Introduction

Companies that produce at different stages of a production process or that produce complementary goods often have a “self-preference,” meaning that they prefer to buy from, sell to, or otherwise coordinate with their own internal divisions rather than competitors of those divisions. It is a common and self-fulfilling phenomenon. The expectation that other firms will engage in self-preferencing can induce firms to engage in the practice themselves.

To cite just a few notable examples, in 1996, AT&T divested itself of its manufacturing division with the new entity being Lucent Technologies.[1] While AT&T was itself the result of a forced vertical breakup that split AT&T’s local telephone operations from its long-distance service and manufacturing capabilities, the divestiture of Lucent Technologies was voluntary. A primary motivation was that as the markets for telecommunications in which AT&T competed became more competitive (due in part to the Telecommunications Act of 1996), its manufacturing division (known as Western Electric) was increasingly seeking to supply AT&T’s competitors; and those competitors were reluctant to rely on one of their competitors for inputs as they likely feared that Western Electric would give preferential treatment to its own telecommunications division.

One of the major strategic moves in Google’s corporate history was to invest in the Android operating system and to keep it as open source software.[2] Had it not done so, Apple might well have come to dominate the smartphone market, making Google reliant on its competitor’s device for delivery of mobile search. And its decision to make Android open source (despite the risk that open source systems fork into incompatible variants) was to limit its opportunities to engage in opportunistic self-preferencing.

In 2012, Apple replaced Google Maps for turn-by-turn instructions with Apple maps in iOS 6. The roll-out did not go well.[3] At least initially, the move revealed a “self-preference” despite having an inferior product, and at least part of Apple’s motive was likely to avoid relying on Google for an input in case Google were to threaten to give preferential treatment to its own use of Google Maps.

Self-preferencing also raises public policy concerns, including antitrust doctrine toward vertical mergers. This latter topic has been of particular interest recently as the United States Department of Justice (DOJ) and Federal Trade Commission (FTC) have just issued new vertical merger guidelines,[4] 36 years after the DOJ last issued merger guidelines that addressed vertical mergers. The DOJ 1984 Merger Guidelines[5] suggested relatively relaxed enforcement and stood in distinct contrast to the relatively hostile treatment of vertical mergers in the DOJ 1968 Merger Guidelines.[6] While it remains too early to tell whether the 2020 Vertical Merger Guidelines signal that the US agencies will be more aggressive in challenging vertical mergers than they generally have over the past three decades, they might. The DOJ’s failed challenge to AT&T’s acquisition of Time Warner,[7] which combined AT&T’s DirecTV with Time Warner’s video networks, also suggests a greater willingness to block vertical mergers than they have demonstrated over the past 35 years. And several prominent antitrust economists have argued that economic analysis supports a more interventionist approach.[8]

Another broad area of antitrust law in which self-preferencing plays a central role is allegations of “monopoly leveraging” through means other than a merger. This can occur in a variety of ways. Contractual tying is one. Innovation in product design is another, particularly in sectors in which technological change is rapid. When a company integrates previously separate components or products, competitors might frame the decision as monopoly leveraging. Yet another possibility is entry by a dominant firm into an adjacent or complementary stage. While entry by itself is generally considered procompetitive, any preferential treatment the dominant firm gives its own product is sometimes interpreted as monopoly leveraging.

The remainder of this chapter is organized as follows. In the next section, I lay out the economics of self-preferencing by showing how a vertical merger between a distributor of two products with the manufacturer of one of those products creates an incentive to sell more of the good produced by the company it purchases and less of the competing good. I also explain the complicated ways in which that self-preference affects consumers. Then, I describe the new Vertical Merger Guidelines and assess their likely implications for enforcement. Finally, I turn to monopoly leveraging claims. I will focus on three cases from the tech sector: suits by the manufacturers of plug-compatible peripherals against IBM in the 1970’s, the Department of Justice’s suit against Microsoft in the 1990’s, and the investigations in a number of jurisdictions into Google for “search bias.” The first two are examples of product integration. The third is widely considered to be another such example, although I will argue that it is not.

From the standpoint of competition policy, it might seem desirable to modularize competition to the greatest extent possible so that the best and cheapest products prevail at every stage of a production process and in every component of systems of complementary products. But integration can also create efficiencies – both real and contractual/organizational. Producers at one stage of a value chain often have the greatest incentive and the greatest technical capacity to lower prices or improve products at an adjacent stage. The challenge for public policy is how to trade off the costs of foreclosure resulting from self-preferencing against the efficiencies of integration. Because these trade-offs are complicated, it is perhaps not surprising that there have been pendulum swings in enforcement philosophies and expert opinions. Through the 1960’s, antitrust enforcement in the United States was generally hostile to vertical integration. Then, starting in the late 1970’s, antitrust enforcers began viewing vertical mergers and vertical integration as being almost entirely benign.[9] In recent years, the pendulum seems to have at least started to swing back as several prominent scholars have argued for a much more aggressive stance against vertical integration and foreclosure.[10] A general theme of this chapter is that despite these swings in opinion, the economics of how to weigh the competing effects on a case-by-case basis is still under-developed. As a result, presumptions play an important role in enforcement. A key question for policy makers is whether there should still be a presumption that the economic relationship between the production of vertically-related and complementary products is fundamentally different from the economic relationship between the production of substitute products. If so, intervention with respect to vertical/complementary mergers, agreements, and expansion should be far more limited than intervention with respect to horizontal mergers, agreements, and (to a lesser extent) expansion.

I. The Economics of Self-Preferencing

Self-preferencing can arise for a variety of reasons. There might be technological advantages from physical integration of technically separable components. Technological coordination might require the sharing of proprietary knowledge, and a company might not consider contractual promises that limit another firm’s use of its intellectual property to provide adequate protection. When a good or service provided by a company is part of a system that can fail, then a company might not want to risk being blamed for a failure that results from another firm’s components.[11] Another broad class of cases, which this section will address, concerns cases when competition is imperfect at adjacent stages. In such cases, a firm might prefer to get the margin at all stages rather than at just one.

As noted above, it might initially seem desirable to modularize competition at different stages, or for different components, to the maximum extent possible.[12] However, another important consideration arises with respect to complementary activities. In the extreme, suppose that the two stages are provided by two different monopolists. Assuming they are restricted to charging linear prices,[13] individual profit-maximization creates a problem known as “double marginalization.” A combination of the two firms through a merger eliminates the double marginalization and causes prices to drop. Even though profits go up, consumers benefit from the lower prices. In a remarkable work, Augustin Cournot demonstrated this point in 1838 for products that he modeled as being complementary.[14] Spengler demonstrated it for a model of vertical mergers in 1950.[15]

This trade-off between the benefits of modularizing competition for complementary goods and avoiding double marginalization is central to the pre-merger review of vertical mergers. Merger enforcement entails predicting market outcomes with an altered market structure. The logic competition agencies and courts use to make such predictions is to analyze how a merger affects the firms’ underlying incentives and to assume that the post-merger firm will pursue its own interest. Consider a merger of two competitors, A and B. When they are separate, A’s attempts to attract more business (by, say, cutting prices or improving its product) might take business from B. All else equal, therefore, a horizontal merger between A and B dulls the incentive to compete for more business. To the extent that there are other competitors in the market that will try to compete away business from the A-B combination and from which the combined firm can try to attract customers, the harm to competition may be insubstantial and potentially outweighed by any efficiencies that the merged firm can realize. But, absent efficiencies, horizontal mergers reduce the incentive of merging firms to compete.

Because of the elimination of double marginalization (EDM) in vertical/complementary mergers, the effect on pricing incentives can be exactly the opposite of the case with horizontal mergers. This fundamental difference between the incentive effects of horizontal mergers and mergers of successive monopolists is why competition authorities and courts are generally more likely to block horizontal mergers than they are to block vertical or complementary mergers. As the European Commission explained in its non-horizontal merger guidelines: “Non-horizontal mergers are generally less likely to significantly impede effective competition than horizontal mergers.”[16] It also explains why the US competition agencies have been far more likely to challenge horizontal mergers than vertical mergers or mergers of firms that produce complementary products.

But EDM does not completely resolve the competition issues. Both Cournot’s and Spengler’s exposition of the problem rested on the assumption of successive or complementary monopoly. Those models provide no scope for self-preferencing because there are no competitors to be disadvantaged through a strategy of raising rivals’ costs (RRC) [17] or foreclosure. To model how a vertical merger could result in an anticompetitive effect through foreclosure of competitors of the merging firms, the underlying assumptions must allow for competition within at least one stage of production.

A. Effect of a Vertical Merger on Pricing Incentives

With imperfect competition at successive or complementary stages, the theoretical basis for expecting self-preferencing is quite robust. However, if one then examines the effect of self-preferencing on consumers, the results are much more fragile. Self-preferencing can result in consumer harm, but the case that such a result is to be expected is unpersuasive.

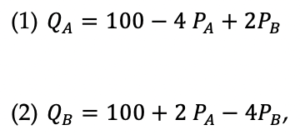

The simplest model to explore the potential for a vertical merger to harm consumers entails a monopolist at one stage and two firms at the adjacent stage. For the purposes of this chapter, I will assume a downstream monopolist (think of it as a retailer and denote it as R) that (by virtue of being a monopolist) is the only seller of goods it purchases at wholesale from two manufacturers.[18] Call the goods they produce A and B and refer to the two firms as MA and MB. Suppose that demand for the final goods is given by:

where QA and QB are the quantities of Goods A and B that R sells and PA and PB are the prices it charges. Suppose further that MA and MB have unit costs of 10 and charge R wholesale prices of 20. The key features of these two demand curves are that the demand for each good is a decreasing function of its own price and an increasing function of the price of the other good, so they are substitutes. When the price of one of the goods increases (holding constant the price of the other), some of the demand lost gets diverted to the other good.

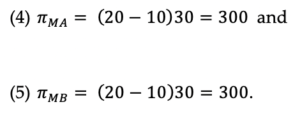

It is straightforward to show that the prices that maximize the retailer’s profits in this example are PA = PB = 35. At those prices, demand for the two goods is QA = QB = 30. The retailer’s profits are given by:

![]()

The profits of the two manufacturers are:

To see that a price of 35 for Good A maximizes the retailer’s profits, consider what would happen if it lowered its price to 34. Based on equations (1) and (2), a reduction in PA by 1 causes QA to increase by 4 and QB to drop by 2. Thus, the $1 price reduction for Good A would result in QA = 34 and QB = 28. The retailer’s profits would then be:

![]()

which is less than the maximum profits of 900. We can decompose the profit reduction of 4 into three components:

![]()

The first term reflects the reduced price R receives for the 30 units of Good A it would sell at the higher price. The second term is R’s profit margin on the increased sales of 4 units that result from the price reduction. The last term reflects the margin R loses from selling 2 fewer units of Good B.

Similarly, consider increasing PB by 1 to $36 (holding PA at the profit-maximizing value of 35). The increase causes the quantity of Good B demanded to drop by 4 and the quantity of Good A demanded to increase by 2. With those prices, R’s profits are:

![]()

Again, the profits are lower; and we can decompose the price reduction into three components:

![]()

The first component is the higher margin per unit that R receives on the units of Good B that it continues to sell. The second term is the margin R loses because of the reduction in demand for B caused by the price increase. The third term reflects the margin on the additional sales of Good A that result from the increase in the price of Good B.

This decomposition of the incremental effects from price changes helps reveal how a vertical merger creates an incentive for self-preferencing. Suppose R and MA merge and that, as a result, R is able to obtain Good A at marginal cost of 10 rather than the market price of 20. Modifying equation (7) to reflect the lower marginal cost, we get:

![]()

The difference between (7) and (7’) is in the middle term. Rather than getting a margin of (34 – 20) = 14 on each additional unit of Good A sold, R now gets a margin (34 – 10) = 24. The extra 10 per unit that R now gets from a decrease in the price of Good A applied to the 4 extra units sold from the price decrease tilts the balance from making the price decrease unprofitable to making it profitable.

The difference between (7) and (7’) reflects what is commonly referred to as EDM. Holding the price of Good B constant, the merged firm has an incentive to lower the price of Good A, and this incentive reflects self-preferencing. Prior to the merger, because the wholesale prices to R are the same for A and B (and because demands are symmetric), R charges the same for the two goods and is indifferent between selling an extra unit of A and an extra unit of B. With the merger, R’s margin on A increases and therefore it develops a preference for selling an additional unit of A rather than an additional unit of B; and, as a result, it has an incentive to lower PA (again, all else equal).

But the effect of the merger on R’s incentives with respect to PA is not the entire story. R has another lever to increase sales of A as long as it is willing to sacrifice some sales of B. Now that R gets Good A at a marginal cost of 10, the effect on R’s profits from raising PB changes from (9) to:

![]()

Thus, whereas an increase in PB from 35 to 36 lowers R’s profits prior to the merger, the increased margin on A makes an increase in PB after the merger profitable, holding PA constant at $35.

Because A and B are substitutes, every increase in sales of one of the products due to a decrease in its price diverts some sales from the other. Given equations (1) and (2), the rate of this diversion is ½ unit in lost sales of A for every 1 unit increase in the sales of B. The margin on the diverted sales is a marginal opportunity cost of selling each good. When R is independent of MA and MB, it takes this opportunity cost into account with respect to the retail margin. That is, when it considers lowering its price to increase sales of B, it recognizes that half the increased sales of B will come at the expense of sales of A. In the formal economic analysis, this opportunity cost has the same effect on R’s incentives as an out-of-pocket opportunity cost of the same magnitude. When R and MA merge, however, this marginal opportunity cost increases. Prior to the merger, this opportunity cost is the diversion ratio (0.5 in this case) multiplied by the retail margin on the other good. After the merger, this opportunity cost of sales of B is the diversion ratio multiplied by the total margin on Good A. Because the manufacturer’s margin on Good A had been 10 and the diversion ratio is 0.5, the merger, in effect, increases the merged firm’s marginal cost of selling B by 0.5 x $10 = $5. Moresi and Salop refer to this effect as vertical upward pricing pressure.[19]

Intuitively, it might seem that a vertical merger between R and MA must entail a trade-off between a price reduction for Good A due to EDM and a price increase for Good B from a “raising rivals’ costs” (RRC) incentive. This intuition turns out to be wrong, however. While the merger causes the profit-maximizing price to drop from $35 to $30, the price for Good B remains the same at $35. This is the case despite the vertical upward pricing pressure. The intuition that vertical upward pricing pressure ensures an increase in the price of Good B fails because it ignores how a reduction in the price of Good A from $35 to $30 interacts with the effect of increasing the price of B from $35 to $36. There are two effects to consider. In (9’), the first term reflects the increased revenue the firm generates from the units of Good B that it continues to sell after the $1 price increase. In equation (9’), the estimated effect is $26. But, the reduction in the price of Good A from $35 to $30 causes demand for B to drop by 10 units. Thus, the $1 increase in price underlying equation (9’) applies only to 16 units, not 26. Second, because the reduction in the price of Good A from $35 to $30 reduces the total margin on Good A, it also reduces the vertical upward pricing pressure. Taking account of the reduction in the price of Good A to $30, the effect of increasing the price of Good B to $36 becomes:

![]()

In this specific example, because the price of Good A drops while the price of Good B remains the same, consumers are better off. And this is so even assuming that the wholesale price of Good B remains constant. If MB responds to the reduced demand for Good B by lowering its wholesale price, then R would rationally respond by lowering the retail price of Good B as well, thus making consumers still better off.[20]

While the vertical merger of R and MA benefits consumers, it lowers MB’s profits. Without the merger, it sells 30 units of B and, with a profit margin of $10 per unit, earns profits of $300. After the merger, it only sells 20 and, assuming it keeps the same margin, its profits drop to $200. Given the reduction in MB’s unit sales and profits, it should come as no surprise if MB complained to the competition authorities that the merger of R and MA will result in foreclosure of MB and will therefore be harmful to competition. But the profit reduction for MB resulting from the merger is due entirely to the reduction in the price of MA. If, as is appropriate, one interprets the retail margin on Good B as its cost of distribution, its loss of sales and profits does not reflect an RRC effect.

The exposition rests on linear demand functions and a specific set of assumptions about the parameters (constants) in those demand curves. Actual demand curves need not be linear. But there is nothing unusual about linear demand curves. Moreover, some other commonly used functional forms lead to similar conclusions. Thus, one cannot dismiss the results from linear demand curves as an odd special case.[21]

The condition on the parameters for a vertical merger to leave the price of Good B unchanged is that the coefficient on the price of Good B in the demand equation for Good A equals the coefficient on Good A in the demand equation for Good B. In equations (1) and (2), both equal 2. They do not have to be 2 for a vertical merger to have no effect on the price of B. That effect would be the same if both cross effects were both 0.5, 1 or 3.[22] The result does not require that the other parameters be equal, so it does not require symmetric demand.

Even when the demand curves are not symmetric, there is a theoretical reason to assume, as a base case, that the cross-price effects are equal.[23] They do not have to be; and, when they are not, a vertical merger between R and MA induces a change in the price R charges for Good B. When the coefficient on the price of Good B in the demand equation for Good A exceeds the coefficient on the price of Good A in the demand for Good B, then the R-MA merger causes an increase in the retail price of Good B. Under that condition, the force driving the merged firm to increase the price of Good B – the RRC effect – depends on the coefficient on Good B in the demand equation for Good A. The offsetting effect – the effect of a reduction in the price of Good A on the optimal price for Good B – depends on the coefficient on the price of Good A in the demand equation for Good B. When the two coefficients are equal, these two effects offset each other. When the coefficient on the price of Good B in the demand equation for Good A exceeds the coefficient on the price of Good A in the demand equation for Good B, the RRC effect dominates.

Even if one could present econometric evidence that the underlying demand conditions make an increase in the price of Good B likely, such a condition is not sufficient to establish net consumer harm (meaning a reduction in consumer surplus) from a vertical merger between R and MA. If the merger simulation implied an increase in the price of Good B and a decrease in the price of Good A, one would need to weigh the different effects. It is theoretically possible that the net effect on consumers could be negative. Indeed, it is theoretically possible that if the RRC effect is sufficiently strong and the countervailing competitive effect is sufficiently weak, the merged firm might have an incentive to increase the price of Good A as well as the price of Good B.

If a merger simulation predicts that a vertical merger between R and MA would cause the price of Good B to increase, the same model could predict that a vertical merger between R and MB would cause the price of Good A to drop. This lack of robustness in the models that might predict harm from a vertical merger poses significant challenges for policy makers. If enforcement policy would prevent a firm from merging with some firms at an adjacent stage but not others, the agencies should be able to provide reasonable guidance for what determines which deals they are likely to approve and which ones they are likely to challenge. The DOJ sought to block AT&T’s acquisition of Time-Warner. Would it have sought to block AT&T from acquiring any major programmer? Would it have sought to block any major program distributor from acquiring Time-Warner? Even if the Agencies rely at least in part on the results of some sort of merger simulation, they need to provide enough guidance about what conditions tend to generate challenges that parties can rely on without hiring an economist to formulate and calibrate a Nash bargaining model.

B. Complications

In most merger investigations, an assumption underlying the analysis of competitive effects is that, both before and after the merger, the firms involved choose the prices that maximize their profits. This is the case whether the analysis is a full-blown merger simulation or the relatively recent development of Upward Pricing Pressure (UPP) analysis.[24]

To be sure, the US competition agencies have increasingly relied on bargaining models in their merger simulations.[25] These models have proved particularly appropriate in markets where bargaining plays a prominent role in price determination, such as the prices that managed care companies pay hospitals.

In analyzing bargaining situations, the standard practice among competition agency economists and experts who work for them is to rely on the Nash Bargaining solution.[26] The model in the previous section rested on the assumption of duopoly upstream and monopoly downstream. The bargaining assumption might seem more natural when an upstream monopolist sells an input to two competing downstream firms. In such a situation, the monopolist and each downstream firm might bargain over the price of the intermediate good that the upstream monopolist provides. Still, one might imagine R and MB negotiating over the retail margin R can charge on Good B.

Under the Nash bargaining solution, the price falls somewhere between the price the monopolist would ideally like to charge and the minimum it would be willing to accept. Where the price falls within that range depends on the relative bargaining power of the two firms. (If, as some modelers assume, the two parties have equal bargaining power, the final outcome falls near the middle of the range between the minimum price the seller would accept and the price that would maximize the seller’s profits.)

In deciding the minimal terms that it is willing to accept, each firm considers what would happen if negotiations were to break down. When negotiations between the monopolist at one stage and one of two competing firms at the other stage break down, the result is typically increased sales by the other competing firm. When it is integrated with the other competing firm, the monopolist does not lose as much from the failure to reach an agreement because it gets the margin on the increased sales of the firm it owns. With less to lose from the breakdown of negotiations, it is certainly plausible that the merger would allow the firm to strike a more attractive bargain. Such an outcome is most plausible when the terms the monopolist negotiates before a vertical merger are worse than the minimum (from its perspective) acceptable terms after the merger. The case is less persuasive when the pre-merger terms are better from the standpoint of the monopolist than the minimally necessary terms for an agreement with MB to be profitable.

Another complication concerns contractual incompleteness. The transactions cost literature on vertical integration has stressed the risk of expropriation when firms make “durable transaction-specific investments.”[27] In the above example, if R is the only feasible retailer to distribute Good B to final consumers (as we have assumed), then any sunk costs MB had to incur to produce Good B are transaction specific. Suppose that MB’s entry into the market would be profitable if it could sell 30 per year with a profit margin of $10 per unit over the life of its investment but would be unprofitable if it could only sell 20 per year. Under such circumstance, B might enter if antitrust enforcement is hostile to vertical mergers and not enter if antitrust enforcement is tolerant of vertical mergers. If, in fact, one could establish that MB would not have entered had it anticipated the merger between R and MA, is there a persuasive case that the merger is anticompetitive and should be blocked?

Such a position is problematic for at least two reasons. First, it ignores the possibility that R would acquire MB and that such an acquisition would increase the expected profitability of MB’s entry. Second, and more fundamentally, suppose that the profitability of MB’s entry also requires the persistence of tacit collusion with MA to keep prices above their marginal costs? If so, should the antitrust authorities permit price fixing between MA and MB because it is “dynamically” pro-competitive? Alternatively, suppose that MB had entered into a contract with R under which it promised to supply MB to R for $20/unit with the constraint that R not reduce the price of Good A below $35/unit? If such a contract would be viewed as a naked restraint of trade that violates the Sherman Act, then blocking the merger between R and MA to accomplish the identical objective makes no sense.

As I will discuss in more detail below, companies often enter markets knowing that they rely critically on performance by companies at adjacent stages. When they do, they need to recognize and, to the extent possible, protect themselves against the risk that the company they rely on might alter its behavior.

Whenever entry requires sunk costs, as it almost always does, it entails risks. One of the common risks is that the market environment becomes more competitive, thus making entry less attractive. Encouraging entry by standing in the way of future procompetitive developments is the essence of protecting competitors rather than protecting competition.

II. The New US Vertical Merger Guidelines and their Predecessors

The first US merger guidelines that covered vertical mergers were the DOJ’s 1968 Merger Guidelines.[28] Prior to the newly-issued DOJ and FTC Vertical Merger Guidelines, the most recent US merger Guidelines with standards for vertical mergers were the DOJ’s 1984 Merger Guidelines.[29] The DOJ and FTC have issued revised horizontal merger guidelines three times since 1984, most recently in 2010.[30] In 2007, the European Commission issued non-horizontal merger guidelines.[31] The US agencies, however, had not seen fit to issue new vertical merger guidelines until now. In evaluating the new US vertical merger guidelines, it is worth considering what they are replacing, why it took so long for the FTC and DOJ to decide to issue new vertical merger guidelines, and why they ultimately concluded that they needed to issue new vertical merger guidelines.

The 1968 Guidelines reflected the “structure-performance” paradigm that had dominated the industrial economics literature since the seminal work of Joe Bain as well as an implicit view that vertical mergers among firms with significant market shares posed nearly as great a threat to competition as horizontal mergers.[32] They stated:

The Department’s enforcement activity under Section 7 of the Clayton Act, as in the merger field generally, is intended to prevent changes in market structure that are likely to lead over the course of time to significant anticompetitive consequences. In general, the Department believes that such consequences can be expected to occur whenever a particular vertical acquisition, or series of acquisitions, by one or more of the firms in a supplying or purchasing market, tends significantly to raise barriers to entry in either market or to disadvantage existing non-integrated or partly integrated firms in either market in ways unrelated to economic efficiency.[33]

The 1968 Guidelines did not explicitly use the term “self-preferencing,” but the stated concern about not putting other firms at a disadvantage embodies the view that self-preferencing by a firm in a sufficiently concentrated market would constitute an antitrust violation. To prevent the possibility that a vertical merger would put competing firms at a disadvantage, the DOJ expressed its intent to block a vertical merger when the supplier of the intermediate good has at least 10% of the market.[34] This threshold exceeded the market share thresholds for objectionable horizontal mergers, but not by much.

Between 1968 and 1984, the Chicago critique of the industrial economics literature had significantly influenced antitrust policy makers.[35] A key component of the Chicago critique was the importance of the distinction between vertical mergers and restraints on the one hand and horizontal mergers and restraints on the other. The two models that were key to the Chicago school critique of vertical merger policy were the model of a monopolist vertically integrating into a perfectly competitive stage and the successive monopoly model. The former gave rise to what is commonly referred to as the “single monopoly profit theorem.”[36] It states that as long as an adjacent stage is competitive, a monopolist in one stage cannot increase its profits by vertically integrating into an adjacent stage. The underlying assumption of perfect competition (as well as some additional assumptions needed for the result) severely limit its relevance for antitrust policy. The key result in the successive monopoly model is that prices under successive monopoly are even higher than they are under vertically integrated monopoly and that, as a result, a vertical merger between successive monopolists would result in lower, not higher prices.

These ideas influenced policy and caused the section on vertical mergers in the 1984 Merger Guidelines to suggest much less enforcement against vertical mergers (and, implicitly, much less of a concern that self-preferencing is sufficient grounds for market intervention). The primary concern with vertical mergers expressed in those guidelines was potential competition. Although not explicitly stated, the underlying logic was much different from the logic underlying horizontal merger enforcement, which focuses heavily on how a merger will affect short run pricing incentives. With its focus on the disciplining effect of potential entry, the 1984 Guidelines would seem to suggest a merger of successive monopolists would face a serious risk of a challenge. Yet, according to the successive monopoly model, a merger of successive monopolists would create an incentive to lower prices—not to raise them. Notwithstanding the successive monopoly model, however, the concern with eliminating potential competition was economically sound. When two firms each have dominant positions in successive (or complementary) stages of an industry, the dominant firm at one stage is typically the firm with the biggest incentive to challenge the monopoly at the adjacent stage.

The 2020 Vertical Merger Guidelines seem to represent a fundamental change in approach. The effect of a vertical merger on entry remains a concern. Section 1 states, “In addition, if one of the parties to a transaction could use its pre-existing operations to facilitate entry into the other’s market, the Agencies may consider whether the merger removes competition from the potential entrant, using the methods described in the Horizontal Merger Guidelines.”[37] This last clause is potentially significant. The 2010 Horizontal Merger Guidelines state:

A merger between an incumbent and a potential entrant can raise significant competitive concerns. The lessening of competition resulting from such a merger is more likely to be substantial, the larger is the market share of the incumbent, the greater is the competitive significance of the potential entrant, and the greater is the competitive threat posed by this potential entrant relative to others.[38]

In cases of successive dominance, each firm has a (very) large share at its respective stage and the firm at the other stage is of great competitive significance. Thus, one can read the reference to the approach of the Horizontal Merger Guidelines as reflecting a particular concern for mergers of successively dominant firms. If the Agencies intended to indicate a special concern with such mergers, it is puzzling why they did so in such an indirect way (particularly since challenges to horizontal mergers based on potential entry concerns are rare).

Despite the reference to concerns about entry, these guidelines seem to suggest enforcement based on predicting relatively short-run price effects (which is also the focus of most horizontal merger enforcement). How much enforcement will change as a result of the new Vertical Merger Guidelines is not clear as they are ambiguous in spots. Three are of particular importance.

The first issue concerns whether the projected price increases that will give rise to a challenge must be “downstream” (i.e., final good) or, alternatively, whether a projected increase in upstream prices (i.e., intermediate good prices) would be sufficient. Section 1 states, “When a merger involves products at different levels of a supply chain, the direct customers the Agencies will consider are actual and potential buyers of the downstream products.”[39] This sentence would seem to indicate that a projected increase in downstream prices will be necessary to warrant a challenge. However, Section 3 states, “In any merger enforcement action involving a vertical merger, the Agencies will normally identify one or more relevant markets in which the merger may substantially lessen competition.”[40] Then, the heading for “Example 1” is “Relevant markets can be upstream or downstream.” If an upstream market can be a relevant market, then one might read this passage to suggest that increase in the price of an input (which could be a downstream margin) will be sufficient to merit a challenge. This distinction is important because, as Section II demonstrated, a plausible outcome of a vertical merger is an increase in the price of an input despite a reduction in the price of the final good.

The second concerns two cryptic sentences:

To the extent practicable, the Agencies use a consistent set of facts and assumptions to evaluate both the potential competitive harm from a vertical merger and the potential benefits to competition.

The Agencies do not treat merger simulation evidence as conclusive in itself, and they place more weight on whether merger simulations using reasonable models consistently predict substantial price increases than on the precise prediction of any single simulation.[41]

If a “consistent set of facts” requires models based on a single set of assumptions that incorporates the complicated cross-effects of vertical mergers and if the second sentence means that the models the Agencies rely on to justify a challenge to a vertical merger must be robust to assumptions that are difficult to verify (such as the functional form of demand curves), then they may find that very few vertical mergers meet their standards for a challenge. However, if the Agencies mean the phrase, “[t]o the extent practicable,” to provide wiggle room to challenge vertical mergers even if they do not have a coherent model that is robust with respect to a range of plausible alternatives, then their attempts at enforcement might be substantially more aggressive than would be implied by those two sentences.

Third, the discussion of foreclosure and raising rivals’ costs states that “a merger may increase the vertically integrated firm’s incentive or ability to raise its rivals’ costs by increasing the price or lowering the quality of the related product.”[42] In general, the mere ability to raise prices without the incentive to do so is not taken either as evidence of market power or a legitimate basis for predicting price increases. For example, the hypothetical monopolist test that underlies market definition requires that a hypothetical monopolist over a product (or set of products) would find a small but significant non-transitory price increase to be profitable.[43] (Of course, a hypothetical monopolist would have the ability to raise prices even if doing so would cause demand to drop enough to make the price increase unprofitable.)

If the Agencies are only going to challenge vertical mergers when they have a coherent and robust set of models based on profit-maximizing behavior that predict that downstream prices will increase, then these guidelines do not signal a substantial change in policy. However, if they are going to challenge vertical mergers because one or more firms rely on one of the merging firms for an input, do not have equally (or nearly equally) good alternative sources of supply, and if they are concerned that the merged firm will engage in self-preferencing, then the Agencies may seek to intervene in vertical mergers far more often than they have in the past.

III. Monopoly Leveraging

In the previous section, I argued that a firm with market power at one stage of production has the greatest incentive to enter an adjacent stage and that, as a result, a vertical merger between two firms with dominant positions at complementary stages can cause a substantial lessening of competition. But the realization of that competition through actual entry can also give rise to allegations of anticompetitive behavior if the integrating firm exhibits self-preferencing and, in so doing, creates an “unlevel playing field.” The problem has arisen frequently in the tech sector as highly successful firms have expanded into adjacent activities. In some of these cases, the integrating firm’s initial success was to create a “platform” that other firms used and came to rely on. The allegations of anticompetitive conduct often entail an implicit claim that platforms implicitly promise unbiased treatment to all users of the platform. A common complication is that the boundaries of stages and products change rapidly as technology advances. The economic models of leveraging posit two well-defined stages or products. The marketplace reality of the distinction between stages is often less clear-cut.

A. IBM and Manufacturers of Plug-Compatible Peripherals

Self-preferencing is hardly a new issue in antitrust. A set of cases brought against IBM by the manufacturers of plug-compatible peripherals in the early 1970’s illustrates a common pattern.[44] At the time, IBM was the largest provider of general-purpose mainframe computers. Computer systems of that era consisted of a central processing unit (CPU) and a set of peripherals (tape drives, disk drives, card readers, and printers) that connected to the CPU. IBM sold all the components needed for a computer system. In addition, a set of companies reverse-engineered the interface between the peripherals and the CPU and offered “plug-compatible” peripherals (PCMs), typically at a lower price than IBM charged.

California Computer Products (CalComp) was one of the plug-compatible manufacturers that sued IBM for Sherman Act violations. Its products included disk drives and disk drive control units. CalComp alleged that IBM’s integration of the disk drive control unit into some models in its System 370 line of computers, thus obviating the need for a separate disk drive control unit, was anticompetitive because it denied CalComp the opportunity to supply disk drive control units for those computers.

In upholding the district court’s directed verdict in favor of IBM, the appeals court observed, “The evidence at trial was uncontroverted that integration was a cost-saving step, consistent with industry trends, which enabled IBM effectively to reduce prices for equivalent functions. Moreover, there was substantial evidence as well that in the case of Models 145, 158 and 168 the integration of control and memory functions also represented a performance improvement.”[45] It went on to rule, “IBM, assuming it was a monopolist, had the right to redesign its products to make them more attractive to buyers whether by reason of lower manufacturing cost and price or improved performance. It was under no duty to help CalComp or other peripheral equipment manufacturers survive or expand. IBM need not have provided its rivals with disk products to examine and copy, … nor have constricted its product development so as to facilitate sales of rival products.”[46]

The key aspect of this case, which is generalizable to other cases involving self-preferencing, is that the IBM computer system created business opportunities for other firms; and these firms made investments that relied heavily on assumptions regarding IBM’s future behavior. Despite being reliant on IBM, CalComp (and other PCMs) also invested to compete with IBM. If the conditions underlying the single monopoly profit theorem held, IBM could have benefited from a competitive peripheral sector, as better and cheaper peripherals would increase demand for IBM systems, which IBM could benefit from by charging higher prices for its CPUs. In fact, another one of CalComp’s allegations was that IBM lowered the prices of its peripherals and raised the prices of its CPUs. While that pricing behavior is directionally consistent with the single monopoly profit theorem, it appears that IBM preferred to charge positive margins on all the components to its systems and that the competition from PCMs lowered its profits. Thus, there can be little question that IBM preferred to sell entire systems, rather than just some components of systems which also included equipment from PCMs.

Should the antitrust laws protect the likes of CalComp, or is the risk that IBM would act so as to reduce the profitability, or even make completely obsolete, the business model of companies like the PCMs simply a risk that PCMs should have recognized when they entered? As the court ruled in Transamerica v. IBM,

It is not difficult to imagine situations where a monopolist could utilize the design of its own product to maintain market control or to gain a competitive advantage. For instance, the PCMs were only able to offer IBM’s customers an alternative because they had duplicated the interface…. Had IBM responded to the PCMs’ inroads on its assumed monopoly by changing the … interfaces with such frequency that PCMs would have been unable to attach and unable to economically adapt their peripherals to the ever-changing interface designs, and, if those interface changes had no purpose and effect other than the preclusion of PCM competition, this Court would not hesitate to find that such conduct was predatory….

It is more difficult to formulate a legal standard for design conduct than it is to imagine clearly illegal situations. Any such standard must properly balance a concern for the preservation of desirable incentives with the need to prevent monopolization by technology. Like pricing, equipment design can have pro-competitive as well as anti-competitive aspects. Truly new and innovative products are to be encouraged, and are an important part of the competitive process. For this reason, the acquisition or maintenance of monopoly power as a result of a superior product does not violate the Sherman Act.[47]

This statement clearly lays out the basic dilemma with respect to self-preferencing. The economics of why companies want to engage in self-preferencing are clear. Companies might, absent legal constraints, take actions for the sole purpose of excluding a competitor, but the challenge for public policy is to sanction anticompetitive cases without simultaneously chilling the incentive to continue to innovate.[48]

B. Microsoft

Microsoft’s first product was the operating system DOS. It attained a dominant position as the operating system for personal computers when IBM selected it as the operating system for its personal computers. In 1983, Apple introduced the Lisa line of computers, which were the first personal computers with a graphical user interface (GUI). Microsoft responded by introducing Windows. The first versions of Windows were desktop programs that sat on top of DOS. With its Windows 95 release, Microsoft integrated the desktop program into the operating system.

Windows (and, before it, DOS) is an open operating system. It exposes “Applications Programming Interfaces” (APIs) that writers of computer applications use as hooks to make their programs run. Windows is a platform that is a classic example of a two-sided product.[49] It needs to attract users, but users do buy Windows-based computers to use Windows applications, not just Windows itself. Microsoft needs applications programmers to write programs for Windows, which is why Microsoft has Microsoft developer tools.

Precisely because Microsoft could expect to sell more copies of Windows if better Windows applications were available, it had an incentive to write applications itself. This need was particularly urgent when Lotus 1-2-3 and WordPerfect, which had been the most widely used spreadsheet and word processing programs for DOS, stumbled with their first versions for Windows. As businesses required a good set of productivity tools, developing a good spreadsheet and word processing program (as well as other components of what became the Office suite of programs) was critical to the success of Windows; and it did not take long for Microsoft’s personal productivity tools to dominate the market.

Not only did Microsoft develop its own applications that it licensed separately from Windows, it continued to add features to its operating system that had previously been available as stand-alone products from a variety of sources. An example that might seem trivial is screen savers. At first, they were stand-alone applications. Microsoft’s inclusion of a screen saver in Windows 3.1 did not completely destroy the market for screen saver programs—as some people were willing to pay for designs other than those Microsoft offered, but the market shrunk substantially. (Of course, subsequent features that simply shut off monitors after a period of inactivity would have eventually destroyed the market.)

If Microsoft’s inclusion of a screen saver in Windows was not controversial, its decision to integrate Internet Explorer (IE) into Windows 98 was. When Microsoft introduced Internet Explorer as a stand-alone application for Windows 95, Netscape dominated the market for web browsers.

Netscape was founded in April 1994, shipped its web browser in December 1994, and went public in August 1995. In the quarter that proceeded its initial public offering (IPO), Netscape had a net loss of $1.6 billion. Despite never having turned a profit, it went public at a valuation of approximately $1 billion and saw its value approximately double in the first day of trading (after nearly tripling in intraday trading). This IPO is credited as the start of the dot.com era in financial markets that culminated in the dot.com crash of 2000. Ultimately, Netscape lost the first round in the “browser war” to Microsoft.

When the DOJ and several states brought an antitrust suit against Microsoft in 1998, the centerpiece of their suit was that, at first, making Internet Explorer free and requiring original equipment manufacturers (OEMs) to install it and, subsequently, integrating Internet Explorer into Windows constituted an illegal tie. The district court ruled that it was and that, as a result, Microsoft – at the time the company with the highest stock market valuation in the world – should be broken up. The US Court of Appeals for the DC Circuit ruled that the district court had misapplied the modified per se rule against tying and remanded the case to the district court to judge the tie based on a rule of reason.[50] DOJ and Microsoft subsequently settled the case without a judgment as to whether the tie was reasonable.

Whether or not Microsoft’s actions with respect to IE violated the antitrust laws raises fundamental issues about the antitrust treatment of self-preferencing. One view is that Netscape’s innovation relied heavily on a complementary asset provided by Microsoft and that Microsoft’s actions effectively expropriated the value of Netscape’s innovation. According to this view, Microsoft’s tying, if legal, would act as a disincentive for small firms to come up with innovative – indeed, disruptive – products. It would also inhibit future competition in modularized products in which all companies compete on a “level playing field.”

But the dilemma that the Transamerica court so clearly articulated applies. It is easy to imagine how a company like Microsoft might abuse its position in the operating system market with respect to a successful application, but it is much harder to articulate an economically sound standard under which its decision to integrate a new feature into its product is illegal. Economic models of markets with a platform and users of a platform assume a clear delineation between the two. Particularly in technologically advancing industries, however, such distinctions are rarely so clear. Before there was a web, web browsers were neither an application nor part of an operating system. It is not surprising that as the web developed, web browsers first appeared as stand-alone applications. But headlamps were first available only as stand-alone features for automobiles. Only after some time did they become a necessary component of a car. Particularly given the two-sided nature of Microsoft’s business in which applications developers would want to embed calls to the web in their products, the reasonableness of Microsoft’s behavior should not turn merely on whether a sufficiently large fraction of personal computer users might have preferred to use a different browser. Yet another factor to consider is that Netscape’s business model entailed charging licensing fees for its browser. Had it prevailed in the browser wars, a double marginalization problem would have resulted.

Whether or not Microsoft’s behavior with respect to IE was reasonable, Netscape and those who invested in it understood (or should have understood) the risk. As David Teece observed in a pathbreaking article in 1986,

It is quite common for innovators – those firms which are first to commercialize a new product or process in the market – to lament the fact that competitors/imitators have profited more from the innovation than the firm first to commercialize it! Since it is often held that being first to market is a source of strategic advantage, the clear existence and persistence of this phenomenon may appear perplexing if not troubling. The aim of this article is to explain why a fast second or even a slow third might outperform the innovator. The message is particularly pertinent to those in science and engineering driven companies that harbor the mistaken illusion that developing new products which meet customer needs will ensure fabulous success. It may possibly do so for the product, but not for the innovator.[51]

He went on to observe that control over key complementary assets often determines which company or companies profit from an innovation.

The prospectus for Netscape’s IPO clearly articulated this risk. As it stated, “In particular, the Company’s client software will likely be subject to price erosion due to free client software distributed by online service providers, Internet access providers and others. In addition, computer systems companies, such as Microsoft Corporation (‘Microsoft’) and International Business Machines (‘IBM’), are now bundling or are planning to bundle client software with their operating systems at little or no additional cost to users, which will likely cause the price of Company’s client products to decline.”[52]

As part of an extended discussion of the threat from Microsoft, the prospectus contains the observation, “Moreover, to complete development of Netscape Navigator for Windows 95, the Company must obtain certain technology from Microsoft. There can be no assurance that Microsoft will make such technology available to the Company on a timely basis, on commercially reasonable terms or at all.”[53] It then goes on to explain that it expects similar behavior from IBM and Apple.

Netscape entered despite this risk; and, while one can presume that Netscape and investors in Netscape expected general protection under the law, it seems unlikely that Netscape’s entry was based on the implicit assumption that antitrust law would protect it against Microsoft’s attempts to use its dominance in personal computer operating systems to its advantage in competing with its browser.

C. Google

No set of cases better exemplifies the challenges in formulating policy with respect to self-preferencing than those involving allegations of search “bias” against Google.

One of the first of these investigations internationally was the FTC’s inquiry into whether Google’s search results were “biased” towards its own “properties” and, if so, whether such self-preferencing was an unfair method of competition under Section 5 of the Federal Trade Commission Act. After a 19-month investigation, the FTC closed the investigation. In its strongly-worded closing statement, the FTC went well beyond saying that Google’s behavior did not violate U.S. competition law. Rather, it asserted that the behavior at issue was the sort of competitive behavior that competition statutes encourage.[54] Competition authorities in other jurisdictions that have reached similar conclusions include Taiwan,[55] the UK,[56] Canada,[57] and Brazil.[58] A notable exception to this list is the European Commission (EC), which issued a record fine against Google, alleging an abuse of dominance with respect to its shopping search.[59]

At issue in the FTC investigation was Google’s use of its “universals.” To understand what universals are, some background on internet search is necessary. The internet gives people access to a trove of information; but for that access to be useful, people must be able to locate the information they want. Yahoo! provided one approach to finding information on the internet. It had hired people to review web sites and catalog them into categories such as “sports” or “news” and then subcategories, such as “basketball” and “soccer” under “sports.” As the information available on the web exploded, this approach proved impractical.

Algorithmic search provided another approach. It relied on technology for crawling and cataloging all web sites on the “open web.” The results for a particular query term were then based on an algorithm that, for every query, assigned all the web sites the search engine had catalogued a score that reflected the match between the web site and the query. The results returned by early general search engines were a list of the sites to which the algorithm assigned the highest scores. Google’s initial success was because its PageRank algorithm yielded results that searchers found more useful than those provided by the other search algorithms available at the time.[60]

Google is a general search engine, meaning that it is designed to provide responses for any category of search. An alternative approach to search is thematic or “vertical” search, meaning search engines designed for specific categories of search. This approach to search preceded the start of Google in 1997. Travelocity and Expedia, which were two of the top three specialized Web travel sites before they merged in 2015, launched in 1996.[61] MapQuest, an early Internet mapping service that AOL acquired in 2000, launched in 1996. CitySearch, the first online source devoted to providing information about local merchants and locally available services, also launched in 1996.

General search engines have a natural advantage over thematic search engines in that they provide a sort of “one-stop shopping.” But they also have an inherent disadvantage. A fundamental problem for search engines is to ascertain user intent. Search terms are inherently ambiguous, and different people entering the same search term might be looking for much different information. While thematic search sites have this problem to some extent, a query in Expedia is almost surely a travel search, and knowing the class of search makes it far easier to generate relevant results.

The approach of Google and every other general search engine, including Bing, Yahoo!, and DuckDuckGo is, for every query, to run multiple thematic algorithms. That is, for every query, general search engines do not run just one algorithm. They run a shopping algorithm, a travel algorithm, a news algorithm, a local algorithm, and so on.

When Google first developed separate algorithms, it displayed them as different pages. Someone doing a shopping search on Google would have to click on the shopping page to see the results from Google’s shopping search, its news page to get results from Google’s news search, and so on. Of course, only users who understood what the separate pages in Google search results were would know to click on them. The different tabs reflecting different thematic search results gave Google what one commentator referred to as a “Swiss Army Knife” appearance.[62]

Over time, Google and all other general search engines developed the technology to integrate their thematic search results onto their first “Search Engine Results Page” (or “SERP”) based on probabilistic assessments of the intent behind the search. A Google “universal” was a set of results from one of Google’s thematic searches placed together in a box along with a link to more results from the same thematic search. For example, if Google’s algorithms determined a high probability that a search for “George Bush” (who was President when Google introduced universals) was likely a news-themed query, the SERP would contain a box with a set of links from Google’s news results along with a link to a page with its full set of news results for a query for “George Bush.” Similarly, if Google’s algorithms ascertained that a query for “Nike shoes” would, with sufficient probability, reflect an intent to locate a merchant that offers Nike shoes for sale, the SERP would have included Google’s shopping universal.

While Google achieved great initial success by generating superior results for some searches, its results for other types of searches were not as strong. Google’s PageRank algorithm drew on the insight that the number of external links to a web page is a signal of page quality. As powerful as this insight was for some searches, it did not help much in searches for “Italian restaurants near me.” Thematic local search sites like Yelp! would no doubt have preferred that Google continue to respond to such queries with links to thematic search sites. But someone entering a query for “Italian restaurants near me” into Google is likely looking for a nearby Italian restaurant rather than another search site that will provide a list of nearby Italian restaurants. In this regard, Google’s universal search results were simply its search results for queries that it perceived with some probability to fit a particular theme, and allegations that Google search results were biased toward Google “properties” were, in effect, allegations that Google search results were biased toward Google search results. The implicit assertion that the thematic results were somehow distinct from Google’s “general” search results reflects a fundamental confusion about the technology underlying general search.

Still, vertical search sites complained since Google was a significant source of traffic for them. As Yelp, a vertical search site specializing in local searches, claimed in its Prospectus, “Our success depends in part on our ability to attract users through unpaid Internet search on search engines like Google, Yahoo! and Bing.”[63] It goes on to state:

Google in particular is the most significant source of traffic to our website accounting for more than half of the visits to our website from Internet searches during the nine months ended September 30, 2011. Our success depends on our ability to maintain a prominent presence in search results for queries regarding local businesses on Google. Google has removed links to our website from portions of its web search product, and has promoted its own competing products, including Google’s local products, in its search results. Given the large volume of traffic to our website and the importance of the placement and display of results of a user’s search, similar actions in the future could have a substantial negative effect on our business and results of operations.[64]

Ultimately, the FTC rejected the complaints of vertical search sites and, in closing its investigation after 19 months, issued a closing statement in which it stated that universals were innovations in product design that Google intended to improve its search results and that any ill effects those changes had on other search sites reflected competition on the merits, not an unfair method of competition.

But the European Commission reached a different conclusion. In 2017, it found that Google had abused its position of dominance in “general search” to gain an unfair advantage in shopping search. This conclusion reflects a fundamental misunderstanding of search products and general search technology. Part of the problem stems from the multiple meanings of the word “general” as it applies to search. One meaning is a characterization of a type of search engine. Google (like Bing, Yahoo!, and DuckDuckGo) is a general search engine, meaning that it seeks to provide results for all classes of search. This meaning of “general” is similar to the word “department” when one says that Macy’s is a department store. Macy’s does not sell “departments.” It has multiple departments selling different types of goods. The word “department” distinguishes Macy’s (and stores like it) from stores that specialize in one type of good such as clothing stores or sporting goods stores. Similarly, the term “general search engine” distinguishes Google, Bing, Yahoo!, and DuckDuckGo from thematic or vertical search engines that specialize in one type of search.

Every search has a specific intent. Someone who enters a query into Google for “running shoes” in hope of locating running shoes to purchase does a shopping search. Someone who enters a query into Bing for “restaurants near me” is doing local search. A query to DuckDuckGo for “1984 US merger guidelines” is not a shopping, travel, local, news, video, or image search. One might label this category as “miscellaneous” or “general information.” Another possibility, though, is to label this class of search as “general search.” If so, then general search is just one of many classes of search that general search engines seek to satisfy. General search engines are not the only places to engage in this type of search. Wikipedia, which is not a general search engine, is another site for finding general information. But it might be that Google’s share of general (or general information or miscellaneous) search is higher than its share of other categories of search.

Even if that is so, however, “general search” is not a component of shopping or local search, and so it makes no sense to suggest that bias in Google’s general search toward its own shopping results is an abuse of its alleged dominance in general search. Just as Macy’s needs to offer men’s suits that compete successfully with those available at men’s clothing stores if it wishes to have a successful men’s suit business, Google needs to compete with other providers of shopping search, including most notably Amazon, if people are going to use Google for shopping searches. When Google returns its shopping results at the top of (or anywhere on) the SERP in response to such a query, it is giving the user Google’s search results for that query. Those results are a single service. They are not a combination of multiple services or components, one in which it is dominant and one in which it is not.

By characterizing Google’s efforts to improve its results for shopping queries as monopoly leveraging, the EC’s Google shopping decision reveals the risks in bringing unilateral conduct cases alleging monopoly leveraging. As the Transamerica court observed, it is easy to imagine situations in which a dominant company would have both the incentive and ability to take actions that have the sole purpose of excluding a competitor to the detriment of customers, but it is far harder to articulate practical standards that prohibit such behavior without chilling the incentive of successful firms to continue to innovate and improve their products.

Conclusion

One of the models that underpinned the Chicago critique of a range of competition policy doctrines related to vertical foreclosure was the model of a monopolist integrating into an adjacent, perfectly competitive stage. That model which, as noted above, is sometimes described as the “single monopoly profit theorem,” is sometimes taken to suggest that firms with market power at one stage of a production process or over one of a set of complementary goods cannot increase profits by integrating into the adjacent stage. While the result is of course correct given the underlying assumptions, those assumptions are quite strong and fail to apply in many real settings. In fact, firms often have an incentive to integrate (either directly or through merger) into adjacent stages that are not perfectly competitive; and, when they do, they often have an incentive to engage in self-preferencing.

For at least the past fifty years, antitrust economists have been arguing that the economic relationship among firms engaged in complementary activities is fundamentally different from those that sell substitute products and therefore compete with each other. Competitors have a mutual incentive to restrict output. In contrast, producers of complements have a mutual incentive to expand output. One lever to do so is to foreclose or raise the costs of rivals, but that is just one lever and it is not necessarily the dominant one. A key issue for policy makers is to judge whether the incentives for self-preferencing invalidate this distinction or, alternatively, whether it provides a modest qualification that justifies intervention in a few rare exceptions to the general rule. And, whether or not the exceptions are rare, one needs to identify the conditions that distinguish when intervention is appropriate from those when it is not.

With respect to vertical mergers, I have argued that what may be a trend towards intervention based on short-run pricing incentives is not based on sound economics as it fails to recognize the complexity of the countervailing incentives. A more coherent and economically sound policy, I believe, is to focus vertical merger enforcement on instances of successive dominance. The theory of such an approach is potential competition. The FTC and DOJ have been far more reluctant than they once were to challenge mergers on potential competition grounds, and it may be that they will find resistance to such challenges in court. However, one of the barriers to successful potential competition cases is that it is often difficult to explain why a particular company presents a unique threat. In cases of successive dominance, such claims can be compelling because a firm with market power at one stage has the most to gain from increased competition at an adjacent stage.

With respect to monopolization (or other forms of unilateral conduct) cases, allegations of vertical foreclosure particularly in markets characterized by significant technological advances often implicate innovation in product design. Since changes in product design that have no purpose other than to exclude competitors are theoretically possible, some might argue that companies with significant market power should have to demonstrate consumer benefit from their innovations. Such a policy might seem consistent with consumer welfare maximization as the objective underlying competition policy enforcement. But such a position requires that competition agencies and courts are well-suited to judging the consumer welfare implications of innovations, and it makes no allowance for the possibility that attempts to innovate to improve products sometimes fail. Ford was not trying to fail with Edsel and the Coca-Cola Company was not trying to fail with New Coke. Even the most successful companies make mistakes in product designs. Subjecting companies to antitrust liability for such cases would necessarily dull the incentive to innovate in product design and deny consumers the benefits from such innovations.

Footnotes

* Questrom School of Business, Boston University.

[1] The Story Of Ma Bell: A Brief History of the Company That Is as Old as the Telephone Itself, CNN Money (July 9, 2001), https://money.cnn.com/2001/07/09/deals/att_history/.

[2] John Callaham, The History of Android OS: Its Name, Origin, and More, Android Authority (Aug. 18, 2019), https://www.androidauthority.com/history-android-os-name-789433/; Press Release, Open Handset Alliance, Industry Leaders Announce Open Platform for Mobile Devices (Nov. 5, 2007), http://www.openhandsetalliance.com/press_110507.html.

[3] Britney Fitzgerald, Apple Map Fails: 19 Ridiculous Glitches Spotted in Apple iOS 6’s Anti-Google App, HuffPost (Sept. 9, 2012), https://www.huffpost.com/entry/apple-map-fails-ios-6-maps_n_1901599.

[4] U.S. Dep’t of Justice & Fed. Trade Comm’n, Vertical Merger Guidelines (2020) [hereinafter Vertical Merger Guidelines], https://www.ftc.gov/system/files/documents/reports/us-department-justice-federal-trade-commission-vertical-merger-guidelines/vertical_merger_guidelines_6-30-20.pdf.

[5] U.S. Dep’t of Justice, 1984 Merger Guidelines (1984) [hereinafter 1984 Merger Guidelines], https://www.justice.gov/archives/atr/1984-merger-guidelines.

[6] U.S. Dep’t of Justice, 1968 Merger Guidelines (1968) [hereinafter 1968 Merger Guidelines], https://www.justice.gov/archives/atr/1968-merger-guidelines.

[7] United States v. AT&T Inc., 916 F.3d 1029 (D.C. Cir. 2019).

[8] See, e.g., Steven C. Salop, Invigorating Vertical Merger Enforcement, 127 Yale L.J. 1742 (2018); Steven C. Salop, Presentation at U.S. Federal Trade Commission Hearings on Competition and Consumer Protection in the 21st Century: Revising the Vertical Merger Guidelines (Nov. 1, 2018), https://www.ftc.gov/system/files

/documents/public_events/1415284/ftc_hearings_5_georgetown_slides.pdf; Jonathan B. Baker, Nancy L. Rose, Steven C. Salop, & Fiona Scott Morton, Recommendation and Comments on the Draft Vertical Merger Guidelines (Feb. 24, 2020), https://media.justice.gov/vod/atr/comments-draft-vmg/dvmg-0017.pdf.

[9] A notable exception was the decision by the Reagan administration Justice Department to settle the long-running monopolization suit by forcing AT&T to divest itself of its local operating companies, which were local monopolies subject to rate regulation. But the presence (and expected persistence) of local rate regulation make that a special case. As long distance service was becoming increasingly competitive, there was a concern that AT&T would try to shift its costs for providing long distance service to its local service, thus both giving it a strategic advantage in long distance service and partially circumventing local rate regulation. Even those who view vertical integration as being benign recognize an exception for vertical integration to circumvent rate regulation.

[10] See note 9.

[11] A classic example is Jerrold Electronics, which was a pioneer in the development of cable television systems at the time when the primary use of such systems was to make over-the-air television signals available in areas that got poor reception. Even though such systems had multiple components, some of which were available from multiple sources, Jerrold only offered entire systems. See United States v. Jerrold Elecs. Corp., 187 F. Supp. 545, 551-52 (E.D. Pa. 1960).

[12] See, e.g., Joseph Farrell & Phil J. Weiser, Modularity, Vertical Integration, and Open Access Policies: Towards a Convergence of Antitrust and Regulation in the Internet Age, 17 Harv. J.L. & Tech. 85 (2003).

[13] That is, the seller charges a constant price per unit regardless of the quantity a buyer purchases. Hart and Tirole analyzed vertical mergers when sellers can charge “perfect” non-linear prices. See Oliver Hart & Jean Tirole, Vertical Integration and Market Foreclosure, 1990 Brookings Papers on Econ. Activity: Microeconomics 205 (1990). With perfect non-linear prices, the price for the marginal unit equals marginal cost. Thus, perfect non-linear pricing eliminates EDM as an effect of a vertical merger. While non-linear pricing is common, “perfect” non-linear pricing is not. With perfect non-linear pricing, the seller extracts all the available economic profit in the fixed fee. Getting agreement on such a fixed fee, given imperfect information, would in general be challenging. Also, such a contract would leave the seller with no incentive to promote the product. To maintain such an incentive, the pricing structure must entail a price above the upstream firm’s marginal cost.

[14] Augustin Cournot, Researches into the Mathematical Principles of the Theory of Wealth (Nathaniel T. Bacon trans., London, MacMillan 1897). The original French version was published in 1838.

[15] Joseph J. Spengler, Vertical Integration and Antitrust Policy, 58 J. Pol. Econ. 347-52 (1950).

[16] European Comm’n, Guidelines on the Assessment of Non-horizontal Mergers Under the Council Regulation on the Control of Concentration Between Undertakings, ¶11 (Oct. 18, 2008), https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2008:265:0006:0025:en:PDF.

[17] The term “raising rivals’ costs” is due to Salop and Scheffman. See Steven C. Salop & David T. Scheffman, Raising Rivals’ Costs, 73 Am. Econ. Rev. 267 (1983); Steven C. Salop & David T. Scheffman, Cost-Raising Strategies, 36 J. Indus. Econ. 19 (1987); see also Thomas G. Krattenmaker & Steven C. Salop, Anticompetitive Exclusion: Raising Rivals’ Costs to Achieve Power over Price, 96 Yale L.J. 209 (1986).

[18] This numerical example is based on Michael A. Salinger, Vertical Mergers in Multi-Product Industries and Edgeworth’s Paradox of Taxation, 39 J. Indus. Econ. 546-56 (1991).

[19] Serge Moresi and Steven C. Salop, vGUPPI: Scoring Unilateral Pricing Incentives in Vertical Mergers, 79 Antitrust L. J. 185 (2013).

[20] Another model in which this competitive effect on the price of the intermediate good can dominate the foreclosure effect is Michael A. Salinger, Vertical Mergers and Market Foreclosure, 103 Q. J. Econ. 345-56 (1988).