Introduction

Multi-sided platforms, also known as “two-sided markets,” are synonymous with the digital economy.[1] Common examples include Google Search, Facebook, Amazon Marketplace, Windows, Android, and Uber. Yet platforms are not new. Newspapers, broadcast television, and the yellow pages are platforms that predate the digital age. In this chapter, we address a number of foundational questions.[2] What exactly are platforms? How do platforms relate to the various types of network effects? Importantly, do we need different tools to assess potential anticompetitive conduct that involves platforms?

Specifically, we begin with a discussion of the various types of network effects, as these effects are integral to understanding the nature of platforms. Next, we consider platforms more from the perspective of incentives rather than an overt focus on a standardized definition. We also discuss how platforms compete, including discussions of “zero-price” markets and the associated idea of “attention” markets. Finally, we offer some guidance on some relevant economic issues to consider when assessing platform markets in the context of antitrust cases.

I. Network Effects

In discussing network effects, Professors Michael Katz and Carl Shapiro explain that “[t]here are many products for which the utility that a user derives from consumption of the good increases with the number of other agents consuming the good.”[3] Commonly cited examples of products with these “direct” network effects include email, telephones, and fax machines.[4] The idea is that, as more individuals adopt these products, the benefits to existing users (that is, the “network” of users) increases. Specifically, joining a network creates both a private gain to the individual and a social benefit to others on the network.[5] This dual benefit creates a positive feedback loop; having more users makes the network more valuable and desirable to each additional user. It is no coincidence that the examples listed above all involve mechanisms of communication. These types of mechanisms tend naturally to cause network effects because of the benefits arising from the ability and option to communicate with more people as the network grows.[6] Such effects are akin to “demand-side economies of scale,” i.e., the benefits of consumption increase as the network expands.[7]

In contrast, “indirect” network effects, or cross-group effects, arise when the increased participation by one group creates a greater incentive and corresponding benefit for another, related group to participate.[8] For example, as more consumers purchase mobile devices running the Android operating system, the incentive for app developers to write software for Android increases. Similarly, as more passengers use a ride sharing app such as Lyft, drivers experience greater incentives to join the Lyft network, or platform. Both Android and Lyft are examples of multi-sided platforms, which we discuss in greater depth in the following section. While the distinction between direct and indirect network effects is important and certainly worth making, particularly in the context of digital platforms, they both ultimately come down to providing users greater value the more that others participate on the same network.[9]

Given the presence of network effects, both direct and indirect, do first-mover advantages create lock-in and a path dependency[10] where markets can tip and create “winner takes all” (or “winner takes most”) outcomes? Might this also entail markets tipping in favor of inferior products or standards? These and related issues were the subject of early economic research on network effects.[11] The idea is that, even if a better, superior product or standard were to emerge, customers may stick with the inferior product because its network is larger and the market has already tipped in its favor.[12] This effect is compounded in the presence of switching costs; but even with nominal switching costs, there could still be a path dependency if there is a coordination problem that inhibits migration.[13] A particular user might prefer a competing product or standard for various reasons, including an objectively superior set of features; however, without the ability to bring over a large proportion of other users in a collective switch, the theory is that the competing network will stall. Moreover, difficulties in overcoming incumbency are further exacerbated to the extent that there are economies of scale on the production side as well.[14]

The strength of this tendency to stay on a given path depends, however, on a number of factors. First, it will depend on the strength of the network effect and/or whether the network effect is primarily responsible for the success of a product. Users could adopt a product for reasons other than a desire for a relatively large network. For example, while subscribers to an online version of a newspaper might value reading other user comments to the various stories posted, these comments likely represent only a small fraction of the total value that they derive from their subscription. On the other hand, the presence of other users will be significantly more important to users of business review sites like TripAdvisor and Foursquare. While these sites have useful basic information about local businesses, such as hours of operation and location(s), it is likely the breadth and depth of user reviews which represent the overwhelming value from visiting these sites. Thus, the relative importance of the size and quality of the network will depend on the particular market. Even in markets where network effects are important, there remains the question of when, and the degree to which, the network hits diminishing returns.

The importance of considering the strength and scope of network effects is undoubtedly important for assessing social media, where there is not a “one size fits all” approach.[15] Like the canonic examples of email and telephones, social media has direct network effects that can be quite powerful. There is little doubt that the success of platforms such as Facebook, YouTube, LinkedIn, and TikTok involves not only the user- and platform-supplied content but also the social interactions. Again, the question is the nature and extent to which a particular social media platform relies on network effects.

Professor Catherine Tucker’s research reveals that network effects on social media can be quite “local,” in that what primarily affects a platform’s utility to users is not a large network per se but rather the participation of specific sets of users such as friends, relatives, co-workers, and classmates.[16] Fundamentally, products can be still be useful as long as there are two people who want to communicate with each other.[17] For instance, even for products with strong direct network effects such as fax machines, it can be a viable method of communication at various network sizes.[18] Thus, coordinating migration to a new or alternative network is not necessarily a significant hinderance if the primary value from joining a network is derived from a relatively small group of people. This point is not universal, however: It could be that the success of certain types of networks are dependent on having a large group of people rather than just a subset.[19] A potential example, for some users at least, is Twitter, where the characteristics of the network correspond to type of public forum.[20]

A second factor that potentially limits lock-in is product differentiation that caters to a spectrum of consumer preferences.[21] Again, focusing on social networks, they can be differentiated along a number of dimensions including the format of communication, the type of advertising, the type and quality of complementary features, privacy settings, and demographic appeal.[22] Differentiation also matters for platforms such as operating systems that entail both hardware and software components. Clearly, both are important. Depending on the consumer, non-network-based features like processor speed, memory, and camera quality can be a significant part of the decision to adopt a particular system.[23] The point is that equilibria can emerge with more than one network if consumers value product variety.

Relatedly, a third factor is that “tipping is less likely if agents can easily use multiple standards;”[24] this practice is often labeled “multi-homing.” There are numerous examples of competing platforms coexisting.[25] The ability to multi-home is dependent to a large extent on the level of switching costs and the consumption or production costs incurred from using multiple products.[26] All else equal, lower switching costs will mitigate lock-in and facilitate migration to competing platforms or multi-homing. For example, in online advertising, if there are tools available to seamlessly run ad campaigns on more than one platform, then this will encourage the use of multiple systems. In contrast, if there are hinderances and incompatibilities between networks, then this could lead some advertisers to single-home on the leading platform. Even in this latter scenario, which involves higher costs to multi-home, the decision will also depend on the degree of user overlap, that is, consumer multi-homing and switching behavior.[27] Even if a particular site or platform has a significantly smaller user base, if that base is highly differentiated and cannot be easily reached on other platforms, then advertisers will have an incentive to multi-home.[28]

Finally, the welfare implications of markets tipping to a dominant system, network, or platform are not always clear.[29] On the one hand, strong efficiencies arise from compatibility and interoperability as well as both demand-side and supply-side economies of scale.[30] On the other hand, costs arise from the loss of variety and potentially being locked into an inferior standard or product.[31] Relatedly, the economics literature has not settled the question regarding which type of market structure leads to greater rates of innovation, e.g., competition versus monopoly;[32] it is largely this question that will ultimately determine the welfare consequences of markets where a dominant firm emerges with the benefits of network effects.[33]

II. Multisided Platforms

In the previous section, we introduced the idea of multi-sided platforms in the context of defining indirect network effects, which inherently involve the relationship between various groups. In this section, we further explore the characteristics of multi-sided platforms and how they differ from single-sided markets.

A. Defining Platforms

What exactly is a multi-sided platform? There are various approaches to this question, and all provide important context. Professors David Evans and Richard Schmalensee offer a fairly comprehensive definition when they state that a platform “has (a) two or more groups of customers; (b) who need each other in some way; (c) but who cannot capture the value from their mutual attraction on their own; and (d) rely on the catalyst to facilitate value creating interactions between them.”[34] This definition highlights the role of a platform as catalyst, organizer, and matchmaker bringing together different groups so they can interact or exchange in some manner. Examples include shopping malls, eBay, and Amazon Marketplace. These physical and virtual marketplaces organize sellers in some fashion, whether in an attractive retail space with plentiful parking or online on a uniform network, with the goal of attracting consumers. While sellers could completely forego platforms and sell directly to consumers, the value of platforms is that they create a convenient mechanism for users to purchase goods and services.

In contrast, Professors Andrei Hagiu and Julian Wright offer a somewhat different definition: Platforms “enable direct interactions between” two or more groups where each group is “affiliated with the platform” in some manner (typically through platform-specific investments).[35] Their focus is more on the choice that a firm can make to either vertically integrate or use a multi-sided platform model.[36] One advantage of the Hagiu and Wright approach is the focus on distinguishing platforms based on the “direct” interactions between two or more groups; that is, each side maintains “control over the key terms of the interaction.”[37] The goal of their definition is to explicitly de-emphasize indirect network effects, as it could be argued that these network effects exist for single-sided markets such as retailers.[38]

Finally, Professors Jean-Charles Rochet and Jean Tirole focus on the interrelated price structure between the various sides of a platform.[39] Specifically, Rochet and Tirole explain that “[t]he quest for ‘getting both sides on board’ makes no sense in a world in which only the total price for the end user interaction, and not its decomposition, matters.”[40] This finding, according to Rochet and Tirole, is what actually distinguishes a platform from a conventional single-sided market: “We define a two-sided market as one in which the volume of transactions between end-users depends on the structure and not only on the overall level of the fees charged by the platform.”[41] An advantage of Rochet and Tirole’s definition is that it explicitly incorporates the platform’s incentive to ensure participation on both sides of the platform and their interrelated demands through cross-group effects.

Rochet and Tirole’s definition also explicitly acknowledges the importance of looking at both sides of a platform when examining its conduct. Otherwise, for instance, what might appear to be below cost pricing on one side—for example, the audience on ad platforms—is really just profit maximization based on the structure of prices to the various sides (that is, below cost pricing to the audience and above cost pricing to the advertisers).[42]

While these various definitions emphasize different aspects of platforms, they are complementary and cumulatively inform our current understanding. What emerges is the importance of identifying the strength and direction of the cross-group effect(s) and the nature of the interaction or exchange that is facilitated by the platform. Further, the profit maximization of platforms explicitly involves the need to get two or more sides “on board” through pricing, design, and governance decisions. What also emerges is that these distinctions are not always crystal clear with bright lines distinguishing multi-sided platforms from single-sided markets. For example, Amazon’s business has both single-sided elements (such as when it vertically integrates into the production of various goods like the Kindle e-reader) and multi-sided elements (such as Amazon Marketplace, which is the program that allows third-party sellers to use the Amazon platform).[43] We will return to how to reconcile these tensions in infra Section II.B.

More than a definition, platforms are business models. Take for instance ride-sharing platforms and taxis. Both Uber and taxis perform the same basic function—transporting passengers—albeit with different features; thus, they are differentiated economic substitutes from the passengers’ perspective.[44] Yet Uber is a multi-sided platform while taxis are vertically integrated single-sided firms. Similarly, credit cards, personal checks, and cash are all methods of payment for goods and services. Each has its advantages and disadvantages, but they all ultimately serve the same purpose even though credit cards are platforms, while banks issuing personal checks are not.[45]

B. Are there Platform Sub-Categories?

As platforms are business models, the monetization strategy can vary depending on the specific type of platform. Contrast, for instance, Ticketmaster, Etsy, and Amazon Marketplace, which all primarily monetize through transaction fees, with Facebook, Google Search, and YouTube, which all primarily monetize through advertising revenue. Even comparable platforms, such as Apple’s iOS and Google’s Android, monetize differently. Apple has vertically integrated its software with hardware, which represents a significant portion of Apple’s revenue from iOS.[46] For Google, Android represents a key distribution channel for its complementary services including Google Search and YouTube (and, in turn, their advertising revenues).[47] But both Apple and Google also monetize through fees based on transactions in the App Store and Google Play, respectively.

These distinct methods of monetization beg the question of whether or not there are identifiable platform sub-categories that can help guide antitrust analysis. In an early classification scheme, Professor David Evans proposed three sub-categories: (1) “market-makers,” (2) “audience-makers,” and (3) “demand-coordinators.”[48] Market-makers “enable members of distinct groups to transact with each other,” such as, shopping malls, eBay, Nasdaq, and dating services.[49] Audience-makers “match advertisers to audiences,”[50] such as, newspapers, broadcast television, and magazines. Finally, demand-coordinators “do not strictly sell ‘transactions’ like a market maker or ‘messages’ like an audience-maker; they are a residual category much like irregular verbs.”[51] Examples given include operating systems, credit cards, and video game consoles.

Specifically in the context of antitrust analyses, Filistrucchi et al. propose making a distinction between “non-transaction” and “transaction” platforms.[52] Citing Filistrucchi et al., the Supreme Court made this same distinction in Ohio v. American Express,[53] according it more prominence in platform classification discussions. Non-transaction platforms, as the name implies, “are characterized by the absence of a transaction between the two sides of the market.”[54] This is effectively equivalent to Evans’ “audience-makers.” In contrast, transaction platforms “such as payment cards, are instead characterized by the presence and observability of a transaction between the two groups of platform users.”[55] In terms of Evans’ classification scheme, a transaction platform is something of a mix between “market-makers” and “demand-coordinators.”

While the Evans and Filistrucchi et al. schemes do not perfectly align, we find value in combining the two. The term “transaction” platform is fairly descriptive and encompasses platforms that facilitate an actual market transaction or exchange (and not merely an interaction through advertisements) between buyers and sellers. This would include ride sharing apps (Uber, Lyft), house rental apps (Airbnb, Vrbo), physical marketplaces (shopping malls, auction houses), virtual marketplaces (eBay, Etsy, Amazon Marketplace), and credit cards (Visa, American Express). In all of these examples, the platforms monetize at least in part through fees to join the platform and/or transaction fees. Transaction platforms also involve bi-directional cross-group effects, as the two sides or groups must be explicitly attracted to each other in some manner, or there is nothing to exchange. Further, given that the two sides of the platform are buyers and sellers, their interaction produces a common output through that exchange.

What about operating systems (Windows, MacOS, iOS, Android), gaming consoles (Nintendo Switch, Xbox, PlayStation), and web browsers (Chrome, Safari, Firefox)? The nature of these platforms is somewhat different than transaction platforms—while sharing some similarities. For instance, Windows creates a uniform, standardized system for hardware and software suppliers, which are complements, so they can sell compatible products to end-users. It is only after exercising this role as coordinator that Windows, in a sense, facilitates the exchange between hardware/software sellers and buyers. Notably, platforms can exist within platforms: Android has a uniform standard so that various complementary groups can coordinate, but it also has Google Play, which functions as a transaction platform bringing together app developers and users. In these examples, given the importance of coordination, we find Evans’ “demand-coordinator” label to be particularly fitting.

A somewhat unconventional example of demand coordinating platforms is standard-setting organizations (SSOs). SSOs play a crucial role in developing, supporting, and setting interoperability and performance standards.[56] There are hundreds of SSOs across a range of industries including telecommunications, electronics, and the Internet.[57] Fundamentally, SSOs are economic platforms. They act as a facilitator between innovators and implementers that results in increased levels of exchange, and, ultimately, increased gains from trade and enhanced rates of innovation.[58] In order to establish a successful platform, an SSO must implement policies and governance that attract both innovators and implementers. SSOs seek this balance due to oft-conflicting incentives between their participating groups.[59]

Finally, we have “non-transaction” platforms, which align with Evans’ “audience-maker” categorization. This basically includes all ad-supported platforms, where the facilitation is not an exchange per se, but rather an interaction. The interaction might be observable, such as when a user clicks on an ad, or unobservable, such as when a user views an ad but does not interact in any measurable way.[60]

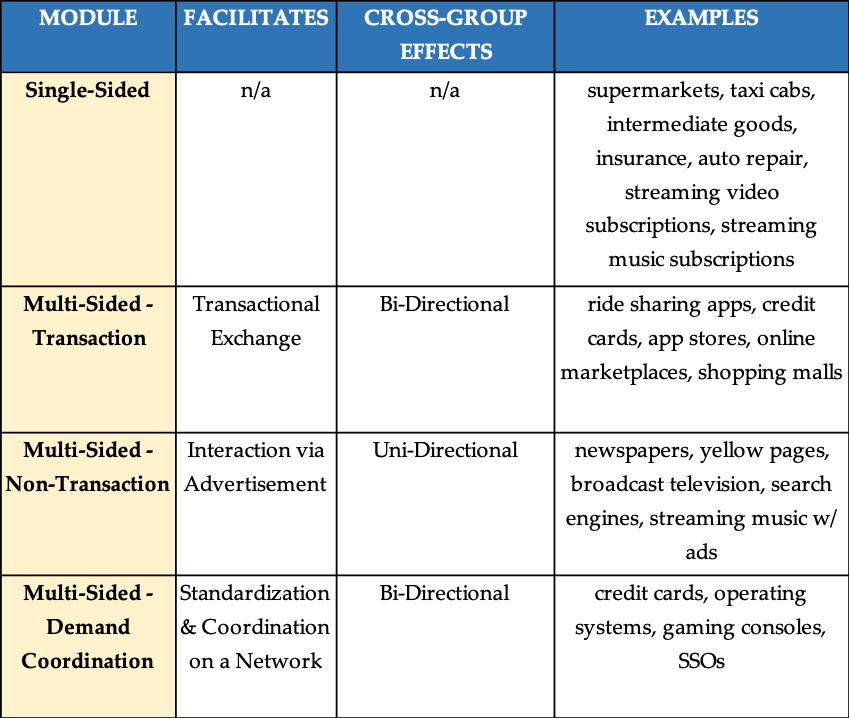

We ultimately propose these categories, not as “all or nothing” groupings, but more as platform “modules” that a business can stack on top of, or next to, each other. In this sense, we can also include single-sided products as a module. This observation that businesses are more a composite of modules rather than a specific type of platform solves a number of tensions when trying to categorize them. Take for instance credit cards. While in the above exposition, we included them as an example of a transaction platform, credit cards also play a standard-setting-like role in putting merchants and cardholders all on the same network so they can seamlessly transact.[61] Additionally, unlike something like Uber, a credit card does not explicitly match a specific buyer and a specific seller. It is more of a host that enables, and then benefits if and when an exchange occurs—similar to shopping malls and virtual marketplaces. Perhaps this is why Evans originally categorized credit cards as demand-coordinators,[62] whereas Filistrucchi et al. considers them transaction platforms.[63] Similarly, operating systems primarily play a coordinating role, but they subsequently facilitate, and benefit from, exchanges on their platform. For example, Microsoft collects a transaction fee for software sales through its online Microsoft Store.[64] Again, these complexities might explain why Filistrucchi et al. use operating systems as an example of a transaction platform,[65] whereas Evans considers them demand-coordinators.[66] The answer is that operating systems such as Windows are both transaction and demand-coordinating platforms. The same could be said of managed care organizations (MCOs) that create a network of hospital providers and patients, which ultimately results in a market exchange. These are all examples of businesses that “stack” a number of different platform modules rather than conform neatly to one category or another.

In the following table, we summarize a classification scheme based on modules and how platforms can be a mix of these modules. The benefit of this modular approach is that is harmonizes two proposed schemes in the literature and highlights the actual complexity of businesses that involve platform services. Otherwise, there is a potential danger in pigeonholing a platform into one category or another. This is particularly relevant in antitrust, where precedents have formed around specific types of platforms.[67]

Table 1: Different Modules that Can Comprise a Business Involving Platform Services

There is also variation within a module. Consider Google Search and Facebook, which are generally categorized as prototypical non-transaction platforms. Both offer attractive content to users, offer a zero-price, and monetize through advertisements. Yet, a closer look reveals that Facebook creates direct network effects (on the user side), while Googles Search does not.[68] This tells us that Google is primarily responsible for providing the content that attracts users to its search platform, while Facebook can rely on the presence of users and the content they provide. In the following section, we dig deeper into these non-transaction, zero-price platforms and the incentive effects created by the competition for audience attention.

In sum, while there are important distinctions between platforms that warrant some type of classification scheme, there are also some strong commonalities that should not be overlooked. Regardless of the type of platform, indirect network effects play a central role and the structure of prices across all groups is central to a platform’s profit maximization. This recognition should impact considerations of defining the relevant product market and assessing competitive effects, which we further explore in Section IV.[69]

III. Assessing Platforms: Zero-Price Platforms & Attention Markets[70]

Zero-price platforms, such as Google Search and Facebook, are a particular focus of digital reports and scholarship[71] and, consequently, antitrust scrutiny. In this section, we delve deeper into whether or not user access is actually “free” for these platforms and, if not, what exactly is being exchanged. Additionally, we examine the idea of “attention markets,” which has implications for both defining the relevant product market and competitive effects analyses.

A. Are Users Exchanging Data for Platform Access?

One belief is that we are exchanging ourselves, or our data, for access to ad-supported platforms.[72] In effect, we are giving up some of our privacy. This has led to proclamations that “you are the product” or “when it is free, the product is me.” Holding aside the normative considerations of this exchange, is this the full story? If not, what is the precise exchange between users and platforms?

While there is a superficial appeal to the above characterization, it is sufficiently imprecise that it can lead to poor intuition. Normally, when we assess markets, we consider an exchange involving a positive price, which is the “cost” of purchasing the good or service from the perspective of consumers. In turn, the price that a firm receives, that is, revenue, is used to fund its operations including distributing the product, paying workers, and renting capital. Revenues can also be used to fund innovations and improve future iterations of the product.

For zero-price platforms, the benefit of the exchange originates from two sources—both the users and advertisers. The data collected from users must offer some benefit to platforms; otherwise, they would not bother to incur the costs involved with collecting and storing the data. But what is that benefit? Second, and more straightforward, platforms earn revenue by charging a positive price to advertisers. Thus, the first point is that platforms are obviously not ultimately a zero-price enterprise. They clearly earn revenue from advertisers who value the prospect of interacting with the platform’s audience. How do you attract an audience so you can monetize the advertisers? It is through attention-grabbing content, which is the second point. For search engines, this takes the form of relevant search results; for social networks, the value is derived from the ability to connect with others and “consume” the content they provide, whether in the form of messages, public posts, or uploaded videos.

Yet delivering content requires data. For a search engine, this includes data on what you are searching for, what others have searched for, and what you and others have found “relevant” through revealed behavior. In this context, platforms can use data in a very different way than revenue derived from a positive price.[73] Specifically, data can be used to improve the quality of the service for the various groups who participate on the platform. For users, it results in a more curated experience.[74] For advertisers and users, it results in better targeted ads.

Of course, some disutility can arise from having one’s data collected. This disutility is a consideration that users make when considering whether or not to be on a platform or how much they wish to interact on the platform.[75] Yet, it is important to consider privacy—not so much about not wanting to give up data—but as the control of data.[76] This is where consumer disclosure is part of the assessment of consumer welfare—as well as the associated ability to control what and how the data is used. All else equal, privacy and data collection policies that are transparent, accessible, and easily understood will lead to better outcomes where consumers can make informed choices. On net, consumers are implicitly weighing the utility from more relevant content with the disutility of sharing data.

Thus, if users are not strictly “exchanging” data for access to the platform, then what exactly are they exchanging? For ad-supported platforms, users are exchanging some, but not all, of their attention for access to the content provided.[77] Particularly for online search, ads can serve as a substitute for non-sponsored content. It stands to reason that there must be some aggregate interaction with the ads, otherwise, there would be no viable attention market as advertisers would have no demand for consumers’ attention.

In sum, zero-price platforms have a positive “shadow price”[78] in the form of users providing some of their attention while on the platform as well as information about themselves while using the platform.[79] Yet this shadow price must net out the benefits that users derive from a platform’s use of their data, as a percentage of users—perhaps the majority—are willing to opt-into a platform using at least some of their data if this results in a more personalized and higher quality service.[80] This netting out process tells us that wholesale statements such as “paying with data” are wanting, as some users would willingly provide the data; although for more privacy minded users, the characterization is more on point. What is universal across users, however, is that they are the audience for advertisers, which, depending on the circumstance, might or might not be welcome.

B. What are Attention Markets?

In a given year, Americans spend more time consuming ad-supported media than they do working.[81] Given the importance of attention, for both content and advertisements, some scholars have suggested the explicit recognition of “attention markets” in the context of antitrust assessments of various platform conduct.[82] The idea is that relevant product market considerations should not necessarily be limited to, for instance, questions regarding whether Facebook and YouTube share similar functional attributes. Rather, do consumers consider these two differentiated social networks to be close enough substitutes, based on their fungible attention, to influence these platforms’ competitive incentives? It is the recognition that Facebook and YouTube are competing, at least on some dimensions, for people’s time.[83]

Taking a step back, what are we trying to accomplish with relevant product markets and competitive effects analyses? The goal is to understand the nature of competition and the incentives a firm faces in terms of pricing, output, quality, and innovation. Functional interchangeability might address this question as long as it represents a good proxy for consumer demand. Yet, generally speaking, functional attributes can only take us so far. For instance, is tap water in the same relevant market as spring water? Maybe—it depends on the specific nature of the demand being examined (including the time and place). Are battery-powered toothbrushes in the same relevant market as manual toothbrushes? Both clean teeth. Obviously, the true test is revealed consumer behavior including the diversion between various categories and products when consumers migrate—whether it is due to a price change, new entry/exit, or quality change.

In the same way, focusing solely on functional overlaps can lead to an excessively narrow view of competition for household attention. For instance, does Disney+ compete with Netflix, YouTube, and Facebook? While “compete,” in antitrust, is a technical consideration, these services may possibly be sufficiently close substitutes for some households in some settings. In other settings and contexts, these services could be very distant substitutes. The point is that, if we recognize this competition for attention, then it expands the possible boundaries to consider competitive effects. For instance, whatever one’s view of Facebook’s acquisition of Instagram back in 2012, limiting the analysis to whether Instagram is more about pictures and Facebook is more about words is not a particularly a good approach.

Relatedly, to illustrate the idea of very different functional products exhibiting some degree of substitution for attention, Evans shows how the composition of the top 50 U.S. websites has changed dramatically between 2002, 2007, and 2012.[84] Holding aside issues of relevant antitrust markets—these results show how very different sites can compete for users’ attention. Similarly, Boik et al. find that “[b]etween 2008 and 2013”—a time of notable growth in online activity—“households substitute online categories such as chat and news for social media and video.”[85] Further, “even if many households shifted their attention to more sites with video offerings, which tend to demand more time, it appears these shifts are at the expense of attention at other sites, at which the household was already spending significant time.”[86]

Recognizing that platforms are competing for attention also leads to the point that platforms are trying to grab “use” as well as “users.” For instance, it is conceivable that a platform would rather have 10 users using the service for 100 minutes a week rather than 100 users using it for 1 minute a week.[87] Why does this distinction matter? It gets at the incentives to compete and innovate. Even if a leading platform has saturated the market in terms of its user base, this does not mean the platform’s incentive is then to simply “harvest” their rents and stop innovating or introducing new features. The intensity of use could still be contestable.[88] If so, then this suggests that platforms, including those with large market shares, have an incentive to continue to compete for attention through the development of new features, improvements, and content.

If we focus solely on the number of users, however, it might lead to the conclusion that very little of a particular market is contestable. Under this paradigm, when we see large platforms such as Google and Facebook introduce complementary products or features, we might be more inclined to take a skeptical view. Are these platforms trying to leverage their market power into adjacent markets in order to protect their core monopoly products while reducing overall welfare? They might be. Yet, if we consider use, as well as users, then there is at least a recognition that platforms have some procompetitive incentives to continue to compete for attention. Again, this is not to suggest that anticompetitive motives and conduct cannot arise in markets with large ad-supported platforms.

To further illustrate the point, consider credit cards. The average cardholder has four credit cards.[89] Yet each cardholder also likely has a favorite card for most types of purchases. Thus, credit card networks are still competing for cardholder use even though they are already “in your wallet.” In some ways, the competition is just beginning once a cardholder adopts a card.[90]

IV. Platforms and Antitrust Analysis[91]

In this final section, we explicitly explore what impact the presence of multi-sided platforms should play in antitrust analyses. There are questions about defining the relevant product market as well as conducting competitive effects analysis. How do platforms fit into the multi-step rule of reason framework? There are no easy answers. Rather, the answer, as is often the case, is that it depends.

Within this context, the Supreme Court was recently asked to decide on the appropriate antitrust framework to apply to markets involving platforms, including (1) whether each side of a platform constitutes a separate relevant product market for the purposes of antitrust analysis and (2) what evidence is required to satisfy a plaintiff’s prima facie burden under the rule of reason in the context of platforms.[92] Two primary schools of thought have developed around these questions. While each school appears to agree in principle upon the relevant economic considerations in evaluating the competitive effects of conduct in multisided platforms, there are critical differences between the two schools when it comes to how courts and agencies should structure and sequence their analysis.

The first school argues that platforms should be assessed in a manner similar to single-sided markets in that each side should, ultimately, be considered separately—which we can label as the “separate markets” approach.[93] Further, harm to a group of consumers on one side of a platform should be sufficient to dispel the plaintiff’s prima facie burden and, without more, establish an antitrust violation. We can label this as the “separate effects” approach, as it finds that any effect that makes a group worse off somewhere on a platform—for example, a price increase to merchants—is generally sufficient to show antitrust harm.[94] Thus, countervailing welfare gains for consumers on the other side of a platform would only be considered a “defense,” and defendants would bear the burden of proof to establish that resulting efficiencies outweigh harm to the first group.

In contrast, the second school of thought argues that platforms are inherently defined by the interrelationships between their various sides and thus, product market definitions should generally include all sides of a platform. Thus, courts and agencies must explicitly consider cross-group effects when defining markets.[95] We can label this as the “integrated market” approach. For instance, American Express would be considered a platform that operates in a single product market.[96] Given this integrated market definition, it follows that finding harm to one side of a platform is insufficient to meet the prima facie burden and a proper competitive effects analysis must jointly consider all sides of a platform—which we can label as the “integrated effects” approach. This approach does not simply treat the other side of a platform as a potential consideration for an efficiencies defense, capable of rebutting a showing of harm, but rather as a fundamental part of determining whether there is competitive harm of the type proscribed by the antitrust laws—that is, the acquisition or exercise of monopoly power—in the first place.

The stakes between the two schools of thought, as it relates to competitive effects and the prima facie burden, are high. Central to the issue of liability in rule-of-reason cases is the idea of “harm to competition.” It is well understood that harm to a specific group of consumers does not necessarily establish cognizable antitrust harm. For instance, price discrimination harms some groups of consumers but benefits others—yet, it is generally not the type of conduct that results in a restriction of market output and an increase in market price.[97] Another example would be an efficient merger that drives out a less-efficient rival. In this case, consumers who preferred the differentiated product of the rival would be worse-off—although consumers, as a whole, are better off.[98] Thus, it is not extraordinary that decisions in competitive markets harm some groups of consumers but benefit others. Indeed, product differentiation is a fundamental feature of competition. Consequently, the focus of antitrust laws is to condemn conduct that improperly creates or maintains monopoly power. It is, thus, critical to make a distinction between harm to a group of consumers and “competitive harm” or “anticompetitive effects” cognizable by the antitrust laws. This is particularly relevant for multisided markets where there are two or more distinct group of consumers.

Within this setting, the Supreme Court in Ohio v. American Express endorsed the integrated market and integrated effects approach—as it applies to transaction platforms. The Court writes, “[C]redit-card networks are best understood as supplying only one product—the transaction—that is jointly consumed by a cardholder and a merchant. Accordingly, the two-sided market for credit-card transactions should be analyzed as a whole.”[99] Thus, “[i]n two-sided transaction markets, only one market should be defined.”[100] Moreover, “[e]vidence of a price increase on one side of a two-sided transaction platform cannot, by itself, demonstrate an anticompetitive exercise of market power.”[101]

However, the Court did not fully address whether the principles underlying its analysis apply—and if so, to what extent—to what it describes as “non-transaction platforms.” This gap in the Court’s decision has not gone unnoticed, with observers offering speculations and conjectures as to the impact of the case on non-transaction platforms, such as Google and Facebook, in the future.[102] Various academic scholarship has begun to emerge on this question.[103]

The point of this discussion is to highlight the current legal and economic debates regarding the treatment of platforms in antitrust. In this context, it is clear that features of platforms, namely its role as an intermediary bringing different groups together, who themselves have very different incentives, can create real questions as to how to administer the rule of reason framework. Are benefits to one side an efficiency defense to harms to the other side or part of the initial assessment of antitrust harm? Further, can we, in certain matters, focus only on one side of a platform—such as on advertisers when the allegation is that platforms are using exclusive contracts in a manner that reduces competition and welfare? These are not easy questions. There are reasonable points made on both sides. Ultimately, what is needed, however, is to start from the premise that we must first understand the incentives that platforms face and go from there.

Conclusion

Network effects and platforms are integral to every discussion of digital markets. Economic scholarship has developed important insights into these intertwined topics and are increasingly becoming part of antitrust enforcement and court decisions. While there are benefits in attempting to classify platforms into specific categories, we ultimately find it is more important to treat each platform as a specific business that can operate under very different incentives compared to seemingly similar platforms.

Footnotes

* I thank Scalia Law student Timothy Swartz for excellent research assistance.

[1] There are various reasons to avoid using the term “two-sided markets” in the context of antitrust matters, including the fact that a platform can have more than two sides and the loose use of the word “markets.”

[2] This chapter is focused more on pedagogy and is not intended as a comprehensive, technical overview of the economics of network effects, platforms, and the related literature. Excellent summaries are available that serve such a purpose. See, e.g., Oz Shy, A Short Survey of Network Economics, 38 Rev. Indus. Org. 119 (2011); Marc Rysman, The Economics of Two-Sided Markets, 23 J. Econ. Persp. 125 (2009). See also Avi Goldfarb & Catherine Tucker, Digital Economics, 57 J. Econ. Literature 3 (2019). Additionally, for a treatment of network effects “in action,” see Christopher Yoo, Network Effects in Action, in The GAI Report on the Digital Economy (2020).

[3] Michael L. Katz & Carl Shapiro, Network Effects, Competition, and Compatibility, 75 Am. Econ. Rev. 424, 424 (1985). While our primary focus is on positive network effects, in the sense that a user’s utility increases with more users on the same network or standard, network effects can also be negative. See, e.g., Shy, supra note 2, at 119–20 (“Negative network effects are generated by congestion or interference, and also are the result of snobbism or vanity, in that a consumer loses the sense of belonging to an elite group when a product is adopted more widely.”).

[4] Some of the earliest economic literature on network effects began with models assessing potential equilibria in the telephone system. See Ronald Artle & Christian Averous, The Telephone System as a Public Good: Static and Dynamic Aspects, 4 Bell J. Econ. & Mgmt. Sci. 84 (1973); Jeffrey Rohlfs, A Theory of Interdependent Demand for a Communications Service, 5 Bell J. Econ. & Mgmt. Sci. 16 (1974).

[5] Alternatively, the value that consumers receive from using a networked product can be divided into what Liebowitz & Margolis call (a) the “autarky value,” which is the value of the product even if no one else uses the same product, and (b) the “synchronization value,” which is the additional value from being able to interact with others on the network. See S. J. Liebowitz & Stephen E. Margolis, Network Externalities (Effects), https://wwwpub.utdallas.edu/~liebowit/palgrave/network.html. This can be an important distinction because even a relatively “small” network can survive if the autarky value is sufficiently high and/or the synchronization value is sufficiently high even with a smaller network. To put a finer point on this, Liebowitz & Margolis note that “[a]s this article was being written, commentators are speculating on whether Apple computer will survive, since its network (base of users) is shrinking, some think, below a minimum acceptable level.” Id. As the subsequent growth and success of Apple affirms, an undue emphasis on the perceived level of network effects can lead to poor predictions.

[6] See Shy, supra note 2, at 121 (“Consumers’ sensitivity to the size of telecommunication networks can be explained as follows: The number of potential direct connections (or links) among n subscribers is given by L(n) = n(n − 1)/2. If, for example, the number of subscribers increases from 10 to 11, the number of possible connections increases by L(11) − L(10) = 55 − 45 = 10. Hence, the addition of the 11th subscriber makes 10 additional connections possible[.]”).

[7] See Hal Varian, Use and Abuse of Network Effects, in Towards a Just Society: Joseph Stiglitz and Twenty-First Century Economics 229, 230 (Martin Guzman ed., 2018).

[8] See, e.g., Paul Klemperer, Network Effects and Switching Costs (Mar. 2005) (manuscript at 2), https://www.nuff.ox.ac.uk/Economics/papers/2006/w6/New%20Palgrave.pdf, (“Indirect network effects arise if adoption is complementary because of its effect on a related market” (emphasis in original)).

[9] See, e.g., Jeffrey Church et al., Indirect Network Effects and Adoption Externalities, 7 Rev. Network Econ. 337, 339 (2008) (“Network externalities that arise in settings with indirect network effects have the same microfoundations, in part, as network externalities that rise in settings with direct network effects.”).

[10] In this context, “path dependence” describes a situation wherein “a minor or fleeting advantage or a seemingly inconsequential lead for some technology, product, or standard can have important and irreversible influences on the ultimate market allocation of resources, even in a world characterized by voluntary decisions and individually maximizing behavior.” S.J. Liebowitz & Stephen E. Margolis, Path Dependence, Lock-In, and History, 11 J.L. Econ. & Org. 205, 205 (1995).

[11] For some of the earlier and pioneering work on potential market inefficiencies from network effects, see, e.g., Joseph Farrell & Garth Saloner, Standardization, Compatibility, and Innovation, 16 RAND J. Econ. 70 (1985); W. Brian Arthur, Competing Technologies, Increasing Returns, and Lock-In by Historical Events, 99 Econ. J. 116, 127 (1989) (“But in the increasing returns case laissez-faire gives no guarantee that the ‘superior’ technology (in the long-run sense) will be the one that survives.”).

[12] See, e.g., Stan J. Liebowitz & Stephen E. Margolis, The Fable of the Keys, 30 J.L. & Econ. 1, 1 (1990) (“The economic literature on standards has focused recently on the possibility of market failure with respect to the choice of a standard. In its strongest form, the argument is essentially this: An established standard can persist over a challenger, even where all users prefer a world dominated by the challenger, if users are unable to coordinate their choices.”).

[13] In this context, “path dependence” describes a situation wherein “a minor or fleeting advantage or a seemingly inconsequential lead for some technology, product, or standard can have important and irreversible influences on the ultimate market allocation of resources, even in a world characterized by voluntary decisions and individually maximizing behavior.” S.J. Liebowitz & Stephen E. Margolis, Path Dependence, Lock-In, and History, 11 J.L. Econ. & Org. 205, 205 (1995).

[14] Economies of scale, a.k.a., increasing returns to scale, occur when the average total cost of production falls as output increases.

[15] This chapter uses the terms “social media” and “social networks” interchangeably.

[16] See Catherine Tucker, Online Advertising and Antitrust: Network Effects, Switching Costs, and Data as an Essential Facility, CPI Antitrust Chron. 2-3 (Apr. 2019) (“In the few forums where there are same-sided network effects, such as social media websites, my research suggests that these type of network effects are quite local. This means that they depend only on the user’s smaller friend-group and do not depend on the user base of the entire platform.”); Catherine Tucker, Network Stability, Network Externalities, and Technology Adoption, in 37 Entrepreneurship, Innovation, and Platforms: Advances in Strategic Management (2017). Although, it is important to acknowledge that increases in the sheer number of users—analogous to the income effect in economics—also bring more users into each subgroup.

[17] This point is acknowledged by the Stigler Comm. on Dig. Platforms, Stigler Ctr., Chicago Booth Sch. of Bus., Final Report 38 n.51 (2019) [hereinafter “Stigler Report”], https://research.chicagobooth.edu/-/media/research/stigler/pdfs/digital-platforms—committee-report—stigler-center.pdf (“To send a message to someone, a user only needs that single person to be on a particular messaging app, rather than everyone they would want to send a message to. This explains why many messaging apps can live alongside one another—WhatsApp, Snapchat, SMS, and Facebook Messenger all have significant customer bases.”).

[18] Fax machines have a long history, but it was the introduction of Xerox’s Magnafax Telecopier in 1966, which truly jumpstarted the technology. See Jonathan Coopersmith, Faxed: The Rise and Fall of the Fax Machine (2016). Its use first grew in scale and viability in newsrooms and the military, rather than as a mass market product. See, e.g., Keith Randall, The Rise and Fall of the Fax Machine, Texas A&M Today (Aug. 6, 2015), https://today.tamu.edu/2015/08/06/the-rise-and-fall-of-the-fax-machine. Even today, the fax machine is still frequently used in real estate firms, pharmacies, and the medical industry. See id.; Lloyd Minor, Why Your Doctor’s Office Still Depends on a Fax Machine, Wall St. J. (Sept. 19, 2019), https://blogs.wsj.com/experts/2019/09/19/why-your-doctors-office-still-depends-on-a-fax-machine.

[19] However, a platform’s competitive viability might not necessarily depend on replicating the size of the largest social network in the same market.

[20] See, e.g., Elizabeth Harper, Twitter 101: Understanding the Basics, Techlicious (May 17, 2013), https://www.techlicious.com/guide/twitter-101-understanding-the-basics (“Think of Twitter as a big, open room.”). An illustration of Twitter as a public forum is President Donald Trump’s use of the platform to reach 80+ million followers. See Donald J. Trump (@realDonaldTrump), https://twitter.com

/realdonaldtrump (visited June 30, 2020). It is indeed difficult, and costly, to replicate this type of reach through other social media sites and other channels of communication.

[21] Michael L. Katz & Carl Shapiro, Systems Competition and Network Effects, 8 J. Econ. Persp. 93, 106 (1994) (“Consumer heterogeneity and product differentiation tend to limit tipping and sustain multiple networks.”). See also Rysman, supra note 2, at 134 (“. . . if standards can differentiate from each other, they may be able to successfully coexist.”).

[22] For example, among users aged 12 to 17, Snapchat is the market leader with 16.4 million users, while Instagram and Facebook are second and third, at 12.8 million and 11.5 million, respectively. See, Facebook is Tops with Everyone but Teens, eMarketer (Aug. 28, 2018), https://www.emarketer.com/content/facebook-is-tops-with-everyone-but-teens. Even for broader age ranges, from ages 12–34, in just four years (from 2015 to 2019), Snapchat went from 15 percent of Facebook’s usage to virtually equal usage. See Social Habit 2019, Edison Research 26 (May 30, 2019), http://www.edisonresearch.com/wp-content/uploads/2019/05/The-Social-Habit-2019-from-Edison-Research.pdf.

[23] For instance, for mobile devices, studies consistently show the importance of camera quality in consumers’ purchasing decision. See, e.g., Kristina Sruoginis, Media Influence on Telecom Purchases 12, Interactive Advertising Bureau (Oct. 2017), https://www.iab.com/wp-content/uploads/2018/01/Digital-Influence-on-Telecom-Purchases.pdf; Michael Zhang, The Importance of Cameras in the Smartphone War, PetaPixel (Feb. 12, 2015), https://petapixel.com/2015/02/12/importance-cameras-smartphone-war.

[24] Rysman, supra note 2, at 134.

[25] Examples include console video game systems (PlayStation, Xbox, Nintendo Switch), mobile operating systems (Android, Apple), desktop operating systems (Windows, MacOS, Linux), web browsers (Chrome, Safari, Firefox, Brave), travel search engines (Expedia, TripAdvisor, Kayak, Skyscanner), matchmakers (Match.com, eHarmony, OkCupid, Catholic Match), credit cards (Visa, MasterCard, American Express, Discover), and ride sharing apps (Uber, Lyft, Wingz).

[26] For an extensive overview of switching costs, see Joseph Farrell & Paul Klemperer, Coordination and Lock-In: Competition with Switching Costs and Network Effects (May 2006) (unpublished manuscript), https://escholarship.org/uc/item/9n26k7v1.

[27] See, e.g., Attila Ambrus et al., Either or Both Competition: A “Two-Sided” Theory of Advertising with Overlapping Viewerships, 8 Am. Econ. J. 189, 190 (2016) (“[M]any contend that a distinguishing feature of online consumption is the users’ increased tendency to spread their attention across a wide array of outlets.”).

[28] Id. at 191 (“This implies in our model that outlets do not only care about the overall consumer demand level, as in existing models, but also about its composition, i.e., the fraction of exclusive versus overlapping consumers.” (emphasis in original)).

[29] See, e.g., Joseph Farrell & Garth Saloner, Standardization and Variety, 20 Econ. Letters 71, 71 (1986) (“. . . there can be multiple equilibria, and it is quite possible that one of them involves too much standardization.”); Angelique Augereau et al., Coordination Versus Differentiation in a Standards War: 56K Modems, 37 RAND J. Econ. 887, 888 (2006) (In discussing the 56K modem, the authors find that welfare would have been significantly improved if the various internet service providers (ISPs) had standardized on a single platform rather using multiple 56K modem platforms: “there was a benefit to coordinating ISPs and consumers on a single standard as quickly as possible, but market actors failed to quickly standardize.”); Chien-fu Chou & Oz Shy, Network Effects Without Network Externalities, 8 Int’l J. Indus. Org. 259, 270 (1990) (“More interestingly, it may happen that all consumers are worse off when the number of brands increases since it makes each brand supported by a small variety of services.”); Simon P. Anderson & Stephen Coate, Market Provision of Broadcasting: A Welfare Analysis, 72 Rev. Econ. Stud. 947, 965 (2005) (asking, in a theoretical examination of broadcast television markets: “What can be said about the normative implications of monopoly ownership? In contrast to standard markets, there is no presumption that monopoly ownership produces lower aggregate welfare.”).

[30] An example of these efficiencies is the continued importance of standard setting organizations (SSOs), which play a role in developing, supporting, and setting interoperability and performance standards for industries such as telecommunications, electronics, and the Internet. Fundamentally, SSOs are platforms that balance the interests of multiple groups, including those looking to implement technologies as well as those developing those technologies. See Joanna Tsai & Joshua D. Wright, Standard Setting, Intellectual Property Rights, and the Role of Antitrust in Regulating Incomplete Contracts, 80 Antitrust L.J. 157, 159–162 (2015). See also infra Section II.C.

[31] Work by Liebowitz & Margolis questions whether standardization results in inferior outcomes, as some believed was true for the QWERTY keyboard and Sony’s Betamax standard for analog video cassettes. See Liebowitz & Margolis, supra note 12 (discussing the QWERTY keyboard); Stan J. Liebowitz & Stephen E. Margolis, Winners, Losers & Microsoft: Competition and Antitrust in High Technology 240 (1999) (“[M]arket failure ought to be a very specific and very worldly claim. Policymakers shouldn’t go about correcting markets until they have concrete proof that markets have failed. The abstract possibility of market failure is an inadequate basis for the making of real-world policy.”).

[32] See, e.g., Michael L. Katz & Howard A. Shelanski, Mergers and Innovation, 74 Antitrust L.J. 1, 16–27 (2007).

[33] Cf. Sarit Markovich, Snowball: A Dynamic Oligopoly Model with Indirect Network Effects, 32 J. Econ. Dynamics & Control 909, 912 (2008) (“Standardization, however, is not necessarily bad for consumers. The high speed of innovation leading to standardization provides fast, quality growth within the industry as well as in related industries that produce substitute goods. Moreover, whenever we see standardization, there are incentives for more than one software firm to produce for the winning platform.”).

[34] Davis S. Evans & Richard Schmalensee, The Antitrust Analysis of Multi-Sided Platform Businesses 7 (Nat’l Bureau of Econ. Research, Working Paper No. 18783, 2013), https://www.nber.org/papers/w18783.pdf.

[35] Andrei Hagiu & Julian Wright, Multi-Sided Platforms, 43 Int’l J. Indus. Org. 162, 163 (2015).

[36] In many respects, this echoes the seminal work of Professor Ronald Coase on central question of what constitutes a “firm” and its boundaries in relation to the larger market. See Ronald H. Coase, The Nature of the Firm, 4 Economica 386 (1937). See also Oliver E. Williamson, The Vertical Integration of Production: Market Failure Considerations, 61 Am. Econ. Rev. 112 (1971); Oliver E. Williamson, Transaction-Cost Economics: The Governance of Contractual Relations, 22 J.L. & Econ. 233 (1979).

[37] Hagiu & Wright, supra note 35, at 163.

[38] The idea is that, as there are more consumers at a retailer, then this creates a greater incentive for manufacturers to offer their products to a given retailer, such as Walmart—even though the manufacturers do not directly sell to consumers.

[39] See Jean-Charles Rochet & Jean Tirole, Platform Competition in Two-Sided Markets, 1 J. Eur. Econ. Ass’n 990 (2003); Jean-Charles Rochet & Jean Tirole, Two-Sided Markets: A Progress Report, 37 RAND J. Econ. 645 (2006). See also Mark Armstrong, Competition in Two-Sided Markets, 37 RAND J. Econ. 668 (2006). One of the earliest works on the importance of the structure of prices for “gatekeepers,” however, is Michael R. Baye & John Morgan, Information Gatekeepers on the Internet and the Competitiveness of Homogeneous Product Markets, 91 Am. Econ. Rev. 454 (2001).

[40] Rochet & Tirole, Platform Competition, supra note 39, at 1018.

[41] Rochet & Tirole, Progress Report, supra note 39, at 645.

[42] See, e.g., Attila Ambrus & Rossella Argenziano, Asymmetric Networks in Two-Sided Markets, 1 Am. Econ. J.: Microeconomics 17, 18 (2009) (“The cheap side of a network, which can even be subsidized and therefore generate loss, is used to create a large enough consumer base that makes it attractive for consumers on the other side of the market to join the network.”).

[43] Further, this balance between single-sided and multi-sided aspects of Amazon’s business has changed over time. In 1999, 3% of Amazon sales were from 3rd party sellers; in 2018, it was 58%. See Adam Levy, Amazon’s Third-Party Sales Are Exploding, Motley Fool (Apr. 13, 2019, 9:17 AM), https://www.fool.com/investing/2019/04/13/amazons-third-party-sales-are-exploding.aspx.

[44] See Abel Brodeur & Kerry Nield, An Empirical Analysis of Taxi, Lyft and Uber Rides: Evidence from Weather Shocks in NYC, 152 J. Econ. Behavior & Org. 1, 2 (2018) (“. . . we use data for all trips taken in NYC taxi cabs before (January 2010–April 2011) and after (2014–2016) Uber and Lyft’s rise in popularity, and show that the number of taxi rides per hour decreased by approximately 25% after Uber entered the New York market in May 2011.”); see also id. at 14 (“[T]he results are consistent with a substitution from taxi rides to Uber and Lyft rides . . .”).

[45] This is not to say they are in the same antitrust relevant market, which is a specific legal and economic construct based on narrowing the field of analysis to capture the most important and relevant competitive interactions that explain the conduct in question.

[46] See Christina Bonnington, Apple’s Profit Machine, Slate (Feb. 01, 2018, 5:52 AM), https://slate.com/technology/2018/02/apples-app-store-is-becoming-a-major-revenue-source-for-apple.html.

[47] Kamil Franek, How Google Makes Money from Android: Business Model Explained, Kamil Franek Bus. Analytics (Jan. 14, 2020), https://www.kamilfranek.com/how-google-makes-money-from-android.

[48] David S. Evans, The Antitrust Economics of Multi-Sided Platform Markets, 20 Yale J. on Reg. 320, 334–35 (2003).

[49] Id. at 334.

[50] Id. at 335.

[51] Id.

[52] Lapo Filistrucchi et al., Market Definition in Two-Sided Markets: Theory and Practice, 10 J. Competition L. & Econ. 293, 297–300(2014).

[53] Ohio v. Am. Express Co., 138 S. Ct. 2274, 2286–87 (2018).

[54] Filistrucchi et al., supra note 52, at 298.

[55] Id.

[56] See, e.g., U.S. Dep’t Of Justice & Fed. Trade Comm’n, Antitrust Enforcement and Intellectual Property Rights: Promoting Innovation and Competition 33 n.1 (2007), http://www.ftc.

gov/reports/innovation/P040101PromotingInnovationandCompetitionrpt0704.pdf (citing Gregory Tassey, Standardization in Technology-Based Markets, 29 Res. Pol’y 587, 589–90 (2000)).

[57] See, for example, Standard Settings Organizations and Standards List, ConsortiumInfo.org, http://www.consortiuminfo.org/links/ (last visited Jul. 27, 2020), for a list of SSOs and standards in a variety of fields. Some prominent examples are the Institute of Electrical and Electronics Engineers (IEEE), which develops standards for telecommunications, information technology, and power generation; the European Telecommunications Standards Institute (ETSI); and the American National Standards Institute (ANSI).

[58] The terms “innovators” and “implementers” are simply shorthand to highlight the different natures of the two sides that are attracted to an SSO. It is not to suggest that those who seek to have their intellectual property become standardized are not also implementers in other contexts—nor that those who seek to implement the standard are not innovators in their own right.

[59] Innovators are interested in protecting their intellectual property rights, having their technology widely adopted, and receiving a sufficient return on their investment. Implementers are interested in access to the latest technology, assurance that an adopted technology will be widely implemented (and thus avoiding lock-in with the wrong technology—colloquially, “betting on the wrong horse”), and paying reasonable royalties. SSOs implement policies to balance these interests as they seek to increase the size of both groups.

[60] The observability of an ad interaction is a technological limitation. For instance, cameras conceivably could follow the eyes of a user and reliably determine whether an ad has been viewed on a website.

[61] The same could be said for stock exchanges such as the Nasdaq and NYSE.

[62] Evans, supra note 48, at 335.

[63] Filistrucchi et al., supra note 52, at 298–99.

[64] See, e.g., Codrut Neagu, 8 Ways in Which Microsoft Makes Money From Windows 10, Digital Citizen (Jun. 20, 2019), https://www.digitalcitizen.life/how-microsoft-makes-money-windows-10.

[65] Filistrucchi et al., supra note 52, at 298 n 12.

[66] Evans, supra note 48, at 335.

[67] This is the case in Ohio v. American Express, where the Court categorized credit cards as a transaction platform. See 138 S. Ct. at 2279–90. The plethora of commentary on the case, from both sides of the debate, all place the transaction versus non-transaction distinction at the forefront of the discussion. See, e.g., Michael L. Katz, Ohio v. American Express: Assessing the Threat to Antitrust Enforcement, CPI Antitrust Chron. (Jun. 2020, at 11); Joshua D. Wright & John M. Yun, Ohio v. American Express: Implications for Non-Transaction Multisided Platforms, CPI Antitrust Chron. (Jun. 2019, at 29).

[68] For a more in-depth discussion of the differing network effects between Facebook and Google Search, see John M. Yun, Does Antitrust Have Digital Blind Spots?, 72 S.C. L. Rev. (forthcoming 2020).

[69] See, e.g., Gunnar Niels, Transaction Versus Non-Transaction Platforms: A False Dichotomy in Two-Sided Market Definition, 15 J. Competition L. & Econ. 327, 330 (2019) (“The notion that both sides matter for market definition is correct, but is unduly restricted to transaction platforms. Both sides matter for market definition for non-transaction platforms as well.”).

[70] This section builds on John M. Yun, Characteristics of “Zero Price” Markets, The Price Point, ABA Antitrust Section Price Conduct Committee (forthcoming 2020).

[71] See, e.g., Stigler Report, supra note 17, at 61 (“Facebook, Google, and, increasingly, Amazon act as gatekeepers to the online advertising market.”); Austl. Competition & Consumer Comm’n, Digital Platforms Inquiry, Final Report 1 (2019), https://www.accc.gov.au/system/files/Digital%20platforms%20inquiry%20-%20final%20report.pdf (“The ubiquity of the Google and Facebook platforms has placed them in a privileged position. They act as gateways to reaching Australian consumers . . .”); [UK] Dig. Competition Expert Panel, Unlocking Digital Competition 28 (2019), https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/785547/unlocking_digital_competition_furman_review_web.pdf [hereinafter “Furman Report”] (“This dominance in digital advertising revenues is linked to the dominance of these two companies in the attention market. In the UK, internet users spend over a third of their time online on sites owned by Google and Facebook.”).

[72] See, e.g., Furman Report, supra note 71, at 22 (“For services funded through advertising, consumers will pay through provision of their data—which has value to advertisers and developers of new services.”).

[73] Of course, data could also be sold to third parties for revenue, which would move data closer to a “price” for platform access.

[74] For example, YouTube’s recommendations, Facebook’s News Feeds, and Spotify’s Discover Weekly are features intended to tailor to specific users’ tastes.

[75] For more on the welfare consequences of the use of data on consumer welfare in the context of online platforms, see, for example, Michael R. Baye & David E.M. Sappington, Revealing Transactions Data to Third Parties: Implications of Privacy Regimes for Welfare in Online Markets, 29 J. Econ. Mgmt. Strategy 260 (2020).

[76] See, e.g., Alessandro Acquisti et al., The Economics of Privacy, 54 J. Econ. Literature 442, 444–48 (2016).

[77] Inevitably, there will be a distribution of users where some are completely repelled by ads while others are more open to them.

[78] A shadow price is the true opportunity cost of an activity—particularly where there is no explicit market price. See, e.g., David A. Starrett, Shadow Pricing in Economics, 3 Ecosystems 16, 16 (2000).

[79] Platforms conceivably could also use data about users gathered outside of the platform. This would be the case for platforms that buy or collect third-party data. The welfare implications of this practice would seem strongly linked to the level of data aggregation, user control or consent, and disclosure policies.

[80] For an examination of the welfare effects of opt-in or opt-out policies, see, e.g., Baye & Sappington, supra note 75, at 268–69; James Campbell et al., Privacy Regulation and Market Structure, 24 J. Econ. Mgmt. Strategy 47, 67–68 (2015); Jian Jia et al., The Short-Run Effects of GDPR on Technology Venture Investment (manuscript at 8–23) (May 22, 2020), https://ssrn.com/abstract=3278912.

[81] See David S. Evans, The Economics of Attention Markets 2 (Apr. 15, 2020) (unpublished manuscript), https://ssrn.com/abstract=3044858, (“In 2019, Americans adults will spend 514 billion hours during which they will engage mainly with content interspersed with ads compared to 325 billion hours working.”).

[82] See David S. Evans, Attention Rivalry Among Online Platforms, 9 J. Competition L. & Econ. 313, 330–38 (2013). See also Tim Wu, The Attention Merchants: The Epic Scramble to Get Inside Our Heads (2016) (discussing the longstanding competition among firms for consumer attention).

[83] Before the rise of the Internet and associated services, broadcast television was the primary ad-supported platform through which households engaged in leisure. See Kevin M. Murphy & Ignacio Palacios-Huerta, A Theory of Bundling Advertisements in Media Markets 2–4 (Nat’l Bureau of Econ. Research, Working Paper No. 22994, 2016), https://www.nber.org/papers/w22994.pdf.

[84] See Evans, supra note 82, at 319 (Table 1). Relatedly, Evans shows that time spent on discrete website categories has changed as well. See id. at 325 (Table 4).

[85] Andre Boik et al., The Empirical Economics of Online Attention 3 (Nat’l Bureau of Econ. Research, Working Paper No. 22427, 2016), https://www.nber.org/papers/w22427.pdf. See also id. at 4 (“Reallocation of online attention comes almost entirely in the form of changes in how households select from a portfolio of different web sites, but not in the form of changes in total time or breadth and depth.”).

[86] Id. at 31.

[87] For instance, when Google shutdown its Google+ social network, Google detailed that Google+ “has low usage and engagement: 90 percent of Google+ user sessions are less than five seconds.” See Ben Smith, Project Strobe: Protecting your data, improving our third-party APIs, and sunsetting consumer Google+, Google Blog (Oct. 8, 2018), https://www.blog.google/technology/safety-security/project-strobe.

[88] We use “contestable” in the sense that firms must still compete for consumers’ attention even if a market is concentrated. We are not invoking a particular competitive model that assumes zero barriers to entry and exit. See William J. Baumol et al., Contestable Markets and the Theory of Industry Structure (1982).

[89] See Bureau of Consumer Financial Protection, The Consumer Credit Card Market 35 (2019), https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2019.pdf (Figure 7).

[90] For more on the competitive interactions between credit card networks, see, e.g., Todd J. Zywicki, The Economics of Credit Cards, 3 Chap. L. Rev. 79, 110–45 (2000); Curtis R. Taylor, Supplier Surfing: Competition and Consumer Behavior in Subscription Markets, 34 RAND J. Econ. 223, 223–26 (2003); Benjamin Klein et al., Competition in Two-Sided Markets: The Antitrust Economics of Payment Card Interchange Fees, 73 Antitrust L.J. 571, 571–614 (2006).

[91] This section includes excerpts from Wright & Yun, supra note 67.

[92] Am. Express Co., 138 S. Ct. at 2285–90.

[93] See, e.g., Michael Katz & Jonathan Sallet, Multisided Platforms and Antitrust Enforcement, 127 Yale L.J. 2142, 2161–69 (2018); Brief for John M. Conner et al. as Amici Curiae Supporting Petitioners at 5–12, Ohio v. Am. Express Co., 138 S. Ct. 2274 (2018) (No. 16-1454); Brief of 28 Professors of Antitrust Law as Amici Curiae Supporting Petitioners at 17–34, Ohio v. Am. Express Co., 138 S. Ct. 2274 (2018) (No. 16-1454). There is a general recognition, however, that cross-group effects must still be considered, to some degree, even if separate markets are defined. See, e.g., Katz & Sallet at 2150–51, 2157–60. For a detailed overview of the two schools of thought, see Joshua D. Wright & John M. Yun, Burdens and Balancing in Multisided Markets: The First Principles Approach of Ohio v. American Express, 54 Rev. Indus. Org. 717 (2019).

[94] Cf. Brief of 28 Professors, supra note 93, at 14.

[95] See, e.g., James D. Ratliff & Daniel L. Rubinfeld, Is There a Market for Organic Search Engine Results and Can Their Manipulation Give Rise to Antitrust Liability?, 10 J. Competition L. & Econ. 517, 534–38 (2014); Patrick R. Ward, Testing for Multisided Platform Effects in Antitrust Market Definition, 84 U. Chi. L. Rev. 2059 (2017); Brief for Amici Curiae Prof. David S. Evans & Prof. Richard Schmalensee in Support of Respondents at 8–27, Ohio v. Am. Express Co. (2018) (No. 16-1454); Brief for Amici Curiae J. Gregory Sidak & Robert D. Willig in Support of Respondents at 14–21, Ohio v. Am. Express Co. (2018) (No. 16-1454).

[96] See Brief for Amici Curiae Sidak & Willig, supra note 95, at 14–21.

[97] See Benjamin Klein, Market Power in Aftermarkets, 17 Managerial & Decision Econ. 143, 155 (1996) (“[M]arket power is not necessary for a firm to successfully engage in discriminatory pricing. All that is necessary is that the firm face a negatively sloped demand for its products, as all firms selling unique products do. Although such a negatively sloped demand and ability to price discriminate would not exist under the assumptions of perfect competition, it must be distinguished from the negatively sloped demand and ability to price discriminate that is present because a firm possesses a large share of the market.”).

[98] See Ken Heyer, Welfare Standards and Merger Analysis: Why Not the Best?, 8 Competition Pol’y Int’l 146, 155 (2012).

[99] Am. Express Co., 138 S. Ct. at 2278.

[100] Id. at 2287 (citing to Filistrucchi et al., supra note 52, at 302).

[101] Id. at 2278.

[102] See, e.g., Washington Bytes, Will the Supreme Court’s Amex Decision Shield Dominant Tech Platforms from Antitrust Scrutiny?, Forbes (Jul. 18, 2018), https://www.forbes.com/sites/washingtonbytes/2018/07/18/antitrust-enforcement-of-dominant-tech-platforms-in-the-post-american-express-world (panel discussion between Hal Singer, Michael Kades, Randy Picker, & Chris Sagers).

[103] See, e.g., Herbert Hovenkamp, Platforms and the Rule of Reason: The American Express Case, 2019 Colum. Bus. L. Rev. 35 (2019) (dubbing the American Express decision an “economic misfire”); David S. Evans & Richard Schmalensee, Antitrust Analysis of Platform Markets: Why the Supreme Court Got It Right in American Express 67–80 (2019) (discussing Times-Picayune Publ’g Co. v. United States, 345 U.S. 594 (1953), as an example of a non-transaction platform); Wright & Yun, supra note 67 (arguing that the Court’s distinction does not prohibit the use of the Court’s logic to non-transaction platforms); Niels, supra note 69 (arguing that the distinction does not matter for market definition purposes).