Introduction[1]

A. Purpose of This Chapter

Vertical restraints are contractual arrangements between firms at different levels in a supply chain (e.g., manufacturer and retailer, manufacturer and distributor, distributor and retailer) that are more complex than simple per-unit pricing arrangements. The purpose of this chapter is to provide an overview of the economics of vertical restraints and thereby provide an economic foundation for the antitrust analysis of vertical restraints.

The literature on vertical restraints is large. This chapter touches on many of the relevant concepts at a high level, references past work for certain ideas, and focuses in depth on four main issues: (i) the general nature of double marginalization and the benefits of vertical restraints that eliminate it in both single- and multi-product settings;[2] (ii) the welfare effects of vertical restraints that address service externalities; (iii) the implications of bilateral contracting and bargaining for the effects of vertical restraints; and (iv) the effects of anti-steering provisions, a vertical restraint that does not appear explicitly in most textbooks but has been prominent in antitrust cases in the digital age.

B. The Digital and Non-Digital Economies

Although this volume is directed at antitrust analysis for the “Digital Economy,” the analysis in this chapter is equally applicable to all (e)commerce irrespective of the degree of ‘e’ involved in the commerce. The advent of the digital age has not changed the economic concepts that have developed since Adam Smith’s Wealth of Nations[3] to understand the role of contracts in the allocation of goods and resources in the economy.

Certain factors that are relevant for the economic analysis of vertical restraints can differ between environments that make heavy use of ecommerce and environments that do not, but these factors affect the characteristics of the market under study, not the economic principles that govern the analysis. For example, the increase in the number of next-day deliveries in the digital age likely occurred because the cost of next day delivery fell due to the digitization of ordering and inventory management and the logistics of distribution.[4] There are no new economic concepts required to understand the effects of lower costs on output. Similarly, a high-end golf club manufacturer’s motivation to prevent consumers from getting fitted for the clubs at significant cost to a golf shop and then purchasing the clubs at discounted prices on the internet does not require any new “digital” economics to understand.[5] The manufacturer’s concern that golf shops would stop supplying fitting services under these circumstances exists whether the discounted clubs are sold on the internet or in a discount brick & mortar shop. The golf club manufacturer’s concern may be higher in the digital age, but economists knew long before the digital age that a reduction in the cost of free-riding (go home and order the clubs at discounted prices for delivery the next day from an outlet with minimal overhead) is likely to increase free riding.

While ecommerce has not created new economic constructs, there is little doubt that certain industry characteristics (e.g., economies of scale, network effects) that can affect the conclusions of an economic analysis have become more prevalent. These characteristics can make it more likely or less likely that specific vertical restraints harm competition, depending on the circumstances.

C. Relationship to Vertical Mergers/Integration

Many issues that are important in the analysis of vertical mergers are also important in the analysis of vertical restraints. Indeed, much of the literature on vertical restraints examines whether vertical restraints can achieve “the vertically integrated” or “fully integrated” outcome, which typically means the outcome that would arise if an upstream seller owned its distributors or a downstream buyer owned its suppliers. The logic for this approach is that many important motivations for vertical restraints involve designing contracts that provide the contracting parties with incentives to make independent decisions that maximize their joint profits (their “fully integrated” profits), so they can divide those profits with transfer payments. This means that in many contexts, vertical restraints can have similar or even the same effects as vertical integration, depending on the context.

John Yun has a separate chapter in this Report on vertical integration and mergers. There is inevitable overlap between the content of these chapters. I will be clear about when the analysis in this chapter applies to questions about vertical mergers and when it does not. The reader is referred to Yun’s chapter for a discussion focused specifically on vertical mergers.

I. Overview of the Motivations for and Effects of Vertical Restraints

A. The Nature of the Problem

Firms at different stages of production (e.g., manufacturer and distributor, manufacturer and retailer, distributor and retailer) contract with each other to exchange goods and services that the buyer will either resell or use to make another product. The contracting seller is commonly referred to as the upstream firm operating in the upstream market (although the boundary of the relevant antitrust market at the upstream level is not always obvious and often requires analysis). The contracting buyer is commonly referred to as the downstream firm operating in the downstream market (with the same caveat about the boundaries of the relevant antitrust market). The contract between the upstream and downstream firms is called a vertical contract.

The simplest vertical contract and the one discussed first in most textbooks on industrial organization is a linear tariff, where the upstream firm charges the downstream firm a per-unit price—a “linear” price—for the product.[6] I use the term “tariff” to distinguish the part of the vertical contract that involves money exchanged between the upstream and downstream firm from other parts of the contract. While linear tariffs are simple, in many cases firms in a vertical channel can increase their joint profits with contractual terms that go beyond simple linear prices. These terms are called vertical restraints. Examples of practices that have been labeled vertical restraints include certain forms of nonlinear pricing (e.g., quantity forcing, all-units discounts, or retroactive rebates), resale price maintenance (“RPM”), exclusive territories (“ET”), exclusive dealing (“ED”), loyalty discounts, anti-steering, tying, and bundled discounts.

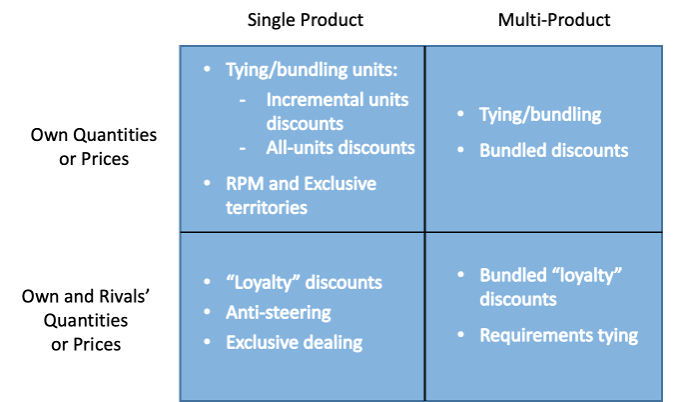

The distinguishing characteristic of a vertical restraint is that the amount the downstream firm pays the upstream firm is not represented by a linear tariff but depends in some way on downstream prices or quantities (or on other factors, but as we’ll see, dependence of prices and quantities encompasses dependence on other factors). Figure 1 provides a concise taxonomy of vertical restraints based on whether they involve single or multiple products and whether the upstream firm’s tariff is conditioned on its own quantity or price or also on the quantities or prices of rival products.[7]

Figure 1: Taxonomy of Vertical Restraints

The reader might find it surprising to see exclusive dealing classified as a tariff conditioned on own and rivals’ quantities or prices like loyalty discounts and anti-steering, and to see volume discounts classified as a form of tying or bundling. The explanation is that in a formal economic sense, all vertical restraints involve conditioning monetary transfers on own or own and rivals’ quantities or prices. For example, exclusive dealing can be interpreted as a special case of a share-based loyalty discount in which the share threshold is 100 percent and the discount offered for reaching the threshold is large enough that the downstream firm would not purchase positive amounts from a rival. Similarly, the floor on a rival’s retail price imposed through anti-steering is a weak form of exclusive dealing in the sense that the floor limits the amount of the rival’s product the downstream firm will sell. Because ED, loyalty discounts, and anti-steering are related in this way, insights from the exclusive dealing literature can be helpful in the analysis of the other practices. Likewise, a volume discount offered for a single product technically involves bundling over the units of that product, as explained in detail below. Although antitrust law does not refer to volume discounts as a form of tying or bundling, the economic literature recognizes the connection, and insights from that literature on how nonlinear pricing eliminates double marginalization are helpful in the analysis of bundled discounts in the sale of multiple products.

It should be noted that both the economic literature and law are not always clear on the precise meaning of the term “vertical restraint,” in particular, whether contracts that have nonlinear tariffs but no other restraints should be called “vertical restraints.” However, because nonlinear tariffs have an element of bundling, which can be a form of tying (see Section III.A.1 below), and some nonlinear tariffs have been found to be anticompetitive restraints of trade (e.g., all-units discounts and quantity forcing), I adopt the convention that vertical contracts that depart from simple linear tariffs involve vertical restraints.

Why do firms use vertical restraints? It will be helpful to address this question with reference to the classic bubble diagram that economists have found useful in analyzing vertical contracts.

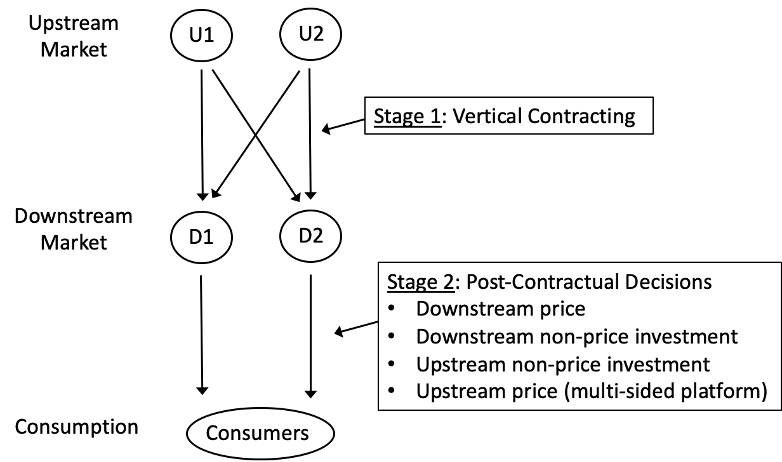

Figure 2 shows production and sales flows in a typical vertical channel, where upstream firms U1 and U2 (and potentially others) sell inputs to downstream firms D1 and D2 (and potentially others) who use the inputs to produce products for sale to final customers. The inputs might be finished products that downstream firms simply resell to final consumers, as in retailing, or they may be used with other inputs in a production process that produces a finished good or another intermediate good.

Figure 2: Vertical Structure, Contracts, and Decisions

In most of the economics literature, contract design and the other decisions that vertically related firms make are modeled as a multi-stage game, often a two-stage game. In stage 1, firms agree to supply terms, including the tariff and other provisions in the contract. In stage 2, firms in the upstream and downstream markets independently make their remaining strategic decisions subject to the contractual terms determined in stage 1. In the classic vertical contracting environment, stage-two decisions include downstream price and non-price decisions and upstream non-price decisions. In multi-sided platforms, stage-two decisions may also involve prices charged to other participants in the platform. Non-price decisions at both levels may involve investments in quality, service, or advertising that typically affect the demand for the firms’ products, or they may involve investments to lower production costs. Throughout this chapter, I conceptualize the vertical contracting problem with this two-stage game framework, as virtually all of the economics literature on vertical restraints is nested within this framework.

In designing their vertical contracts, the contracting parties seek to maximize their profits. In pursuing this objective, firms face two high-level concerns: (1) contractual efficiency, and (2) competition. Vertical restraints are motivated by one or both of these concerns.

B. Contractual Efficiency

Focus first on contracting between U1 and D1, holding fixed the contracts and stage two decisions involving competitors (i.e., holding fixed the contracts and decisions of U2 and D2 in Figure 2.) This abstraction helps highlight the contractual efficiency aspects of vertical restraints.

Suppose initially that firms and courts have complete information and there is no risk or uncertainty and no transaction costs. In the absence of legal constraints, U1 and D1 then can write a complete contract that specifies or constrains in some way all of their stage-two decisions. If the firms can use transfer payments that do not depend on output or their other decisions (e.g., fixed fees), their optimal contract will specify all stage two choices made by U1 and D1 (e.g., D1’s price, D1’s investment, U1’s investment) to maximize joint profits and a fixed transfer payment to divide joint profits. This complete contract would involve vertical restraints under the definition given above (departures from simple linear pricing), although only some of the terms in the contract have been labeled as such in the antitrust literature. In particular, contractual terms that specify or constrain the downstream price would involve some form of RPM; terms that specify or constrain the quantity to be sold or purchased could involve quantity forcing, all-units discounts, take-or-pay provisions; terms that constrain where D1 can sell or the suppliers from which it may buy (or that condition the tariff on these factors) would involve some form of exclusivity, etc. Although other terms in the contract that specify non-price choices like upstream or downstream investment or advertising are conceptually similar to the terms that have been labelled vertical restraints, such terms generally have not been so labeled in the literature or in antitrust investigations. Importantly, constraints on decisions that have been labeled as vertical restraints and have drawn antitrust scrutiny, e.g., RPM and all-units discounts, are conceptually no different than terms that are not considered vertical restraints, such as joint advertising arrangements or other joint investment projects. Yet, in all cases where fixed transfers are feasible, terms that go beyond simple linear tariffs presumably are designed to maximize some notion of joint profits. The policy question is whether these efforts harm the competitive process in a way that reduces welfare.

Two factors interfere with the idealized “efficient” contract (efficient for the firms) just described. First, it may not be feasible for firms to specify all stage-two decisions in the contract because it may be too costly to monitor these actions and too difficult for a court to verify them in a contract dispute. This circumstance, often due to transaction costs, is known as a situation of incomplete contracts. For example, post-contractual demand-enhancing efforts by the upstream firm (e.g., marketing or decisions that affect quality) and downstream firm (e.g., marketing or product demonstrations) may be too costly to monitor, in which case it would not make sense to specify these decisions in the contract. In this case, although firms may choose not to contract directly over these decisions, they may include vertical restraints in the contract that provide incentives that influence these decisions. In many such cases, vertical restraints can achieve the fully integrated outcome even though the contract is incomplete because the vertical restraints align incentives in ways that induce firms to make the same decisions an integrated firm would make. And in many such cases, vertical restraints that increase joint profits and achieve the fully integrated outcome also increase welfare by lowering price or increasing non-price investment by firms at one or both levels of production. And it is well-known that welfare often rises even if price rises because the benefits from increased non-price investment often exceed the harm due to higher prices. The goal of antitrust policy is to identify those instances in which vertical restraints that substitute for more complete contracts harm the competitive process in ways that reduce welfare.

Factors that impede contractual efficiency and motivate vertical restraints include various externalities, incomplete or imperfect information, and risk. The motivation for vertical restraints to address these issues becomes evident from an understanding of how simple linear tariffs fail to address these issues:

(i) Double marginalization – the basic vertical externality. When firms employ linear tariffs, an increase in the wholesale price charged by the upstream firm raises the downstream firm’s marginal cost and lowers downstream profits. Similarly, an increase in the downstream price reduces the quantity demanded and lowers upstream profits. These externalities create double marginalization, which is the double-markup due to successive monopoly, which leads to lower joint profits and output than would be true if the firms could contract in a way to eliminate these externalities, as discussed further below.

While the double-marginalization problem is often described as arising from externalities as in the preceding paragraph, the economic literature also recognizes that elevated wholesale margins due to linear wholesale pricing occur when the upstream firm does not bundle the units of the upstream product that it sells to the downstream buyer.[8] While not common in antitrust discussions, this understanding is important because it shows that what is called double marginalization in the single product context is also present in the multiproduct context if the products are substitutes and are not bundled. As explained further in Section III.A.1 below, a motivation for bundled discounts in this context is the desire to eliminate the multiproduct variant of double marginalization.

(ii) Non-price vertical externalities. The downstream firm may invest in quality or advertising to increase the demand for the product, which increases upstream profits whenever upstream margins are positive. The upstream firm may invest in quality or advertise so as to increase the demand for the product, which increases downstream profits whenever downstream margins are positive. In either case, investment inflicts a positive externality on the party at the other level in the vertical chain. Other factors equal, this leads to less investment than would occur under full integration.

(iii) Non-price horizontal externalities. In situations with multiple firms at either level in the vertical chain, demand-enhancing investments by individual firms may spillover to benefit rival firms. If the investing firm’s margin is less than the fully integrated margin, then these externalities lead to less investment than the amount a fully integrated firm would choose.

(iv) Risk sharing. In environments where cost or demand is uncertain, the upstream and downstream firms would like to write a contract that shares risk optimally given their risk preferences. As an example, suppose demand is uncertain and the downstream firm is more risk averse than the upstream firm. A higher wholesale price transfers a greater share of the risk to the upstream firm, but it also creates double marginalization.

(v) Information externalities. In many economic environments, firms have private information about the nature of the market in which they sell. For example, the downstream firm may have better information than the upstream firm about demand. In this case, linear pricing can worsen double marginalization relative to a nonlinear tariff that elicits the revelation of demand information by the downstream firm.

C. Competition

The second high-level concern of firms involved in vertical contracting is the impact on competition. U1 and D1 may recognize the impact of their contractual terms on the stage-two decisions of rivals at the upstream level, the downstream level, or both. This may give them an incentive to use their contracts to soften competition or to compete more aggressively, depending on the circumstances.

Incentives to use vertical contracts to soften competition typically exist alongside the contractual efficiency motivations (i) through (v) discussed in the preceding section. For this reason, the competitive analysis of the effects of vertical restraints requires a case-by-case analysis that takes into account both contractual efficiency effects and competition softening or strengthening effects. The net effects of vertical restraints are complex and highly sensitive to a range of factors, including the following:

(i) The relevant contractual benchmark. Firms in a vertical relationship choose a contract that either specifies a simple linear tariff or vertical restraints that condition monetary transfers on the quantities or retail prices chosen by the downstream firm. Suppose the current contract C involves vertical restraints. The competitive effect of the vertical restraints embodied in C must be measured against a counterfactual that would arise if the vertical restraints were prohibited. Suppose that if the vertical restraints were prohibited, firms would choose contract C’ instead of C. In general, the new contract C’ will involve a different conditioning of monetary transfers between the firms on a different set of factors. To evaluate the effects of the vertical restraints in C, one has to predict the contract C’ that arises when the restraints are prohibited, predict the outcome that occurs under the new contract C’, and compare that outcome with the outcome that arises under the original contract C.

For example, suppose the vertical restraint under consideration is an all-units discount, which offers the buyer a discount on all units purchased if its purchases exceed a minimum quantity threshold. In evaluating the effects of an all-units discount, it matters whether prohibiting the all-units discount would lead to a linear tariff, which could create double marginalization, an alternative nonlinear tariff (e.g., a two-part tariff), which might have different incentive properties, or an alternative contract with different vertical restraints (e.g., RPM or some other vertical restraint).

A common theme in the literature on vertical restraints is that it is often true that more than one vertical restraint can be used to accomplish the same objective, perhaps with different transaction costs. When this is true, it is obviously important in evaluating the effects of the restraint to take into account the alternatives that may be available to the firm. More generally, it is important to understand the motivation for the vertical restraint in the first place, as that can help determine how the vertical contract is likely to change when one or more vertical restraints are prohibited.

(ii) Upstream and downstream market structure and competitiveness. The effects of vertical restraints depend on the nature of competition in the upstream and downstream markets. However, unlike the case of horizontal mergers and restraints, market power is a poor indicator of the likelihood that a vertical restraint could harm competition. The reason is that both the benefits and harms from vertical restraints can increase with greater market power. For example, greater market power in the upstream market may increase the benefit from using vertical restraints to eliminate double marginalization, and the increase in this benefit due to greater market power may exceed the increase in potential harm form the restraints associated with greater market power.

Antitrust Guidelines frequently use measures of market power as proxies for the likelihood that mergers or specific unilateral conduct may harm competition. For example, the Horizontal Merger Guidelines in most countries specify safe harbors based on concentration indices, and in some cases they specify a rebuttable presumption of harm when concentration exceeds certain thresholds. This is not possible for vertical restraints for the reasons just given. Indeed, the recently issued Vertical Merger Guidelines in the U.S. do not specify safe harbors based on concentration for this reason.[9]

(iii) Transaction costs and the degree of nature of contractual incompleteness. The effect of specific vertical restraints generally depends on the cost of specifying different terms in a contract. For example, if downstream firms make important non-price decisions that affect the demand for U1’s product but are too costly to specify in a contract, then vertical restraints may be used to encourage downstream firms to choose or get closer to the non-price decision that a fully integrated firm would choose. On the other hand, if it is possible to contract over non-price decisions directly at relatively low cost, then the motivation for vertical restraints is likely to be something else.

(iv) Bargaining, commitments, and the timing of decisions. The predictions of vertical contracting models are sensitive to whether upstream firms can commit to non-discriminatory terms and refuse to engage in bilateral negotiations, or whether they negotiate (or renegotiate) terms on a bilateral basis. Bilateral negotiations generally create contracting externalities that alter the implications of different vertical restraints, depending on the circumstances.

In recent vertical merger investigations, plaintiffs have used a bargaining framework that assumes that supply contracts and downstream prices are determined simultaneously.[10] However, in most markets with vertical contracting, downstream firms can adjust downstream prices in response to changes in wholesale prices, and bargaining parties are likely to take this into account when bargaining. The difference between sequential and simultaneous determination of wholesale and retail prices might seem like a detail, but economic analysis shows that the distinction is important.

(v) Information structure. The literature on vertical contracting shows that the information structure—in particular the presence or absence of private information, uncertainty, and risk; the observability of rival’s contracts; and the verifiability of independent decisions (and thus the degree of contractual incompleteness)—can be important factors for determining the effects of vertical restraints. For example, when a downstream firm has private information about its cost or demand, it is generally not optimal for the firms to agree to set the marginal price equal to marginal cost even in the case of bilateral monopoly, and the result is a degree of double marginalization. Thus, there can be double marginalization even when nonlinear contracts are feasible. As another example, when downstream competitors cannot observe their rival’s supply terms, their behavior depends on beliefs about those terms, and different beliefs lead to different outcomes. And when information is not sufficient to verify actions that are important determinates of value, vertical restraints may be an alternative way induce firms to make joint profit maximizing decisions.

II. Multi-sided Platforms

A. Platforms Involve Additional Externalities

The digital age has increased the role of multi-sided platforms in the economy. The classic, pre-digital age example of a multi-sided platform is a newspaper company that sells newspapers to the public and advertising to companies or consumers attempting to advertise and sell products or convey information for some other reason to the public. In the digital economy, search engines, social media, and online retailers also sell products or services to consumers and advertising to companies or consumers trying to sell products to others.

The main difference between multi-sided platforms and other markets for the purpose of analyzing vertical restraints is that multi-sided platforms involve additional externalities that must be accounted for in the analysis. In the newspaper example, which harkens back to the pre-digital age, the demand for advertising depends on readership, as greater readership means more consumers are likely to see ads published in the newspaper. Thus, a consumer’s decision to subscribe to a newspaper creates a positive spillover—an externality—on advertisers. Similarly, newspaper advertising may affect the demand for subscriptions (an externality) either positively or negatively, as some consumers benefit from the ads while others prefer to obtain news without the ads. The newspaper example also involves network externalities, as the more consumers that subscribe to a newspaper, the more valuable the newspaper becomes as an advertising outlet, the more ads the newspaper is likely to sell, and the more valuable the newspaper becomes to consumers who purchase subscriptions in part to benefit from the ads.

B. Techniques for the Antitrust Analysis of Vertical Restraints Involving Platforms Differ Little Techniques for Analyzing Non-Platform Markets

Although an economic literature has developed that focuses on economic aspects of multi-sided platforms,[11] it is important to understand that the economic concepts involved in the analysis of vertical restraints involving multi-sided platforms are little different than they are in the analysis of environments that do not involve multi-sided platforms.

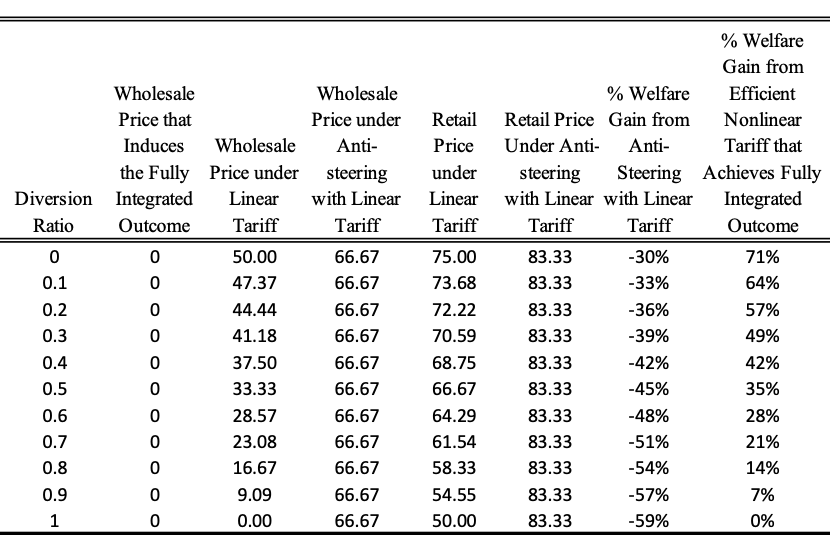

Consider the analogy between the potentially exclusionary effects of the anti-steering restraints employed by American Express (“Amex”), a multi-sided platform, and exclusive dealing by a company that sells a single product in a vertical chain. Amex has two types of customers: (i) merchants, who pay Amex for the right to transact with customers using the American Express Card; and (ii) consumers, who purchase American Express Cards and associated services from Amex to allow them to use the American Express Card to make purchases from merchants under contract with Amex. Thus, Amex is a multi-sided platform that provides services to merchants and consumers, and the benefits to these groups from Amex’s services are obviously interrelated—there are both cross-platform and network externalities.

Amex’s anti-steering provisions constrained retailers’ ability to charge consumers different prices for purchases made using the American Express Card than they charge for purchases using a different credit card. A potentially pro-competitive motivation for this restriction is the promotion of services Amex offered consumers that helped them identify stores they might find attractive, thereby encouraging consumers to visit stores that accept the American Express Card. The argument is that if retailers could turn around and sell the product to customers attracted by Amex’s services using a different credit card that offered a higher profit margin, Amex’s incentives to offer these services would diminish, and consumers could be worse off as a result.

Without getting into the merits of this argument,[12] observe that it is conceptually little different than an argument that a manufacturer’s incentives to make investments that attract consumers to a store are greater when it uses exclusive dealing to contractually restrain retailers from selling competing products that would benefit from the manufacturer’s investments. The anti-steering restrictions imposed by Amex are best thought of as a weak form of exclusive dealing that constrains but does not prohibit retailers from selling rival products or services, thereby making it more profitable for Amex to invest. The antitrust issue is whether the potential benefits of such investments outweigh potential harms from exclusionary or competition softening effects of the restraint. The fact that Amex is a multi-sided platform (selling to both merchants and consumers) likely affects the quantitative analysis of the incentives for and the net effects of the restraint, and it obviously should be accounted for in the analysis, but the conceptual point is the same in both cases—the vertical restraint may correct the externality that allows competitors to benefit or “free ride” on the platform’s or the manufacturer’s investment.

The point here is not that the economic literature on multi-sided platforms is not relevant or has not contributed to our understanding of economic issues related to platforms, but only that the determination whether a particular vertical restraint in a particular circumstance is procompetitive or anticompetitive uses the same general tools regardless of whether one or more parties to the vertical contract runs a multi-sided platform.

III. Taxonomy of Economic Effects of Vertical Restraints

In this section I provide additional detail on the effects of vertical restraints based on the economic literature, organizing the discussion around the following vertical structures: (A) bilateral monopoly; (B) upstream monopoly and downstream competition; (C) downstream monopoly and upstream oligopoly, and (D) competition at both levels. Although most real-world situations fall under (D), the abstractions present in (A) through (C) correspond to insights developed in the literature and are useful for identifying and describing factors that are relevant for the analysis of vertical restraints in the general case (D).

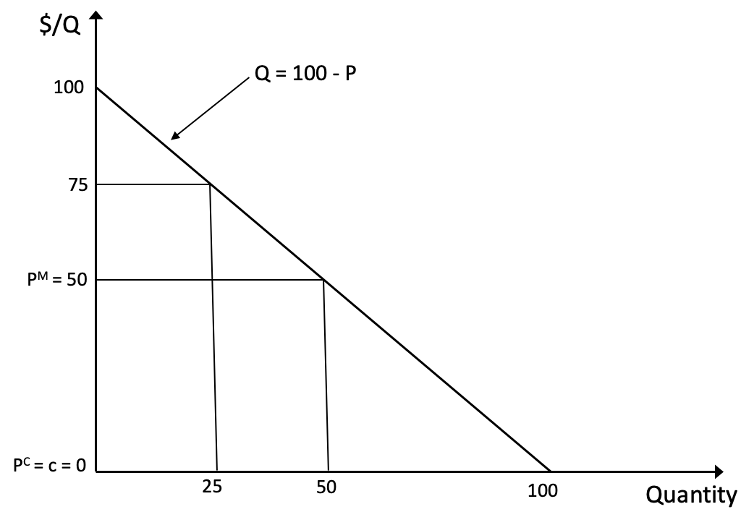

To help understand the economics issues, I use a simplified example throughout this section. Assume that one or more upstream firms produce a product that is resold by one or more downstream firms.[13] In the simplest case with homogenous products, the demand for the downstream product is Q= 100-P, where Q is quantity and P is the downstream price, as illustrated in Figure 3. I introduce product differentiation that generates the same demand for each product when firms charge the same downstream prices below as needed. The wholesale price (not shown) is denoted w, and if the firms use fixed transfer payments, the transfer (not shown) is denoted F. The upstream firm produces at constant marginal cost c, and downstream firms incur no costs to bring the product to market other than what they pay upstream firms for the product.[14] For simplicity, I also assume that upstream marginal cost is zero in numerical examples that follow, but I sometimes refer to their marginal cost as c to emphasize the role of upstream margins in determining the effects of vertical restraints. The dotted lines representing marginal revenue are explained below.

Figure 3: Illustrative Example with Linear Demand and Constant Marginal Cost

Much of the literature compares the effects of vertical restraints to two reference points: the price that would prevail if the upstream and downstream markets were perfectly competitive, and the price that would prevail if the markets were monopolized by an integrated firm. The perfectly competitive price is Pc = c in general and Pc = c = 0 in all numerical examples in this section. The fully integrated monopoly price is PM= (100+c)/2 in general and PM= 50 in the numerical examples. I follow the literature and refer to outcomes that yield the monopoly price as the “fully integrated” or “vertically integrated” outcome. Although the fully integrated outcome is a common reference point, it is important to keep in mind that vertical restraints do not always achieve that outcome, and when this is true, this outcome is less relevant as a reference point.

A. Successive Monopoly

1. Double Marginalization – the Basic Vertical Pricing Externality

As a starting point, it is useful to examine contracting between a single upstream and single downstream firm—successive monopoly. In terms of the bubble diagram in Figure 2, think of the contracts and decisions involving U2 and D2 as fixed, and focus on contracting between U1 and D1 when the residual demand for U1’s product is Q = 100 – P as in Figure 3.

The most widely discussed inefficiency in vertical contracts that do not include vertical restraints is double marginalization, referred to as “the basic vertical externality” in Tirole’s authoritative textbook on Industrial Organization.[15] Under successive monopoly (although all that is required is market power at both levels of the industry), this externality arises when the wholesale price exceeds marginal cost, w > c. In this case, when the downstream firm raises its price and causes a reduction in the quantity sold, it causes a reduction in upstream profit of w – c for each unit of sale that is lost. Because the downstream firm does not take into account this externality in choosing the downstream profit-maximizing price, it sets the downstream price higher than it would if it were vertically integrated and could acquire the input internally at cost.

In the linear demand example in Figure 3, it can be shown that the profit-maximizing wholesale price is $50, and the profit-maximizing retail price given a wholesale price of $50 is $75. Thus, compared to the fully integrated outcome with a retail price $50 that can be achieved through certain vertical restraints (as discussed further below), double marginalization raises the retail price from $50 to $75, harming consumers and reducing total welfare. Turning this around, under successive monopoly, vertical restraints that achieve the fully integrated outcome reduce price from $75 to $50, benefiting consumers and increasing total welfare.

Bundling interpretation. The externality interpretation of double marginalization is helpful for pointing out how to eliminate the problem. Specifically, the externality disappears when w = c, in which case the upstream firm’s profit from the marginal unit is zero and the downstream firm’s pricing decision no longer affects upstream profit.

However, another interpretation of double marginalization that is rarely discussed in the literature is extremely useful for understanding both the nature of the distortion and how to eliminate it in more general settings, e.g., when firms sell multiple products. Economic analysis shows that linear pricing, which most scholars understand as the root cause of double marginalization, is a consequence of constraints on the upstream seller’s ability to bundle the units of the product. Because double marginalization is a consequence of linear pricing, it follows that double marginalization is also a consequence of constraints on the ability to bundle.[16] More generally, economic analysis shows that constraints on the upstream firm’s ability to bundle any substitute objects that it sells, whether the objects are units of the same product (each unit is identical), units of different substitute products, or both, generates double marginalization. The recognition that double marginalization is a consequence of the inability to bundle substitutes has two important implications. First, double marginalization is a more widespread problem in vertical contracting than is generally recognized, as it involves not only the absence of bundling the units of specific products, but also the absence of bundling across products. Second, constraints on the ability to bundle substitute products prevents contracting firms from solving double marginalization through bundling. The second observation has obvious implications for policy toward tying and bundling, as discussed further below.

The notion that it is helpful or even relevant to view departures from linear tariffs as arising from constraints on bundling might seem inapposite to many readers—what does linear and nonlinear pricing have to do with bundling? Suppose the upstream seller charges $10 per unit for a product and the downstream firm purchases two units of the product. This tariff does not bundle the units of the product. The reason is that the sum of the prices paid to purchase two units in separate transactions, $20, is the same as total price paid to purchase the “bundle” of two units in a single transaction. On the other hand, suppose the upstream seller charges a two-part tariff with a fixed fee of $15 and a wholesale price of $5. (These numbers are purely illustrative.) This tariff bundles the two units because the sum of the prices paid when two single units are purchased in separate transactions is $40 [= 2 x (15 + 5)], and this exceeds the total price paid for a bundle of two units purchased in a single transaction, $25 [= 15 + (2 x 5)]. Thus, we see that a single-product two-part tariff (one form of nonlinear pricing) bundles the units of the product.

More generally, non-requirements tying, full-line forcing, aggregate rebates, and other bundled discounts involve bundling the units of different products in addition to bundling the units of each product. As noted above, in the single product setting, one can show that double marginalization arises from the inability to bundle units of the product. Similarly, in the multiproduct setting involving substitute products (potentially imperfect substitutes), one can show that an analogous distortion—a generalization of double marginalization to the multi-product setting—arises from the inability to bundle across products.[17]

Contractual solutions to the double marginalization problem—single product case. The elimination of double marginalization (“EDM”) through vertical restraints occurs through the same mechanism as EDM effects from vertical mergers: lowering the effective wholesale price (or the “shadow” wholesale price, as discussed below) to upstream marginal cost, e.g., by setting w = c. The vertical restraints used to accomplish this depend on whether the vertical contract involves single or multiple products.

Consider first the single product case. In environments with complete information and no uncertainty or risk, it is well-known that several different nonlinear tariffs can eliminate double marginalization, including two-part tariffs, all-units discounts, declining block tariffs (of which two-part tariffs are a special case), and quantity forcing (e.g., take-or-pay contracts, which are really a special case of an all-units discount). In addition, fixed-price or maximum RPM can also eliminate double marginalization. All of these contracts work by setting the effective wholesale price, what economists sometimes call the “shadow” price, equal to marginal cost.

A two-part tariff, which involves a linear wholesale price and fixed fee, works by explicitly setting w = c in the contract so that the downstream firm has the same marginal cost as a vertically integrated firm that can purchase the input at cost. Under this contract, the downstream firm chooses the retail price that maximizes the fully integrated profit, PM = 50, and the fixed fee divides these profits between the upstream and downstream firms. A tariff with a declining block structure, e.g., a price of $50 for the first 25 units and a price of zero for each unit beyond 25, can also work. This tariff induces the downstream firm to sell 50 units (and price at $50) because (i) the cost to the downstream firm of each unit beyond 25 is the same as the marginal cost of an integrated firm, so the downstream firm has the same incentive at the margin as an integrated firm, and (ii) the amount paid to the upstream firm, 1250 [= 50 x 25] is less than the downstream firm’s gross profit of 2500 [= 50 x 50].[18]

An alternative nonlinear tariff that achieves the fully integrated outcome is an all-units discount tariff that charges the downstream firm a high per-unit price on all units if total purchases are less than some quantity threshold and a lower per unit price on all units if total purchases exceed the threshold.[19] For example, suppose the wholesale price is $100 when total purchases are less than 50 units and $49 if total purchases equal or exceed 50 units. This tariff induces the downstream firm to purchase 50 units, the joint profit-maximizing quantity. The reason is that if the downstream firm purchases any positive amount less than 50 units, its profits will be zero or negative (because the downstream price is less than the downstream firm’s unit cost of $100 for all positive quantities less than 50). On the other hand, if the downstream firm purchases and resells 50 units, the resulting downstream price of $50 exceeds the wholesale price of $49, and the downstream firm makes a positive profit of $50 [= (50-49) x 50]. The downstream firm has no incentive to sell more than 50 units, because selling an additional unit would lower the price to $49 and wipe out the downstream profits.[20]

As noted earlier, all vertical restraints that involve eliminating double marginalization do so by setting the effective wholesale price equal to upstream marginal cost. But in the all-units discount just presented, the actual wholesale price paid by the downstream firm is $49, which is far greater than upstream marginal cost of $0. Indeed, $49 is almost as high as the wholesale price of $50 associated with double marginalization. It might be tempting to argue that there is little welfare benefit from the all-units discount because the wholesale price charged in the all-units discount is nearly as high as it is under double marginalization. However, this argument is incorrect.

The reason the argument is wrong is that the relevant price for evaluating the outcome is what economists call the “shadow price” paid by the downstream firm, and this price does equal (and is not less than or greater than) upstream marginal cost in any all-units discount that achieves the fully integrated outcome. The shadow price, a term that is likely unfamiliar to antitrust practitioners, is the effective price to the downstream firm of the last unit purchased given both the wholesale price it pays and the constraints embodied in the tariff. The simplest way to think about the shadow price in the context of an all-units discount is that it is the wholesale price that would induce the downstream firm to purchase the quantity it chooses if there were no constraining quantity threshold. Because the chosen quantity in this is example is the quantity that a fully integrated monopolist would choose, the shadow price must equal upstream marginal cost, as that is the wholesale price that induces the downstream firm to behave the same way as a vertically integrated firm. That is, at the quantity chosen under an optimal all-units discount, the shadow price, is equal to the upstream firm’s marginal cost.[21] No inference about the efficiency of the optimal all-units discount tariff is possible based on the nominal wholesale price, which serves only to transfer surplus. In particular, it would be wrong to conclude from the nominal wholesale price of $49 in this example that there is little benefit from the use of all-units discounts to eliminate double marginalization.

Quantity forcing (or a take-or-pay provision) works the same way as an all-units discount—indeed, these contracts are a special case of an all-units discount with effectively an infinite price for positive quantities less than the quantity threshold.

RPM can eliminate double marginalization by fixing the price rather than quantity at the joint profit maximizing level, which has the same effect. All of these strategies that eliminate double marginalization amount to effectively creating a shadow price for the upstream firm’s product that induces the downstream firm to choose the fully integrated quantity or price.

The discussion thus far has assumed that there is no asymmetric information and no uncertainty or risk. The addition of these factors complicates the analysis in ways that are beyond the scope of this chapter. However, a point worth emphasizing is that the equivalence of two-part tariffs, all-units discounts, quantity forcing, and RPM for the case of bilateral contracts under complete information generally does not hold when information is incomplete. To illustrate, suppose demand is uncertain, the upstream firm is risk neutral, but the downstream firm is risk averse. In this case, a nonlinear tariff is not sufficient to achieve the fully integrated outcome. The reason is that optimal risk sharing requires transferring risk to the upstream firm, which requires eliminating the downstream firm’s margin so that it does not bear risk due to demand fluctuations, but it is not possible to eliminate the downstream margin with a nonlinear contract. However, if the fully integrated downstream price does not vary with demand, a maximum RPM contract that eliminates the downstream margin and compensates the downstream firm with a negative fixed fee can achieve the integrated outcome, eliminating double marginalization and optimally sharing risk. If the fully integrated downstream price does vary with demand, RPM combined with a nonlinear tariff is generally more efficient than a nonlinear tariff alone.[22]

Contractual solutions to double marginalization – multiproduct case. If the upstream and downstream firms contract over multiple products that are substitutes for each other, the equivalence results for the restraints discussed in the single product case no longer hold. The reason has to do with the relationship between double marginalization and bundling, as discussed earlier.

When a multiproduct upstream firm distributes two imperfect substitute products through a downstream retailer, product specific two-part tariffs are insufficient to achieve the fully integrated outcome.[23] The intuition for the case of two products, A and B, is as follows. Product specific two-part tariffs allow the upstream firm to extract the downstream firm’s incremental profit from selling each of products A and B. If the upstream firm tried to extract more, the downstream firm would drop one or both products. However, because products A and B are substitutes, the sum of the downstream firm’s incremental profits from selling A and B is less than the total profit from the sales. This means that product-specific two-part tariffs are insufficient to extract the fully integrated profit. The optimal product-specific two-part tariff generally involves wholesale prices above marginal cost.[24] Intuitively, a small increase in the wholesale price of product A (starting at marginal cost) has a small effect on joint profits (since a price equal to marginal cost maximizes joint profits), but it strictly increases the downstream firm’s incremental profit from selling B. The same is true for a small increase in the wholesale price of product B. Since the upstream firm captures the incremental profits with fixed fees, it increases its profits by raising wholesale prices, creating a double marginalization distortion. This is the multiproduct variant of the double marginalization distortion discussed earlier.

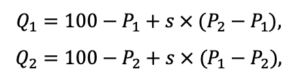

A generalization of the single-product linear demand example to the case of two products helps illustrate the effects of single-product and multi-product double marginalization. Suppose there are two products, 1 and 2, with the following product-specific demands:[25]

where the subscripts indicate products 1 and 2 and s is a substitution parameter between 0 and infinity that reflects the degree of substitution between products 1 and 2. If s = 0, then the demand for each product depends only on its own price, i.e., the products are independent in demand. If s > 0, products 1 and 2 are imperfect substitutes—an increase in the price of either product raises the demand for the other but does not divert all customers to the other product. As s becomes larger, the products become closer and closer substitutes.[26] In any symmetric outcome where the products have the same equilibrium price, the demand for each product has the same form as the demand function introduced at the beginning of this section, i.e., the demand for product 1 is Q1 = 100 – P1, the demand for product 2 is Q2 = 100 – P2, and the reference points for perfect competition and monopoly have the same prices as in the single product case. Thus, the size of the distortion associated with a particular retail price in a symmetric outcome in this multiproduct setting is comparable to the size of the distortion in the single product setting (e.g., a price of $75 causes the same percentage welfare reduction relative to the fully integrated price of $50 in both settings.)

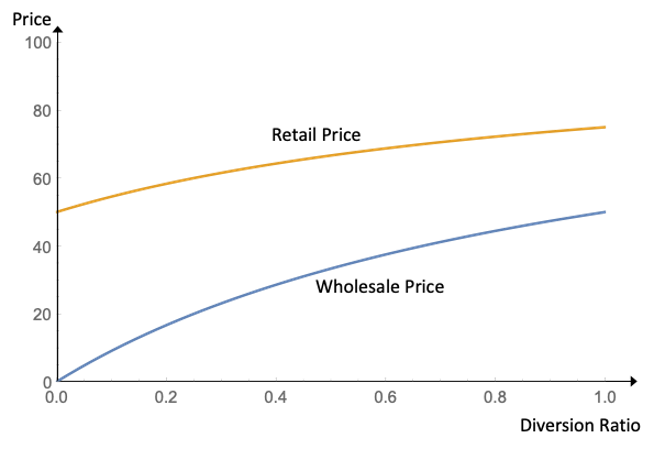

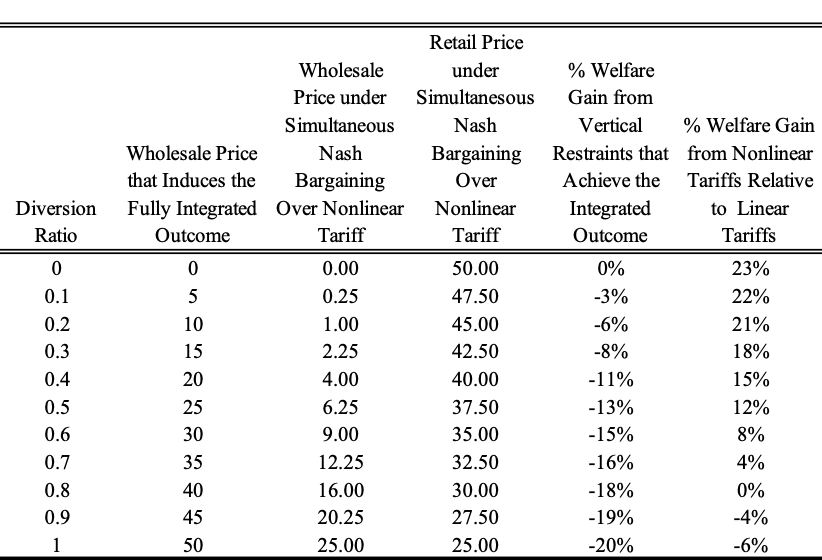

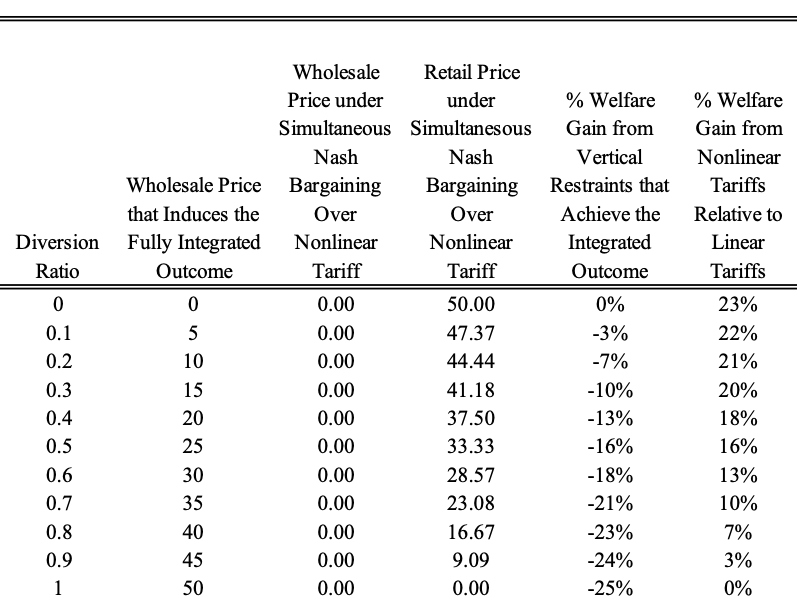

Using the methods in Shaffer,[27] it is possible to find the equilibrium retail prices when the upstream firm uses product-specific two-part tariffs. Figure 4 plots the equilibrium wholesale and retail prices against the diversion ratio between products 1 and 2.[28] Note first that the wholesale price is $0 and retail price is $50 when the diversion ratio is zero, which is the case where products 1 and 2 are independent in demand. This shows that product-specific two-part tariffs—bundling the units of each product but not bundling different products—fully eliminates the double marginalization distortion when the products are independent in demand. This is as expected because the case of two independent demands is the same as having two independent bilateral monopolies, each selling their own product, and two-part tariffs are sufficient to achieve the fully integrated outcome in the single product setting in this case.

Figure 4: Double Marginalization Distortion from the Inability to BundleAcross Products In the Multi-Product Setting

The more interesting cases occur when diversion ratios are positive. As the diversion ratio approaches 1, where products 1 and 2 become perfect substitutes, the wholesale price rises toward $50 and the retail price rises toward $75. This is the same double marginalization outcome that occurs with linear pricing in the single product case, except that it now occurs with both products. The important point is that double marginalization occurs even though the contract involves two-part tariffs. The size of the double marginalization problem depends on the diversion ratio. When the diversion ratio is small, so that the products are not very close substitutes, product-specific two-part tariffs eliminate most of the double marginalization, and the inability to bundle across products leads to a relatively small additional distortion due to double marginalization. On the other hand, as the products become very close substitutes and the diversion ratio approaches 1 (which is equivalent to perfect substitutes in this example), the double marginalization problem due to the inability to bundle across products is as bad as it is under linear pricing in the single product case!

The reason for this result is that the key economic factor behind double marginalization is the inability to bundle, as explained earlier.[29] In the single product case, double marginalization is a consequence of the seller’s inability to bundle the units of the product, as through nonlinear pricing. In the multi-product case, double marginalization is a consequence of the seller’s inability to bundle the units of each product with each other and with the units of other substitute products. It follows that, contrary to conventional wisdom, nonlinear tariffs are insufficient to solve the double marginalization problem in the multiproduct setting when the products are substitutes. Any solution involving vertical restraints that condition the tariff only on quantities requires some form of tying or bundling both the units of specific products (as with nonlinear pricing) and the units of different products.

It should be noted that the requirement that products are substitutes for the inability to bundle to generate double marginalization does not require that the products are substitutes in final demand. Products that are independent or even somewhat complementary in final demand can be substitutes in the derived demand facing the upstream supplier. For example, scarce shelf space at the retail level can make two products that are independent in final demand substitutes in demand from the upstream firm’s perspective because retailers may substitute between the products in deciding which products to stock.

Shaffer has shown that several vertical restraints can achieve the fully integrated outcome in the multiproduct setting involving substitute products, including full line forcing, aggregate rebates, and maximum RPM.[30] These are equivalent vertical restraints when information is complete. Empirical literature provides support for the prediction that bundling substitute products provides EDM benefits.[31]

The finding that the inability to bundle causes double marginalization has important implications for antitrust policy toward bundled discounts. In LePages,[32] the antitrust issue was whether bundled discounts employed by the defendant excluded competitors and harmed competition. Because the inability to bundle substitute products causes double marginalization, a complete analysis of the antitrust question in that case requires balancing benefits from the elimination of double marginalization with any harm due to exclusion. The court in LePages did not explicitly consider pro-competitive benefits from the elimination of double marginalization, nor, to my knowledge, has this benefit been considered in other cases involve bundled discounts or tying.

2. Downstream Non-Contractible Investment

Imagine now that in addition to choosing the downstream price, the downstream firm’s stage-two decisions include one or more non-price decisions, such as the amount of advertising or customer service effort, both of which can enhance the demand for the product. Suppose that it is not possible to specify these decisions in a contract. If the upstream firm earns a positive margin, these actions have spillover effects on the upstream firm that the downstream firm will ignore in choosing its own profit-maximizing level of these non-price efforts. Generally, if the upstream margin is positive, the downstream margin will be less than the margin of a fully integrated firm, and the downstream firm will invest less than an integrated firm would invest at any given downstream price.

A contractual solution that eliminates double marginalization by setting the wholesale price equal to upstream marginal cost can also correct the distortion of non-price effort. However, the problem is more complex than the case where the downstream firm’s only stage two decision is price.

In the single product case, a two-part tariff that sets the wholesale price equal to marginal cost still works to achieve the fully integrated outcome. The downstream firm will then have the same incentives as a fully integrated firm and will choose the joint profit-maximizing (fully integrated) levels of price and the non-price actions. Variants of all-units discounts can also work provided the wholesale price charged when the downstream firm fails to purchase the threshold volume is high enough to discourage it from cutting back on investment and raising price. RPM combined with a linear tariff does not work because the wholesale price required to induce the fully integrated downstream investment is marginal cost, but that price that fails to capture any surplus for the upstream firm.

In the multiproduct setting where the products are substitutes, a two-part tariff is not sufficient for the same reason it is not sufficient when the only downstream decisions are prices. However, RPM can be combined with either a two-part tariff or an all-units discount to induce the downstream firm to set the fully integrated price and choose the fully integrated investment levels.

3. Double Moral Hazard

Double moral hazard arises when both the upstream and downstream firms make independent non-contractible decisions that affect the outcome. For example, both the upstream and downstream firms may make investment decisions after the contract is signed that affect the demand for the product. Or the downstream firm may make only a price decision and the upstream firm may make a non-contractible quality decision. Both cases technically involve double moral hazard.

When double moral hazard is present, a dilemma exists that can make it impossible to achieve the fully integrated outcome when contracts are incomplete, i.e., when the downstream price and upstream and downstream investment decisions cannot be specified in the contract. As we’ve seen, the wholesale price that induces the downstream firm to choose the joint profit maximizing price and quantity under successive monopoly is the upstream firm’s marginal cost. However, a wholesale price equal to marginal cost provides the upstream firm with no incentive at the margin to invest. Raising the wholesale price encourages greater upstream investment, but at the same time it creates double marginalization. Due to this conflict—between encouraging additional upstream investment and mitigating double marginalization—it is often not possible to align both upstream and downstream incentives in a way that induces the fully integrated outcome in the presence of double moral hazard.[33]

Two papers in the literature address the incentives for and the effects of vertical restraints in the presence of double moral hazard. One paper examines the effects of resale price maintenance when the upstream and downstream firms both make non-contractible demand-enhancing investments and the downstream firm also chooses the final price.[34] This model features three vertical externalities, one relating to price and two relating to the firms’ non-price decisions. RPM (sometimes maximum and sometimes minimum) typically mitigates the problem somewhat, but it does not induce the fully integrated outcome. The reason is that even with RPM, the manufacturer has only a two-dimensional incentive device (the wholesale price and retail price) to control three target variables (upstream investment, downstream investment, and the retail price).

The author does not examine the welfare effects of RPM in the model, but it seems clear that welfare effects would be ambiguous for the usual reasons in models that involve non-price decisions. However, it is clear that the use of RPM will often enhance welfare. For example, in the special case where the downstream firm’s only decision is price, a maximum RPM contract that eliminates the retail margin can eliminate double marginalization and induce the fully integrated level of upstream investment, because the upstream firm then collects the integrated profit and faces the same investment incentives as an integrated firm. This will often enhance welfare, as discussed further below.

Another paper examines the role of all-units discounts to address the double moral hazard problem.[35] The analysis shows that all-units discounts are generally more efficient contracts than two-part tariffs and do as well or better than more complex continuous tariffs (e.g, declining block tariffs with two or more blocks) in environments with double moral hazard. The basic logic is that, unlike two-part tariffs, an all-units discount can eliminate double marginalization with a nominal wholesale price above marginal cost that encourages upstream investment. This is not possible with a two-part tariff because the wholesale price that eliminates double marginalization (w = c) eliminates the upstream margin, discouraging upstream investment. In general, all-units discounts are more efficient than two-part tariffs, and in environments with uncertain demand, they are more efficient than incremental units discounts such as declining block tariffs.

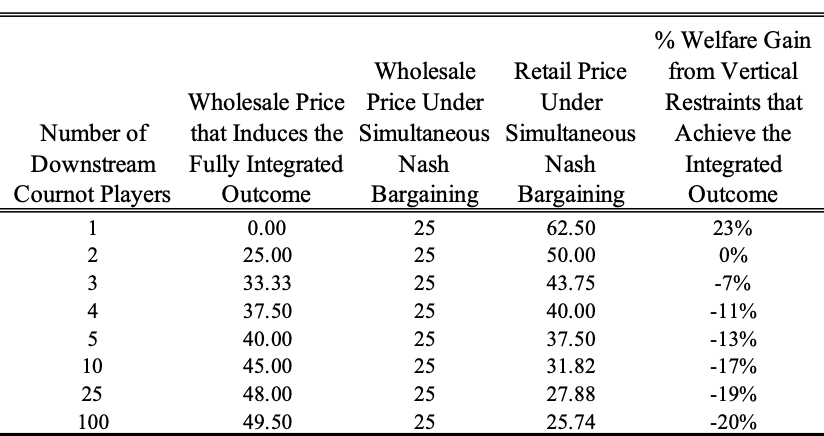

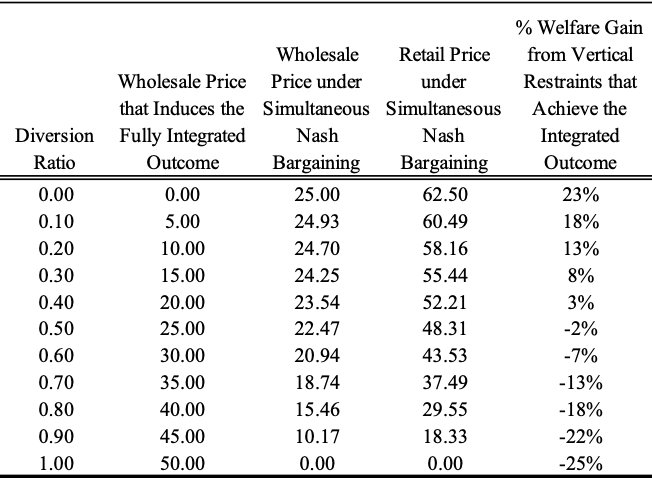

4. Bargaining

In the 1980s, economists began studying the implications of bargaining over the terms of vertical contracts. Bargaining can alter the analysis of vertical restraints substantially in environments with downstream competition (as explained below), but it does not alter the qualitative conclusions in this section about the role of vertical restraints in successive monopoly. For example, suppose the upstream and downstream firms negotiate a linear tariff through symmetric Nash bargaining (discussed in more detail below) and that the only post-contractual downstream decision is the downstream price. If firms’ disagreement profits are zero (meaning they receive zero profits if they fail to agree) and they have no outside options, it can be shown that the Nash bargaining solution in the numerical example in this section yields a wholesale price of $25 and a retail price of $62.50.[36] Thus, downstream bargaining power lowers the wholesale price relative to the $50 wholesale price that arises when the upstream firm makes take-it or leave-it (“TIOLI”) offers and thereby reduces the degree of double marginalization, but some double marginalization remains, as the equilibrium retail price ($62.50) still exceeds the fully integrated price ($50). Vertical restraints that achieve the fully integrated outcome under TIOLI offers still do so, and they still lower the downstream price.

Similarly, in the multiproduct setting, bargaining does not alter the results that linear tariffs create double marginalization and that product-specific two-part tariffs are insufficient to achieve the fully integrated outcome because they fail to eliminate fully the double marginalization that arises from the inability to bundle.[37]

5. Welfare Effects

In the symmetric case considered in this section, the welfare effects of vertical restraints are straightforward when the downstream retail price is the only stage two decision. Vertical restraints that achieve the fully integrated outcome lower the retail price and increase welfare relative to situations with double marginalization in both single product and multiproduct settings.

When non-price decisions are in the mix, the welfare effects of vertical restraints that increase joint profits are theoretically ambiguous. The reason is that the joint profit-maximizing choice of the non-price attribute may be higher or lower than the socially optimal choice, depending on the nature of demand curvature. However, under some standard assumptions commonly used in applications, vertical restraints typically increase welfare.

Specifically, suppose that marginal cost is constant and the final demand for the product exhibits constant curvature, a special case of which is linear demand.[38] Suppose further that changes in upstream or downstream investment shift or rotate demand without altering its curvature. Under these assumptions, vertical restraints increase consumer and total welfare relative to the case with no vertical restraints.

This result is explained in steps as follows. Start from the double marginalization outcome that arises in the absence of vertical restraints. Allow the negotiating firms to introduce a fixed fee that divides profits. Note that the introduction of a fixed fee does not change consumer surplus or total welfare. Now suppose the firms re-optimize by choosing a new contract with vertical restraints that achieves the fully integrated price and investment levels. Under constant curvature demand and constant marginal cost, consumer surplus and profits vary in a constant proportion to each other as the seller optimally adjusts price in response to changes in non-price attributes that shift or rotate demand (e.g., demand-enhancing retail services).[39] This means that any change in price and the investment that increases joint profits also increases consumer surplus. Because any vertical restraints agreed to by the upstream and downstream firms must increase joint profits (otherwise they would not make the change), the vertical restraint also increases consumer surplus. It follows that under constant marginal cost and constant curvature demand, vertical restraints increase consumer surplus, profits, and total welfare.

In an amicus brief filed in the Leegin case, the authors argued that it is possible that the use of vertical restraints to promote downstream investment would lead to suboptimal investment levels.[40] As a theoretical matter, vertical restraints can lead to over- or under-investment in services relative to the socially optimal levels. However, the preceding analysis shows that in the bilateral setting, vertical restraints raise both consumer and total welfare under the simplest textbook assumptions—linear demand and constant marginal cost. Departures from this prediction require sufficiently large departures from the constant curvature assumption in a specific direction. In any case, the argument that vertical restraints can theoretically distort investment upward or downward, depending on demand curvature, is not an argument against the Supreme Court’s decision in Leegin to adopt a rule-of-reason standard for the antitrust treatment of RPM.

In the same Amicus, the authors argue that “[t]o the extent that the economic literature provides support for resale price maintenance as welfare-enhancing, the support is limited to cases of manufacturer-induced RPM, not retailer-induced RPM . . . Retailer-induced RPM should give rise to a rebuttable per se approach.”[41] Yet, both the upstream and downstream firms share the same interest in vertical restraints that induce the fully integrated outcome because they can divide the maximized joint profits with a fixed transfer payment. Economic theory does not support a rebuttable per se approach for vertical restraints just because one or more retailers benefit from their use.

B. Downstream Competition

I now turn to situations where U1 contracts with multiple downstream firms who may compete with one another. In terms of the bubble diagram in Figure 2, think of the contacts and decisions involving U2’s products as fixed.

It is important to recognize that conditional on U1’s contract with D2, the issues discussed in the preceding section on contracting between successive monopolists remain relevant in the contracts between U1 and D1, and vice versa. That is, contract efficiency considerations remain important. However, the additional externalities associated with downstream competition raise additional considerations that affect the analysis. Important considerations include the presence of service externalities across retailers, whether contracting is bilateral or multilateral, and the observability of contracts.

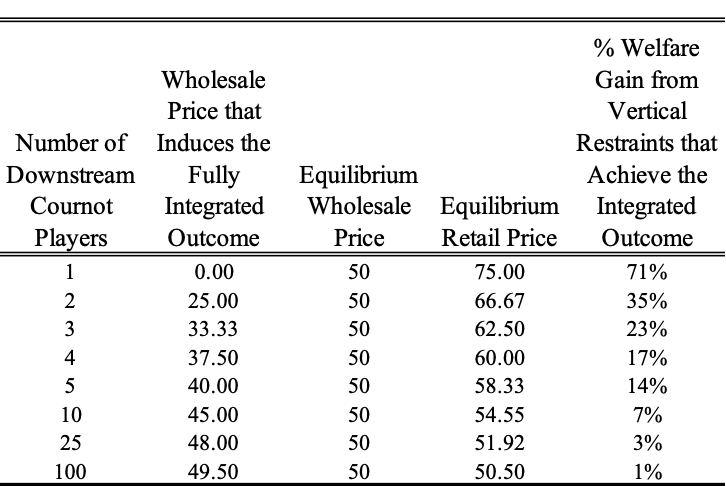

1. No Non-Contractible Investments; No Bilateral Contracting

To fix ideas, suppose that upstream firm U1 sells through N downstream firms that are Cournot competitors in the downstream market. (Under Cournot competition, each firm chooses its own quantity to maximize profits taking as given its competitors’ quantities.) Absent vertical restraints, double marginalization remains an issue. If U1 offers TIOLI linear tariffs in the illustrative example in Figure 3, it can be shown that it will charge a wholesale price of $50 irrespective of the number downstream firms. The retail price depends on the intensity of downstream competition, as shown in Table 1. If there is only 1 downstream firm, the outcome involves successive monopoly and a downstream price of $75. Greater downstream competition (N > 0) lowers the retail price, but in this example the wholesale price remains at $50. As the market becomes more and more competitive, double marginalization gradually disappears. The remaining distortion relative to the perfectly competitive outcome arises from “single marginalization” due to U1’s market power in the upstream market.

Table 1: Take-it or Leave Linear Tariffs

Downstream Cournot Competition

Vertical restraints in this case, as in the bilateral monopoly case, seek to eliminate double marginalization and lower the retail price to the fully integrated level. One approach that works is a set of two-part tariffs that induce downstream competitors to choose the fully integrated monopoly price of $50 as the outcome of downstream competition. The wholesale price that does this depends on the number of downstream competitors. This wholesale price is zero when there is one downstream firm and rises from $0 to $50 as the number of downstream firms grows toward infinity, which generates the perfectly competitive outcome in the downstream market.

Observe that the greater the degree of market power in the downstream market as reflected by a smaller number of competitors, the greater the welfare benefit from vertical restraints that achieve the fully integrated outcome. This is the first of several examples throughout this section that show why market power screens are less useful in the analysis of vertical restraints and mergers than they are in the analysis of horizontal mergers. Generally, market power at one or both levels is necessary but not sufficient for harm to arise from vertical restraints or mergers.

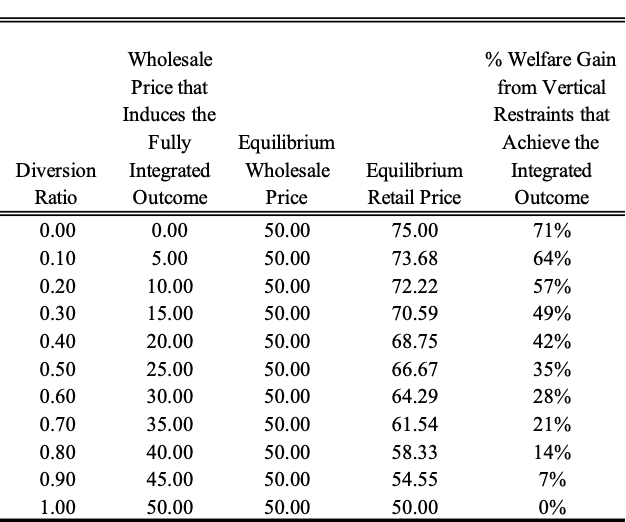

A similar situation occurs when the upstream firm offers TIOLI linear tariffs to downstream differentiated Bertrand competitors. (Under Bertrand competition, each firm chooses its own price to maximize profits taking as given their rivals’ prices.) For simplicity, suppose there are two Bertrand competitors with the linear differentiated demands introduced earlier. Recall that the products are independent in demand when s = 0 and they become closer substitutes as s increases. To aid intuition, it is convenient to measure the degree of substitution and thus the intensity of downstream competition by the diversion ratio between the competitors rather than the substitution parameter. The diversion ratio in this example is Diversion Ration = s/(1 – s).

Table 2 shows how the outcome under TIOLI linear tariffs compares with the fully integrated outcome for different values of the diversion ratio. As in the case of downstream Cournot competition, the equilibrium wholesale price exceeds the price that induces the fully integrated outcome except in the extreme case where downstream firms are perfectly competitive, which occurs when the diversion ratio approaches 1. Thus, vertical restraints that achieve the fully integrated outcome reduce price and increase welfare relative to the case of no vertical restraints, and this effect is larger the greater the degree of downstream market power as reflected by a smaller diversion ratio.

Table 2: Take-it or Leave Linear Tariffs

Downstream Bertrand Competition

Table 2 provides useful insight into one of the policy debates in the commentary and discussion surrounding the 2020 Vertical Merger Guidelines issued in the summer of 2020 in the U.S.[42] The issue is the merger specificity of cost savings from eliminating the wholesale margin when nonlinear tariffs are employed prior to a vertical merger. An argument often made is that nonlinear tariffs between the merging firms prior to the merger eliminate EDM benefits. Although it is true that nonlinear pricing can eliminate double marginalization (at least in the single product case), observe that the wholesale prices that induce the fully integrated outcome in Table 2 exceed marginal cost in every case except downstream monopoly. This means that if the upstream firm can make TIOLI nonlinear contract offers prior to the merger, a vertical merger still creates cost savings from eliminating the upstream margin, which lowers the downstream firm’s marginal cost and retail price. As long as the wholesale price exceeds marginal cost, this benefit, which is similar to the benefit from EDM, exists.[43]

A point that is often missed in vertical merger discussions is that if the upstream firm sells through TIOLI nonlinear contracts prior to merging with a differentiated downstream Bertrand competitor, such a merger would not achieve the integrated outcome and would be unprofitable absent some efficiency benefit. The reason is that by vertically merging, the upstream firm loses the ability to use the wholesale price with the integrating downstream firm to soften competition. If there are two downstream firms, for example, it generally takes two incentive devices (here two wholesale prices) to induce downstream firms to charge the fully integrated downstream prices.[44] However a merger between U1 and D1 takes one of the incentive devices off the table because the integrated firm cannot credibly pretend to pay itself a wholesale price above marginal cost. This prevents the use of nonlinear tariffs to achieve the fully integrated outcome. The full effects of the merger in this case are found by weighing the benefit to the integrating firm from eliminating the upstream margin against any increase in the wholesale prices charged to unintegrated downstream firms.

In contrast to the Bertrand case, in the Cournot case illustrated in Table 1, a vertical merger does induce the fully integrated outcome, just like a TIOLI nonlinear tariff. The reason is that under the assumption of constant marginal cost and no product differentiation, the merged firm can achieve the fully integrated outcome with only a single downstream seller.[45]

2. Downstream Non-Contractible Investments, No Bilateral contracting

Several papers have examined the effects of nonlinear pricing, RPM, and ET when competing downstream firms make both price and non-contractible non-price decisions that affect final demand. Telser’s seminal paper focused on the situation where downstream firms compete on price and by offering a non-price service at no explicit charge that increases the value of the product to consumers.[46] He showed that if consumers can obtain the service from one retailer but then purchase the product at a lower price from another retailer who does not provide the service (“free riding”), the incentive for retailers to provide the service is reduced and may disappear entirely. He then showed how RPM and ET can overcome this problem to ensure that valuable pre-sale services are provided in the market.

Mathewson and Winter developed a formal model that encompasses the externalities present in Telser’s model.[47] They examine in detail how a manufacturer that can credibly commit to tariffs that are observable to all downstream firms and are not bilaterally renegotiated can achieve the vertically integrated outcome with various combinations of two-part tariffs, RPM, and ET.

Mathewson and Winter derive strong results for the case where each downstream firm’s strategic decisions include price and a non-price decision (e.g., advertising) that affects demand. In one case they consider, each downstream firm’s advertising decision affects only its own demand. In another case, advertising by one downstream firm causes “spillovers” that benefit other downstream firms. The latter case involves a degree of free riding that formalizes the type of free-riding introduced by Telser. For these cases, Mathewson and Winter derive the following results:

- When there are no advertising spillovers, nonlinear tariffs alone are insufficient to achieve the fully integrated outcome. Closed territory distribution (a strong form of ET) combined two-part tariffs, and minimum RPM with two-part tariffs are sufficient to achieve the fully integrated outcome.

- When there are advertising spillovers, closed territory distribution combined with two-part tariffs is no longer sufficient to achieve the fully integrated outcome. Minimum RPM combined with two-part tariffs is sufficient.

The welfare implications of Telser’s and Mathewson and Winter’s results are ambiguous in theory. However, as in the successive monopoly case discussed earlier, if demand has constant curvature, marginal cost is constant, and downstream firms are symmetric, vertical restraints increase welfare.