] As explained by the Federal Circuit in CSU, L.L.C. v. Xerox Corp., a patent infringement action can give rise to an antitrust claim only if “the asserted patent was obtained through knowing and willful fraud” or if “the infringement suit was a mere sham to cover what is actually no more than an attempt to interfere directly with the business relationships of a competitor.”[41] An antitrust scholar protested that the Federal Circuit’s “approach prevents antitrust from playing any legitimate role in the attempt to increase welfare.”[42] But it was not the Federal Circuit’s approach that did that: Antitrust law never empowered courts to do whatever might increase welfare.

Although a “patent empowers the owner to exact royalties as high as he can negotiate with the leverage of that monopoly[],”[43] holders of standard essential patents contract away that power when they commit to license on FRAND (fair, reasonable, and non-discriminatory) terms. A FRAND commitment can be enforced by standards implementers as third-party beneficiaries to the contract,[44] and breaching a FRAND commitment does not violate antitrust law.[45] Antitrust law protects the competitive process, and breaching a FRAND commitment normally harms no competitive process.[46] The D.C. Circuit rejected the FTC’s contention that deception to avoid a FRAND commitment was anticompetitive conduct even absent any impact on competition among technologies,[47] and no circuit has held to the contrary.

IV. Economic Insights on Innovation and Patents

Kenneth Arrow analyzed the incentive to invest in an innovation that reduces the marginal cost of production. He showed that a monopolist completely protected from competition and unable to price discriminate in the sale of its product would innovate less than is socially optimal.[48] The monopolist would have too little incentive to invest for the simple reason that it produces less than the socially optimal quantity, which concomitantly reduces the benefit of a reduction in unit production cost.

Richard Gilbert and David Newbery analyzed a stylized innovation competition between a potential entrant and a monopoly incumbent producer that owns the current technology.[49] They bid against each other to acquire a patent for a new technology that reduces marginal cost. If the incumbent wins the auction, it remains a monopoly producer; if the potential entrant wins the auction, it becomes the lower-cost producer in a duopoly market. Gilbert and Newbery showed that the monopolist will outbid the potential entrant and introduce the new technology to preempt duopoly competition.

The foregoing results highlight the two opposing forces that drive the relationship between monopoly and innovation. Monopoly profits provide an incentive for a monopolist to innovate when necessary to retain the monopoly, but the output reduction due to monopoly creates a disincentive for innovation by a monopolist. Depending on the precise question posed and assumptions made, monopoly can be said either to enhance or retard innovation.

Jennifer Reinganum analyzed oligopolistic competition through uncertain research and development, assuming that a successful innovator captured a large share of the market.[50] With perfect patent protection, she showed that increasing the number of symmetric firms competing to innovate increased not just the total investment in research and development, but also each firm’s investment. With imperfect patent protection, which allows imitators to appropriate some of the value of an innovation, she found that the effect of increased competition on innovation was ambiguous.[51]

The patent system raises many policy issues, and economic theory offers insights on all of them. The most important issue might be what should be patentable, and on that question, economic theory has the least to say. The main economic insight is that patents should be granted only when necessary to generate the investment needed to produce an invention.[52] This insight is consistent with patent law’s nonobviousness requirement.[53] Economic theory has had more to say about patent length and breadth, but as is so often is the case, economics shows that the best policy depends on the circumstances, so patent length and breadth should differ for different inventions.[54] For example, William Nordhaus showed that optimal patent length for processes is greater for inventions that drastically lower cost than for inventions that marginally lower costs,[55] and Paul Klemperer argued that the optimal trade-off between length and breadth of utility patents depends on the degree of heterogeneity in willingness of consumers to substitute to alternatives outside the scope of the patent.[56]

A large economics literature has empirically examined the inter-industry relationship between market structure and either the inputs to innovation (e.g., research and development expenditures) or indicia of innovative output (e.g., patents). Although the studies could not observe innovation directly, they generally claimed support for the “inverted-U” hypothesis, i.e., that innovation is greatest with moderate market concentration, while the most and least concentrated market structures exhibit less innovation.[57] Recent studies of innovation within a single industry over time have avoided some of the problems inherent in the prior inter-industry studies, and they found that mergers reduced innovation.[58] Recent research garnering much publicity concludes that 5.3–7.4% of pharmaceutical mergers are “killer acquisitions” that cause the drugs in Phase I development not to proceed to Phase II.[59]

Economists have employed several notable surveys to investigate aspects of the patent system. A survey conducted by Edwin Mansfield in the early 1980s asked respondents what percentage of their new products would not have been developed absent patent protection.[60] He found that the percentage varied from 60% in pharmaceuticals and 38% in chemicals down to 0% in several industries. Contemporaneously, a survey conducted by Yale economists also found that the importance of patents varied greatly across industries, and it found that first-mover advantages were the most important means, overall, for appropriating the value of innovation.[61]

Roughly a decade later, Carnegie Mellon researchers got the same general findings as the Yale economists using an improved survey methodology.[62] The Carnegie Mellon researchers, however, found that patents had become more important since the Yale survey, and they found that the importance of secrecy had increased even more than the importance of patents. A 2008 survey conducted by researchers at Berkeley found similar results for high-technology start-ups, although those firms viewed patents as more important than the large firms previously surveyed.[63]

A review of the surveys and other economic literature concluded that the most robust findings were that the use of patents is highly heterogeneous across industries and that patents were most important in the pharmaceutical and chemical industries.[64] Another robust finding was that firms in nearly all other industries rely more on informal protection mechanisms, especially first-mover advantages. In addition, firms treat various protection mechanisms as complementary and use multiple methods.

Economists have used a variety of methods to determine whether patent protection actually encourages innovation. Petra Moser focused on technology exhibitions beginning with London’s 1851 Great Exhibition in the Crystal Palace.[65] She found that relatively few of the inventions on display were patented, and that countries without patent protection contributed many prize-winning inventions. On the other hand, she also found evidence that inventive activity in countries without patent protection was concentrated in industries that did not rely on patents for appropriability. She also found that late 19th Century advances in chemistry had made reverse engineering easy in the chemical industry and thus made patent protection important.[66]

Economists also have used cross-country comparisons to examine the impact of increased patent protection. Josh Lerner examined changes in the rate of patent applications associated with 177 changes in patent protection across 60 countries and 150 years.[67] He found that stronger patent protection had not increased patenting, and he concluded that reason could be measurement problems and could be an absence of a direct link between patent protection and invention. Yi Qian looked only at the pharmaceutical industry, in which patents were known to be important. Using patent citations to weight their significance, she found no effect when a country introduced patent protection.[68]

One controversy in patent policy is whether the disclosure function of the patent system works as intended, and some legal scholars have argued that it does not.[69] Survey evidence, however, finds that patents are an important source of information for U.S. inventors,[70] especially in biotechnology and chemistry.[71] In addition, Deepak Hegde and Hong Luo found that accelerating disclosure under the 1999 American Inventors Protection Act (AIPA) caused biomedical patents to be licensed, on average, ten months sooner.[72] Deepak Hegde, Kyle Herkenhoff, and Chnqi Zhu estimated that the AIPA caused patenting and research and development investment to increase by about 6%.[73] Current research finds that the government’s program to establish a Patent and Trademark Depository Library in each state led to a substantial increase in patenting,[74] and that temporary secrecy during World War II reduced follow-on innovation.[75]

Another controversy in patent policy is whether, on balance, patents enhance or retard follow-on innovation. Michael Heller and Rebecca Eisenberg gained notoriety by asserting that a proliferation of biomedical patents resulted in splintered and overlapping ownership rights effectively preventing researchers from standing on anyone’s shoulders, and by dubbing this as the “anticommons.”[76] Recent contributions to the debate have observed that voluntary cooperation often avoids the anticommons problem.[77] In addition, survey evidence indicates that patents are less a hinderance in biomedical research than access to cell lines, reagents, and unpublished information.[78] Empirical research by Bhaven Sampat and Heidi Williams found that gene patents had no impact on follow-on innovation.[79]

Controversy over whether patents enhance or retard follow-on invention is not limited to biomedical patents. Some scholars have argued that “patent thickets” in other industries frustrate product market competition and innovation.[80] However, an analysis of patent litigation data by Alberto Galasso and Mark Schankerman found that patent thickets were associated with more rapid resolution of litigation, although that effect was diminished substantially by the 1982 creation of the Federal Circuit and the resulting strengthening of patent rights.[81] In later work, Galasso and Schankerman found that the Federal Circuit’s invalidation of patents increased citations to the invalidated patents in subsequent patents, although only in computers and communications, electronics, and medical devices.[82] Thus, those industries might have problematic patent thickets.

V. Inventors’ Fair Share

Patent royalties are negotiated in the shadow of possible infringement litigation, as anyone found to have infringed a valid patent is ordered to pay damages that are no less than a reasonable royalty.[83] In addition, courts sometimes determine what does, or does not, constitute a reasonable royalty in litigation arising under FRAND commitments. In this later context, courts have tended to take a “top down” approach by first determining an appropriate aggregate percentage royalty for all patents practiced in implementing a standard.[84] We analyze the closely related problem of how inventors and implementers divide the joint gain or “surplus” from their licensing agreements. Any such division could be implemented through a percentage royalty.[85]

It might make sense for all of the inventors and implementers associated with a standard to agree on royalties before a standard is set, but they do not.[86] Nor do standard setting organizations provide a forum for later discussions of royalties or the fair division of the gains from implementing technology subject to a standard. One reason that inventors and implementers do not all negotiate collectively is the risk of an antitrust suit alleging a Sherman Act violation. A judge might (wrongly) construe the joint negotiations as per se illegal price fixing.

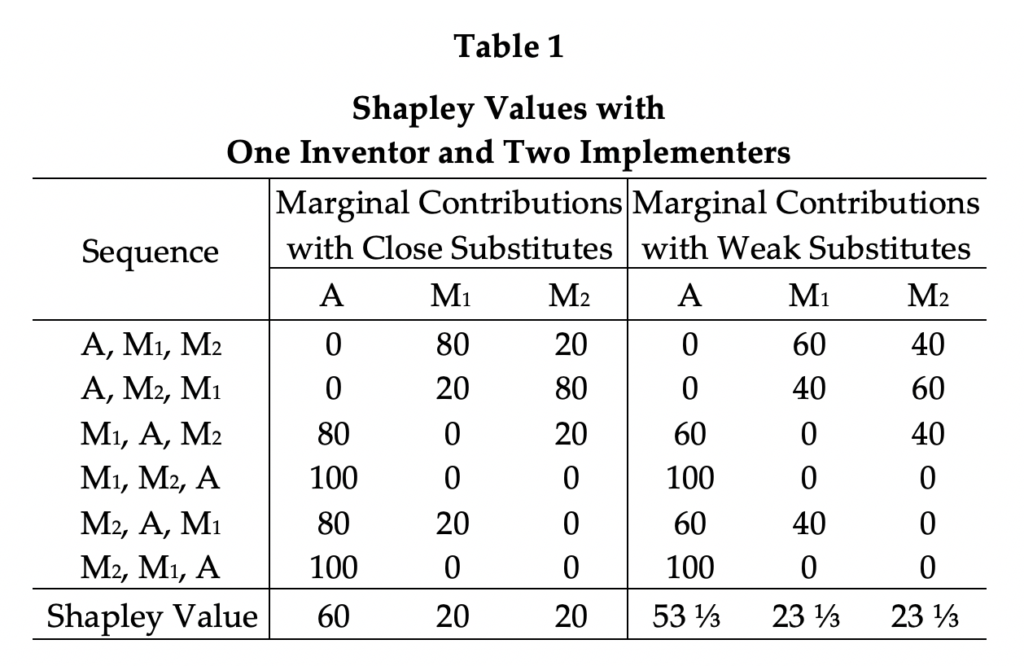

Cooperative game theory offers solutions to the problem of fairly allocating a surplus generated by cooperation, and one such solution presumably would be the outcome of all-inclusive royalty negotiations. The only solution having certain reasonable properties is the Shapley Value,[87] which gives each party a share of the surplus proportional to that party’s marginal contribution to the surplus. What this means can be seen through a simple example involving an inventor, A, and two symmetric licensees, M1 and M2—manufactures implementing the invention.

To make matters concrete, we use a numerical example in which licensing both manufacturers produces a surplus of 100, which derives from profitable sales of their products. If the manufacturers’ products are perfect substitutes, licensing either of them also generates the full surplus of 100, and if the manufacturers’ products are not substitutes at all, licensing either of them generates a surplus of 50, as an implication of the symmetry assumption. We consider two intermediate cases: With “close substitutes,” licensing either M1 or M2 generates a surplus of 80, and with “weak substitutes,” licensing either M1 or M2 generates a surplus of 60.

Table 1 computes the Shapley Values for these two cases. The marginal contributions are defined by imagining that the parties act in sequence and attributing the full surplus from an agreement to whichever party to the agreement comes later in the sequence and thus makes the agreement possible. Consider the sequence A, M1, M2: With A coming first, it makes no contribution because no surplus is generated unless A reaches agreement with one of the manufacturers. With M1 coming after A, it makes the first agreement possible and thus makes a marginal contribution of 80 with close substitutes and 60 with weak substitutes. With M2 coming last, it makes a smaller marginal contribution of 20 or 40 by making the second agreement possible. The Shapley Value of the game is the arithmetic mean of the marginal contributions of the three parties over all possible sequences, as shown in the last row of Table 1.

The Shapley Value was proposed as a solution to a cooperative game, but real-world inventors and implementers do not engage in multilateral bargaining.[88] It turns out, however, that the Shapley Value is a solution to some noncooperative games with bilateral bargaining.[89] We will return to the Shapley Value after exploring the economic theory of noncooperative bilateral bargaining. This theory was pioneered by John F. Nash, Jr.,[90] and its central teaching is the maxim—“the alternatives to agreement determine the terms of agreement.” To get its fair share of the surplus, each party threatens to walk away from the bargaining table. The potency of a party’s threat is determined by its best alternative to reaching agreement, and both parties are assumed to be fully informed about the alternatives and associated payoffs. Each party’s payoff absent the agreement under negotiation is its “threat point.”

To illustrate how the threat points affect the terms of agreement, we posit an inventor that can generate a profit of 40 by implementing an invention itself. The inventor’s threat point, thus, is 40. We also posit a manufacturer that cannot produce a product implementing the invention without a license, nor can it use freely available technology to produce a close substitute. The manufacturer’s threat point, thus, is 0. Finally, we posit that the manufacturer can generate a profit of 100 (before royalties) by implementing the invention under a license. As compared with the threat points, agreement between the two parties generates an incremental surplus of 60. Nash bargaining theory predicts that the surplus is divided equally, and the inventor also gets the 40 it earns absent agreement. Thus, the manufacturer pays the inventor 70 out of the proceeds from selling the patented product and retains a net profit of 30.

Externalities complicate bargaining when the surplus generated by one agreement serves as a threat point for other agreements, as often is true with technology licensing. To account for externalities, economists have developed generalizations of Nash bargaining theory. We apply what was dubbed the Nash-in-Shapley solution in which the parties enter into bilateral agreements that give the parties the Shapley Value. The agreements emerge from “bargaining competition,” in which inventors have the opportunity to enter into bilateral agreements with some but not necessarily all potential implementers, and in which implementers have the opportunity to enter into bilateral agreements with some but not necessarily all inventors.

The process of bargaining competition is in equilibrium when every inventor and every implementer is happy about which agreements it has entered into and as to their terms, in view of all other actual or potential agreements. Economic theory does not specify a dynamic process through which equilibrium is reached, but we can imagine that all agreements are subject to renegotiation and that the parties iterate to equilibrium. Alternatively, we can imagine that the parties reach equilibrium in one step by negotiating bilateral contingent contracts that specify distinct terms for each possible set of other bilateral agreements that could be reached.

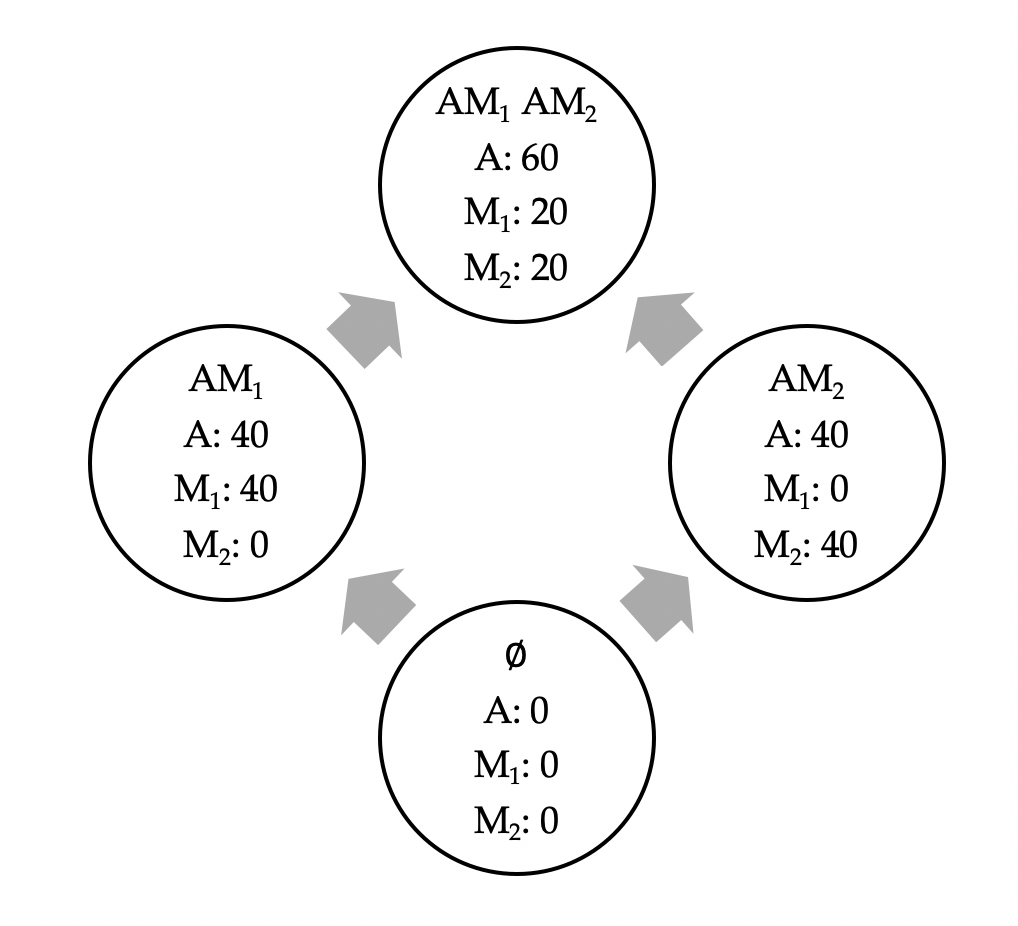

Using the diagram above,[91] we now reexamine the scenario analyzed in Table 1 through the lens of bargaining competition, and we first consider the close substitutes case. The bottom circle represents the absence of agreement, signified by the symbol for the null set, ∅. Each party gets 0. The arrows emanating from the bottom circle reflect that it is the threat point for the two agreements at the next level above. Agreement between A and M1, signified AM1, is represented by the left circle, and agreement between A and M2, signified AM2, is represented by the right circle. With either agreement, the parties reaching agreement equally split the surplus of 80. The top circle represents A reaching agreement with both manufacturers. As A bargains with M2, the left circle is the threat point, and as A bargains with M1, the right circle is the threat point, both as indicated by the top two arrows. In both threat points, A gets 40 more than the manufacturer with which it is bargaining, so the payoffs when both agreements are reached must satisfy A = M1 + 40 = M2 + 40. The parties divide the total surplus of 100, which provides a third equation that must hold in equilibrium: A + M1 + M2 = 100. The solution is the Shapley Value: A = 60, M1 = M2 = 20.

In the weak substitutes case, the surplus generated by a single agreement is 60, and the marginal surplus from a second agreement is 40. With the manufacturers’ products being weaker substitutes, the inventor’s threat point is just 30 (half of 60). The equations that must be solved for the equilibrium payoffs are A = M1 + 30 = M2 + 30 and A + M1 + M2 = 100. The solution again is the Shapley Value: A = 53 ⅓, M1 = M2 = 23 ⅓. The main insight from the two forgoing examples is that the inventor benefits from competition among implementers, and the intensity of that competition relates to both the number of implementors and the substitutability of their products in the downstream market.

Now, consider the case of two complementary inventors, A and B, bargaining with one implementer, M, and assume that inventors cannot themselves produce a marketable product. The analysis of this case is simple because the technologies are strictly complementary; a single agreement between A and M or between B and M has a payoff of 0, just as no agreement. Only the party that comes last in the sequence makes any marginal contribution, so the parties share the joint surplus equally. This means that two-thirds of the surplus goes to the two inventors. This insight can be highly significant in FRAND disputes involving telecommunications technology because multiple parties typically hold complementary standard essential patents.

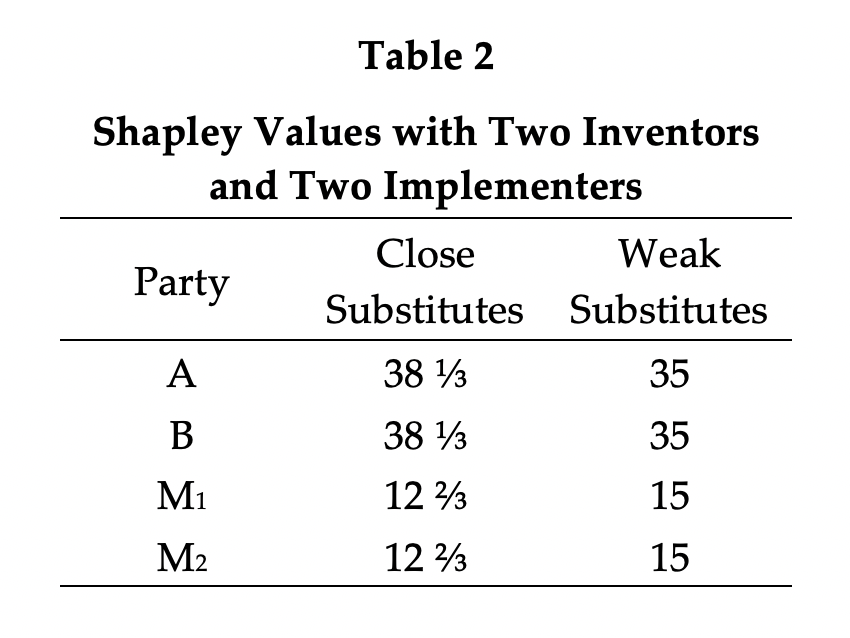

Finally, consider the case of two complementary inventors, A and B, bargaining with manufacturers of substitute products, M1 and M2. Because the inventions are entirely complementary, this case is much like the case of one inventor and two implementers. With the numerical values assumed above, the Shapley Values are shown in Table 2.

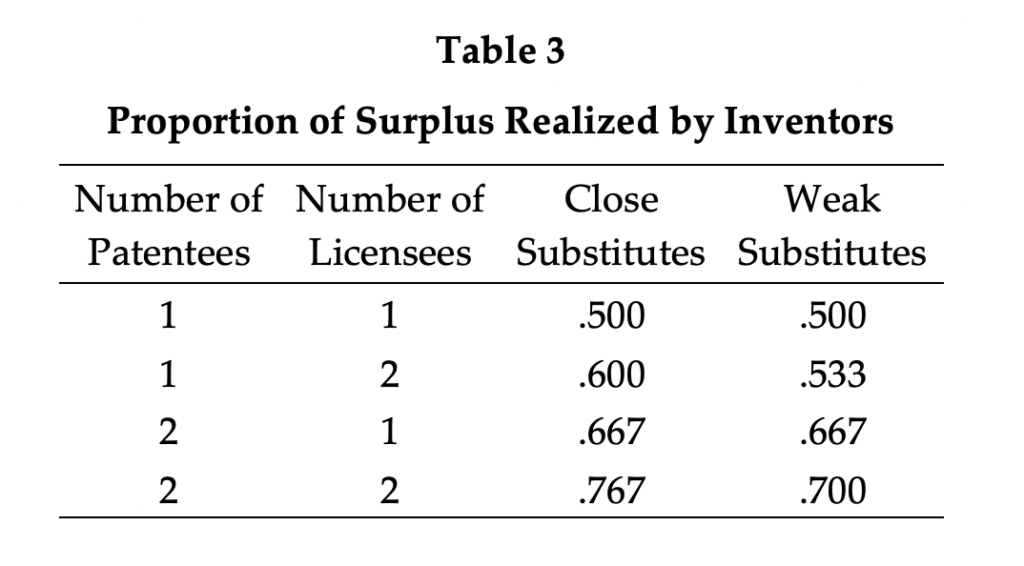

Key insights from the foregoing can be seen in Table 3, which recapitulates the proportion of the surplus realized by inventors in all the examples. This proportion increases with the intensity of product market competition among implementers, and it increases with the number of separate inventions that must be licensed to produce a successful product. Critically, the division of the surplus tilts more toward inventors the more of them are needed for successful implementation.

“The purpose of the FRAND requirements . . . is to confine the patentee’s royalty demand to the value conferred by the patent itself as distinct from the additional value—the hold-up value—conferred by the patent’s being designated as standard-essential.”[92] Thus, a FRAND royalty is the amount that would have been produced in bargaining “just before the patented invention was declared essential to compliance with the industry standard.”[93] A theory of bargaining competition could prove useful in disputes over FRAND licensing commitments, even if calculating the Shapley Value would be challenging because the threat points cannot be observed directly.

A standard essential technology might have had a good substitute when the standard was set. In bargaining competition just before the standard is set, owners of technologies with good substitutes get small shares of the surplus because they make small marginal contributions. If every technology incorporated into a standard had a good substitute, the inventors’ aggregate fair share of surplus could be much less than half; however, the inventors’ aggregate share would be more than half if any standard essential technology had no good substitutes when incorporated into the standard, and that condition seems likely to hold for most standards.

Conclusion

Public policy toward innovation faces a trade-off: Increasing the compensation of successful inventors increases dynamic efficiency by spurring technological progress, but it decreases static efficiency by enlarging a wedge between price and marginal cost. In making this trade-off, public policy is guided by two insights—economic growth is the prime driver of social welfare gains, and technological progress is the prime driver of economic growth. Patent and copyright law, therefore, were designed to help inventors and authors appropriate a significant share of the value of their inventions and writings. Antitrust law neither revokes nor restricts any right granted by patent law, and antitrust law can contribute little in resolving disputes arising from commitments to license on FRAND terms.

Economic theory and empirical research into innovation and the patent system reveal a complex and varied landscape. Two robust conclusions are that too little is invested in innovation and that both the innovation process and the role of patents in the process vary greatly across industries and inventions. Depending on the precise question posed, theory predicts that monopoly can enhance or retard innovation, and data generally support the hypothesis that both monopolies and unconcentrated markets are relatively inhospitable to innovation. Although patents are critical to innovation in the pharmaceutical and chemical industries, they are unimportant in many industries, and patent protection generally has been found to have no effect on the pace of innovation.

The application of bargaining theory potentially can go a long way toward solving contentious disputes between inventers and implementors on the division of the gains from the introduction of new technologies. In principle, bargaining theory provides a concrete solution to the problem of determining a FRAND royalty, i.e., the royalty that would have come out of bargaining just before a patented invention was incorporated into a standard. The abstract application of bargaining theory in Section V of this chapter suggests that inventors should get most of the gains from introducing new technology, although many commentators have presumed quite the opposite.

Footnotes

[1] N. Pac. Ry. Co. v. United States, 356 U.S. 1, 4 (1958).

[2] Kenneth J. Arrow & Gérard Debreu, Existence of an Equilibrium for a Competitive Economy, 22 Econometrica 265 (1954). Arrow and Debreu proved that the equilibrium for an entire competitive economy (as opposed to a single competitive market) is Pareto optimal, i.e., no one in the economy can be made better off without making someone worse off.

[3] Kenneth J. Arrow, Economic Welfare and the Allocation of Resources for Invention, in The Rate and Direction of Inventive Activity 609, 622–24 (Richard R. Nelson ed., 1962).

[4] Arrow additionally posited that a purchaser of information could not know its value without examining it closely, and that markets, consequently, would be unable to price information accurately. Id. at 615.

[5] If an invention is sold outright to someone who licenses to implementers, the acquiror steps into the inventor’s shoes and typically shares in the proceeds from the sale of goods and services. Particularly in the digital economy, the reward to invention sometimes is indirect: Services produced using an invention are given away, but revenue is generated by selling advertising or ancillary goods and services.

[6] John Bates Clark & John Maurice Clark, The Control of Trusts 134–35 (1912).

[7] Robert M. Solow, Lecture for the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1987: Growth Theory and After (Addendum, Aug. 2001), https://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/1987/solow-lecture.html.

[8] Robert M. Solow, Technical Change and the Aggregate Production Function, 39 Rev. Econ. & Stat. 312, 314–15 (1957). Follow-on research refined Solow’s analysis, but did not overturn his basic conclusion. See Richard R. Nelson, Research on Productivity Growth and Productivity Differences: Dead Ends and New Departures, 19 J. Econ. Literature 1029 (1981).

[9] See, e.g., Charles I. Jones, Sources of U.S. Economic Growth in a World of Ideas, 92 Am. Econ. Rev. 220 (2002); Michael J. Boskin & Lawrence J. Lau, Capital, Technology, and Economic Growth, in Technology and the Wealth of Nations 17 (Nathan Rosenberg et al. eds., 1992). During the 1990s, improvements in information technology were found to have contributed more than half of the increase in industrial productivity in the United States. Stephen D. Oliner & Daniel E. Sichel, The Resurgence of Growth in the Late 1990s: Is Information Technology the Story?, 14 J. Econ. Persp. 3, 18–19 (2000).

[10] For further discussion of GDP and the digital economy, see Avinash Collis, Consumer Welfare in the Digital Economy, in The GAI Report on the Digital Economy (2020).

[11] John Bates Clark, Essentials of Economic Theory 368–69 (1907).

[12] Joseph A. Schumpeter, Capitalism, Socialism and Democracy 82–83 (Taylor & Francis e-Library 2003) (1943).

[13] William J. Baumol, The Free Market Innovation Machine: Analyzing the Growth Miracle of Capitalism 1 (2002). Baumol distinguished invention from innovation, which implements invention in a tangible way. He argued that capitalism has excelled in innovation. Id. at 10.

[14] See William F. Baxter, Legal Restrictions on Exploitation of the Patent Monopoly: An Economic Analysis, 76 Yale L.J. 267, 313 (1966) (“The only justification for using monopoly as opposed to direct government subsidy to induce innovation is to utilize the competitive processes of the private economy to assess and reward proportionately the value of each particular invention.”).

[15] See, e.g., Arrow, supra note 3, at 618 (“Thus basic research, the output of which is only used as an informational input into other inventive activities, is especially unlikely to be rewarded. In fact, it is likely to be of commercial value to the firm undertaking it only if other firms are prevented from using the information obtained. But such restriction on the transmittal of information will reduce the efficiency of inventive activity in general and will therefore reduce its quantity also.”).

[16] Examples of basic inventions that did not generate much short-term financial benefit are the transistor and the laser.

[17] See, e.g., Charles I. Jones & John C. Williams, Too Much of a Good Thing? The Economics of Investment in R&D, 5 J. Econ. Growth 65, 75–76 (2000); Charles I. Jones & John C. Williams, Measuring the Social Return to R&D, 113 Q.J. Econ. 1119, 1132–34 (1998).

[18] U.S. Const., art. I, § 8, cl. 8. For early debates on rationales for patents, see generally Fritz Machlup & Edith Penrose, The Patent Controversy in the Nineteenth Century, 10 J. Econ. Hist. 1 (1950).

[19] For many years, inventors could delay disclosure by not filing patent applications until their inventions became commercial. They faced no risk of losing priority to another patent application because a patent could be awarded only to the first to invent. Inventors also could drag out the application process, thereby extending patent protection and postponing disclosure. Beginning March 16, 2013, the United States followed the rest of the world in awarding patent to the first to file. Leahy-Smith America Invents Acts, 35 U.S.C. § 102(a) (2018). And patent applications filed after November 29, 2000 generally have been published 18 months after filing even if no patent had issued. American Inventors Protection Act of 1999, 35 U.S.C. § 122(b) (2018).

[20] Letter from Isaac Newton to Robert Hooke (Feb. 5, 1675), https://digitallibrary.hsp.org/index.php/Detail/objects/9792. For a discussion of earlier versions of the adage, see Umberto Eco, Foreword to Robert K. Merton, On the Shoulders of Giants: A Shandean Postscript, at xiii–xv (1993) (1965).

[21] Pennock v. Dialogue, 27 U.S. (2 Pet.) 1, 19 (1829). Chief Justice John Marshall explained that a patent is “the reward stipulated for the advantages derived by the public for the exertions of the individual [inventor], and is intended as a stimulus to those exertions.” Grant v. Raymond, 31 U.S. (6 Pet.) 218, 242 (1832).

[22] Pfaff v. Wells Elecs., Inc., 525 U.S. 55, 63 (1998). See also Bonito Boats, Inc. v. Thunder Craft Boats, Inc., 489 U.S. 141, 150–51 (1989) (“The federal patent system . . . embodies a carefully crafted bargain for encouraging the creation and disclosure of new, useful, and nonobvious advances in technology and design in return for the exclusive right to practice the invention for a period of years.”).

[23] For a comprehensive, but dated, review of economic thought on the patent system, see Fritz Machlup, An Economic Review of the Patent System 22–44 (Study No. 15 of the Subcomm. on Patents, Trademarks, and Copyrights of the Senate Comm. on the Judiciary, 85th Cong., 2d sess., 1958). For a recent review, see Adam Karbowski & Jacek Prokop, Controversy Over the Economic Justifications for Patent Protection, 5 Procedia Econ. & Fin. 393 (2013).

[24] Clark, supra note 11, at 366.

[25] Id. at 360. Irving Fisher, who has been called the greatest economist the United States ever produced, similarly explained that, when a “business involves a large sunk cost,” the fear of imitative competition will cause firms to “avoid sinking capital in the enterprise” and that it “is largely in recognition of this fact and in order to encourage such investment that patents and copyrights are given.” Irving Fisher, Elementary Principles of Economics 331 (1912). And the magnum opus of libertarian icon Ludwig von Mises argued that “inventors . . . and authors . . . are burdened with the costs of production, while the services of the product they have created can be gratuitously enjoyed by everybody . . . If there are neither copyrights nor patents, the inventors and authors . . . have the chance to earn profits [only] in the time interval until . . . the invention or the content of the book are publicly known.” Ludwig von Mises, Human Action: A Treatise on Economics 657 (Scholars Edition 1998) (1949).

[26] Clark, supra note 11, at 367–68.

[27] See generally John Jewkes, David Sawers & Richard Stillerman, The Sources of Invention (2d ed. 1969).

[28] Empirical evidence cited in Section IV of this chapter typically does not find that patents promote innovation.

[29] See, e.g., Joseph E. Stiglitz, Economic Foundations of Intellectual Property Rights, 57 Duke L.J. 1693 (2008).

[30] See Walker Process Equip., Inc. v. Food Mach. & Chem. Corp., 382 U.S. 172, 177 (1965) (a patent “is an exception to the general rule against monopolies” (quoting Precision Instrument Mfg. Co. v. Auto. Maint. Mach. Co., 324 U.S. 806, 816 (1945)); United States v. Line Material Co., 333 U.S. 287, 309 (1948) (“The Sherman Act was enacted to prevent restraints of commerce but has been interpreted as recognizing that patent grants were an exception.” (citing E. Bement & Sons v. Nat’l Harrow Co., 186 U.S. 70, 92 (1902)).

[31] See Brief for the United States as Amicus Curiae Supporting Petitioner at 6, Gen. Talking Pictures Corp. v. W. Elect. Co., 305 U.S. 124 (1938) (No. 38-1) (“A grant of monopoly is an exception to the general law against restraints in trade. As such an exception the patent privilege should be construed strictly.” (capitalization altered)) (brief signed by Solicitor General Robert H. Jackson and Assistant Attorney General Thurman Arnold).

[32] Simpson v. Union Oil Co. of Cal., 377 U.S. 13, 24 (1964).

[33] Ward S. Bowman, Jr., Patent and Antitrust Law 1 (1973).

[34] See FTC v. Actavis, Inc., 570 U.S. 136, 160 (2013) (“A patent carves out an exception to the applicability of antitrust laws.”) (Roberts, C.J., dissenting).

[35] Am. Hoist & Derrick Co. v. Sowa & Sons, Inc., 725 F.2d 1350, 1367 (Fed. Cir. 1984).

[36] Atari Games Corp. v. Nintendo of Am., Inc., 897 F.2d 1572, 1576 (Fed. Cir. 1990).

[37] Verizon Commc’ns Inc. v. Law Offices of Curtis V. Trinko, LLP, 540 U.S. 398, 407 (2004).

[38] United States v. Addyston Pipe & Steel Co. 85 F. 271, 281 (6th Cir. 1898).

[39] See NYNEX Corp. v. Discon, Inc., 525 U.S. 128, 135 (1998) (holding that, even in a per se case, a plaintiff “must allege and prove harm, not just to a single competitor, but to the competitive process, i.e., to competition itself”); Gregory J. Werden, The Foundations of Antitrust: Events, Ideas, and Doctrines 249 (2020) (“The [Supreme] Court has always articulated and applied the rule of reason in a manner that makes the dispositive issue the impact of the conduct on the competitive process, not the impact of the conduct on concrete measures of market performance.”). See also Geneva Pharm. Tech. Corp. v. Barr Labs. Inc., 386 F.3d 485, 489 (2d Cir. 2004) (“The antitrust laws, however, safeguard consumers by protecting the competitive process.”); Clamp-All Corp. v. Cast Iron Soil Pipe Inst., 851 F.2d 478, 486 (1st Cir. 1988) (Breyer, J.) (antitrust law reserves the label “anticompetitive” for “actions that harm the competitive process”).

[40] Intergraph Corp. v. Intel Corp., 195 F.3d 1346, 1362 (Fed. Cir. 1999). See Schering-Plough Corp. v. FTC, 402 F.3d 1056, 1067 (11th Cir. 2005) (“a patent holder does not incur antitrust liability when it chooses to exclude others from producing its patented work”); Abbott Labs. v. Brennan, 952 F.2d 1346, 1354 (Fed. Cir. 1991) (“The commercial advantage gained by new technology and its statutory protection by patent do not convert the possessor thereof into a prohibited monopolist.”).

[41] In re Indep. Service Org. Antitrust Litig., 203 F.3d 1322, 1326 (Fed. Cir. 2000) (citation omitted).

[42] Michael A. Carrier, Unraveling the Patent-Antitrust Paradox, 150 U. Pa. L. Rev. 761, 778 (2002).

[43] Brulotte v. Thys Co., 379 U.S. 29, 33 (1964). See United States v. General Electric Co., 272 U.S. 476, 489 (1926) (Taft, C.J.) (“the patentee may grant a license to make, use and vend articles under the specifications of his patent for any royalty”).

[44] See Microsoft Corp. v. Motorola, Inc., 795 F.3d 1024, 1033 (9th Cir. 2015).

[45] See FTC v. Qualcomm Inc., __ F.3d __, __ [slip at 39] (9th Cir. 2020) (referring to “the general rule that breaches of [FRAND] commitments do not give rise to antitrust liability”); Gregory J. Werden & Luke M. Froeb, Why Patent Hold-Up Does Not Violate Antitrust Law, 27 Tex. Intell. Prop. L.J. 1 (2019).

[46] The Third Circuit recognized the possibility of Sherman Act Section 2 liability when an implementer can prove that a patent holder made an “intentionally false promise” to license on FRAND terms, the standard-setting organization relied on the promise, and the patent holder breached the promise. Broadcom Corp. v. Qualcomm Inc., 501 F.3d 297, 314 (3d Cir. 2007). But these conditions are not met as long as it is plausible that the patent holder believed the FRAND royalty was a high royalty. Moreover, all the elements of a Section 2 case must be established, which means that the plaintiff must prove that a good alternative for the patent holder’s technology was available when the standard was set.

[47] Rambus Inc. v. FTC, 522 F.3d 456 (D.C. Cir. 2008).

[48] Arrow, supra note 3, at 619–22.

[49] Richard J. Gilbert & David Newbery, Preemptive Patenting and the Persistence of Monopoly, 72 Am. Econ. Rev. 514 (1982). For a similar preemption result, see Partha Dasgupta & Joseph Stiglitz, Uncertainty, Industrial Structure, and the Speed of R&D, 11 Bell J. Econ. 1, 13–14 (1980).

[50] Jennifer F. Reinganum, A Dynamic Game of R and D: Patent Protection and Competitive Behavior, 50 Econometrica 671 (1982). For a similar analysis, see Tom Lee & Louis L. Wilde, Market Structure and Innovation: A Reformulation, 94 Q.J. Econ. 429 (1980).

[51] Other researchers analyzed asymmetric models in which knowledge gained from past research effort affected current investment. Many outcomes were found to be possible. See Drew Fudenberg et al., Preemption, Leapfrogging and Competition in Patent Races, 22 Eur. Econ. Rev. 3 (1983); Ulrich Doraszelski, An R&D Race with Knowledge Accumulation, 34 RAND J. Econ. 19 (2003).

[52] See Edmund W. Kitch, The Nature and Function of the Patent System, 20 J.L. & Econ. 265, 280–84 (1977).

[53] See 35 U.S.C. § 103(a) (“A patent for a claimed invention may not be obtained . . . if the differences between the claimed invention and the prior art are such that the claimed invention as a whole would have been obvious before the effective filing date of the claimed invention to a person having ordinary skill in the art to which the claimed invention pertains.”); KSR Int’l Co v. Teleflex Inc., 550 U.S. 398, 417 (2007) (“When a work is available in one field of endeavor, design incentives and other market forces can prompt variations of it, either in the same field or a different one. If a person of ordinary skill can implement a predictable variation, § 103 likely bars its patentability. For the same reason, if a technique has been used to improve one device, and a person of ordinary skill in the art would recognize that it would improve similar devices in the same way, using the technique is obvious unless its actual application is beyond his or her skill.”).

[54] See Lawrence M. DeBrock, Market Structure, Innovation and Optimal Patent Life, 28 J. L. & Econ. 223 (1985). Richard J. Gilbert & Carl Shapiro, Optimal Patent Length and Breadth, 21 RAND J. Econ. 106 (1990); Robert P. Merges & Richard R. Nelson, On the Complex Economics of Patent Scope, 90 Colum. L. Rev. 839 (1990); Ted O’Donoghue, Suzanne Scotchmer & Jacques-François Thisse, Patent Breadth, Patent Life, and the Pace of Technological Progress, 7 J. Econ. & Mgmt. Strategy 1 (1998); Suzanne Scotchmer, Standing on the Shoulders of Giants: Cumulative Research and the Patent Law, 5 J. Econ. Persp. 29 (1991).

[55] See William D. Nordhaus, The Optimal Life of a Patent: Reply, 62 Am. Econ. Rev. 428 (1972).

[56] See Paul Klemperer, How Broad Should the Scope of Patent Protection Be?, RAND J. Econ. 113 (1990).

[57] For reviews of this literature to 1990, see F.M. Scherer & David Ross, Industrial Market Structure and Economic Performance 644–57 (3d ed. 1990); Wesley M. Cohen & Richard C. Levin, Empirical Studies of Innovation and Market Structure, in 2 Handbook of Industrial Organization 1059 (Richard Schmalensee & Robert D. Willig, eds. 1989). For a more recent contribution, see Philippe Aghion et al., Competition and Innovation: An Inverted-U Relationship, 120 Q.J. Econ. 701 (2005).

[58] See, e.g., Justus Haucap, Alexander Rasch & Joel Stiebale, How Mergers Affect Innovation: Theory and Evidence, 63 Int’l J. Indus. Org. 283 (2019) (examining the impact of pharmaceutical mergers); Mitsuru Igami & Kosuke Uetake, Mergers, Innovation, and Entry-Exit Dynamics: Consolidation of the Hard Disk Drive Industry, 1996–2016, Rev. Econ. Stud. (forthcoming). Experimental evidence points in the same direction. See Philippe Aghion et al., The Causal Effects of Competition on Innovation: Experimental Evidence, 34 J.L., Econ. & Org. 162 (2018).

[59] Colleen Cunningham, Florian Ederer & Song Ma, Killer Acquisitions, J. Pol. Econ. (forthcoming), https://ssrn.com/abstract=3241707. As a result of this paper, “killer acquisitions” became a hot topic in antitrust, for example, the subject of a June 2020 session of the OECD’s Competition Committee. See Amelia Fletcher, Colleen Cunningham, Erik Hovenkamp, & Wim Holterman, OECD Policy Panel: Start-Ups, Killer Acquisitions, & Merger Control (June 11, 2020), http://www.oecd.org/daf/competition/start-ups-killer-acquisitions-and-merger-control.htm. See also John M. Yun, Potential Competition, Nascent Competitors, and Killer Acquisitions, in The GAI Report on the Digital Economy (2020).

[60] Edwin Mansfield, Patents and Innovation: An Empirical Study, 32 Mgmt. Sci. 173 (1986).

[61] Richard C. Levin et al., Appropriating the Returns from Industrial Research and Development, 3 Brookings Papers on Econ. Activity (Microeconomics) 783 (1987).

[62] Wesley M. Cohen, Richard R. Nelson, & John P. Walsh, Protecting Their Intellectual Assets: Appropriability Conditions and Why U.S. Manufacturing Firms Patent (or Not) (NBER Working Paper No. 7552, Feb. 2000), https://nber.org/w7552.

[63] Stuart J.H. Graham et al., High Technology Entrepreneurs and the Patent System: Results of the 2008 Berkeley Patent Survey, 24 Berkeley Tech. L.J. 1255 (2009).

[64] Bronwyn Hall et al., The Choice between Formal and Informal Intellectual Property: A Review, 52 J. Econ. Literature 375 (2014).

[65] Petra Moser, Patents and Innovation: Evidence from Economic History, 27 J. Econ. Persp. 23 (2013); Petra Moser, How Do Patent Laws Influence Innovation? Evidence from Nineteenth-Century World’s Fairs, 95 Am. Econ. Rev. 1214 (2005).

[66] Petra Moser, Innovation without Patents: Evidence from World’s Fairs, 55 J.L. & Econ. 43 (2012).

[67] Josh Lerner, The Empirical Impact of Intellectual Property Rights on Innovation: Puzzles and Clues, 99 Am. Econ. Rev. 343 (2009).

[68] Yi Qian, Do National Patent Laws Stimulate Domestic Innovation in a Global Patenting Environment? A Cross-Country Analysis of Pharmaceutical Patent Protection, 1978–2002, 89 Rev. Econ. & Stat. 436 (2007).

[69] Jeanne C. Fromer, Patent Disclosure, 94 Iowa L. Rev. 539 (2009); Benjamin N. Roin, The Disclosure Function of the Patent System (or Lack Thereof), 118 Harv. L. Rev. 2007 (2005).

[70] Wesley M. Cohen et al., R&D Spillovers, Patents and the Incentives to Innovate in Japan and the United States, 31 Res. Pol’y 1349, 1363 (2002) (49% of U.S. survey respondents reported that patents were “moderately” or “very” important as a source of information for recent research and development projects).

[71] Lisa L. Ouellete, Who Reads Patents?, 35 Nature Biotech. 421 (2017).

[72] Deepak Hegde & Hong Luo, Patent Publication and the Market for Ideas, 64 Mgmt. Sci. 495 (2018). As observed in note 18, under the AIPA, patent applications normally are published 18 months after filing. Previously, applications were kept secret, and patents were published when issued, which on average took about two years longer than the current 18-month lag.

[73] Deepak Hegde, Kyle Herkenhoff, & Chenqi Zhu, Patent Publication and Innovation (unpublished paper, June 8, 2020), https://ssrn.com/abstract=3158031.

[74] Jeffrey L. Furman, Markus Nagler & Martin Watzinger, Disclosure and Subsequent Innovation: Evidence from the Patent Depository Library Program (NBER Working Paper No. 24660, May 2018), https://nber.org/papers/w24660.

[75] Daniel P. Gross, The Consequences of Invention Secrecy: Evidence from the USPTO Patent Secrecy Program in WWII (NBER Working Paper No. 25545, Feb. 2020), https://nber.org/papers/w25545.

[76] Michael A. Heller & Rebecca S. Eisenberg, Can Patents Deter Innovation? The Anticommons in Biomedical Research, 280 Sci. 698 (1998).

[77] See, e.g., Jonathan M. Barnett, The Anti-Commons Revisited, 29 Harv. J.L. & Tech. 127 (2015); Jorge L. Contreras, The Anticommons at Twenty: Concerns for Research Continue, 361 Sci. 335 (2018); Charles R. McManis & Brian Yagi, The Bayh-Dole Act and the Anticommons Hypothesis: Round Three, 21 Geo. Mason L. Rev. 1049 (2014).

[78] John P. Walsh, Wesley M. Cohen & Charlene Cho, Where Excludability Matters: Material versus Intellectual Property in Academic Biomedical Research, 36 Res. Pol’y 1184 (2007); see also Heidi L. Williams, Intellectual Property Rights and Innovation: Evidence from the Human Genome, 121 J. Pol. Econ. 1 (2013) (Celera, a leader in sequencing the human genome, limited the disclosure of its data, and that reduced subsequent scientific research and product development roughly 20–30%).

[79] Bhaven Sampat & Heidi L. Williams, How Do Patents Affect Follow-On Innovation? Evidence from the Human Genome, 109 Am. Econ. Rev. 203 (2019).

[80] E.g., Carl Shapiro, Navigating the Patent Thicket: Cross Licenses, Patent Pools and Standard Setting, in 1 Innovation Policy and the Economy 119 (Adam B. Jaffe, Josh Lerner & Scott Stern, eds. 2001).

[81] Alberto Galasso & Mark Schankerman, Patent Thickets, Courts, and the Market for Innovation, 41 RAND J. Econ. 472 (2010).

[82] Alberto Galasso & Mark Schankerman, Patents and Cumulative Innovation: Causal Evidence from the Courts, 130 Q.J. Econ. 317 (2015).

[83] See 35 U.S.C. § 284 (“Upon finding for the claimant the court shall award the claimant damages adequate to compensate for the infringement, but in no event less than a reasonable royalty for the use made of the invention by the infringer . . . ”).

[84] See TCL Commc’n Tech. Holdings Ltd. v. Telefonaktiebolaget LM Ericsson, 943 F.3d 1360, 1367–69 (Fed. Cir. 2019).

[85] Real-world patent licenses normally set the royalty as a percentage of a royalty base, which typically is gross sales revenue for products embodying the licensed patents. To simplify matters, assume that the patent and any product implementing it have the same life span. Implementing a given division of the surplus through a percentage royalty, then, first requires determining the ratio of the surplus (i.e., sales revenue net of manufacturing and distribution costs) to the royalty base. That ratio is then multiplied by an inventor’s share of the surplus to yield that inventor’s percentage royalty.

[86] Exceptions to this general rule are standard setting organizations that insist on royalty-free licensing. For more on Standard Setting Organizations, see Joanna Tsai, Standard Setting Organizations, Intellectual Property, and Standardization: Fundamentals and Recent Proposals, in The GAI Report on the Digital Economy (2020).

[87] See Lloyd S. Shapley, A Value for n-Person Games, in Contributions to the Theory of Games 307 (Harold W. Kuhn & Albert W. Tucker, eds. 1953).

[88] Multilateral bargaining to determine patent royalties is analyzed by David J. Salant, Formulas for Fair, Reasonable, and Non-Discriminatory Royalty Determination, 7 Int’l J. IT Standards & Standardization Res. 66 (2009); Anne Layne-Farrar, A. Jorge Padilla, & Richard Schmalensee, Pricing Patents in Standard-Setting Organizations: Making Sense of FRAND Commitments, 74 Antitrust L.J. 671 (2007).

[89] See Roman Inderst & Christian Wey, Bargaining, Mergers, and Technology Choice in Bilaterally Oligopolistic Industries, 34 RAND J. Econ. 1 (2003); Noemí Navarro & Andres Perea, A Simple Bargaining Procedure for the Myerson Value, 13 B.E. J. Theoretical Econ. 131 (2013); Luke M. Froeb, Vladimir Mares & Steven T. Tschantz, Nash-in-Shapley: Bilateral Bargaining with Recursive Threat Points (unpublished) (June 9, 2019), https://ssrn.com/abstract=3304179; Xiaowei Yu & Keith Waehrer, Recursive Nash-in-Nash Bargaining Solution (unpublished) (Feb. 3, 2019), https://ssrn.com/abstract=3319517.

[90] See John Nash, Two-Person Cooperative Games, 21 Econometrica 128 (1953); John Nash, The Bargaining Problem, 18 Econometrica 155 (1950).

[91] The diagram is from Froeb, Mares & Tschantz, supra note 89.

[92] Apple, Inc. v. Motorola, Inc., 869 F. Supp. 2d 901, 913 (N.D. Ill. 2012) (Posner, J.) (citing Broadcom Corp. v. Qualcomm Inc., 501 F.3d 297, 313–14 (3d Cir. 2007)).

[93] Id.