Introduction

We are living in a time of rapid and exciting technological innovation. That innovation has driven economic growth, job creation, productivity, and human progress around the world. Significant levels of investment and entrepreneurship have fueled innovation across a growing and vibrant digital economy, and increasingly that innovation is encroaching on traditional economies as well. Entrepreneurs within well-established firms and fledgling startups compete intensely to introduce new business models and to develop better products and services that bring important benefits to consumers, workers, and businesses. Many of these innovations have become part of everyday life, and at times can easily be taken for granted, but their impact on our lives is no less clear and the ecosystem that enables their creation no less critical to preserve.

E-commerce marketplaces have created new opportunities for buyers and sellers to transact and have given local businesses broader reach. Social media platforms have allowed individuals to interact and distribute information more easily. The sharing economy has disrupted stagnant old industries to bring better and more affordable services to consumers while creating new means for individuals to generate income. Telecommunications equipment manufacturers have developed new products that make home- and work-life more productive and enjoyable in ways unimaginable two decades ago. Online advertising technology has allowed businesses to better target their ad dollars while funding a suite of free services such as email, online mapping tools, messaging apps, online search engines, and video sharing. Video streaming services have added new avenues for developing and distributing content to consumers. And this innovation continues as areas such as artificial intelligence and machine learning—once thought distant futures—become mainstream parts of innovation programs and likely core features of the next wave of products and services.[1]

But the innovation that has created and grown the digital economy has not taken place equally across all parts of the globe. The unequivocal global leader in innovation is the United States. The United States is where most of the world’s leading innovators have taken root and grown to prominence. It also is where the next wave of innovators are laying the foundations to be future disrupters and industry leaders. By contrast, Europe has struggled to develop a successful innovation culture and to promote the types of technological changes that ultimately have a widespread and positive impact on society. Put plainly, Europe is at an innovation deficit.[2] The reasons for this disparity no doubt are complex. Creating a climate for innovation requires the right combination of several factors, including an effective business environment that promotes entrepreneurship and risk-taking, a balanced regulatory environment that promotes competition and trade, and a strong public sector influence that fosters public-private partnerships and targeted innovation objectives.[3] Across a variety of measurements, the United States appears to have been more successful to date in developing these characteristics to create an ecosystem that more effectively promotes innovation than have its counterparts across the Atlantic Ocean.

But America’s innovation successes and, in particular, the meteoric growth of the most successful U.S. tech companies, have not come without detractors. The success of U.S. tech companies both at home and abroad has brought increased criticism and scrutiny by lawmakers and regulators.[4] Concerns about perceived increases in industry concentration, alleged systematic strategies to acquire nascent rivals to forestall future competition, and supposed rampant exclusionary and predatory conduct by dominant firms have all forced a reexamination of the U.S. antitrust laws and raised questions about whether the ineffectiveness of those laws has allowed companies to stifle competition and innovation and harmed society overall.[5] As a result, policymakers are grappling with difficult questions about how to promote competition and innovation in the modern economy.

It is of course appropriate to take stock of laws to ensure they are achieving their intended goals and to implement reforms where they are not. But how best to structure these rules to prohibit anticompetitive conduct while permitting procompetitive conduct has inherent tradeoffs.[6] As the evidence of widespread competitive harm is debated and proposals to reform the U.S. antitrust laws are considered, policymakers should not lose sight of the positive developments that have arisen under the current innovation culture and inadvertently undermine a system that is the envy of the world.

That is not to say that the U.S. system is perfect—far from it. There are legitimate complaints that the U.S. system lacks focus and is innovating in the wrong areas, and thus is squandering an opportunity to harness its capabilities to bring about a technological revolution that is commensurate with its potential.[7] But in improving the innovation focus of the United States, it would be counterproductive to undermine the very features that have made it successful and give it future promise.

The U.S. system today excels at allowing startups to find capital to support budding ideas that may become the next great technology. It endorses large firms that have run the gauntlet of competition with success, reinvesting their earnings and expanding the markets in which they compete. It cherishes the rule of law and promises well-defined antitrust laws that protect against conduct that is anticompetitive while allowing procompetitive conduct to flourish. It is this vigorous competition—promoted by the antitrust laws—that has led entrepreneurs to develop new ideas, business models, and has motivated capital to take risks on them.

But the pressure to remake the U.S. antitrust laws is significant and has led to reform proposals that go well beyond merely increasing antitrust agency resources and encouraging greater enforcement on the margin. They entail significant changes to our modern antitrust framework. Some have called for making it more difficult for large companies to acquire startups.[8] Others have sought to shift the burden of proof to defendants so that the government can more easily prevail in antitrust challenges in court.[9] Still others are keen to force successful companies to share the key physical and digital infrastructures they have developed through their own hard work and determination in order to help rivals compete.[10] Maybe most dramatically, some have proposed doing away with focusing antitrust on consumer welfare—the lodestar of the U.S. antitrust laws—in order to use antitrust enforcement to achieve broader policy goals.[11]

These proposals seem intent on recasting antitrust law in the image of European competition policy, which places far less faith in the market and far more control in the hands of regulators. While the regulatory environment is but one component of a complex system that promotes innovation, suddenly altering a legal framework developed deliberately over decades through case-by-case experience by enacting dramatic reforms presents a significant risk of undermining a system that has outperformed its counterparts around the world and dampening the incentive to invest, innovate, and compete.

This chapter explores investment, entrepreneurship, and innovation in the United States and Europe and takes stock of the two regions’ relative performance in encouraging technological change. Although there is no single perfect metric for measuring success in innovation, there are several qualitive and quantitative measures through which we can assess how countries compare in fostering a culture that promotes the improvement or development of products and services. That evidence suggests that, at least for now, the United States has a far healthier innovation culture than Europe. This chapter discusses some of the specific criticisms that assert that innovation has declined in the United States as compared to Europe in part because of ineffective competition policy in America and explores some of the potential implications that could arise from adopting certain antitrust reform proposals. In the end, the fact that the United States continues to be the world’s innovation hub warns against implementing sweeping and radical changes to antitrust and broader regulatory policy that might undermine a culture that fosters competition, innovation, and economic growth.[12]

Comparing Innovation in the United States and Europe

The United States has shown that an economy that is free from unnecessary regulation, while at the same time protecting against anticompetitive conduct through a well-defined system of antitrust rules, creates an ecosystem ripe for prosperity, dynamism, risk-taking, and innovation. Although the United States and Europe have economies of roughly the same size, the data show that across a range of metrics, the United States has outperformed its counterparts in Europe in promoting innovation. A successful innovation environment is the result of numerous cultural and policy factors—such as education systems, immigration policy, regulatory environment, attitudes to risk-taking and personal achievement, and access to managerial talent—many of which are difficult to measure. Nevertheless, there are several qualitative and quantitative metrics that suggest the United States has fostered an environment that is far superior to Europe’s in promoting innovation.

The United States is home to the most innovative companies that span numerous industries. This includes the most successful global tech firms at the forefront of technological change. These companies consistently outspend their European counterparts on research and development, a key indicator of product improvement and development. The United States also has greater and faster GDP growth than Europe. Although not a perfect metric, it gives some sense of the contributions that innovative firms have brought to the U.S. economy over time.[13] The United States also has fostered a healthy and growing venture capital industry that has provided critical funding to enable startup creation. While many startups inevitably fail, some ultimately gain traction and develop into the next major product or technology that improves people’s lives. It is no surprise then that the United States is also home to the most so-called “unicorn” firms—private companies valued at $1 billion or more—that represent the next generation of innovators.

These metrics show that the United States offers a superior atmosphere when it comes to fostering innovation and entrepreneurship, allowing them to grow and prosper into successful vehicles of societal change. It follows that the United States should not then seek simply to emulate Europe by adopting competition and other regulatory policies that could cripple the current U.S. innovation system.

A. The United States is Home to the Most Innovative Companies

Economies grow when their entrepreneurs take risks and build businesses that innovate and thrive. Numerous organizations attempt to quantify and rank companies based on their level of innovation. The reports consistently show that American companies dominate the ranks of the most innovative companies in the world and far outpace European counterparts who regularly have fewer companies listed, and are almost always in lower ranks. One of the most respected studies is prepared annually by Boston Consulting Group (BCG). In 2020, BCG identified the 50 most innovative companies in the world based on an extensive survey of global innovation executives.[14] BCG assessed companies’ performance in innovation based on how they are perceived by peers both globally and within their particular industry, their ability to break into new industries and compete in a variety of markets, and the value they were able to create for their shareholders.[15]

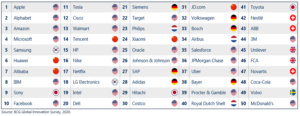

Figure 1 presents the 2020 rankings and shows that American companies dominate the top spots, comprising 14 of the top 20 companies (70 percent). Within the top 20, the only other countries represented are all in Asia, meaning that Europe does not contribute a single company to the top tier of the list. The top-rated firms primarily, although not exclusively, are tech firms. Indeed, the top five companies include four U.S. tech firms: Apple, Alphabet (Google), Amazon, and Microsoft. The list also includes companies from more traditional sectors, such as Walmart, which has invested significantly in e-commerce to challenge the likes of Amazon, Shopify, and other online retail firms.[16] Overall, U.S. companies represent 25 of the top 50 companies (50 percent). Only 14 of the top 50 companies (28 percent) are European-based, and they enter the ranks at 21. None of these companies fall within what generally is considered the tech sector, but rather represent industries such as automobile manufacturing, retail, pharmaceuticals, and consumer goods.

Figure 1 – BCG’s Most Innovative Companies, 2020

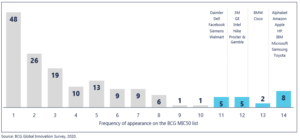

What is equally remarkable is the frequency with which some of these firms have appeared on BCG’s most innovative companies list. As shown in Figure 2, over the last 14 years, 162 companies have appeared on the BCG list.[17] Of those, 48 companies (nearly 30 percent) have appeared only once on the list and only 93 companies (57 percent) have appeared three times or fewer. On the other end, 20 companies (12 percent) have appeared on the list 11 or more times and only eight companies—Alphabet (Google), Amazon, Apple, Hewlett Packard, IBM, Microsoft, Samsung, and Toyota—have been ranked every year. These numbers show that being a serial innovator that can continuously focus resources and attention on developing new and better products and services is incredibly difficult. It is notable then that U.S. firms are the ones that have been best able to achieve repeat honors as leading innovators, representing 15 of the 20 companies (75 percent) that have appeared on the most innovative companies list 11 or more times.

Figure 2 – Number of Appearances by Companies on BCG Innovative Companies List

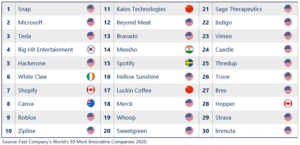

Like BCG, the business magazine Fast Company has evaluated businesses since 2008 to determine the most innovative companies in the world. In 2020, the publication assessed thousands of companies across 44 sectors in every region of the world.[18] Fast Company judged each company according to its prior year’s performance across a combination of innovation and impact factors.[19] The companies that were selected are the ones that make the most profound impact on industry and culture. More so than BCG, Fast Company’s list is heavily represented by smaller startups that have developed creative new business models and product ideas. But, just as is the case with BCG’s most innovative companies list, the companies chosen by Fast Company overwhelmingly are based in the United States. As shown in Figure 3, American companies represent six of the top 10 (60 percent) and 21 of the 30 most innovative companies (70 percent).[20] A trifecta of American companies—Snap, Microsoft, and Tesla—top the list due to the significant impact they have made through their innovations in social media, workspace messaging and video platforms, and electric vehicle development. Asian companies see the second highest representation in the top 30, with four companies making the list. Europe is represented only twice, demonstrating again the United States’ relative success in innovation.

Figure 3 – Fast Company’s Most Innovative Companies, 2020

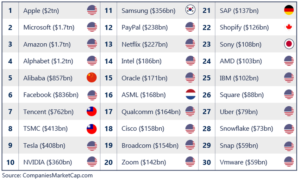

Not only have American firms regularly topped the charts of private organizations’ rankings of the most innovative companies in the world, but they also dominate the list of most valuable publicly traded tech companies by market capitalization. As shown in Figure 3, the top 10 tech companies had a combined market value of $10.2 trillion. Seven of those companies are based in the United States (70 percent), with the remaining three located in Asia (30 percent).[21] None of the top 10 companies are European. Out of the top 30 tech firms by market capitalization, American companies are represented an astonishing 22 times (73 percent). The remaining companies come from Asia (Alibaba, Tencent, TSMC, Samsung, and Sony), Europe (ASML and SAP), and Canada (Shopify). American firms therefore are not only considered the most innovative by peers and business journals, but also lead the world in terms of the value their investments in technology have brought shareholders.

Figure 4 – Largest Tech Companies by Market Capitalization, 2020

B. The United States Has Outperformed Europe in GDP Growth

A primary measure of economic growth is gross domestic product (GDP), which measures changes in national production. GDP provides yet another metric by which to measure the relative success of the United States’ and Europe’s innovation cultures over the long run.[22] Innovation generates economic growth by introducing new technologies and products that expand welfare.[23] Innovation also generates economic growth by increasing productivity and making it easier and cheaper to achieve the same goals with fewer resources.[24] There are, to be sure, some challenges with using GDP to measure innovation. For example, GDP does not capture value created outside of the marketplace (e.g., increased leisure time) and imperfectly captures product quality improvements.[25] GDP also largely ignores the value created by “free” products that have become so pervasive in the digital economy, such social media apps, email services, search engines, and mapping and navigation tools.[26] Indeed, one peer-reviewed study published by the National Academy of Sciences found that consumers would need to receive a yearly payment of $3,600 to give up free internet maps, $8,400 to give up free email, and $17,500 to give up free search engines.[27] As a result, GDP does not capture the full range of consumer surplus created by technological innovation. But these deficiencies do not undermine its use in corroborating other evidence that points similarly to strong innovation successes, particularly when GDP is viewed over a long horizon where technological benefits can come to light fully.

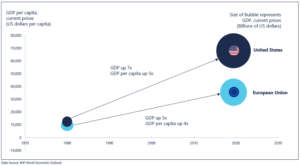

A comparison of the GDP of the United States and the European Union between 1980 and 2018 shows that the United States’ GDP has grown more rapidly than that of the European Union. According to IMF data, the European Union had a GDP of $3.2 trillion in 1980 and a GDP per capita of $8,540.[28] The European Union grew to a GDP of approximately $14.9 trillion and a GDP per capita of approximately $33,560 in 2018.[29] This represents an increase of five times in the European Union’s GDP and four times in the European Union’s GDP per capita from 1980 to 2018. By comparison, the IMF data shows that the United States had a GDP in 1980 of $2.9 trillion and a GDP per capita of $12,550.[30] The United States grew to a GDP of approximately $20.8 trillion and GPD per capita of approximately $63,050 in 2018.[31] This represents an increase of seven times in the United States’ GDP and five times in the United States’ GDP per capita from 1980 to 2018.

The more rapid GDP growth in the United States as compared to Europe has no doubt been caused, at least in part, by the greater focus on investment, innovation, and entrepreneurship in the United States. The world’s most successful innovators—located predominantly in the United States—have helped to fuel this economic growth by investing to discover new technologies, inventing new business models, developing new products and services, and creating entirely new markets. As entrepreneurs took risk and their businesses thrived, so too did the economy, including through the creation of new markets and job opportunities, greater access to markets by small businesses, and enhanced productivity and efficiency through the use of technological changes.

Figure 5 – US vs EU GDP & GDP Growth Per Capita (1980 – 2018)

According to the Bureau of Economic Analysis, the U.S. digital economy accounted for 6.9 percent of GDP in 2017, growing at an annual rate of 9.9 percent since 1998, as compared to 2.3 percent for the economy overall.[32] Technological change also has been an important source of job creation in the United States that has fueled GDP growth. According to one estimate, nearly 12 million people held tech jobs in the United States in 2018.[33] In just under two decades, Amazon, Apple, Facebook, Alphabet (Google), and Microsoft have employed more than one million workers.[34] In 2016, Amazon became the fastest company to employ 300,000 Americans—surpassing Walmart and General Motors.[35] Innovation also has created new markets that have further added to job growth. The app economy—a more than $1 trillion global industry—has created millions of U.S. jobs since Apple’s iPhone launched in 2007. According to one estimate, the U.S. had more than two million app-related jobs as of April 2019.[36] Small businesses also have benefited from innovation by using tech platforms to more affordably reach customers in new markets globally. This business growth and job creation has been enabled by the innovation climate in the United States and contributes to its stronger GDP growth.

C. The United States Leads Europe in Research & Development Spending

A key indicator of a vibrant economy that is characterized by vigorous competition and intense innovation is high levels of spending on research and development. Research and development fuels economic growth, job creation, and competition by allowing researchers and entrepreneurs to discover new technologies, design new products, tap new markets, and improve efficiency and enhance performance. Critics of U.S. competition policy have argued that today’s largest firms have become so large that they are untouchable by competition from current or future rivals and, as a result, have lost the incentive to innovate that once may have been part of their core identity as scrappy upstarts but that has since faded as they rest on their laurels, happy in their dominant positions.[37] They further argue that dominant firms snuff out would-be entrants that otherwise would be devoting capital to research and development initiatives to build competing offerings for consumers.[38] These critics allege that this purported dampening in the incentive to innovate has deprived consumers of better products and services that would otherwise arise through the push and pull of competition.

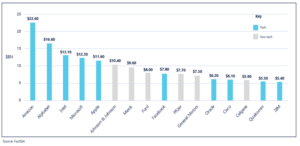

But the actual data tell a different story about the state of research and development in the United States and how it compares to its counterparts in Europe. In fact, companies in the United States lead the world in research and development. As shown in Figure 6, out of the top companies globally investing in research and development spending, 11 out of the top 20 (55 percent) and seven out of the top 10 (70 percent) are based in the United States as of 2018.[39] By comparison, only six of the top 20 are located in Europe (30 percent), and only two find themselves in the top 10 (20 percent). The remaining firms on the list based on research and development spend are based in Asia.

Contrary to critics’ claims, there is no lack of research and development in the United States, and U.S. firms continue to outpace global counterparts in investing in new technologies and products. The reality is that companies in the United States invest in a broad range of research and development initiatives despite the presence of large, successful tech companies. Unsurprisingly, just as no one today would invest in developing a new combustion engine-powered car that would have to compete against established and mature competitors that have considerable expertise in the market, it would be unwise to try to compete against any of the large tech companies with a “me too” product. Instead, innovators (and, as discussed below, the venture capital and other sources of capital that fund them) devote resources to discovering new and different solutions that may indirectly replace incumbents by disrupting old markets and creating new ones. Indeed, this how many of today’s most successful tech firm achieved success—by building new products and creating new markets, not by mimicking yesteryear’s giants, such as IBM, Microsoft, and Intel.

Figure 6 – R&D Investment by Company, Global (2018)

A closer look at research and development investment in the United States further shows that tech firms are leading the way. In fact, many of the tech firms that have allegedly contributed to the decline of competition and innovation in the United States are the biggest spenders. As shown in Figure 7, Amazon, Alphabet, Intel, Microsoft, and Apple comprise the nation’s topic five spenders, with investments totaling more than $75 billion in 2018.[40] These companies are pouring money into innovation not because they have nothing else to do with it but because they are attempting to stay ahead of the competition in their core markets by introducing even better products and services, and to break into adjacent markets where they see opportunities to use their expertise to be disruptive forces.

To name a few examples, Amazon is developing a drone delivery fleet to make its already industry-leading logistics operation even more convenient for consumers and is investing in cashierless store technology to make shopping faster and more efficient.[41] Google is investing heavily in AI and machine learning to improve its search and advertising businesses, as well as to power its aspirations in autonomous driving vehicles.[42] Apple’s investments have led to an array of new products over the years that have broadened the company’s portfolio beyond personal computers to phones, tablets, watches, television subscription services, and payment systems.[43] These are not the actions of companies that are content with their achievements to date and who do not fear that the competitive landscape could change quickly if they do not continue to introduce new and better products that keep their customers satisfied and drive new business growth.

Figure 7 – R&D Investment by Company, United States (2018)

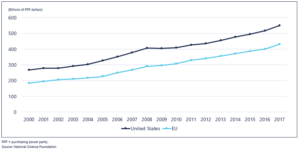

Comparing regional investments at the firm level provides one data point illustrating the vast differences between the innovation ecosystems in the United States and Europe, and those illustrations are corroborated by the data at a more macro country level. The United States consistently has spent more on research and development than any other country or political union in the world. Figure 8 shows that the United States spent $549 billion (on a purchasing power parity basis) on research and development in 2017.[44] By comparison, the European Union spent $430 billion (on a purchasing power parity basis) in 2017, more than $100 billion less than United States. Those disparities in spending have manifested themselves in starkly different digital economies, with the United States attracting more risk-taking innovators who want to build companies that seek to develop new and better products. These investments ultimately have led to significant economic growth and prosperity.

Figure 8 – GDP Expenditures on R&D, US and EU

(2000-2017)

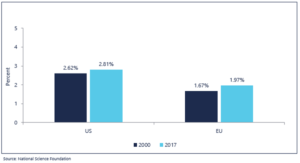

As shown in Figure, 9, the United States also leads Europe in research and development intensity, which measures the ratio of research and development spending relative to GDP. While several smaller economies have greater research and development intensity, the United States boasts a research and development to GDP ratio of 2.81 in 2017, up from 2.62 in 2000, placing it in the top 10 globally.[45] In contrast, Europe’s research and development intensity is measured at just 1.97, up from 1.67 in 2000. Although Europe’s research and development spending has grown somewhat more quickly than the United States over the last nearly 20 years, it still lags behind.

Figure 9 – R&D Intensity, US and EU (2000 & 2017)

But the news has not all been positive for the United States. Its global share of research and development spending has fallen since 2000 as Asian countries, particularly China, have significantly increased their research and development spending and, in recent years, have accounted for most of the growth in global research and development spending.[46] Not surprisingly it is China and other Asian countries, not Europe, that have begun to rival the United States in technology development and innovation.

One criticism of the innovation ecosystem in the United States is that it lacks sufficient support and direction from the public sector.[47] A majority of U.S. research and development spending is derived from the private sector.[48] However, history suggests that some of the strongest periods for innovation in the United States have come from massive expenditures in research and development to meet the urgent demands of national threats or crises, such as World War II and the rise of the Soviet Union in the latter half of the 20th century.[49] During these periods, through federally funded labs and partnerships with university research centers, the United States laid the foundation for becoming the global leader in advanced industries, such as aerospace and electronics.[50]

The realization that China is rapidly innovating and advancing its technological capabilities may revitalize demand for a strong federal role in innovation policy through greater funding for research universities and federal labs and a coordinated strategy on investment priorities. Such a program may hasten the use of technology to rebuild infrastructure and to disrupt long stagnant markets, such as health care, housing, and manufacturing, that are prime candidates for innovation but have largely been overlooked. More public funding and better strategic focus likely would only add to the United States’ success in promoting innovation and create further distance between itself and Europe.

D. Venture Capital Invests Overwhelmingly in the United States

While innovation undoubtedly requires smart, talented, and eager entrepreneurs to conceive of new business models and to develop better products and services, it also requires funding to bring those ideas to fruition. Absent that funding support, thousands of aspiring innovators and startups would be unable to bring their products to consumers and compete in the marketplace. The venture capital funding model has been a key ingredient in the success of the modern digital economy and has enabled thousands of startups to bring their innovations to consumers and to grow their businesses.

Prior to the modern venture capital market, funding for fledgling ideas largely flowed from industrial research labs or a limited number of large companies or wealthy individuals. Those funding sources were much smaller as compared to today, and the funding was much more opaque and more difficult to access. Today, the U.S venture-capital industry is envied throughout the world and serves as an important engine for economic growth. It brings investors with an appetite for risk-taking together with entrepreneurs and innovators who believe they have an idea that can grow and succeed. In doing so, it enables those ideas to become reality.

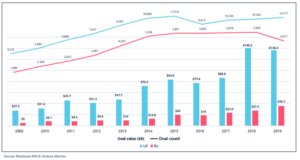

As shown in Figure 10, venture capital investing has soared in the United States over the last 10 years, growing from $27.4 billion in 2009 to an astonishing $136.5 billion in 2019—representing an increase of nearly a 400 percent.[51] The number of venture capital deals has also increased from 4,535 in the 2009 to 10,777 in 2019, an increase of nearly 140 percent. That growth has occurred across all funding stages: angel and seed funding, early stage capital, and late stage capital, providing companies with support from the earliest development phase through to when they are mature companies but not yet profitable.[52] In contrast, the European venture capital market is much smaller, starting with just $5 billion in investment in 2009 and growing to $36.3 billion in 2019.[53] Although European venture capital spending has grown faster than U.S. spending, it was only in 2018 that European venture capital matched the level of investment that the United States experienced nearly 10 years earlier. The deal count also is much smaller in Europe, with deals growing from just 1,689 in 2009 to 5,017 in 2019, which is less than half of the current deal count in the United States.

The disparity between the United States and European venture capital markets is one reason why the U.S. has consistently been home to the most innovative companies and technological development. But it also is evidence that investors view the United States as a better place to invest, in part because of its more favorable innovation climate.

Figure 10 – Venture Capital Investment, United States and Europe (2009-2019)

Venture capital investing is based on the premise that investors who are willing to risk capital on a new idea have the opportunity to reap the rewards of that investment once the company has traversed the difficult process of developing its ideas from untested concepts and business plans into mature and successful businesses.[54] Of course, not all venture-backed startups succeed. Indeed, by one estimate, as many as 75 percent never return cash to their investors, showing that the risks are real.[55] But for those startups that are successful, investors look for ways to exit once they can make an acceptable return. While initial public offerings (IPOs) may be a possibility for certain companies willing to go public, by far the most common mechanism for exit is through an acquisition by another firm.[56] The ability to predict the likelihood of a successful exit therefore significantly influences venture capitals’ willingness to invest in one startup or another, as well as whether to invest in startups at all or instead to place their capital in other investment vehicles that present a better combination of risk and reward. The current growth in venture capital investing is due, in part, to the perception that investing in startups presents an attractive risk-reward profile based on the ability of investors to earn returns following an exit event.

Much has been written regarding concerns that tech startups are increasingly being acquired by large dominant firms in an effort by those dominant firms to arrest the future competition that they might face from the startup.[57] The most frequently cited examples are Facebook’s acquisitions of Instagram in 2012 and WhatsApp in 2014, which many today perceive to have been growing competitive threats to Facebook.[58] Others argue that it is only as a result of being acquired by Facebook that Instagram and WhatsApp were able to grow into the successful products they are today.[59] In response, some policymakers and commentators have introduced proposals that would make acquisitions by certain companies more difficult to complete, either by making them presumptively unlawful or banning those mergers in their entirety.[60]

But while the antitrust laws should (and can) prevent anticompetitive mergers of nascent[61] or potential competitors,[62] and the antitrust authorities must develop strategies for effectively demonstrating such harm in deals where it exists, imposing broad prohibitions on a large swath of acquisitions (most of which present no competitive issues) inevitably will make investor exit more difficult and costly. Such changes likely would reduce the incentive to invest and could smother the investment that has fueled new business development and innovation in the United States.

Proposals to completely ban acquisitions by companies of a certain size or make them presumptively illegal absent persuasive evidence that they are procompetitive (regardless of whether any competition concerns exist),[63] would add friction to venture capital’s exit opportunities without improving antitrust enforcement.[64] Because capital has other alternatives into which it can flow, decreasing the ability for investors to exit may make it relatively more attractive for investors to put their capital in other markets or investment vehicles. This result could reduce venture capital investment in the United States and dampen technological innovation and new business creation.

The notion that new regulations may inadvertently reduce incentives to invest and thereby potentially harm long-term innovation is not merely theoretical. In 2018, the European Union enacted the landmark General Data Protection Regulation (GDPR), which established news rules governing data protection and privacy for firms operating in the European Union.[65] The regulation was widely criticized by many for imposing a broad new regime that was overly burdensome and imposed significant compliance costs, the ultimate effect of which would be to create advantages for incumbents with deeper pockets and resources than smaller firms and startups[66] For investors, GDPR introduced additional due diligence and other acquisition costs when considering investment options. One study shows that in response to the increase in relative costs and uncertainties, foreign investors reduced their per-deal investment by nearly 41 percent, and the monthly number of EU foreign deals dropped 22 percent.[67] The decline was lower but still substantial for investors from within the EU, resulting in a reduction in investment of nearly 36 percent and nearly 16 percent fewer monthly deals.[68] These dramatic declines in investment demonstrate the tradeoff that occurs by imposing additional regulations. The experience with GDPR shows that increasing relative regulatory costs has a negative effect on investment and, as a result, may lead to lower levels of business development, slower growth, and less technological innovation.

E. The United States is Home to the Next Generation of Innovators

Not only is the United States the home of an overwhelming majority of today’s most successful and innovative companies, it also is home to the next generation of innovative firms that will build the products and services on which that we will be depending in the future. Overwhelmingly when entrepreneurs want to start a company they decide to do so in the United States. Some of that surely is because in some cases the United States is where those innovators were raised and went to school. But others purposefully come to the United States because they believe it offers a more hospitable climate for innovation and business development.[69] Indeed, more than 40 percent of Fortune 500 companies that are located in the United States are started by foreigners.[70] Moreover, the companies that are being created in the United States are proving to be the ones that also are the most valued in the world for the new products and services they have introduced.

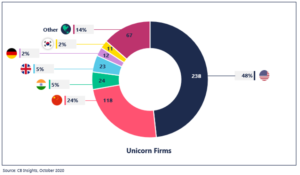

In fact, as shown in Figure 11, nearly half of the world’s so-call “unicorn” firms—private companies valued at $1 billion or more—originate in the United States.[71] The next highest number of unicorn firms is found in China, which has half as many as the United States, although that number is growing quickly. In stark contrast, Europe is far behind both the United States and China, and is home to relatively few unicorn companies, despite having more than 100 million more people.[72] The two most successful countries in Europe in developing unicorn firms have been the United Kingdom, which hosts 23, and Germany, which hosts another 12.

This data shows that entrepreneurs seek to innovate and grow their businesses in the United States more so than in any other country further, further supporting the notion that the United States has fostered a superior climate for innovation than has Europe—one in which innovators and entrepreneurs can attain the funding they need to grow and have ample opportunity vigorously compete against old and new rivals.[73]

Figure 11 – Global Unicorn Firms by Country, 2020 Q3

Conclusion

The United States is the world leader in promoting technological change and innovation. That innovation has fueled the digital economy and the development of products and services that have increased prosperity and welfare. The United States’ innovation culture has far outpaced its counterparts in Europe. Across a wide range of metrics, the United States is better at helping entrepreneurs develop the most innovative global companies through access to venture capital funding and by protecting competition that encourages even the most successful firms to continue to innovate in order to stay ahead of rivals that wish to overtake them. There is no doubt room for improvement. There are legitimate concerns that U.S. innovation is not focused enough on creating technological change in areas that most impact humanity. But this fault is potentially a call for stronger public-private partnership and greater focus on strategic goals, not for new regulations that may undermine the healthy innovation ecosystem that the United States has developed. As competition in the digital economy comes under more intense scrutiny and some policymakers seek to introduce European-style antitrust laws that have less faith in markets and more faith in government control, it is important to remember that the United States’ current regulatory framework has contributed to America’s success in innovation. Dramatic reforms that seek not just to improve antitrust enforcement on the margin, but instead intend to completely rewrite a well-defined body of law that has been carefully developed over decades through case-by-case adjudication that permits procompetitive conduct and condemns anticompetitive conduct, present the risk of upending a well-balanced ecosystem that promotes entrepreneurship, investment, and innovation.

Footnotes

[1] For more on AI and Machine Learning, see Ai Deng, Algorithmic Collusion and Algorithmic Compliance: Risks and Opportunities, in The GAI Report on the Digital Economy (2020).

[2] See, e.g., Larry Downes, Europe’s Innovation Deficit Isn’t Disappearing Any Time Soon, Washington Post (June 8, 2015), https://www.washingtonpost.com/news/innovations/wp/2015/06/08/europes-innovation-deficit-isnt-disappearing-any-time-soon/; Matti Huuhtanen, Why Europe Isn’t Creating Any Googles or Facebooks, Business Insider (Sept. 22, 2015), https://www.businessinsider.com/ap-why-europe-isnt-creating-any-googles-or-facebooks-2015-9; From Clout to Rout, The Economist (June 30, 2016), https://www.economist.com/business/2016/06/30/from-clout-to-rout.

[3] See generally Stephen Ezell & Philipp Marxgut, Comparing American and European Innovation Cultures, Info. Tech. & Innovation Found. 157 (2015), http://www2.itif.org/2015-comparing-american-european-innovation-cultures.pdf; Robert D. Atkinson, Info. Tech. & Innovation Found., Understanding the U.S. National Innovation System, 2020, 15 (2020), https://itif.org/sites/default/files/2020-us-innovation-system.pdf.

[4] See, e.g., Majority Staff of H. Comm. on the Judiciary, 116th Cong., Investigation of Competition in Digit. Mkts. 150–55 (2020) [hereinafter House Majority Antitrust Report], https://judiciary.

house.gov/uploadedfiles/competition_in_digital_markets.pdf. Competition & Markets Authority, Online Platforms and Digit. Advert., Final Report (2020), https://assets.publishing.service.gov.

uk/media/5efc57ed3a6f4023d242ed56/Final_report_1_July_2020_.pdf; Stigler Comm. on Dig. Platforms, Stigler Ctr., Final Report (2019), https://research.chicagobooth.edu/-/media/research/stigler/pdfs/

digital-platforms—committee-report—stigler-center.pdf; Directorate-General for Competition, Eur. Comm’n, Competition Policy for the Digital Era (2019), https://ec.europa.eu/competition/publications

/reports/kd0419345enn.pdf; Austl. Competition & Consumer Comm’n, Digital Platforms Inquiry Final Report (2019), https://www.accc.gov.au/publications/digital-platforms-inquiry-final-report.

[5] See Jonathan Klick, Is the Digital Economy Too Concentrated?, in The GAI Report on the Digital Economy (2020); John M. Yun, Potential Competition, Nascent Competitors, and Killer Acquisitions, in The GAI Report on the Digital Economy (2020); Joshua D. Wright, Elyse Dorsey, Jonathan Klick, & Jan M. Rybnicek, Requiem for a Paradox: The Dubious Rise and Inevitable Fall of Hipster Antitrust, 51 Ariz. St. L.J. 293 (2019).

[6] See, e.g., Frank H. Easterbrook, The Limits of Antitrust, 63 Tex. L. Rev. 1 (1984) (describing the challenges in identifying the welfare implications of certain business conduct and determining what conduct should be permitted because it is procompetitive versus what conduct should be condemned as anticompetitive).

[7] See, e.g., Derek Thompson, Where’s My Flying Car?, Atlantic, Jan.–Feb. 2020, https://www.theatlantic.com/magazine/archive/2020/01/wheres-my-flying-car/603025/; Marc Andreessen, It’s Time to Build, Andreessen Horowitz (Apr. 19, 2020), https://a16z.com/2020/04/18/its-time-to-build/; Atkinson, supra note 3.

[8] House Majority Antitrust Report, supra note 4, at 387–88, 392–94; Jonathan B. Baker et al., Joint Response to the House Judiciary Committee on the State of Antitrust Law and Implications for Protecting Competition in Digital Markets 14 (2020); see also Lauren Hirsch, Elizabeth Warren’s Antitrust Bill Would Dramatically Enhance Government Control Over the Biggest US Companies, CNBC (Dec. 7, 2019 10:00 AM), https://www.cnbc.com/2019/12/07/warrens-antitrust-bill-would-boost-government-control-over-biggest-companies.html.

[9] House Majority Antitrust Report, supra note 4, at 387–88, 391; Baker et al., supra note 8, at 14; Consolidation Prevention and Competition Promotion Act, S.307, 116th Cong. (2019); see also New Release, Klobuchar Introduces Legislation to Deter Anticompetitive Abuses (Mar. 10, 2020), https://www.klobuchar.senate.gov/public/index.cfm/2020/3/klobuchar-introduces-legislation-to-deter-anticompetitive-abuses.

[10] House Majority Antitrust Report, supra note 4, at 384–86.

[11] Id. at 391–92; see also Hirsch, supra note 8. For a discussion of the potential consequences of expanding the goals of antitrust see Elyse Dorsey, Jan M Rybnicek, & Joshua D. Wright, Hipster Antitrust Meets Public Choice Economics: The Consumer Welfare Standard, Rule of Law, and Rent-Seeking, Competition Pol’y Int’l Antitrust Chro. (Apr. 2018); Elyse Dorsey, Geoffrey A. Manne, Jan M. Rybnicek, Kristian Stout, Joshua D. Wright, Consumer Welfare & the Rule of Law: The Case Against the New Populist Antitrust Movement, 47 Pepp. L. Rev. 861 (2020). Antitrust’s “consumer welfare prescription” was first recognized by the Supreme Court in Reiter v. Sonotone Corp., 442 U.S. 330, 343 (1979).

[12] For additional discussion of the political and policy debate related to the current state of the digital economy and proposals to reform antitrust, see Joshua D. Wright & Jan M. Rybnicek, A Time for Choosing: The Conservative Case Against Weaponizing Antitrust, National Affairs (Fall 2020) https://nationalaffairs

.com/time-choosing-conservative-case-against-weaponizing-antitrust.

[13] For a discussion about the relationship between GDP and digital goods, see Avinash Collis, Consumer Welfare in the Digital Economy, in The GAI Report on the Digital Economy (2020).

[14] Michael Ringel et al., Boston Consulting Grp., The Most Innovative Companies in 2020: The Serial Innovation Imperative 16 (2020), https://image-src.bcg.com/Images/BCG-Most-Innovative-Companies-2020-Jun-2020-R-4_tcm9-251007.pdf.

[15] Id. at 7–15.

[16] Tim Mullaney, This is What’s Behind Walmart’s Staying Power that Could Outmaneuver Amazon, CNBC (Aug. 15, 2019, 9:43 AM), https://www.cnbc.com/2019/08/15/walmarts-secret-weapon-in-its-quest-to-outmaneuver-amazon.html.

[17] Ringel, supra note 14, at 8.

[18] The World’s 50 Most Innovative Companies, Fast Company, https://www.fastcompany.com/most-innovative-companies/2020 (last visited Nov. 9, 2020); How ‘Fast Company’ Picked the World’s Most Innovative Companies of 2020, Fast Company (Mar. 10, 2020), https://www.fastcompany.com/

90474625/how-fast-company-picked-the-worlds-most-innovative-companies-of-2020.

[19] How ‘Fast Company’ Picked the World’s Most Innovative Companies of 2020, supra note 18.

[20] Fast Company identifies 50 companies in total for its list. Companies 31 to 50 are excluded from the above chart for ease of reference. These companies almost exclusively are American and only increase U.S. dominance in the list.

[21] Largest Tech Companies by Market Cap, CompaniesMarketCap.com, https://companiesmarketcap

.com/tech/largest-tech-companies-by-market-cap/ (last visited Nov. 9, 2020).

[22] James Broughel & Adam Thierer, Technological Innovation and Economic Growth: A Brief Report on the Evidence, Mercatus Research, Mercatus Center at George Mason University, at 4 (2019), https://www.mercatus.org/system/files/broughel-technological-innovation-mercatus-research-v1.pdf.

[23] See id. at 15–17.

[24] See id. at 7.

[25] Id. at 15–16.

[26] Id.

[27] Erik Brynjolfsson et al., Using Massive Online Choice Experiments to Measure Changes in Well-Being, 116 PROC. NAT’L ACAD. SCI. 7250, 7252 (2019).

[28] GDP Per Capita, Current Prices: U.S. Dollars Per Capita, International Monetary Fund, https://www.imf.org/external/datamapper/NGDPDPC@WEO/EU (last visited Nov. 9, 2020).

[29] Id.

[30] Real GDP Growth: Annual Percent Change, International Monetary Fund, https://www.imf.org

/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD (last visited Nov. 9, 2020).

[31] Id.

[32] Kevin Barefoot et al., Research Spotlight: Measuring the Digital Economy, Surv. Current Bus., May 2019, at 6–12, https://apps.bea.gov/scb/2019/05-may/pdf/0519-digital-economy.pdf.

[33] The Computing Technology Industry Association, Cyberstates 2020 Research Report, CompTIA (2020), https://www.cyberstates.org/pdf/CompTIA_Cyberstates_2020.pdf.

[34] Nate Rattner & Will Feuer, Amazon is Responsible for Most Big Tech Job Growth Since 2000, CNBC (Nov. 4, 2019), https://www.cnbc.com/2019/11/04/how-many-jobs-have-amazon-google-and-apple-created-since-2000.html.

[35] Michael Mandel, A Historical Perspective on Tech Job Growth, Progressive Pol’y Inst. 3 (2017), https://www.progressivepolicy.org/wp-content/uploads/2017/01/tech-job-boom-1-12c-17-formatted.pdf.

[36] Michael Mandel, The Digital Sector: Rising Labor Share, Falling Gross Margin, Progressive Pol’y Inst. 2–6 (2018), https://www.progressivepolicy.org/wp-content/uploads/2018/08/Labor-share-gross-margin.pdf.

[37] Thompson, supra note 7.

[38] American Tech Giants Are Making Life Tough for Startups, The Economist (June 2018), https://www.economist.com/business/2018/06/02/american-tech-giants-are-making-life-tough-for-startups; C. Scott Hemphill & Tim Wu, Nascent Competitors (NYU L. & Econ Research Paper No. 20-50, 202) (Forthcoming U. Penn. L. Rev 2020), https://ssrn.com/abstract=3624058.

[39] Erin Duffin, Ranking of the 20 Companies with the Highest Spending on Research and Development in 2018, Statista (Jul. 22, 2020), https://www.statista.com/statistics/265645/ranking-of-the-20-companies-with-the-highest-spending-on-research-and-development.

[40] Id.

[41] See Concepción de León, Drone Delivery? Amazon Move Closer with F.A.A. Approval, N.Y. Times (Aug. 31, 2020), https://www.nytimes.com/2020/08/31/business/amazon-drone-delivery.html; Taylor Lyles, Amazon Go’s Cashierless Tech May Come to Whole Foods as Soon as Next Year, Verge (Aug. 24, 2020), https://www.theverge.com/2020/8/24/21399607/amazon-cashierless-go-technology-whole-foods-2021-rumor.

[42] See, e.g., Alex Hern, Google’s Self-Driving Car Project Buys British AI Firm Latent Logic, Guardian (Dec. 12, 2019), https://www.theguardian.com/technology/2019/dec/12/googles-self-driving-car-project-buys-british-ai-firm-latent-logic.

[43] See Mike Bostock, A Timeline of Apple Products, Observable (Mar. 7, 2020), https://observablehq

.com/@mbostock/a-timeline-of-apple-products; Jon Porter, Apple One Now Available, Bundling Apple’s Services into a Single Subscription, Verge (Oct. 20, 2020), https://www.theverge.com/2020/10/30/

21541685/apple-one-subscription-individual-family-premier-music-tv-plus-arcade-icloud-news-fitness.

[44] Nat’l Sci. Bd., The State of U.S. Science & Engineering 8 (2020), https://ncses.nsf.gov/pubs/

nsb20201/global-r-d.

[45] Id. at 9.

[46] Id.

[47] Atkinson, supra note 3, at 15.

[48] See id. at 17; Nat’l Sci. Bd, supra note 44, at 10.

[49] Atkinson, supra note 3, at 4–5.

[50] Id.

[51] PitchBook & Nat’l Venture Cap. Ass’n, Venture Monitor Q4 2019 5 (2020), https://files.pitchbook.

com/website/files/pdf/Q4_2019_PitchBook_NVCA_Venture_Monitor.pdf.

[52] See id. at 7–12.

[53] See PitchBook, European Venture Report 3 (2020), https://pitchbook.com/news/reports/2019-annual-european-venture-report.

[54] For more on developments in the venture capital industry and the intersection between venture capital and antitrust, see the Department of Justice’s Public Workshop on Venture Capital and Antitrust, Feb. 12, 2020), https://www.justice.gov/atr/events/public-workshop-venture-capital-and-antitrust.

[55] Faisal Hoque, Why Most Venture-Backed Companies Fail, Fast Co. (Dec. 10, 2012), https://www.

fastcompany.com/3003827/why-most-venture-backed-companies-fail.

[56] PitchBook & Nat’l Venture Cap. Ass’n, supra note 51, at 32.

[57] See generally Yun, supra note 5 (discussing the law and economics of so-called “killer acquisitions”).

[58] See, e.g., House Majority Antitrust Report, supra note 4, at 150–55; see also Sam Schechner & Parmy Olson, Facebook Feared WhatsApp Threat Ahead of 2014 Purchase, Documents Show, Wall St. J. (Nov. 6, 2019), https://www.wsj.com/articles/facebook-feared-whatsapp-threat-ahead-of-2014-purchase-documents-show-11573075742. Another frequently cited example is Google’s acquisition of Youtube in 2006.

[59] See House Majority Antitrust Report, supra note 4, at 150–60; see also Yun, supra note 5, at nn.21, 25 and accompanying text.

[60] See, e.g., Sergei Klebnikov, Elizabeth Warren Reportedly Drafting Bill to Ban “Mega Mergers”, Forbes, Dec. 5, 2019, https://www.forbes.com/sites/sergeiklebnikov/2019/12/05/elizabeth-warren-reportedly-drafting-bill-to-ban-mega-mergers/?sh=3c723e1466a4.

[61] For a recent example, see, for example, Press Release, Fed. Trade Comm’n, FTC Challenges Illumina’s Proposed Acquisition of PacBio (Dec. 17, 2019), https://www.ftc.gov/news-events/press-releases/2019/12

/ftc-challenges-illuminas-proposed-acquisition-pacbio.

[62] See., e.g., Press Release, FTC Puts Conditions on Nielsen’s Proposed $1.26 Billion Acquisition of Arbitron (Sep. 20, 2013), https://www.ftc.gov/news-events/press-releases/2013/09/ftc-puts-conditions-nielsens-proposed-126-billion-acquisition.

[63] See House Majority Antitrust Report, supra note 4, at 387–88; Erik Wasson, Warren, Ocasio-Cortez Float Long-Shot Bid to Pause M&A in Crisis, Bloomberg (Apr. 28, 2020), https://www.bloomberg.com

/news/articles/2020-04-28/warren-ocasio-cortez-propose-temporary-corporate-merger-ban (discussing a proposed temporary moratorium on acquisitions by large firms during pandemic situation).

[64] See David L. Bahnsen, Banning Mergers and Acquisitions: A Bad Idea at a Bad Time, Nat’l Rev. Cap. Matters (Apr. 29, 2020), https://www.nationalreview.com/2020/04/coronavirus-crisis-banning-mergers-and-acquisitions-bad-idea-at-a-bad-time/; Will Rinehart, The Government Should Not Ban Mergers and Buyouts, Am. Action F. (Oct. 4, 2018), https://www.americanactionforum.org/insight/the-government-should-not-ban-mergers-and-buyouts/.

[65] Press Release, Eur. Comm’n, Statement by Vice-President Ansip and Commissioner Jourová Ahead of the Entry into Application of the General Data Protection Regulation (May 24, 2018), https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_18_3889.

[66] See, e.g., Alec Stapp, GDPR After One Year: Costs and Unintended Consequences, Truth on the Mkt. (May 24, 2019), https://truthonthemarket.com/2019/05/24/gdpr-after-one-year-costs-and-unintended-conseque

nces/.

[67] Jian Jia et al., GDPR and the Localness of Venture Investment 3–4 (Jan. 21, 2020) (unpublished manuscript), https://ssrn.com/abstract=3436535.

[68] Id. at 4.

[69] See, e.g., J. David Brown et al., Immigrant Entrepreneurs and Innovation in the U.S. High-Tech Sector (IZA Instit. Discussion Paper No. 12190, 2019), http://ftp.iza.org/dp12190.pdf; Shai Bernstein et al., The Contribution of High-Skilled Immigrants to Innovation in the United States (July 11, 2019) (unpublished manuscript), https://web.stanford.edu/~diamondr/BDMP_2019_0709.pdf (suggesting that immigrants also play an outsize role in American innovation leadership in certain industries).

[70] Michael Grothaus, Some of the U.S.’s Biggest Companies are Founded by Immigrants, Fast Company, July 26, 2018, https://www.fastcompany.com/90202816/some-of-the-u-s-s-biggest-companies-are-founded-by-immigrants.

[71] The Complete List of Unicorn Companies, CBInsights, https://www.cbinsights.com/research-unicorn-companies (last visited Nov. 9, 2020).

[72] Population, Total – European Union, United States, China, World Bank Data, https://data.worldbank.org/indicator/SP.POP.TOTL?locations=EU-US-CN (last visited Nov. 9, 2020).

[73] For additional analysis of Europe’s start-up ecosystem and the challenges it faces, see Kim Baroudy, Jonatan Janmark, Abhi Satyavarapu, Tobias Stralin, & Zeno Ziemke, Europe’s Start-up Ecosystem: Heating Up, But Still Facing Challenges, McKinsey & Co. (Oct. 11, 2020), https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/europes-start-up-ecosystem-heating-up-but-still-facing-challenges.