Introduction

Judge Richard A. Posner famously described the consumer welfare standard as the “lodestar that shall guide the contemporary application of the antitrust laws” in 1986.[1] In the decades since, the antitrust community readily embraced the “lodestar” denomination.[2] The consumer welfare standard is indeed the focal point of modern antitrust analysis, guiding decisions and informing the rules and standards antitrust law imposes. But this is not the consumer welfare standard’s only function as lodestar. It is both guide and tether. It serves as the linchpin tying antitrust law to economic concepts and reasoning. Its guidance illuminates both what antitrust law is and—just as important, what it is not. The consumer welfare standard provides the basis for distinguishing between those concerns that antitrust law appropriately considers and those that it rightly omits. In doing so, the consumer welfare standard ensures a common language is spoken across antitrust matters today.

Antitrust law did not always operate with a common language. For many decades following the passage of the Sherman Act in 1890, antitrust lacked a unifying, consistent language. It was a cacophonous area of law, where decisions could be—and often were—premised upon vastly different reasoning from one to another, leading to numerous inconsistencies and internal tensions. This resulted in a general confusion as to how any given case would be decided. But more fundamentally, to questions regarding the very goals of antitrust law.

The consumer welfare standard, with its economic underpinning, has come to represent a robust language defining antitrust discourse today. For the last several decades, courts and enforcers, economists and practitioners, and other experts have developed this language. The analysis today is far more comprehensive than it was when the courts first embraced the consumer welfare standard 40 years ago. Experts have continued to investigate and seek out theories of harm; to develop economic tools for empirically investigating conduct; and to analyze numerous other components factoring into antitrust analysis, such as potential efficiencies.

Of late, the consumer welfare standard—and antitrust law more broadly—has come under renewed criticism. Criticisms come in various forms, but largely follow a similar thread, cataloguing its purported limitations: That it myopically focuses upon the short term and only upon price effects; that it omits consideration of important socio-political goals; that it is incapable of identifying and condemning problems endemic in the modern economy. While some of the criticisms ring true (the consumer welfare standard does not permit consideration of socio-political factors), others do not (the consumer welfare standard addresses far more than short term price effects). And many miss the mark because they overlook the history of how and why we arrived at the current understanding.

Indeed, a common characteristic of the current criticism, often referred to as the Neo-Brandeisian movement, is that it bears remarkable resemblance to those populist movements that came before it. Today, antitrust critics make nearly the exact same arguments regarding the proper goals of antitrust law—any number of socio-political ends such as protecting small businesses and preventing “bigness”—that similar movements throughout the 20th century (and the late 19th century) espoused.[3] Antitrust law did, in fact, embrace a more socio-political approach, which explicitly purported to serve just such values, for much of the 20th century.

Today’s criticisms thus represent a retrograde approach to antitrust enforcement. Retrograde generally refers to a movement backwards, a retreat, or a decline in condition.[4] In astronomy, though, planets are said to retrograde when they appear to be moving backwards in their orbits.[5] Antitrust law may be in a similar position today. The vigor and pervasiveness of calls to return to an earlier enforcement approach are certainly contributing to an appearance that antitrust law may be reversing its orbit. Whether this is merely an illusion is yet to be determined. Understanding the history of antitrust law and how it came to embrace the consumer welfare standard is, therefore, critical to understanding the current conversation and the fight for the soul of antitrust law. It is also critical to avoiding the very same pitfalls—and the costs to American consumers and to economic development—that defined earlier antitrust enforcement efforts.

Part I of this Chapter examines the history of antitrust law to contextualize the current debate. It addresses the numerous legislative history arguments and examines the courts’ experience enforcing the antitrust laws over the last 130 years, tracing the reasoning behind antitrust law’s developments and its adoption of the consumer welfare standard. Part II describes what the consumer welfare standard is and how it operates today, demonstrating its robustness and articulating its many benefits—to the courts, to enforcers, to firms, and to the public at large. Part III turns to the current debate, analyzing the validity and identifying the shortcomings of the arguments neo-Brandeisians proffer in support of abandoning the consumer welfare standard. Part IV concludes.

I. Antitrust in Context: History

Antitrust law in the U.S. was not always tethered to the consumer welfare standard. When the Sherman Act was first passed into federal law in 1890, the standards by which conduct was to be judged unlawful were far less developed—and far less coherent—than they are today. This led to many of years of increasing confusion, reaching a zenith in the mid-20th century. By that time, antitrust law was considered so muddled and ineffective that serious legal and economic scholars had largely abandoned it as a worthwhile academic endeavor.[6]

Targeted efforts to identify a clear, fundamental goal of antitrust shifted this thinking. Renowned minds of all stripes—including numerous Nobel Laureates, Supreme Court Justices, and appellate court judges—embraced the intellectual challenge of bringing rigor, consistency, and the rule of law to this wayward field. It was these efforts to begin with first principles, to identify the fundamental goal of antitrust and how best that goal could be achieved, that led to the law’s embrace of the consumer welfare standard.

A. Prerevolutionary Chaos: Early Antitrust Enforcement

With the passage of the Sherman Act, the United States first incorporated antitrust law into its federal regulatory landscape.[7] The Sherman Act remains a critical component of the modern antitrust framework. It is, however, rather unusual in its brevity and simplicity, especially as compared to modern day statutes. It left open many questions regarding implementation of the antitrust law, which has had two related effects over time: (1) a persistent interest in the legislative intent behind the Sherman Act’s passage; and (2) a critical role for the courts in developing the antitrust laws.

For over a century, prominent scholars, researchers, and other interested parties have sifted through the legislative history of the Sherman Act in attempts to divine the foundational, unifying purpose of the Act. As early as 1940, a “great deal” had already been said “about the purpose of Congress in passing the act.”[8] A report on U.S. antitrust law by the Temporary National Economic Committee at this time concluded that, “In a search for intent the record has been thumbed through with meticulous care and to little purpose.”[9]

Many have nonetheless persisted in this endeavor over the last several decades and continued to arrive at differing conclusions. While some argue the Act was aimed at maximizing economic goals—as measured by consumer welfare, efficiency, or other factors—others conclude the Act was intended to be a more general reckoning tool for various socio-political goals.[10] These conflicting results seem to underscore a point the Supreme Court has made: that “legislative history is itself often murky, ambiguous, and contradictory,”[11] and that investigating this history tends to become, as Judge Leventhal coined it, “an exercise in ‘looking over a crowd and picking out your friends.’”[12] Indeed, the conflicting results of these endeavors, undertaken by many serious, thoughtful scholars, tends to underscore just how confused the legislative history is and the futility of trying to divine a consistent, singular purpose.

Perhaps more important—and certainly more informative—than the intent of the 1890 (and later) congressmen and language that, by definition, did not make it into the statutes, is the courts’ practical history of enforcing the laws as enacted.[13] The Sherman Act is, as former Assistant Attorney General in charge of the Antitrust Division of the Department of Justice, William F. Baxter, described it, “almost constitutional in quality.”[14] Its broad, concise language lends itself to—even necessitates—common law development by the courts, as Senator Sherman himself recognized.[15] This arrangement delegated to the courts a central role in developing the antitrust laws for more than 130 years. Through that long history, we have learned quite a lot. These important lessons should not be lost amidst today’s loud and vigorous calls to revert antitrust law to its early form.

The Supreme Court early on recognized the important role of the courts in prescribing the particular metes and bounds of antitrust law, and in adapting those metes and bounds to align with modern teachings.[16] In Standard Oil Co. of New Jersey v. United States, the Court noted the “generic enumeration which the statute makes of the acts to which it refers . . . leaves room but for one conclusion, which is, that it was expressly designed not to unduly limit the application of the act by precise definition, but to leave it to be determined by the light of reason . . . whether any particular act or contract was within the contemplation of the statute.”[17] Here, in addition to acknowledging the important work that would need to be conducted by the courts, the Court explicitly incorporated the concept of the “rule of reason” into antitrust analysis.[18] This mode of analysis continues to be a defining characteristic of antitrust law today.

The Standard Oil decision further explained that concerns with monopoly power originally derived from fears of: “1. The power which the monopoly gave to the one who enjoyed it to fix the price and thereby injure the public; 2. The power which it engendered of enabling a limitation on product; and, 3. The danger of deterioration in quality of the monopolized article which it was deemed was the inevitable resultant of the monopolistic control over its production and sale.”[19] From these origins, which appear largely consistent with economic theory, courts expanded the scope of potential evils of monopoly which antitrust law might capture.

While economic concerns still had their place, courts often found the antitrust laws were broad enough to incorporate many additional, socio-political concerns. Court decisions, for instance, found that price cutting might drive from the market the “small dealers and worthy men whose lives have been spent therein, and who might be unable to readjust themselves to their altered surroundings,” and derided the notion that a “[m]ere reduction in the price of the commodity dealt” was a particularly worthy offset to such harms.[20] Indeed, many cases echoed this idea, allowing “that occasional higher costs and prices might result from the maintenance of fragmented industries and markets,” but resolving that protecting other values, such as the promotion of “viable, small, locally owned business”[21] and “put[ting] an end to great aggregations because of the helplessness of the individual before them,”[22] were worth the costs.

These—and more—goals forced courts applying the antitrust laws increasingly to tie themselves in knots in order to acknowledge and weigh all the competing factors. In the influential Alcoa decision, for instance, the Second Circuit (sitting by designation as the court of last resort) issued an opinion reflecting just such contortions.[23] The court recognized that monopoly power, alone, was not unlawful, because the “successful competitor, having been urged to compete, must not be turned upon when he wins.”[24] The court then condemned the defendant, however, for “doubling and redoubling its capacity” to meet consumer demand, concluding it could “think of no more effective exclusion than progressively to embrace each new opportunity as it opened.”[25] The decision thus admits size alone is not an offense and successful competitors should not be punished, but simultaneously punishes the successful competitor before it for growing and continuing to serve consumer demand.

Similarly, in United States v. Topco Associates, Inc., the Supreme Court condemned a joint venture of small and mid-sized regional supermarket operators for creating private label products with exclusive territories—an arrangement that allowed the members to compete more effectively with larger chain stores.[26] Private labels had become a boon for large chain stores, and the district court had found both that the Topco members could not provide a private label outside the joint venture, and that the territorial exclusives were necessary for the joint venture to exist at all.[27] The Supreme Court further acknowledged that Topco members lacked market share (averaging only about 6 percent), and that the private Topco label constituted only about 10% of the goods the members sold.[28] Further still, the Supreme Court recognized that the Topco private label brands’ “very existence [] improved the competitive potential of Topco members.”[29] While the Court lauded the Sherman Act as a champion of “the freedom to compete,” it nonetheless condemned this admittedly competitive conduct as per se unlawful.[30]

Swift condemnation of this kind was, in fact, increasingly characteristic of antitrust decisions at this time. By the midcentury mark, courts had embraced the “inhospitality tradition,” which reflected a deep skepticism of large firms and novel conduct.[31] This skepticism, in turn, tended to result in summary condemnation and an increasing use of the per se rule to outlaw numerous types of conduct. Mergers and joint ventures between even very small firms were unlawful, as were nearly all vertical arrangements.[32] Firms were increasingly restricted as to how they could grow, not only through combination but also through internal expansion, hampering their ability to meet new challenges or to engage in innovative behavior.

In other words, the courts had found the goals of the antitrust laws were many—but enhancing competition between firms, it seemed, was not truly among them.[33] As the courts’ decisions became increasingly convoluted, tensions surrounding antitrust enforcement rose.

B. Antitrust in Crisis

By the mid-20th century, U.S. antitrust law was in crisis. Incorporating so many disparate socio-political goals into the analysis yielded an environment in which decisions increasingly relied upon inconsistent reasoning to reach their outcomes. Holdings often contradicted not only other cases, but the internal logic espoused elsewhere in the same decision. This state of affairs led Supreme Court Justice Stewart, in a scathing dissent, to state that the “sole consistency I can find is that in litigation under § 7, the Government always wins.”[34] In examining the merger before the Court, he found “[n]othing in the present record indicates that there [wa]s more than an ephemeral possibility that the effect” of the merger might have been to harm competition.[35] And he harshly criticized the majority’s decision to condemn a merger resulting in “a firm with 1.4% of the grocery stores and 7.5% of grocery sales in Los Angeles,”[36] deviating starkly from even the 30% threshold established in U.S. v. Philadelphia National Bank[37] just three years prior.

Justice Stewart was far from antitrust’s only critic. Experts across the spectrum have decried the systemic shortcomings of antitrust law during this period. Finding the case law to be “schizophrenic,”[38] “an impenetrable jungle of words,”[39] “an economically irrational war on vertical integration,”[40] “an incoherent and unpredictable body of law,”[41] “standardless and unduly hostile,”[42] and more. Antitrust expert and D.C. Circuit Judge Douglas H. Ginsburg, for instance, concluded that, at this time, “the U.S. Supreme Court simply did not know what it was doing in antitrust cases.”[43] Former FTC Chairman William E. Kovacic and former Antitrust Division Deputy Assistant Attorney General Carl Shapiro similarly noted that most economists, as a result, found the Sherman Act to be “a harmless measure” at best, and an impediment to the “attainment of superior efficiency promised by new forms of industrial organization” at worst.[44]

These criticisms crested in the mid-20th century, but the wave had been building for quite some time. In 1932, for instance, Milton Handler—noted antitrust expert and President Franklin D. Roosevelt’s chief adviser on antitrust matters[45]—conducted a review of Supreme Court precedent. He found, “There is support in the body of authority for almost every position that might conceivably be taken; contrariwise there are embarrassing holdings and dicta which no one theory can fully explain, short of regarding the cases as fundamentally opposed to one another.”[46] He concluded, “when all is said and done, the fact remains that the decisions are in good part inconsistent and the opinions hopelessly confused.”[47]

Not only had antitrust law incorporated myriad, often conflicting values—making it impossible for consistency or coherence to prevail—but it was widely recognized that it also failed to achieve any particular one of its many conflicting goals.[48] It often undermined the very competitive values it purported to preserve. Many decisions not only permitted but in fact sought to preserve higher prices.[49] While the purported justifications typically included protecting individuals against large enterprises, that overlooked entirely the individual consumers who were forced to pay those higher prices, and whose interests were generally not even considered in the courts’ opinions. Scholars readily poked fun at the perverse incentives at play, noting that—contrary to the court’s statement in Alcoa—perhaps “the successful competitor can be turned upon when he wins, because he has been told not to compete.”[50]

It cannot even be said that antitrust law at this time truly assisted the small, local businesses it frequently purported to defend, or otherwise fostered an environment conducive to their success. Small firms, perhaps just as much as large ones, were subject to the shifting and mercurial whims of antitrust law. Mergers of even very small enterprises were typically found unlawful.[51] As Justice Stewart adroitly observed in Von’s Grocery: “The irony . . . is that the Court invokes its sweeping new construction of § 7 to the detriment of a merger between two relatively successful, local, largely family-owned concerns, each of which had less than 5% of the local market and neither of which had any prior history of growth by acquisition.”[52] And as the Topco case illustrates, joint ventures imposing limited restrictions that were necessary to enhance small businesses’ competitive standing were not merely condemned under the rule of reason, but were deemed per se unlawful; no consideration of the effects (economic or otherwise) was allowed.[53] As Justice Blackmun explained in that case, “today’s decision will tend to stultify Topco members’ competition with the great and larger chains. The bigs, therefore, should find it easier to get bigger and, as a consequence, reality seems at odds with the public interest.”[54] Indeed, far from helping smaller enterprises, court decisions during this time often “completely destroyed the very small, locally owned businesses that the decisions were intended to protect.”[55]

In a state of desperate disarray, antitrust law was in need of a foundational reexamination and rebuilding. The spark for this much-needed work came from economists and legal scholars at the University of Chicago.[56] These experts initiated a robust, introspective dialogue on antitrust law and its goals, beginning with the “Fortune Magazine Debates.”[57] In these pages, well-respected experts on the one side defended the multi-faceted, socio-political approach to antitrust, while those on the other countered that economic welfare and analysis, alone, should prevail. The true value of competition, these scholars argued, was in its ability to expand output. They contended that antitrust law could unleash this output expansion by focusing solely on competition. For an area of law that, so far, had proven inept at fostering any one of its many goals, this was an intriguing proposition.[58]

These efforts catalyzed later works expanding upon the basic premise that, by tethering antitrust to an economic foundation, antitrust could become a powerful force of growth. This foundation necessarily rejected the socio-political approach thus far developed because, as noted, it tended to protect firms from the very competition and market forces that drove economic growth and expansion. Work focused on questions of first principles: what is it we want antitrust law to do, and why? And then rigorously examined its capacity to meet these goals. Notably, the marketplace of ideas here began with vigorous voices on both sides, arguing for and against the socio-political approach to antitrust.

As the debate progressed, the economic approach began to gain momentum, bolstered by both theory and practical experience. The socio-political goals had proven to be largely (if not wholly) out of reach, as demonstrated through several decades in this failed experiment. But the possibility of enhancing economic welfare seemed tantalizingly within reach. It also aligned with the broad purpose of the antitrust statutes, which sought to foster competition and to protect individuals; to succeed, firms would have to engage in activities that benefit individual consumers, namely, finding ways to lower prices, expand output, innovate, offer better quality or services, and more. Meanwhile, activities that subverted free market forces could be consistently condemned. As the Supreme Court had recently recognized, “The Sherman Act was designed to be a comprehensive charter of economic liberty aimed at preserving free and unfettered competition as the rule of trade. It rests on the premise that the unrestrained interaction of competitive forces will yield the best allocation of our economic resources, the lowest prices, the highest quality and the greatest material progress[.]”[59] The Court may have struggled with how to implement and unleash these competitive forces, but the foundation for an economics-based approach to antitrust had been laid.

With the renewed energy and clarity of purpose these efforts provided, the courts forged ahead with the work of incorporating these new insights into the law and the matters before them. The Court’s decision in Continental Television, Inc. v. GTE Sylvania, Inc.,[60] is widely acknowledged as marking the shifting of the tides.[61] Here, the Court eschewed the formalistic approach it had previously embraced in cases like Topco, and focused instead upon the effects of the conduct before it. It refused to condemn as per se unlawful restraints a manufacturer had imposed on retailers, finding there existed “a number of ways in which manufacturers can use such restrictions to compete more effectively.”[62] The Court considered the propensity of the conduct before it to harm consumers, utilizing economic insights regarding the ability of such vertical restraints to yield procompetitive effects as opposed to anticompetitive harms. It then held that such conduct should be analyzed under the rule of reason, so as to facilitate the realization of consumer benefits while maintaining the ability to condemn restraints that harmed consumers or competition. This distinctly effects-forward approach represented both a marked departure from the inhospitality tradition, which judged behavior based upon its form, and an evolution to a more informed and coherent approach to fostering competition and consumer welfare.

In the decades since, the Supreme Court and the lower courts have continued to implement this updated approach. While important debates persist to this day regarding how best to craft rules and standards to shape the ideal environment, fundamental themes guiding the analysis were (at least for a time) identified. Economists and the courts agreed that the antitrust laws should seek to foster competition as a means of promoting consumer welfare.[63] They should be guided in their efforts by economic theory and empirical evidence, as well as a consideration of error costs. In other words, legal theories of harm should be largely coextensive with economic theories as to when anticompetitive effects may arise; this provides a solid foundation for legal theories and a coherent method of crafting, articulating, and proving alleged harms. Empirical evidence—about both of the conduct at issue and similar conduct—should inform the rules and standards regarding the level of evidence and proof needed to win a case based upon such a theory; this fosters predictable and consistent outcomes over time, while allowing for evolution as our collective understanding of conduct develops. Scholars participating in this debate—inside and outside the Chicago School—noted that antitrust law was hostile to large swaths of conduct, but when they inquired as to the reasoning underlying that hostility, discovered many unproven assumptions. Finally, courts should seek to establish rules and standards that minimize the combination of costs deriving from administering the relevant rules, from false positives (Type I errors) and from false negatives (Type II errors).[64]

C. Aftermath of a Revolution: Consumer Welfare and Continuing Developments

Antitrust law has largely flourished in the last 40 or so years, having established a newfound sense of self that is both coherent and capable of achieving its ends. It benefits from a longstanding and nonpartisan support for the consumer welfare standard.[65] The Supreme Court has consistently, and on a nonpartisan basis, acknowledged the economic grounding and consumer welfare goals of the antitrust laws.[66] The consumer welfare standard today thus serves as a common language unifying antitrust cases and analysis. Continued disagreements over original legislative intent have not forestalled this consensus, owing to this and many other benefits (developed below), including increased certainty, clarifying and narrowing the scope of applicable goals to consider, and facilitating the rule of law.[67]

This is not to say antitrust law is without its imperfections and shortcomings—far from it. Important debates regarding all manner of issues, from market definition[68] and efficiencies[69] to the applicability of quick look rules[70] and presumptions,[71] persist and continue to inform modern enforcement.[72] For instance, while some argue that antitrust agencies should be more skeptical of vertical mergers,[73] others contend modern enforcement aligns with available empirical evidence regarding the likelihood of anticompetitive harm.[74] But antitrust’s embrace of an economically-grounded approach, guided by the consumer welfare standard, has provided a sound foundation upon which these debates may build. Disagreements can (and often do) arise regarding the likely economic effects in a given case; but all interested parties know what the locus of the inquiry will be and how the conduct will ultimately be judged. There is, in other words, a common language spoken across antitrust cases. Unlike the early days during which antitrust decisions were based upon any number of incompatible socio-political goals, decisions today speak solely to the economic effects of the conduct at issue. To continue the metaphor, rather than arguing over which language to use, parties debate which nuances of the same language best characterize the conduct at issue.

The consumer welfare standard’s focus on economic insights and teachings also affords the flexibility to introduce new theories and concepts, allowing courts and enforcers more accurately to assess the competitive effects of the conduct before them.[75] For instance, the entire raising rivals’ costs (RRC) paradigm arose and was incorporated into the antitrust lexicon post-revolution.[76] Today, RRC theory often drives exclusionary conduct cases. Similarly, modern unilateral effects theory, which underpins a majority of merger enforcement cases today, developed after the antitrust revolution and was largely implemented in the 1990s.[77] Robust debates continue to expand our understanding of what competitive behavior looks like in the modern digital economy, and how most effectively to promote healthy competition while preventing anticompetitive conduct. These debates remain robust, in part, because the consumer welfare standard is able to incorporate new insights—giving those insights real value in modern enforcement efforts. Indeed, the Supreme Court has, on multiple occasions, recognized that antitrust outcomes should develop along with sound developments in our economic comprehension.[78]

II. Antitrust in Action: The Consumer Welfare Standard and Modern Enforcement

The consumer welfare standard brought analytical rigor and returned the rule of law to an area once lacking both. It accomplished this while also providing flexibility for enforcers and courts to keep pace with modern markets and to condemn even novel conduct that anticompetitively harms consumers. This is possible only because of the standard’s economic grounding. It elevates the practical, likely effects of conduct as the locus of analysis, rejecting the earlier approach that frequently condemned conduct based upon form alone.

A. What the Consumer Welfare Standard Is and What it Does

To begin, it is important to understand what the consumer welfare standard is and what it is not, what it does and does not do. While the consumer welfare standard is the lodestar of antitrust analysis, it is not a liability rule. Certain conduct may be unlawful per se or it may be unlawful under a rule of reason analysis (or even a “quick look” analysis). Different theories of harm then entail different evidentiary requirements to satisfy either the per se rule or rule of reason requirements. For instance, predatory pricing claims require evidence of a price below cost plus a likelihood of recoupment;[79] attempted monopolization claims require demonstration of anticompetitive conduct, with a specific intent to monopolize, and a dangerous probability of achieving monopoly power; etc.[80] The consumer welfare standard informs these and other requirements. It tells us that, in choosing the appropriate rules and requirements, we should look to the propensity of a given type of conduct to yield procompetitive benefits or anticompetitive harms, and to the conditions under which one or the other is more likely to predominate. In other words, the consumer welfare standard is aligned with what antitrust law is endeavoring to promote, and hence helps to inform the development of the law, including what liability rule may be appropriate for given conduct.

What does antitrust analysis under the consumer welfare standard actually consider? There are many arguments regarding what the consumer welfare standard can and should cover.[81] But there are also some clearly delineated answers.

Most fundamentally, the consumer welfare standard tethers antitrust to economic analysis. It rejects the consideration of socio-political factors that so frustrated early antitrust cases. In doing so, it provides a consistent language spoken across antitrust cases today. From the focus upon economic factors, a few key premises follow.

It is by now axiomatic that the antitrust laws were designed to protect competition—that is, the competitive process itself—and not to protect individual competitors.[82] Whereas pre-consumer welfare antitrust might condemn an efficient competitor simply for offering prices lower than a less effective competitor could match,[83] modern antitrust would not.[84] This is a critical development that eased numerous tensions. Competition is often a messy business. By design, it allows some firms to win—meaning others must lose. But it is the very possibility of winning that drives competition in the first place. Indeed, the Supreme Court has repeatedly recognized that the prospect of winning—that is, of gaining market share and setting prices accordingly—is critical to encouraging competition itself: “The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system.”[85] One simply cannot exist without the other.

A corollary of this premise is that harm to competitors, alone, is insufficient. There remains, of course, a role for the consideration of harm to competitors in the analysis. For instance, if a defendant undertook a strategy to raise rivals’ costs, if and how those competitors were affected would be relevant to ascertaining the effect this strategy had on competition in the market. But a successful antitrust case today cannot simply be premised upon an allegation of harm to a competitor that does not include harm to competition more broadly.[86]

Indeed, this fundamental notion is not only engrained in U.S. antitrust law, it is recognized globally as the driving goal of competition laws. The OECD, for instance, has identified “substantial agreement among jurisdictions on the broad goals and methods of enforcing competition laws against abuse of dominance, particularly with respect to studying harm to competition, not competitors.”[87] In this way, the consumer welfare standard has truly provided a common, universal language for antitrust enforcement.

Moreover, the consumer welfare standard focuses on understanding how firms compete—and it is robust enough to contemplate the numerous margins along which they might do so. Cases today routinely consider how the conduct at issue affected prices, output, quality, services, innovation, and more. There is a growing misconception today that antitrust law’s consumer welfare standard focuses myopically on short-term price or output effects to the exclusion of other factors—such as effects on innovation and quality—that may be far more important to consumers.[88] A quick examination of the cases lays bare the fault in these allegations.

Consider recent cases brought by the U.S. Antitrust Agencies. By no means the only cases being brought today—private plaintiffs and state attorneys general also have the right to sue under the federal antitrust laws, an ability they frequently exercise. But the federal Antitrust Agencies do bring many cases that contribute critically to the antitrust enforcement landscape. While the agencies do tend to allege price effects, it is rare that they allege solely price effects. Their investigations routinely consider effects on factors such as innovation, quality, service, and R&D,[89] as contemplated in their various guidance documents.[90]

The DOJ’s recent and successful challenge of Novelis Inc.’s proposed acquisition of Aleris Corporation, for instance, alleged this transaction would likely raise prices and reduce quality and innovation in the market for aluminum automotive body sheet.[91] The remedy in this case included (among other things) a divestiture of an Aleris technical service center, known as the “Innovation Center.”[92] The FTC similarly challenged and achieved remedies in the merger of UnitedHealth Group Incorporated and DaVita Inc., finding the merger was likely to raise prices, to “result in a decrease in incentive to compete on quality, services, and other amenities,” and to force senior citizens to “incur higher cost-sharing payments and receive fewer benefits and lower quality healthcare services.”[93] These cases—and many others—demonstrate both that the consumer welfare standard is routinely used to prevent adverse non-price effects and that the Agencies can and do file (and win) such cases.

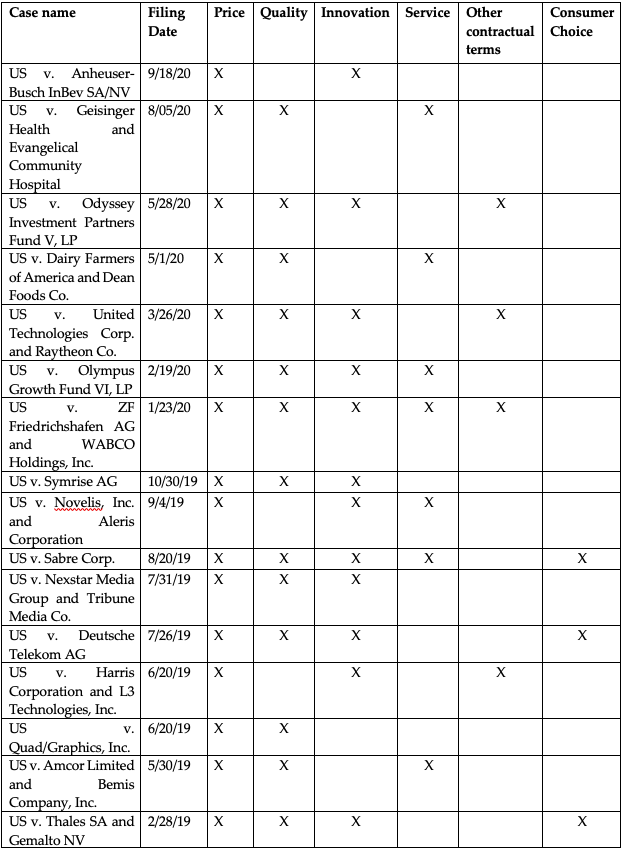

To illustrate the comprehensive approach the Agencies typically take, the below chart identifies civil merger complaints filed by the Antitrust Division between January 2019 and September 2020, and the categories of harms those complaints specifically identified:[94]

Table 1

DOJ Civil Merger Cases: Categories of Effects Alleged Filed January 2019 through September 2020

In all but four of these matters, the Division simultaneously filed a complaint and proposed final judgment that included, among other provisions, divestiture requirements. In one of the remaining cases, the parties abandoned the deal after the Division filed its complaint.[95] The Division litigated and lost just one case.[96] The final case was recently filed and remains in litigation at the time of this Chapter’s publication.

In other words, over the last twenty-one months, the Division filed suit against sixteen mergers as likely to substantially lessen competition along any of a number of margins. None of these challenges relied solely upon alleged price effects. And the Division prevented all but one merger from being consummated in its original, allegedly anticompetitive form; only one other stands a chance of remaining unremedied, were the parties to continue to litigation and ultimately to prevail.[97]

The FTC likewise frequently alleges harm based upon more than just price effects.[98] For instance, it specifically alleged harm to innovation in 54 merger challenges filed between 2004 and 2014.[99] These cases underscore that analysis under the consumer welfare standard routinely incorporates both price and non-price aspects of competition.

B. Benefits of the Consumer Welfare Standard

The benefits of the consumer welfare standard are myriad and significant. This standard establishes a common language that is spoken across antitrust cases, ensuring that courts, agency enforcers, and private parties are able to converse and debate the effects of the conduct at issue, knowing that the ultimate decision will be based upon those very effects. This facilitates a coherent and consistent framework for analysis and the predictability of outcomes. As developed above, the socio-political antitrust regime that prevailed through the mid-20th century wrestled with numerous, often amorphous, factors and lacked any principled means for settling on which of these many bases to rest a given decision. This approach had many costs, including that it essentially obliterated the rule of law.[100] The consumer welfare standard, by contrast, tethers antitrust decisions resolutely to economic effects. This consistency returned a sense of intellectual respect to this area of law. Importantly, it also returned the rule of law.[101]

Moreover, the consumer welfare standard replaced the form-based inhospitality regime with an effects-based approach that promotes efficiency and innovation. The inhospitality tradition had crippled firms’ ability to compete. By treating with extreme skepticism anything they perceived as novel, courts precluded much of the innovation and experimentation with new ideas and approaches that competition needs to survive. Coupled with severe limitations on what firms—large or small—could do to grow, this approach tended to impair competition itself.

The consumer welfare standard replaced this focus upon form and familiarity with an emphasis upon effects and fostering an environment conducive to innovation. The Ninth Circuit’s recent decision in FTC v. Qualcomm, for instance, specifically found that “novel business practices—especially in technology markets—should not be ‘conclusively presumed to be unreasonable and therefore illegal without elaborate inquiry into the precise harm they have caused or the business excuse for their use.’”[102] This reflects a respect for innovation—and the often messy (and costly) process of trial and error that inevitably accompanies it—which the prerevolutionary antitrust regime rejected. Innovation is critical to the modern economy. The consumer welfare approach allows antitrust law to respect and promote innovation and to realize the tremendous benefits of innovation, while simultaneously protecting consumers from truly anticompetitive conduct.

Indeed, the consumer welfare approach focuses on maximizing outcomes for the public at large. All citizens are consumers. Many also play other roles in our societies and economies, including as employees, employers, and business owners. The role of consumer, though, is the most constant and consistent. People may flow into and out of the labor force over time, and may transition between employee and employer roles or between small- and large-business owner. But we continue to be consumers our entire lives. A rule that seeks to maximize benefits to consumers accordingly tends to provide the most consistent benefits over each person’s lifetime.[103] Meanwhile, a rule that favors more specialized narrower interests, such as small business owners, would tend to undermine the broader welfare in favor of the welfare of more specialized interests.

Finally, the consumer welfare standard plays a critical role in limiting the rent seeking, political influence, and protectionism that plagued the prerevolutionary antitrust regime. Socio-politically oriented antitrust enforcement proved highly susceptible to rent seeking and capture by special interest groups.[104] This is unsurprising based upon public choice theory, which predicts that the vaguer a rule is, the more discretion is afforded the enforcer; in turn, more discretion tends to invite more rent seeking behavior, and to increase the likelihood of agency capture. That is, as uncertainty as to outcomes increases, firms will expend more resources towards assuring themselves positive results—for instance, by seeking favorable legislation or agency enforcement aimed at a competitor.

Simultaneously, when rules are opaque, it is more difficult (maybe even impossible) to hold government actors—enforcers and courts—responsible for their actions, as there is no clear way to distinguish between meritorious and biased decisions. In other words, the very factors that characterized pre-revolution antitrust—confusion, vagueness, a multiplicity of goals—made it ripe for abuse. And abused it was.[105] The consumer welfare standard, by contrast, provides a clear roadmap for identifying when enforcers might go off the approved track and consider non-economic, i.e., inappropriate, factors in their decisions. This provides strong protections against capture and political abuse; protections that were notoriously lacking in the socio-political antitrust regime.

III. Antitrust in Retrograde: Renewed Criticisms of Antitrust’s Goals

At the time of this Chapter’s publication, numerous scholars, politicians, and commenters are advocating vociferously for antitrust law to return to its pre-revolution framework. They assert that modern antitrust is undermining democratic values, allowing silos of economic and political power to continue to grow while inequality likewise grows, and permitting laborers increasingly to be taken advantage of.[106] These arguments are similar, if not identical, to arguments made in the mid-20th century.[107] And they have, as they occasionally do, gained traction in recent years. At least one national political party has included both antitrust and positions sympathetic to neo-Brandeis sentiments in its policy platforms;[108] presidential candidates have incorporated antitrust issues as central points of their campaigns;[109] legislative bodies have launched investigations;[110] and legislators have introduced legislation.[111]

Very real impediments to (re)adopting these proposals can—and should—exist. They largely repeat those that prevailed prior to the antitrust revolution, idealizing this very problematic era. There is yet no evidence that achievement of the varied socio-political goals being espoused are correlated to antitrust enforcement, let alone causally tied to such enforcement. Accordingly, their proponents fail to articulate why, let alone demonstrate how, antitrust law could, this time, perform any better.

A. Nostalgia and Antitrust

As neo-Brandeisian policies have continued to build momentum, it has become increasingly clear that its advocates rely heavily upon the same arguments as pre-revolution antitrust. Critics invoke legislative history as being unambiguously in support of their position[112]—an argument that is, at best, controversial but uninformative.[113] Aside from the general limitations upon the probative value of legislative history, in antitrust there is the added complication that, from the very beginning, the statutes afforded to the courts the critical role of operationalizing the broad congressional mandates—of making broadly stated goals and prohibitions workable. As described above, the courts struggled mightily for decades trying to give effect to the numerous socio-political goals that were attributed to antitrust law. Despite their best efforts, these struggles ended in resounding failures for the courts—leading to the very consumer welfare standard critics now condemn.[114]

Despite this history, the neo-Brandeisians’ position increasingly represents an attempt to invoke nostalgia, hearkening to an allegedly Edenic era. Advocates cite to enforcement and legislation in the early to mid-20th century as “effectively curb[ing] the power of size”[115] and promoting a “golden era of egalitarian prosperity.”[116] At times, they look back even further, to the early 19th century, arguing that “citizens of the young United States made themselves free to use their state legislatures to ensure that their markets were open and well-regulated and that incorporations of power necessary to achieve any particular large-scale project were limited in scope and duration.”[117]

The reality, though, is that they are hearkening to an era that simply never was. In looking back at the “good old days,” humans are prone to look through rose-colored glasses; to romanticize the bygone era and minimize—or ignore entirely—the shortcomings and problems that invariably existed. The same is true with the neo-Brandeis movement. They tend to ignore that concerns about bigness and consolidation persisted even at the height of antitrust’s inhospitality toward them and that small, locally-owned businesses faced very real hardships in that regime.[118] They largely fail to engage with the serious struggles, confusion, and disarray that resulted when courts attempted to maximize numerous, amorphous socio-political goals through vague statutory language.[119]

And they often minimize the very real capture—of antitrust agencies and legislatures—that explicitly elevated the interests of particular groups over those of the public at large. For instance, it was during that time that Congress gave us the Robinson-Patman Act, a statute that leading antitrust expert Herbert Hovenkamp has described as “perhaps the most protectionist piece of antitrust legislation ever passed.”[120] Repeated studies of outcomes during this time concluded that enforcement decisions were inconsistent with public interest theory, under which agency decisions are made so as to benefit the public at large.[121] In other words, antitrust outcomes were not serving the American public. The Federal Trade Commission—tasked, along with the Department of Justice’s Antitrust Division, with enforcing the antitrust laws—was excoriated in numerous reports for ineptness. As summed up by Judge Richard A. Posner, numerous reports issued between 1924 and 1969 had found the FTC was “rudderless,” “politicized,” and “all in all, inefficient and incompetent.”[122]

All told, it is clear that antitrust law simply never existed in the coherent and successful form that critics of modern antitrust conceive. Indeed, it was plagued with its own ineptitudes and systemic shortcomings.

B. Antitrust and Socio-Political Goals

There are many key factors to weigh in considering the tradeoffs between the consumer welfare regime and a socio-political approach. Perhaps most important, a socio-political approach would necessarily entail a decrease in consumer welfare.[123] Modern antitrust law reflects the primacy of consumer welfare; its rules, standards, and outcomes are shaped as to maximize the benefits flowing to consumers. While mistakes and missteps may occur, the fundamental goal is to make all consumers better off through healthy competition.

A socio-political approach would, by contrast, subordinate consumer welfare—in whole or in part—to other concerns. Depending upon the particularities of the socio-political rule, consumer welfare may be one of several factors, or may not be an explicit factor at all. In either case, a rule that says consumer welfare is but one benefit to be considered is necessarily willing to trade away some amount of consumer welfare for some other value(s). For instance, a “citizen interest” approach might conclude that the benefit to consumers of lower prices or enhanced innovation is outweighed by factors like dispersing political power. The direct effect of such a decision would be higher prices and less innovation. Indeed, such outcomes were repeatedly observed in the prerevolutionary antitrust regime. Multiple cases demonstrate the Supreme Court’s willingness to tolerate higher consumer prices in search of other values.[124]

In addition to this basic tradeoff, there is the open question regarding antitrust law’s capacity to achieve socio-political benefits. Antitrust enforcement has proven a poor tool for achieving socio-political goals like dispersing political power; so the purported benefit of the rule might not be realized, while the harms (higher prices and diminished innovation) would be. Proponents of the socio-political approach assume that greater antitrust enforcement under this regime would offer a number of benefits, such as reducing concentration and inequality. These arguments tend to focus not on first-order effects—how conduct affects competition in a market—but upon effects further down in the causal chain. They contend, for instance, economic power might ultimately be translated into political power that allows firms to affect laws and law enforcement.[125]

Further, available empirical evidence “offers little to no support” for many new-Brandeisian assumptions.[126] Indeed, existing data tend to demonstrate a weak, if any, correlation between antitrust enforcement and the socio-political factors, let alone evidence of causal relationships.[127] And it “simply does not support the conclusion that (1) there is a meaningful concentration problem in the modern United States economy; (2) assuming such a problem, it is caused by a reduction in competition and a corresponding increase in monopoly power that has resulted in harm to consumers; and (3) again assuming such a problem, that lax antitrust enforcement is to blame, as it is for other social effects, including an increase in economic inequality.”[128]

Here again, several decades of enforcement experience tend to undermine assertions that antitrust law is a competent vehicle for furthering socio-political ends. Consider again the plight of small businesses—one of the most frequently cited reasons for condemning conduct in pre-revolution antitrust.[129] As explained above, conduct by small businesses was summarily condemned by antitrust courts with alarming frequency. They could scarcely engage in any merger or acquisition activity or any joint ventures—even when that conduct would have allowed them to offer innovative products and lower prices and positioned them to compete more aggressively—without running afoul of the antitrust laws. Despite trying to protect “small dealers and worthy men,”[130] antitrust outcomes often had the perverse effect of undermining their interests, results which were “documented over and over.”[131]

Moreover, there are sound reasons to believe the consumer welfare standard, as currently structured, in fact helps to facilitate (albeit indirectly) several of these socio-political goals. The Supreme Court long ago recognized that “the unrestrained interaction of competitive forces will yield the best allocation of our economic resources, the lowest prices, the highest quality and the greatest material progress, while at the same time providing an environment conducive to the preservation of our democratic political and social institutions.”[132] Focusing the competitive process and the welfare of consumers indeed can benefit political and social institutions.

The primary beneficiaries of competition are consumers. They realize this value in many ways. Competition may lead to lower prices, which means that consumers are able to purchase more or different goods to enhance their wellbeing or to work less to afford the same bundle of goods. Competition may also lead to benefits in quality, services, and innovation, which provide consumers with an easier or more streamlined experience. Such benefits may leave consumers with more time (and energy), to engage in other activities that they were essentially priced out of before. While this includes leisure activities like vacationing, it also includes civic activities, such as volunteering and voting.

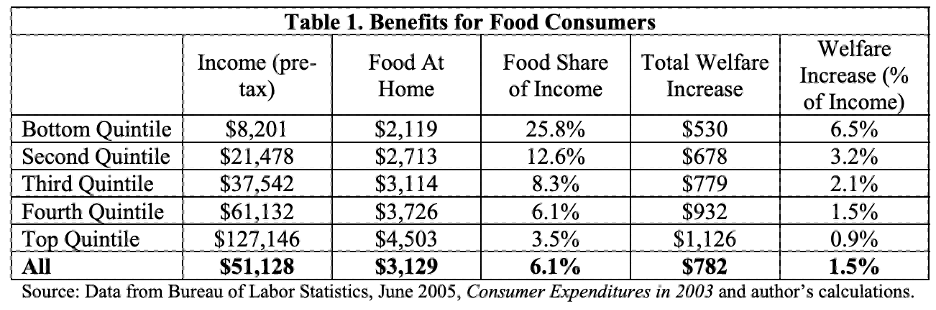

Moreover, less wealthy citizens benefit disproportionately from lower prices and enhanced access to products and services. They are the most sensitive to increases in price, or quality-adjusted price increases, and forced to make the most tradeoffs in terms of any additional (non-essential) activities. Jason Furman’s analysis of the benefits consumers realize from Walmart’s participation in the retail sector highlights this point nicely.[133] He notes that total savings from Walmart are enormous—estimated to be over $260 billion in 2004, or over $2,300 per household.[134] As he documents, lower income households in fact benefit disproportionately from these lower prices. He takes for example groceries—which comprise an increasing percentage of household budget as income decreases—to demonstrate this disparate benefit:[135]

Table 2

His results indicate that the lowest income group’s gain was more than seven times that of the highest income group’s. In other words, the competitive benefits Walmart creates flow disproportionately to lower income individuals and households. This would seem to be consistent with various social concerns, such as income inequality and progressive distributive effects.[136] These disproportionate benefits allow wealth-strapped consumers to purchase more with less—meaning the required hours worked to purchase food diminishes, and their purchasing power (in terms of money and time) increases.[137]

The relevant question, then, is whether a socio-political antitrust regime could improve upon the consumer welfare standard.

C. Identifying the Best Path Forward

This discussion highlights the significant questions that remain unanswered in the calls for retrograde antitrust today, as well as the real tradeoffs that would have to be made in any such regime change. As Herbert Hovenkamp recently explained: “To date the strongest and most central claim of the neo-Brandeis movement remains untested; that is its assumption that individuals in our society would really be better off in a world characterized by higher prices but smaller firms.”[138] This is, indeed, a foundational question yet unanswered. And it presumes the capacity of antitrust to effectively and coherently protect small businesses—a task at which it proved inept for decades.

As explained, lower income or lower wealth citizens are the most susceptible to the harms from higher prices, reduced output, and other competitive harms. The neo-Brandeisian world would, by necessity, reintroduce these very harms because it would subordinate consumer welfare to other values. The progressive distributive effects being what they are, such a regime would tend to inflict the most economic harm on those who are most vulnerable. For instance, this approach would erase many (if not all) of the billions of dollars per year in benefit that consumers realize from the ability to shop at Walmart alone—benefits that disproportionately benefit lower wealth households.[139] To justify such costs, we would want to be very sure that any purported benefits would be realized. But whether such an antitrust regime would offer these benefits remains very much in doubt.[140] Neither empirical evidence nor practical experience suggests they are likely to be achieved.

The neo-Brandeis movement focuses, rightly, on preventing political institutions from being coopted by special interests. The best way to prevent political influence and regulatory capture, however, is to establish clear rules and standards that allow the public to hold decision-makers accountable for their actions. Introducing vague or multi-factored standards, such as a “citizen interest standard,” would reintroduce the very conditions that contributed to the corruption of the prerevolutionary antitrust regime.

Notably, Neo-Brandeisians have yet to settle on a standard. Proponents have advocated various retrograde approaches, from bright line or per se rules, echoing those established in the 1968 Horizontal Merger Guidelines; to a full embrace of the big-is-bad era; to public or citizen interest, trading partner welfare, or similar standards that would expressly incorporate distributional concerns. These myriad standards underscore the complications inherent to attempting to inject socio-political goals into antitrust analysis—complications the courts understand well, from decades of just such experience.

Finally, as developed, antitrust law under the consumer welfare standard already does indirectly promote numerous social goals. For these (and other) reasons, Makan Delrahim, the Assistant Attorney General in charge of the Antitrust Division of the Department of Justice, concluded that “enforcement actions purportedly aimed at supporting our democracy carry too great a risk of inadvertently undermining” these fundamental values.[141] He further reiterated that antitrust under the consumer welfare standard promotes our democratic values, by facilitating free markets and competition, the benefits of which inure to all Americans—echoing the Supreme Court’s repeated pronouncements. Thus, the relevant comparison on this margin is really whether any of the neo-Brandeisian’s new standards could promote these goals more effectively.

Conclusion

Planets in retrograde appear to be moving backwards in their orbits. Of course, they do not actually reverse course. That appearance is merely an illusion. But a casual or uninformed observer might be forgiven for believing they had, in fact, changed their trajectories.

So, too, with the casual observer of the current debate over the suitability of the consumer welfare standard. Proponents of the prerevolutionary antitrust approach are loudly vocalizing their discontent and gaining support, suggesting that antitrust is (at least) in retrograde. But their preferred path is marked with pitfalls, shortcomings, and harms. No clear means for avoiding these hazards has yet been proffered, let alone proven.

Appendix A

DOJ Cases cited in Table 1

- US v. Anheuser-Busch InBev SA/NV, Compl. ¶¶ 5, 24, 25, 27 https://www.justice.gov/atr/case-document/file/1322386/download.

- US v. Geisinger Health and Evangelical Community Hospital, Compl. ¶¶ 59-63, 75, https://www.justice.gov/atr/case-document/file/1313051/download.

- US v. Odyssey Investment Partners Fund V, LP, Compl. ¶ 31 https://www.justice.gov/atr/case-document/file/1280201/download.

- US v. Dairy Farmers of America and Dean Foods Co., Compl. ¶ 33 https://www.justice.gov/atr/case-document/file/1279226/download.

- US v. United Technologies Corp. and Raytheon Co., Compl. ¶ 65 https://www.justice.gov/atr/case-document/file/1262896/download.

- US v. Olympus Growth Fund VI, LP, Compl. ¶ 37 https://www.justice.gov/atr/case-document/file/1250316/download.

- US v. ZF Friedrichshafen AG and WABCO Holdings, Inc., Compl. ¶ 29 https://www.justice.gov/atr/case-document/file/1238191/download.

- US v. Symrise AG, Compl. ¶ 24 https://www.justice.gov/atr/case-document/file/1214021/download.

- United States v. Novelis, Inc. and Aleris Corp., No. 1:19-cv-02033 (N.D. Ohio filed Sept. 4, 2019), Compl. ¶ 51 https://www.justice.gov/atr/case-document/file/1199461/download.

- United States v. Sabre Corp., Sabre GLBL Inc., Farelogix, Inc., and Sandler Capital Partners V, L.P., No. 1:19-cv01548 (D. Del. Aug. 20, 2019), Compl. ¶ 63 https://www.justice.gov/atr/case-document/file/1196836/download.

- See also Fourth Amended Compl. ¶30, https://www.justice.gov/atr/case-document/file/1218851/download.

- United States et al v. Nexstar Media Group, Inc. and Tribune Media Co., No. 1:19-cv-02295 (D.D.C. filed July 31, 2019), Compl. ¶ 60 https://www.justice.gov/atr/case-document/file/1192131/download.

- United States et al v. Deutsche Telekom AG, T-Mobile US, Inc., Softbank Group Corp. and Sprint Corp., N0. 1:19-cv-02232 (D.D.C. July 26, 2019), Compl. ¶ 30 https://www.justice.gov/atr/case-document/file/1187751/download.

- United States et al v. Deutsche Telekom AG, T-Mobile US, Inc., Softbank Group Corp., and Sprint Corp., N0. 1:19-cv-02232 (D.D.C. July 26, 2019), Compl. ¶ 30 https://www.justice.gov/atr/case-document/file/1187751/download.

- United States v. Harris Corp. and L3 Technologies, Inc., No. 1:19-cv-01809 (D.D.C. filed June 20, 2019), Compl. ¶ 24 https://www.justice.gov/atr/case-document/file/1175956/download.

- United States v. Quad/Graphics, Inc., QLC Merger Sub, Inc. and LSC Communications, Inc., No. 1:19-cv-04153 (N.D. Ill. filed June 20, 2019), Compl. ¶ 39 https://www.justice.gov/atr/case-document/file/1176426/download.

- United States v. Amcor Limited and Bemis Co., Inc., No. 1:19-cv-01592 (D.D.C. filed May 30, 2019), Compl. ¶ 33-35, 40, https://www.justice.gov/atr/case-document/file/1167276/download.

- United States v. Thales S.A. and Gemalto N.V., No. 1:19-cv-00569 (D.D.C. filed Feb. 28, 2019), Compl. ¶¶ 24-25 https://www.justice.gov/atr/case-document/file/1139041/download.

- United States v. Learfield Communications, LLC, Compl. ¶ 23 https://www.justice.gov/atr/case-document/file/1132601/download.

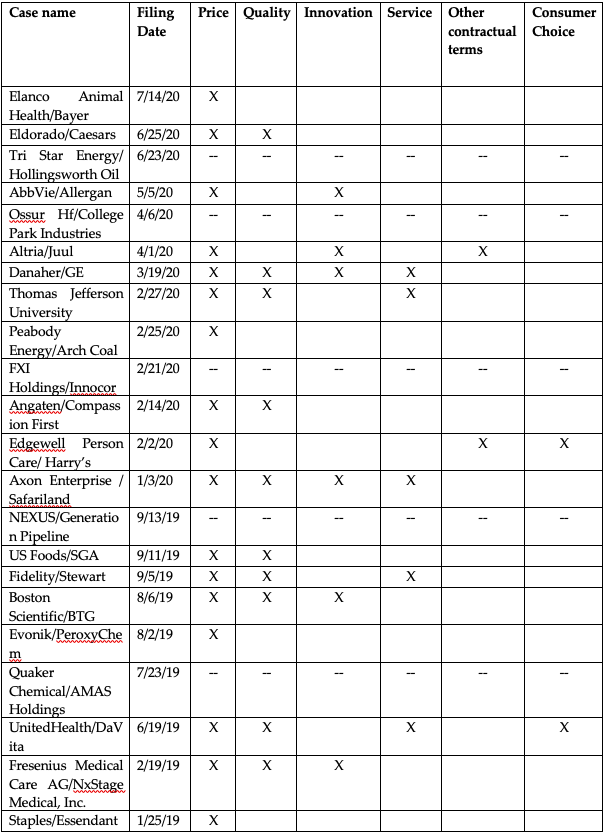

Appendix B

Table 2

FTC Merger Cases: Categories of Effects Alleged

Filed January 2019 through August 2020

Data pulled from FY2019 HSR Report and searches on the FTC’s website. Categories are marked with an “X” only if the complaint specifically identify these effects in the “Effects of the Acquisition” paragraphs. Entries marked “—” did not allege specific categories of effects. Note, when the FTC simultaneously files complaints and settlements, it is less likely to file a detailed complaint incorporating specific categories of alleged harm.

Cases cited:

- In the Matter of Elanco Animal Health, Inc., FTC Dkt. No. C-4725 (compl. filed July 14, 2020), https://www.ftc.gov/enforcement/cases-proceedings/191-0198/elanco-animal-health-bayer.

- In the Matter of Eldorado Resorts, Inc., FTC Dkt. No. C-4721 (compl. filed June 25, 20), https://www.ftc.gov/enforcement/cases-proceedings/191-0158/eldorado-resorts-caesars-entertainment-matter. Compl. ¶ 14, https://www.ftc.gov/system/files/documents/cases/1910158eldoradocomplaint_0.pdf.

- In the Matter of Tri Star Engery, LLC FTC Dkt. C-4720 (compl. filed June 23, 2020), https://www.ftc.gov/enforcement/cases-proceedings/201-0074/tri-star-energy-hollingsworth-oil-matter (This complaint did not allege specific categories of effects, https://www.ftc.gov/system/files/documents/cases/201_0074_tri_star_-_complaint.pdf).

- In the Matter of AbbVie Inc. and Allergan plc, FTC Dkt. No. C-4713 (compl. filed May 5, 2020), https://www.ftc.gov/enforcement/cases-proceedings/191-0169/abbvie-inc-allergan-plc-matter. Compl. ¶ 10, https://www.ftc.gov/system/files/documents/cases/191_0169_abbvie_and_allergan_-_complaint_0.pdf.

- In the Matter of Ossur Hf. And College Park Industries, FTC Dkt. No. C-4712 (compl. filed April 6, 2020), https://www.ftc.gov/enforcement/cases-proceedings/191-0177/ossur-hf-college-park-industries-matter (This complaint did not allege specific categories of effects, https://www.ftc.gov/system/files/documents/cases/1910177c4712ossurcomplaint.pdf).

- In the Matter of Altria Group/JUUL Labs, https://www.ftc.gov/enforcement/cases-proceedings/191-0075/altria-groupjuul-labs-matter. Compl. ¶¶ 62-69, https://www.ftc.gov/system/files/documents/cases/d09393_administrative_part_iii_complaint-public_version.pdf.

- In the Matter of Danaher Corporation, FTC Dkt. No. C-4710 (compl. filed March 19, 2020), https://www.ftc.gov/enforcement/cases-proceedings/191-0082/danaher-corporation-matter. Compl. ¶ 18, https://www.ftc.gov/system/files/documents/cases/191_0082_c4710_danaher_ge_complaint.pdf.

- In the Matter of Thomas Jefferson University, https://www.ftc.gov/enforcement/cases-proceedings/181-0128/thomas-jefferson-university-et-al. Compl. ¶¶ 63-80. https://www.ftc.gov/system/files/documents/cases/181_0128_jefferson_einstein_-_federal_complaint_for_pi.pdf.

- Peabody/Archcoal, https://www.ftc.gov/enforcement/cases-proceedings/191-0154/peabody-energyarch-coal-matter. Compl. ¶¶ 27-32, https://www.ftc.gov/system/files/documents/cases/d09391_peabody_energy-arch_coal_administrative_complaint_0.pdf.

- In the Matter of FXI Holdings and Innocor, https://www.ftc.gov/enforcement/cases-proceedings/191-0087/one-rock-capital-partners-ii-lp-matter (this complaint did not allege specific categories of effects, https://www.ftc.gov/system/files/documents/cases/1910087fxiinnocorcomplaint.pdf).

- In the Matter of Agnaten SE, Compassion First, and NVA, https://www.ftc.gov/enforcement/cases-proceedings/1910160/agnaten-se-compassion-first-nva-matter. Compl. ¶ 14, https://www.ftc.gov/system/files/documents/cases/1910160c4707agnatennvacomplaint.pdf.

- In the Matter of Edgewell Person Care Company and Harry’s, Inc., https://www.ftc.gov/enforcement/cases-proceedings/191-0147/edgewell-personal-care-company-harrys-inc. Compl. ¶¶ 48-70, https://www.ftc.gov/system/files/documents/cases/public_p3_complaint_-_edgewell-harrys.pdf.

- In the Matter of Axon Enterprise and Safariland, FTC Dkt. No. D9389 (compl. filed Jan. 3, 2020), https://www.ftc.gov/enforcement/cases-proceedings/1810162/axonvievu-matter.

- ¶¶ 35-43 https://www.ftc.gov/system/files/documents/cases/d09389_administrative_part_iii_-_public_redacted.pdf.

- In the Matter of DTE Energy Company, FTC Dkt. C-4691 (final order issued on Nov. 21, 2019), https://www.ftc.gov/enforcement/cases-proceedings/191-0068/dte-energy-company-matter (This complaint did not allege specific categories of effects, https://www.ftc.gov/system/files/documents/cases/06_dte-enbridge_complaint_redacted.pdf).

- In the Matter of US Foods Holding Corporation, FTC Dkt. C-4688 (final order issued on Nov. 15, 2019), https://www.ftc.gov/enforcement/cases-proceedings/181-0215/us-foods-sga-matter. Compl. ¶ 14, https://www.ftc.gov/system/files/documents/cases/181_0215_usf-sga_complaint.pdf.

- In the Matter of Fidelity National Financial, Inc. and Stewart Information Services Corporation, FTC Dkt. C-9385 (complaint filed on Sept. 5, 2019), https://www.ftc.gov/enforcement/cases-proceedings/181-0127/fidelity-national-financialstewart-information-services. Compl. ¶¶ 65-78, https://www.ftc.gov/system/files/documents/cases/d09385_fidelity_stewart_administrative_complaint_public_version.pdf.

- In the Matter of Boston Scientific Corporation, FTC Dkt. C-4684 (final order issued on Sept. 18, 2019), https://www.ftc.gov/enforcement/cases-proceedings/191-0039/boston-scientific-btg-matter. Compl. ¶ 11, https://www.ftc.gov/system/files/documents/cases/191_0039_boston_scientific_complaint_8-7-19.pdf.

- In the Matter of Evonik Industries AG, FTC Dkt. C-9384 (complaint filed on August 2, 2019), https://www.ftc.gov/enforcement/cases-proceedings/191-0029/evonikperoxychem-matter. Compl. ¶ 43, https://www.ftc.gov/system/files/documents/cases/d09384_evonik-peroxychem_part_iii_complaint_8-2-19.pdf.

- In the Matter of Quaker Chemical Corporation, FTC Dkt. C-4681 (final order issued on Sept. 9, 2019), https://www.ftc.gov/enforcement/cases-proceedings/1710125/quaker-chemical-corporation-global-houghton-ltdmatter (This complaint did not allege specific categories of effects. https://www.ftc.gov/system/files/documents/cases/171_0125_quaker_houghton_complaint_7-23-19.pdf).

- In the Matter of UnitedHealth Group Inc., FTC Dkt. C-4677 (final order issued on August 12, 2019), https://www.ftc.gov/enforcement/cases-proceedings/181-0057/unitedhealth-groupdavita-matter. Compl. ¶¶ 17-20 https://www.ftc.gov/system/files/documents/cases/181_0057_c4677_united_davita_complaint_6-19-19.pdf.

- In the Matter of Fresenius Medical Care AG & Co. KGaA and NxStage Medical, Inc., FTC Dkt. C-4671 (filed on Feb. 19, 2019), https://www.ftc.gov/enforcement/cases-proceedings/171-0227/fresenius-medical-carenxstage-medical-matter. Compl. ¶ 11, https://www.ftc.gov/system/files/documents/cases/1710227_fresenius-nxstage_complaint_2-19-19_0.pdf.

- In the Matter of Sycamore Partners II, L.P., Staples, Inc. and Essendant Inc., FTC Dkt. C-4667 (final order issued on January 25, 2019), https://www.ftc.gov/enforcement/cases-proceedings/181-0180/sycamore-partners-ii-lpstaples-inc-essendant-inc-matter. Compl. ¶ 11, https://www.ftc.gov/system/files/documents/cases/1810180_staples_essendant_complaint_1-28-19.pdf.

Footnotes

* This Chapter does not necessarily reflect the views of the Department of Justice. I would like to thank Judge Douglas H. Ginsburg and Josh Wright for valuable comments and discussion.

[1] Hospital Corp. of America v. FTC, 807 F.2d 1381, 1386 (7th Cir. 1986).

[2] See, e.g., Douglas H. Ginsburg & Joshua D. Wright, Philadelphia National Bank: Bad Law, Bad Economics, Good Riddance, 80 Antitrust L.J. 377 (2015); Assistant Attorney General Makan Delrahim, U.S. Dep’t of Justice, Keynote Address at the University of Chicago’s Antitrust and Competition Conference, Chicago, IL (Apr. 19, 2018), https://www.justice.gov/opa/speech/file/1054766/download; Joshua D. Wright et al., Requiem for a Paradox: The Dubious Rise and Inevitable Fall of Hipster Antitrust, 51 Ariz. St. L. J. 293, 352 (2019).

[3] See, e.g., Elizabeth Warren, Here’s How We Can Break Up Big Tech, Medium (Mar. 8, 2019), https://medium.com/@teamwarren/heres-how-we-can-break-up-big-tech-9ad9e0da324c (“Today’s big tech companies have too much power—too much power over our economy, our society, and our democracy.”); Lina Khan & Sandeep Vaheesan, Market Power and Inequality: The Antitrust Counterrevolution and Its Discontents, 11 Harv. L. & Pol’y Rev. 235, 237 (2017) (arguing that we should “embrace[] the original goals of antitrust”); Matt Stoller, The Return of Monopoly, The New Republic (July 13, 2017), https://newrepublic.com/article/143595/return-monopoly-amazon-rise-business-tycoon-white-house-democrats-return-party-trust-busting-roots (favorably discussing antitrust enforcement in the early twentieth century).

[4] See Retrograde, Dictionary.com, https://www.dictionary.com/browse/retrograde (last visited Sept. 6, 2020); Definition of Retrograde, Miriam Webster, https://www.merriam-webster.com/dictionary/retrograde (last visited Sept. 6, 2020).

[5] See Mars in Our Night Sky, NASA, https://mars.nasa.gov/all-about-mars/night-sky/retrograde/ (last visited Sept. 6, 2020).

[6] William E. Kovacic & Carl Shapiro, Antitrust Policy: A Century of Economic and Legal Thinking, 14 J. Econ. Persps. 43, 44 (2000) (“Most economists in the late 19th century scorned the Sherman Act. At best, the statute seemed a harmless measure incapable of halting an irresistible trend toward firms of larger scale and scope. At worst, the law would impede attainment of superior efficiency promised by new forms of industrial organization.” (internal citations omitted)); Robert H. Bork, Antitrust Paradox 418 (1978) (“[M]odern antitrust has so decayed that the policy is no longer intellectually respectable. Some of it is not respectable as law; more of it is not respectable as economics[.]”).

[7] Sidenote: While it remains known as the Sherman Act, Senator George F. Hoar, it seems, drafted the version of the legislation as passed. As one report explains, “It is to this day strangely enough called the Sherman Act—for no better reason, according to its author, than that Senator Sherman had nothing to do with it whatever.” Temp. Nat’l Econ. Comm., Investigation of Concentration of Economic Power: Antitrust in Action, at 10 (1940) [hereinafter TNEC Report] (citing George F. Hoar, Autobiography of Seventy Years, vol. II, at 363).

[8] Id. at 10-11.

[9] Id. It further noted that a “great bother is that the bill which was arduously debated was never passed, and that the bill which was passed was never really discussed. The House, in fact, never had a chance at the measure which provoked discussion.” Id.

[10] See, e.g., Bork, supra note 6, at 61-68 (“The legislative history of the Sherman Act, the oldest and most basic of the antitrust statutes, displays the clear and exclusive policy intention of promoting consumer welfare.”); Robert H. Lande, Wealth Transfers as the Original and Primary Concern of Antitrust: The Efficiency Interpretation Challenged, 34 Hastings L.J. 65 (1982) (“Congress passed the antitrust laws to further economic objectives, but primarily objectives of a distributive rather than of an efficiency nature.”); Kahn & Vaheesan, supra note 3, at 270, 277-79 (“The congressmen and senators involved in the debates preceding the passage of the principal antitrust laws voiced a number of concerns, including the protection of consumers and suppliers from firms with market power, the defense of small businesses from the predatory tactics of large rivals, and the preservation of democracy. Efficiency was not on Congress’s radar in 1890 or 1914.”); Sandeep Vaheesan, The Profound Nonsense of Consumer Welfare Antitrust, 64 Antitrust Bull. 479, 480 (2019) (“The drafters of these landmark statutes sought to restrict corporate power over consumers, workers, suppliers, and rivals.”); see also Douglas H. Ginsburg, Bork’s “Legislative Intent” and the Courts, 79 Antitrust L.J. 941 (2014) (identifying various interpretations proferred following Bork’s explication).

[11] Exxon Mobil Corp. v. Allapattah Services, Inc., 545 U.S. 546, 568 (2005) (quoting Judge Leventhal); see also Conroy v. Aniskoff, 507 U.S. 511, 519 (1993) (Scalia, J., concurring).

[12] U.S. Association of Constitutional Law Discussion, Constitutional Relevance of Foreign Court Decisions, Full Written Transcript of Scalia-Breyer Debate on Foreign Law (Jan. 13, 2005), http://www.freerepublic.com/focus/news/1352357/posts (Breyer, J.).

[13] TNEC Report, supra note 7, at 10-11 (“A great deal has been said about the purpose of Congress in passing the act. At best legislative intent is an evasive thing. It is wrapped in the conditions, the problems, the attitudes, the very atmosphere of an era that is gone. But aside from saying that the act reflets its date, there is little more in the way of concretion to recite. Instead, as a creation of the process of legislation, the statute bears the confused marks of its origin.”).

[14] William F. Baxter, Separation of Powers, Prosecutorial Discretion, and the “Common Law” Nature of Antitrust Law, 60 Tex. L. Rev. 661, 663 (1982).

[15] See United States v. Topco, 405 U.S. 596, 620-21 (1972) (Burger, J., dissenting) (“Senator Sherman, in a lengthy, and obviously carefully prepared, address . . . [acknowledged that,] ‘I admit that it is difficult to define in legal language the precise line between lawful and unlawful combinations. This must be left for the courts to determine in each particular case.’” (quoting 21 Cong. Rec. 2457, 2460)); Baxter, supra, note 14, at 663-64; Ginsburg, supra note 10, at 941 (“The open-textured nature of the [Sherman] Act—not unlike a general principle of common law—vests the judiciary with considerable responsibility or interpretation, the discharge of which responsibility requires the courts to imbue the Act with a purpose by which to guide its application.”); Nat’l Soc’y of Prof’l Eng’rs v. United States, 435 U.S. 679, 688 (1978) (“Congress[] did not intend the text of the Sherman Act to delineate the full meaning of the statute or its application in concrete situations. The legislative history makes it perfectly clear that it expected the courts to give shape to the statute’s broad mandate by drawing on common-law tradition.”); Laura Phillips Sawyer, US Antitrust Law and Policy in Historical Perspective (Harv. Bus. Sch. Working Paper No. 19-110, 2019), https://www.hbs.edu/faculty/Publication%20Files/19-110_e21447ad-d98a-451f-8ef0-ba42209018e6.pdf (“The key pieces of antitrust legislation in the United States—the Sherman Act of 1890 and the Clayton act of 1914—contain broad language that has afforded the courts wide latitude in interpreting and enforcing the law.”).

[16] See, e.g., Bus. Elecs. Corp. v. Sharp Elecs. Corp., 485 U.S. 717, 731-32 (1988) (“The changing content of the term ‘restraint of trade’ was well recognized at the time the Sherman Act was enacted.” (citing Gibbs v. Consolidated Gas Co., 140 U.S. 396, 409 (1889))); Kimble v. Marvel Ent., LLC, 576 U.S. 446, 461-62 (2015) (“Congress, as we have explained, intended that [Sherman Act] law’s reference to ‘restraint of trade’ to have ‘changing content,’ and authorized courts to oversee the term’s ‘dynamic potential.’ (quoting Bus. Elecs., 485 U.S. at 731-32)).

[17] 221 U.S. 1, 63-64 (1911).

[18] While Standard Oil is the case credited with introducing the rule of reason to antitrust law, the mode of analysis is itself far older than the Standard Oil case. Prof. Eng’rs, 435 U.S. at 688 (“The Rule of Reason, with its origins in common-law precedents long antedating the Sherman Act . . . has been used to give the Act both flexibility and definition, and its central principle of antitrust analysis has remained constant.”).

[19] Standard Oil, 221 U.S. at 52.

[20] United States v. Trans-Missouri Freight Ass’n, 166 U.S. 290, 323–24 (1897).