Introduction

Digital platforms have transformed the way consumers search for information, read books, listen to music and watch video entertainment, shop, and conduct meetings. Populists from both political parties have recently raised concerns about growing trends in concentration, and in particular the “dominance” of digital platforms such as Google, Amazon, Facebook, and Apple. The pecuniary prices that consumers pay for the services provided by some of these platforms are modest or even “free;” consequently, stated concerns tend to focus on consumer harm that is unrelated to pricing.

Anyone reading the popular press is aware of the following sorts of concerns about the dominance of digital platforms:

- Google is a “bullying 800-pound gorilla”[1] and “an unopposed monopoly”[2] in the market for search engines. The lack of viable competitors means the company can impose whatever terms it wishes on its customers.

- Amazon eliminated competitors by “slashing prices and bleeding money,”[3] and disadvantages competitors by self-preferencing its own products.[4]

- Google and Facebook are always on the lookout for competitive threats and have engaged in “killer” or “blockbuster” acquisitions to prevent other firms from successfully competing for its customers.[5]

- Amazon exploits data of third-party sellers “to determine what new products it will create;”[6] Facebook harms consumers by exploiting consumer data and violating data privacy[7] and “invades users’ privacy” by selling their data to advertisers in exchange for using its platform.[8]

- Disney, Apple, Amazon, and Google have positioned themselves to force consumers to purchase a bundle rather than to only buy the product or service they want.[9]

- Content on platforms such as Twitter and Facebook should be regulated to prevent the biased information that stems from their algorithms’ “filter bubbles” or “echo chambers.”[10]

This paper contributes to the policy debate by providing an appraisal of the economics underlying assertions like these. Our goal is to provide a balanced look at the economic assumptions that underlie the “possibility theorems” policymakers might use to rationalize different policies (e.g., regulation, breaking up large companies, subsidizing entry, forced data sharing, or maintaining the status quo). Our discussion highlights the type of information and analyses required to determine whether alternative forms of intervention are likely to enhance or reduce the welfare of various market participants. While it is relatively easy to identify theoretical conditions under which intervention dominates the status quo (and vice versa), empirical verification is difficult because multi-sided platforms have many interrelated parts and involve complex data. Additionally, some forms of “empirical evidence” (e.g., evidence regarding market shares or firm size) are more vulnerable to false-positives than other evidence (e.g., competitive effects analysis).[11] These complexities augment the challenges inherent in implementing welfare-enhancing policies and highlight the importance of careful, evidence-based decision-making.

I. Evidence Commonly Used to Show that a Digital Platform Has Sufficient Power to Significantly Harm Consumers or Competition

As with other markets, one might worry that a digital platform possesses and wields market power that significantly harms consumers or competition. Before discussing the evidence required to determine if this is the case, we discuss two key concepts: market power and market definition.

Market power is the ability of a firm to price above marginal cost (or alternatively, sustain a price in excess of the competitive level).[12] This notion readily captures market power related to factors other than price (e.g., quality or privacy). In these cases, market power is the ability to impose a shadow price in excess of marginal cost. Conceptually, a shadow price is the amount consumers would pay for a marginal improvement in a non-price attribute of a good or service. [13] By way of example, the shadow price of the quality of some service—say an internet search—is the amount consumers would pay for a marginal improvement in search quality. A firm is said to exercise market power with respect to quality when the shadow price of its chosen quality exceeds the marginal cost of quality. In other words, market power permits the firm to reduce quality (resulting in a higher shadow price), analogous to it restricting output and charging a higher product price.[14] The harm stems from the fact that consumers are willing to pay more than the cost of added quality, but the firm does not provide it.

Defining a relevant market is obviously necessary for calculating shares to quantify “market concentration;” the same is true when the term “dominant firm” is used to convey that a firm is “large” compared to the competition. Market definition may also be helpful in establishing where a firm might possess “economic power” and to ensure that competitive effects analysis focuses on the specific market where antitrust harm may arise.[15] For purposes of this report, we simply note that a key consideration in defining a relevant market—or determining whether a firm is exercising market power—is the extent to which consumers can substitute toward other products in response to price increases.[16] By way of example, a platform may be “dominant” on the consumer side of a two-sided market, yet not wield market power on the advertising side of the market; there may be relatively poor substitutes for searches on Google, but advertisers may have a plethora of substitutes to advertising on Google’s platform. Henceforth, we simply assume a relevant market has been properly defined to include relevant substitutes.

With this overview, we now turn to evidence that is often cited to support an opinion that a platform has sufficient power to significantly harm consumers or competition.

A. Popular Evidence

1. The Platform is “Big”

Arguably the primary evidence that is cited to support claims that Google and other large technology platforms have sufficient power to harm consumers or competition is that they are “too big.”[17] As an initial matter, we note that concerns regarding the absolute size of firms predate the existence of the digital platforms at issue in the current policy debate. Shortly before the Reagan Revolution, for instance, former FTC chairman Michael Pertschuck unsuccessfully advocated using antitrust policies to prevent firms from becoming large through conglomerate mergers. The primary arguments advanced in favor of limiting firm size are protecting: (a) the balance of political power and (b) the corporation’s responsiveness to social needs.[18] To the best of our knowledge, there is little economic evidence that the absolute size of firms per se benefits or harms consumers or competition.[19] Regardless, the inability to identify the threshold beyond which the absolute size of a firm becomes problematic, or measure the associated harms of this nature, significantly limits one’s ability to gather scientific evidence to support or refute such a proposal.

The most common evidence gathered concerns the relative size of a firm. Evidence commonly cited as indicative of a platform’s market power or consumer harm is its dominance per se. Typical examples include Google for search, Facebook for social networking, and Comcast for cable services. The rationale for considering this evidence has its roots in the so-called “Structure-Conduct-Performance” paradigm, which postulates that structural elements of an industry (e.g., firm size or concentration) dictate firm conduct (e.g., pricing decisions) which in turn determines economic performance (e.g., consumer welfare or firm profits).[20] While it is now widely understood that there is not a one-way causal link between market structure and performance, in specialized circumstances economic theory does indicate that concentration may lead to inefficient resource allocations. Ultimately, whether “bigness” or concentration harms consumers or competition is an empirical rather than theoretical question. The following are a few examples of lines of reasoning that may lead to a concern that concentration is bad for consumers and social welfare.

A standard story would be that, say, Comcast has market dominance in providing cable services; in Nashua, New Hampshire, for instance, Comcast is the sole cable provider.[21] It is of course an empirical question whether satellite TV (e.g., Dish, DirecTV) or over-the-top internet streaming (e.g., Netflix, Hulu) are sufficiently close substitutes to be in the relevant market. Classic concerns might include Comcast’s ability to: (a) charge super-competitive prices, (b) bundle services in an attempt to force consumers to buy services they don’t want, (c) shirk on customer service, and/or (d) lag on innovation.

Similar concerns can arise when consumers pay no pecuniary price to use a platform (e.g., conducting a search on Google or viewing a post on Facebook). In this case, one might worry that market dominance (or the absence of competition) results in lower quality (non-price attributes of the platform), or more generally, raises the shadow prices that consumers implicitly pay to use the platform’s services. Assuming that searches on Bing or other platforms are poor substitutes for Google searches, for instance, one might worry that Google’s dominance in consumer search permits it to charge super-competitive shadow prices.[22] Conceptually this might materialize as: (a) poor search results, (b) steering consumers to unwanted links to the platform’s own products or services (self-preferencing), (c) inadequate privacy protection and/or security, or (d) the platform reselling user data without consent.

Evidence that a platform is “too big,” of course, requires a measure of what it means to be “big.” A standard approach is to calculate market shares based on the definition of the relevant market. While it might seem simple to provide evidence that a firm is too large relative to the market, such calculations can be misleading for two-sided platforms. For example, the absence of pecuniary prices on one side of the market may distort shares based on revenues. Likewise, shares based on a conglomerate firm’s total revenues or units sold can distort the actual importance of the platform in a specific market. Finally, care must be taken to avoid using market shares on one side of a two-sided market to infer dominance on the other side of the market. For example, the fact that Google may be dominant in consumer search or that Facebook may be a dominant social networking platform does not imply that either firm is dominant in an appropriately defined market for advertising.

2. Consumers Have No Other Options

Another related piece of evidence commonly cited in support of the proposition that digital platforms have sufficient economic power to harm consumers is a lack of alternatives for their products or services. In this case, the evidence is not based directly on the absolute or relative size of the platform, but instead on evidence of a lack of close substitutes. Obviously, the absence of such substitutes might harm consumers by permitting firms to charge high pecuniary prices and/or high shadow prices by skimping on non-price attributes that consumers value. Notice that this approach supplants thorny issues related to defining the absolute or relative size of a firm with an assessment of evidence regarding the availability of substitutes that constrain the platform’s prices (pecuniary or otherwise).

3. Other Popular Evidence

Owing to difficulties in accurately measuring the absolute or relative size of firms, as well as challenges in identifying the full set of relevant substitutes, it is sometimes popular to use other metrics as proxies. For example, one might provide evidence that digital companies are engaging in too many acquisitions.[23] The ramifications of such evidence depend upon the nature of the acquisitions (e.g., horizontal, vertical, or conglomerate). Horizontal acquisitions may harm consumers by eliminating competition (substitutes). Vertical acquisitions may permit a firm to foreclose competition, again to the detriment of consumers. As noted earlier, some argue that conglomerate mergers may adversely impact the balance of political power or a firm’s responsiveness to social needs.

Evidence sometimes focuses on data as the relevant market, rather than internet searches, advertising, or online commerce. If there is evidence that a firm’s absolute or relative share of a putative data market is large, or that there are no close substitutes for a platform’s data, all of the concerns discussed above may apply with respect to a firm’s large data repository. Ultimately, the ability of a firm to wield power in a data market may raise pecuniary and/or shadow prices for a potentially unlimited number of product and service markets. A common illustration of this concern centers on Amazon, which has large data stores regarding online purchases and consumer preferences, and it could, in theory, leverage such data to its advantage for other products and services (e.g., healthcare, video entertainment, etc.). For example, one theoretical possibility is that a platform might use data it acquires on consumer preferences to permit it (or its advertisers) to extract additional surplus from its customers through price discrimination.[24]

Finally, in instances where the evidence may not indicate that a firm has already achieved some form of dominance, there may be an indication that a platform is attempting to tip the market—or more loosely put, a feeling that “consumer harm is just around the corner.” This may include evidence that the platform is growing “too fast” as a result of strong network effects, consumer lock-in, switching costs, etc.[25]

B. Economic Evidence

While there are conditions under which the aforementioned evidence is consistent with consumer harm, these factors are insufficient to conclude that consumers are actually being (or will be) harmed. For instance, in the case of a highly concentrated market where firms compete on prices and sell similar products, competitive pricing may arise even if only two firms dominate the market.[26] More generally, it is well known that there are many “possibility theorems” indicating that a given business practice might benefit or harm consumers.[27] Consumers are not well-served by policies rooted merely in “possibility theorems;” such theorems can be used to rationalize almost any policy decision. Instead, sound public policy must be rooted in science-based empirical analyses that account for interrelations among different customers’ demands for the many different products and services provided by large platforms, as well as additional complexities related to multi-product costs and network effects. We discuss this economic approach below.

1. Examination of Pecuniary Prices

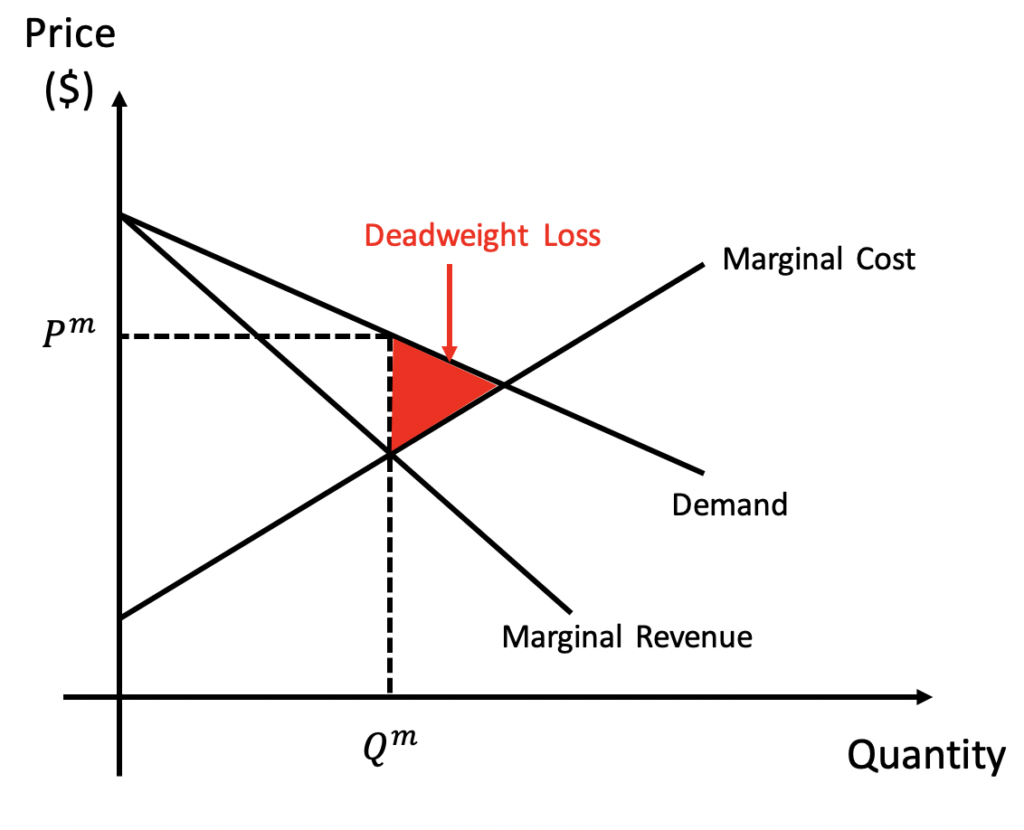

Platforms such as Amazon and Apple charge positive prices for most of their products and services, so standard approaches for analyzing antitrust harm may readily be employed. By way of example, Figure 1 shows the deadweight loss associated with the exercise of monopoly power. As discussed in more detail below, (a) an initial first step is to empirically link a specific business practice (e.g., a merger, self-preferencing, or tying) to higher pecuniary or shadow prices, and (b) the mere fact that a firm charges a price in excess of marginal cost does not indicate that consumers would benefit from intervention.

Figure 1

Some platforms (e.g., Google and Facebook) provide some services to consumers free of charge. One might imagine that the marginal cost to Google (or Facebook) when a consumer makes an additional internet search (or post) is essentially zero. Based on the pecuniary prices that Google and Facebook charge consumers for these services, one might reasonably conclude that there is no evidence of an exercise of market power; the pecuniary prices for these services are socially efficient—despite each firm’s dominance.

However, we note that these platforms operate in two-sided markets that serve not only consumers but also advertisers. It is possible that the pecuniary prices Google and Facebook charge advertisers on Madison Avenue and elsewhere exceed competitive levels. It is also possible that Google and Facebook are charging consumers shadow prices that exceed relevant marginal costs. Again, empirical examination of these possibilities—and whether other forms of advertising discipline the prices these platforms charge advertisers—would be necessary before reaching such conclusions.[28]

The next section discusses in more detail issues related to shadow prices; we defer a more detailed discussion of two-sided markets to Section III.

2. Examination of Shadow Prices

Non-price elements of competition can also impact consumer welfare. For example, competition can impact a firm’s incentive to protect sensitive data or to ensure that the platform accounts for consumers’ privacy preferences. Likewise, competition can impact Facebook’s incentive to provide the quality of features desired by consumers; it can also impact Google’s incentives to return quality search results. As discussed below, one can use shadow prices to examine how non-price elements of a firms’ decisions impact consumer welfare. [29]

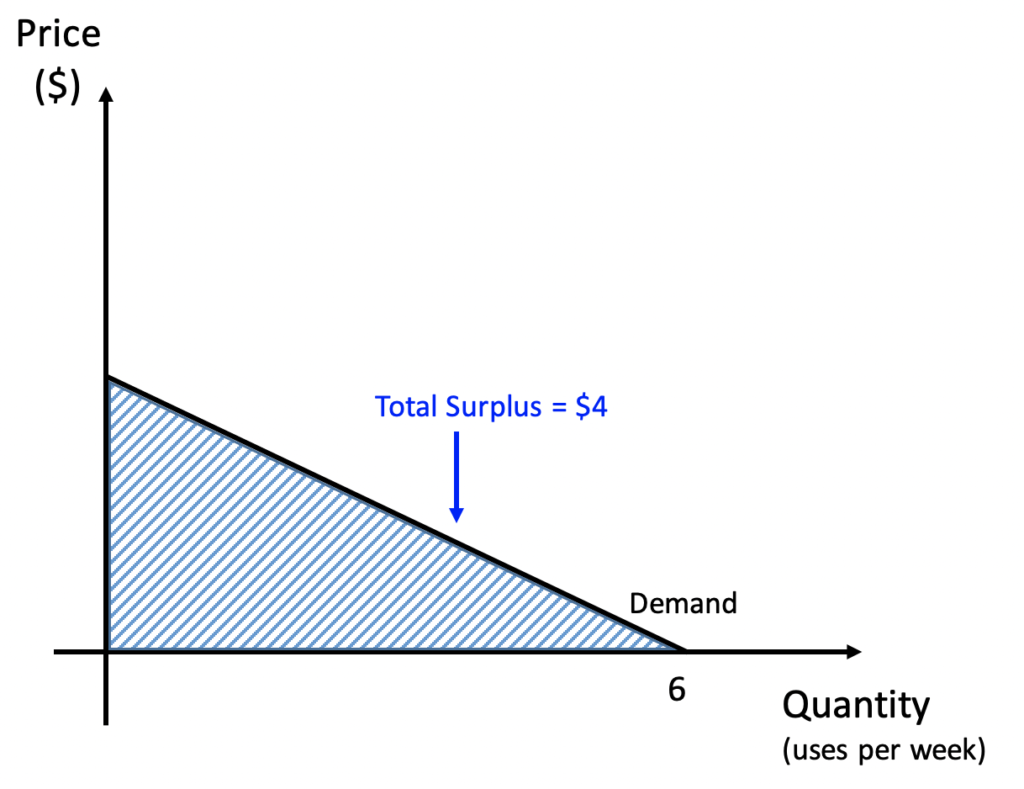

To illustrate the use of shadow prices in situations where consumers do not pay a pecuniary price, consider the case of Google Maps. Figure 2 illustrates the hypothetical demand by a consumer for using Google Maps—that is, the consumer’s marginal willingness-to-pay for each additional use of the app. Since the pecuniary price of using Google Maps is zero, this hypothetical consumer uses the app an average of six times per week at that price. The shaded area represents the total surplus ($4) the consumer receives each week from using the software “for free.” Similar to the case of internet search, Google’s zero pecuniary price is arguably efficient, given that the marginal cost to Google if the consumer uses the app for an additional trip is likely small. However, a zero pecuniary price is not sustainable in light of Google’s fixed costs of providing and maintaining the service. Google must somehow monetize the value it provides consumers in order to sustain this “free” service. One way of doing so is to require users to give up their location data as “payment” for using the app. This, of course, presumes that the data has economic value to, e.g., advertisers.

Figure 2

To be concrete, suppose (a) Google requires a user of Google Maps to disclose his or her location data with zero privacy or security protection, and that (b) the consumer’s shadow price of using the app with zero data protection is $3. In this case, the consumer will choose to use Google Maps because the total surplus of doing so ($4) exceeds the shadow price ($3) of using the app. Notice that the consumer’s cost of using Google Maps isn’t the zero pecuniary price, but the $3 shadow price. Nonetheless, despite the absence of any privacy or security protection, this consumer finds it optimal to use Google Maps and is better off as a result of this transaction with Google.[30]

The fact that this consumer is willing to make the transaction does not mean that the level of privacy or security protection offered by Google is efficient. In this example, starting at zero security, our hypothetical consumer would be willing to pay a shadow price of $3 to marginally enhance security. Zero security is socially efficient if Google’s cost of incrementally enhancing security is $3 or more; it is socially inefficient if the incremental cost is less than $3. Thus, an examination of the efficiency of a company’s privacy policy requires, at a minimum, estimates not only of shadow prices but the costs of providing enhanced security (including potential implicit costs related to quality degradations or inconvenience costs stemming from security enhancements).

In practice, the actual calculus is more complex. We discuss this in more detail later; for now, we simply note that the costs of privacy and data protection typically involve significant fixed costs, and that the benefits of a given investment in data protection typically extend to all consumers. By way of example, if there are 10 million identical consumers, the incremental benefit of privacy or data protection is $30 million (= $3 x 10 million). If the cost of providing this incremental level of data protection is $30 million or more (less than $30 million), the status quo level of protection is efficient (inefficient). As discussed in more detail below, this simple illustration ignores a host of other factors that make the analysis more complex, including heterogeneities in consumer preferences, nuances associated with two-sided markets, demand and/or cost complementarities, network effects, and economies of scale or scope, among other things.

We conclude by noting that these considerations are also relevant when the pecuniary price is positive rather than zero. In short, an evaluation of whether a platform is exercising market power by restricting output or quality (thus raising pecuniary or shadow prices) requires an evaluation of pertinent costs and benefits. As a general matter, it may be efficient or inefficient for a platform to engage in behavior that appears to “skimp” on data security or “monetize” consumer data—even though such business practices might seem harmful (e.g., selling consumer data or steering consumers to products or services that the platform can monetize).

II. What’s the Source of the Market Power?

Regardless of whether one’s concern is that a market is highly concentrated or that a firm enjoys significant market power, it is important to understand the economic reasons a firm might enjoy market dominance or market power. Failure to do so may lead to well-intentioned policies having adverse, unintended consequences on consumers and social welfare.

A. Natural Monopoly

Popular wisdom is that a market served by many firms is good and that markets served by monopolies are bad. The theory of natural monopoly identifies situations in which this popular wisdom is wrong, in the sense that (a) breaking up a so-called dominant firm (or blocking mergers that would enhance concentration) results in inefficiencies that harm, rather than benefit, consumers, and/or (b) the presence of a monopoly or dominant firm may be a natural outcome of fair competition. Expressed differently, evidence that a platform’s pecuniary or shadow prices are substantially above marginal cost—or that a platform has a dominant position in one or more putative relevant markets—does not always imply that consumers would be better off by regulating or breaking up the dominant firm.

In the discussion below, we use the term natural monopoly to denote a situation where a single dominant platform arises “naturally,” as a result of market fundamentals rather than anticompetitive behavior by the firm. As we discuss later in this chapter, factors contributing to natural monopolies are important to consider when evaluating the potential benefits and costs of regulatory actions that are targeted at dominant firms.

1. Cost/Technology-Based Factors

We first discuss cost and technology-based factors that are important to consider in markets dominated by large firms. We begin by examining economies of scale, economies of scope, and cost complementarities.[31]

a. Economies of Scale

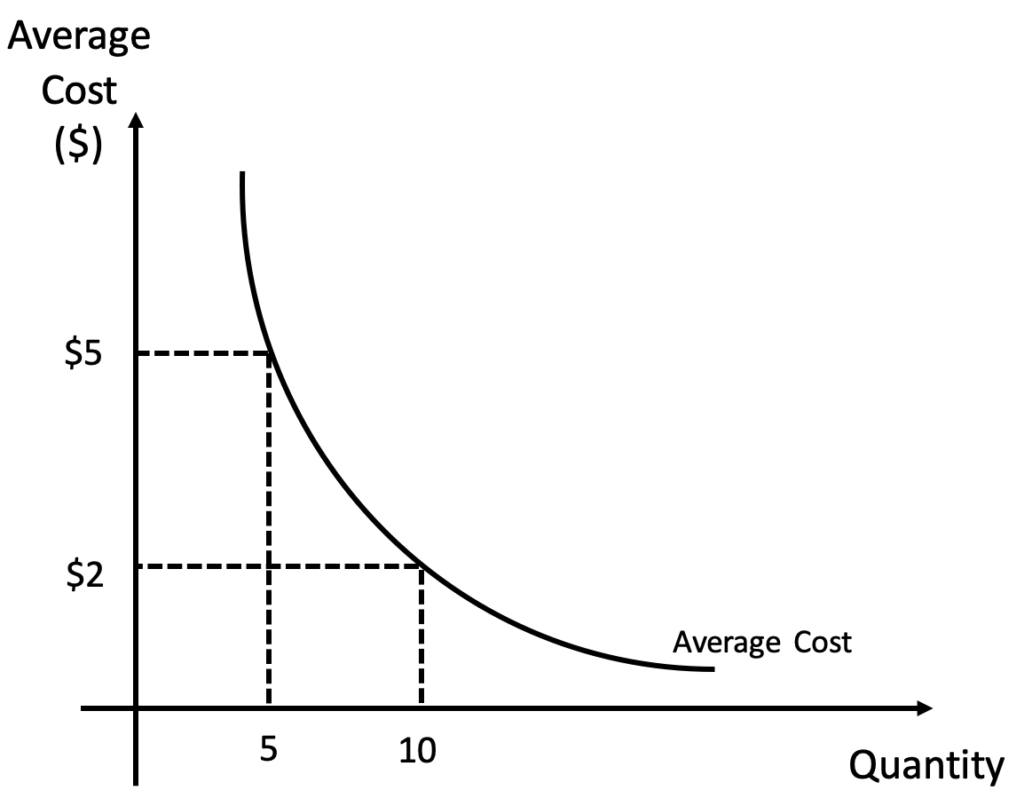

A firm enjoys economies of scale when its long-run average costs decline as it expands output.[32] Formally, if C(q) denotes a firm’s cost of producing q units of a product or service, economies of scale are present when AC(q) = C(q)/q is decreasing in q. Among other things, this implies that a single firm can produce any given level of output at lower costs than firms that share the market. Expressed differently, monopoly is the cost-minimizing market structure when there are economies of scale.

To illustrate, consider Figure 3. Notice that the average cost curve is downward sloping, which indicates that the firm’s cost per unit sold decreases as the firm produces more output. For example, if the firm produces ten units of output, its average cost is $2. If the firm reduces its output to five units, its average cost increases to $5. In order to stay in business in the long run, the firm must cover its average cost of production; thus, to sustain an output of ten units, the firm must sustain a price of at least $2. Suppose that instead of a single firm producing ten units of output, a regulator divided the firm into two separate firms that each produce five units of output. In this case, each firm would have to sustain a price of at least $5 in order to stay in business. This illustrates that efforts to reduce concentration may have the effect of increasing costs, and ultimately sustainable prices. Ultimately, the impact on consumer welfare depends on whether the reduction in market power associated with enhanced competition is sufficiently large to offset the lost economies of scale.[33]

Figure 3

b. Economies of Scope

Many digital platforms sell multiple products and/or services. For instance, Google offers consumers the use of its search engine (Google search), navigation services (Google Maps), video services (YouTube), as well as smart devices (Google Home). Likewise, it offers businesses multiple advertising services (e.g., Google Ads, YouTube Ads, etc.). A firm like Google enjoys economies of scope when its total cost of producing two or more products and/or services is lower than the total cost when multiple firms produce the product lines separately.[34]

Economies of scope may be thought of as a generalization of economies of scale.[35] By way of example, suppose the total cost to a monopolist of producing five units of one product and six units of another product is $100. Suppose a regulator requires the monopolist to divest one line of its business, such that two independent firms produce the two products. Suppose the costs to one of the resulting firms of producing five units of product one is $60 and the costs to the other firm of producing six units of the other product is $70. Then, total costs after divestiture are $130—that is, $30 higher than if the products were produced by a monopolist. This illustrates that efforts to require a monopolist to divest certain business lines again may have the effect of increasing costs, and ultimately sustainable prices. Ultimately, the impact on consumer welfare depends on whether the reduction in market power associated with enhanced competition is sufficiently large to offset the lost economies of scope.

c. Cost Complementarities

Consider a digital platform that sells multiple products and/or services. The firm is said to enjoy cost complementarities if its marginal cost of producing one product or service declines as it increases its production of another product or service.[36]

By way of example, consider a digital platform that produces two products. The first product is sold in a monopolistically competitive market in which many firms compete by selling differentiated products. The firm is the sole producer of the second product, and thus enjoys monopoly power in its sale. A policy that targets the firm’s monopoly power and reduces the firm’s share of the monopolized market (through divestiture or subsidies to competitors, say) will reduce the firm’s output in the monopolized market. If there are cost complementarities, this output reduction increases the firm’s marginal costs of producing the product it sells in the other market, thereby harming consumers in that market because of the higher prices charged as a result of higher marginal costs.

d. Large (Sunk) Entry Costs

Entry costs drive a wedge between the profits from entering a market and the profits from staying out.[37] By way of example, suppose an existing monopolist charges its 100 customers $10 each for a product that costs the monopolist $8 to produce. Suppose an entrant has a superior technology that allows it to produce the same product for only $7. In principle, this firm could enter the market and price at the monopolist’s cost to corner the market and sell to, say, 150 customers at this lower price. Notice that by entering the firm would earn $1 on each unit sold ($8 – $7), or $150. If the cost of entry exceeds $150, would the entrant find it profitable to enter? It turns out that the answer depends on how much of the entry cost is sunk, that is non-recoverable.

Alternatively, suppose customers are only willing to pay $7 for the entrant’s product, owing to the large investments the incumbent has made toward promoting its brand. In this case, entry requires a substantial investment in branding to induce consumers to be willing to pay $8 for the entrant’s product. Depending on how much of these branding costs are sunk, the entrant may not find it profitable to enter.

e. Superior Technology

Technology can also result in market power or dominance. For example, a firm with a superior technology may be able to produce a given product or service at lower cost than rival firms. Or, for the same cost, the firm with superior technology can provide a higher quality product or service than its rivals.

f. Data as a Barrier to Entry

We conclude this subsection by noting that “Big Data” may itself be a barrier to entry.[38] There may be economies of scale, scope, or cost complementarities with respect to maintaining large databases. Likewise, if a firm has a superior technology for storing, accessing, or utilizing Big Data, it may ultimately be the sole firm that maintains that database. In this instance, the firm controlling these Big Data may exercise market power in a putative “data market” through the prices it charges to store, access, or utilize the data. This highlights examples of tradeoffs requiring empirical analysis to determine whether the beneficial effects of cost savings are sufficient to offset the exercise of market power.

Big Data may also give a firm market power in other (non-data) markets. Specifically, if a single firm controls data that is necessary for entering another market (e.g., map applications, or targeted ads), such data may serve as a natural barrier to entry. More broadly, data may also be a barrier to entry when significant sunk costs must be incurred to acquire data necessary to viably compete.[39] By way of example, it may be difficult for other search engines to attract Google’s customers if Big Data are necessary for returning relevant search results.

2. Demand-Based Factors

a. Consumer Preferences for Potential Substitutes

Implicit in our discussion of cost-based factors is the assumption that there are no close substitutes for the product or service provided by the platform. Whether this assumption holds is an empirical question and depends upon consumer preferences.[40] By way of example, the fact that Sirius/XM is the sole provider of satellite radio services and enjoys economies of scale and scope, potential entry barriers, and potentially even patent protection need not imply market dominance if consumers have good alternatives. On the other hand, if empirical evidence indicates that (based on consumer preferences) terrestrial radio, music downloads, and/or streaming services are poor substitutes for satellite radio services, the aforementioned factors may naturally give rise to market power and/or dominance. In short, cost-based factors cannot be examined in a vacuum; consumer preferences and demand are also relevant.

When consumer preferences result in a relatively modest market demand for a product or service, even modest economies of scale or scope may result in only a single firm being able to serve the market. In contrast, when market demand is large, a market may support multiple firms in the presence of cost-based factors that, on the surface, may lead one to presume market dominance.

These observations are relevant not only for defining putative relevant product markets, but also for assessing potential competitive effects. The absence of substitutes is not the only demand-side factor that may contribute to market dominance. As discussed next, demand-side complementarities may also be relevant.

b. Demand Complementarities

Two distinct products (services) exhibit demand complementarities when a reduction in the price of one product (service) increases the demand for the other product (service).[41] When demand complementarities are sufficiently strong, market structure may naturally evolve to a single firm selling both products.[42] Conceptually, the pricing decisions of a single firm will internalize the impact of pricing one product on the demand for the other product.[43] Among other things, this gives a multi-product firm a natural advantage over two individual firms each selling distinct but complementary products. Turning this on its head, breaking up a dominant firm selling complementary products into two or more firms selling individual products, will—other things equal—result in higher prices.

c. Search Costs and/or Switching Costs

Search costs—that is, consumers’ costs of identifying favorable substitutes—may enhance the market power of a platform.[44] While one might speculate that search costs are de minimis on the internet, academic research indicates that even small search frictions can materially impact the behavior of consumers and firms, and therefore prices.[45]

Switching costs are the explicit and implicit costs a customer must incur to move its business from one firm to another. Switching costs drive a wedge between the value a consumer gets from using the status quo platform and the value enjoyed by using a superior alternative.[46] In extreme cases, this may enable an inferior platform to remain dominant because the switching costs limit consumers’ willingness to switch to a competing platform.

For example, a variety of different switching costs might prevent some iPhone users from switching to Android devices. Such costs might include transferring contacts and photos, learning new user interfaces, the need to purchase/download new apps, and so on. The presence of large switching costs may exacerbate lock-in and therefore contribute to market power and/or dominance.[47]

3. Network Effects and Two-Sided Markets

Network effects can also contribute to market dominance. Broadly, network effects are a form of externalities in which the value one entity obtains from a product or service depends on the number of other entities using that product or service. Network effects can be direct or indirect. Facebook and Twitter are classic examples of platforms exhibiting direct network effects; the value of using either platform increases as additional users are attracted to the platform, since a given post or tweet connects to a wider audience. Apple’s iPhone is an example of an ecosystem where indirect network effects are present.[48] As the number of iPhone users increases, users indirectly benefit because the larger user base induces developers to create more (and/or higher-quality) iPhone apps.[49]

When network effects are sufficiently large, a platform may achieve a critical mass of users, such that the pool of remaining potential users naturally shun other platforms and flock to that platform. This situation is sometimes called market tipping and may result in a single dominant platform. It is important to note that network effects do not necessarily result in markets tipping to the most efficient platform. Furthermore, entry by a superior platform may be hindered by lock-in, even if the cost to an individual user of switching is negligible.[50] Intuitively, the benefit to an individual switching to the superior platform may be dwarfed by the lost network effects if other users do not also switch.

Network effects are especially complex for platforms that serve two-sided markets.[51] Additionally, for some two-sided platforms, competition and efficiency depends on whether customers on a given side of the platform engage in single homing or multi-homing. [52] By way of example, English is a language platform that serves a two-sided market (those wishing to transmit and receive information). We (the authors) engage in single-homing—we exclusively use English as our language platform. But some individuals single-home on another language platform (e.g., Spanish) or engage in multi-homing (e.g., use both Spanish and English to communicate).

As a result of these and other complexities in two-sided markets, the emergence of (or evolution towards) a single, large dominant platform may—as a matter of economic theory—benefit or harm consumers. Ultimately, distinguishing these possibilities is a data-intensive exercise and depends on the environment (including demand, costs, the type and extent of network externalities, and the nature of competition).[53]

B. Potentially Harmful Business Practices

Not all factors that result in dominance and/or market power are natural; a platform may engage in actions designed to weaken, eliminate, or stifle competition. We discuss these possibilities next. Then, we discuss strategies designed to extend market power into markets for other products or services.

1. Strategies to Eliminate or Weaken Competition

While search and/or switching costs are often natural, a firm may intentionally create such costs in an attempt to make it costly for consumers to seek out, or switch to, substitutes. Such business practices may heighten a firm’s market power by eliminating actual or potential competitors.

Another business strategy a dominant platform might use to weaken or eliminate competition is to acquire competitive threats—a practice that is sometimes called “killer” acquisitions.[54] Related, a not-yet dominant firm may merge with formidable competitors in an attempt to become dominant. Our view is that the FTC, DOJ, merging parties (and if necessary, courts) are in a better position to gather the information needed to determine whether a merger is likely to harm consumers than those voicing opinions on traditional and/or social media.[55]

A dominant firm may also use prices as a tool for eliminating competitors. For example, a firm may engage in predatory pricing—that is, charge a price below its relevant unit costs of production in order to drive competitors out of the market.[56] For such a strategy to be profitable, the firm must ultimately be able to recoup the losses incurred by charging higher post-exit prices. A dominant firm may also prevent competitors from entering its market by limit pricing—charging a sufficiently low price that entry is unprofitable.[57]

A multi-product firm may engage in cross-subsidization to eliminate competition in one of its markets. For example, a firm might price one of its products at marginal cost, but below its average total cost, to prevent a would-be competitor from selling this product. The firm subsidizes these losses with profits earned from other product lines for which it enjoys market power.[58] In considering this possibility, it is important to consider that cross-subsidization may be necessary to sustain a platform in a two-sided market. For example, it is not sustainable for Google to provide Google Maps to consumers for free, unless it can somehow subsidize this free service by monetizing consumer data through the sale of another product (e.g., targeted ads). In this case, cross-subsidization may benefit or harm consumers; the efficiency of such a strategy depends not only on shadow prices but also on the costs associated with protecting certain types of user data.

Predatory pricing may be difficult to distinguish from pro-competitive pricing strategies such as cross-subsidization and penetration pricing.[59] Penetration pricing is the practice of charging an initial low price (potentially below marginal and/or average total cost) in an attempt to induce consumers to buy a new product. Penetration pricing is therefore a strategy that may permit firms to overcome lock-in and/or switching costs. While this strategy involves “recoupment” (via higher subsequent prices), it is not designed to drive competitors out of the market but to penetrate a potentially dominated market.

Finally, a platform may take actions that soften competition. One example is strategies designed to raise rivals’ costs. [60] Raising rivals’ costs lessens competitors’ ability to compete in price or quality, and thereby can contribute to a firm’s market power and/or dominance. Another example is softening price competition via collusive strategies embedded inside complex algorithms.

2. Strategies to Extend Market Power

Tying and foreclosure are classic examples of strategies whereby a firm that enjoys market power in one market (e.g., a computer operating system) attempts to extend its market power into another market (e.g., software).[61] The classic example is embedded in U.S. v. Microsoft.[62] At the time (late 1990s), Microsoft’s operating system was a platform that served users, software developers, and original equipment manufacturers (OEMs). In fact, the Microsoft Windows platform was the dominant operating system at the time, and it attempted to leverage this market power into the market for a specific software market (web browsers) by tying the sale of its operating system to OEMs loading its Internet Explorer.

As another example, suppose Google engages in a business practice whereby its search results favor links to products or services monetized or owned by Google. As a matter of theory, it is possible that such “self-preferencing” restricts consumers’ information about the availability of choices, thus harming them either by (a) reducing expected match quality, (b) raising consumers’ search costs and permitting Google to raise prices for these products, or in extreme cases, (c) foreclosing a related market by driving competitors out of business or preventing entry.[63]

III. Assessment of Alternative Regulatory Policies

We now look at potential regulatory tools to remedy potential harm from the business practices discussed above. In looking at these tools, it is important to recognize that different tools and prescriptions require different information in order to implement them and may entail different costs. Examples of tools include blocking mergers, dismantling monopolies, price regulation, privacy protection, and mandated data sharing.

A. Economic Merits of Potential Remedies

1. Divestiture/Break-up/Moratoria on Mergers

One tool that might be used to protect consumers from a dominant firm’s market power is to break the large firm into smaller firms (as was the case in the famous Standard Oil and AT&T cases[64]), or more commonly since the Hart-Scott-Rodino Antitrust Improvements Act of 1976, to require divestitures when evidence indicates that a merger is likely to elevate prices, reduce product and/or service quality, or otherwise harm consumers.

The economic rationale for such break-ups or moratoria on mergers is that, other things equal, consumers benefit from enhanced competition.[65] In many market environments, enhanced competition makes the demand for any given firm’s product more elastic, thus inducing firms to lower prices. However, competition also results in firms splitting market demand, and therefore reducing the scale of their operations. As discussed earlier, when there are economies of scale, scope, or cost complementarities, this can result in higher costs that tend to elevate prices. Whether consumers ultimately benefit depends on whether the reduction in market power is sufficiently large to offset such cost inefficiencies. Because large platforms are likely to enjoy economies of scale, scope, and cost complementarities, careful empirical analysis is necessary to ensure that breaking up a large platform into smaller pieces—or preventing a firm from getting larger through acquisition—will result in sustainably lower prices.

Additionally, it is important to recognize that if the sources of monopoly power or dominance are natural, the market structure may evolve to monopoly following a break-up. This may arise as a result of network effects and tipping, or cost considerations. For example, if consumers engage in single homing on a dominant two-sided platform, the market may evolve back to monopoly after a break-up. As discussed earlier, there is no guarantee that the market will evolve (or tip) to the best platform. On the other hand, if consumers multi-home and market fundamentals can sustain two platforms, a break-up may result in platform competition and superior choices for consumers.

Regardless of whether a dominant platform serves a traditional or two-sided market, under some conditions it may be impossible to sustain multiple firms without subsidizing market participants. For example, this may be the case if total demand is small relative to the firm’s costs or there are large economies of scale or scope.

It is also important to note that forcing a large firm to divest vertical or complementary assets will externalize beneficial demand complementarities, potentially elevating prices. For example, the divestiture of vertical assets may raise prices as a result of double marginalization.[66] Likewise, the divestiture of complementary assets may raise prices; as discussed earlier, a monopolist will charge lower prices for complementary products than two independent firms because it internalizes the beneficial effects of lowering the price of one product through higher demand for complementary products.

In the absence of large sunk entry costs, breaking up a dominant firm may be unnecessary. In this case, if an incumbent platform is charging super-competitive prices for some products or services, existing or de novo platforms may readily enter the product or service space to compete. In these instances, competition and/or potential competition may discipline behavior.

It is also possible that breaking up a dominant firm adversely affects technology and/or quality. While the economics literature identifies theoretical conditions under which a monopoly will innovate more or less than competitive firms,[67] breaking up a dominant digital platform could result in a separation of property rights over complementary technologies. This can result in inefficiencies and/or other challenges, including (a) lost economies of scale, scope, or cost complementarities in innovation, and (b) thorny issues related to standard setting and FRAND pricing.[68]

2. Price Regulation

Regardless of whether the market structure is consistent with natural monopoly, market power generally results in socially inefficient prices. Consequently, even if some of the efficiencies discussed above are present, it is theoretically possible that allowing the dominant firm to persist but regulating price will improve welfare.

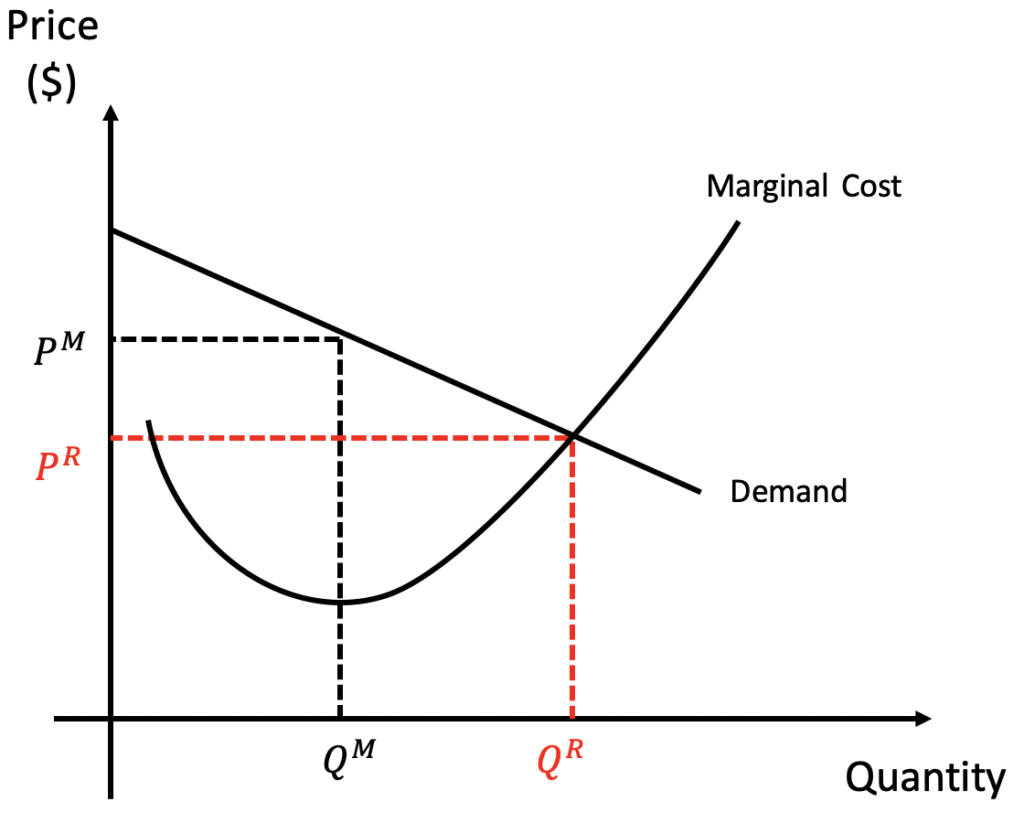

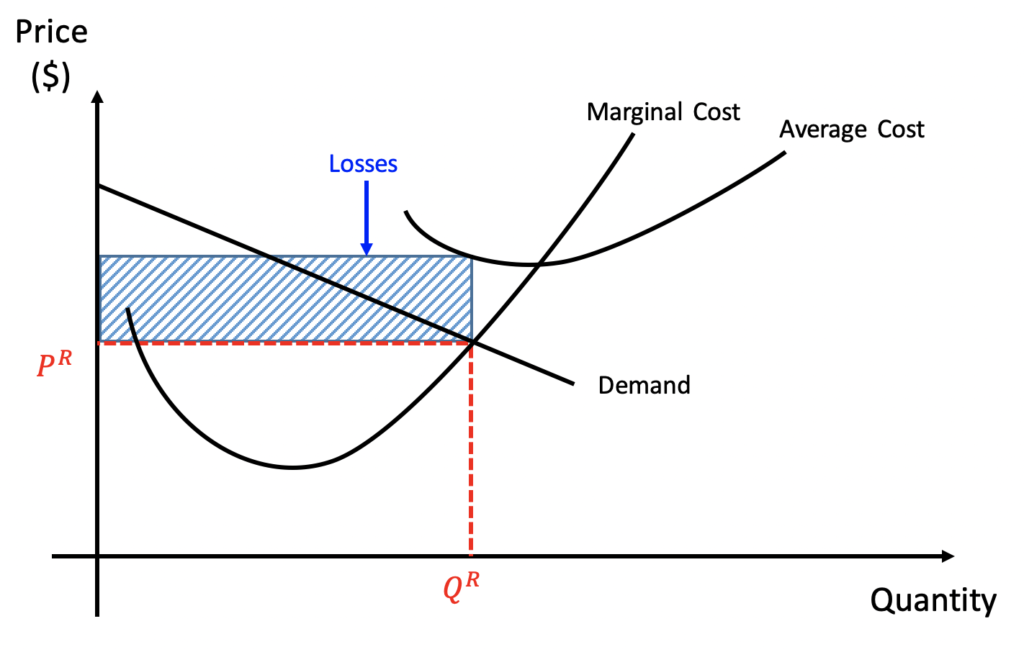

Figure 4 illustrates the potential improvement in welfare arising from price regulation. An unconstrained monopolist will charge the monopoly price, PM, which exceeds the marginal cost of production. In this figure, it is theoretically possible to improve social welfare by regulating the monopolist’s price at PR; consumers get more output at a lower price.

Figure 4

While it is a simple matter to identify the socially efficient price in Figure 4, this is a difficult task in practice. For virtually any market, efficient prices are a function of complex and dispersed information about consumer preferences, firm costs, technology, etc. As evidenced by the failure of the former Soviet Union’s command economy, bureaucrats may be unable to centrally aggregate and process the necessary information and expertise required to set prices efficiently.[69] In addition, the regulatory bureaucracy may be slow to adapt in response to changes in the demand and cost conditions displayed in Figure 4. Consequently, even if a regulator has the requisite information about demand and costs to initially regulate prices efficiently, there is no guarantee that regulated prices will be dynamically efficient over time.

The complexities highlighted in Figure 4 may be exacerbated for digital platforms. The determination of welfare-improving regulated prices is even more complex for such platforms, owing to (a) difficulties in determining welfare-improving regulated prices for multi-product platforms with demand and/or cost complementarities, (b) challenges in efficiently regulating multiple prices for two-sided markets with network effects, and (c) the dynamic nature of technology markets.

Finally, there is no guarantee that socially efficient prices are sustainable. As shown in Figure 5, regulating the price at PR (where price is set at marginal cost) would ultimately drive the monopolist out of business. A regulator may attempt to overcome such problems by imposing second-best (Ramsey) prices, which requires additional information about the firm’s long-run average costs.[70] Or, as discussed below, the regulator may choose to force the firm to price at marginal cost but subsidize the firm.

Figure 5

3. Subsidies

In many digital markets, efficient (first-best) price regulation may require subsidies owing to the fact that marginal or incremental costs are zero or small relative to average costs. Conceptually, Figure 5 shows that a monopolist would require a subsidy of the shaded area in order to cover all of its costs at the first-best price. As discussed earlier, the information required to identify the required the subsidy that sustains first-best prices may be difficult to attain for Big Tech markets, owing to complexities arising from economies of scope, cost and demand complementarities, and network effects arising in two-sided markets.

4. Non-Price Regulation

To the extent that a dominant platform exploits its market power by skimping on product or service attributes valued by consumers, it is theoretically possible for a regulator to impose socially efficient levels of these attributes. For example, a regulator armed with sufficient knowledge and data about the platform’s business might attempt to impose welfare-improving privacy regulations (as attempted by the EU in its General Data Protection Regulation and by the state of California in its California Consumer Privacy Act), restrictions on self-preferencing, or information censorship (e.g., political-balance mandates).

In practice, however, regulators may lack the specific information required to dictate socially optimal levels. Likewise, as discussed concerning price regulation, regulators’ information is often static; even if the regulator can impose regulations that improve current welfare, there is no guarantee that regulation will be dynamically efficient. If the regulator gets it wrong (e.g., imposing too much or too little quality), the outcome of the regulation may be worse than the market solution. For example, if the regulator imposes significant data protection costs, well in excess of shadow prices, some consumers may be harmed as a result of hassle costs or higher prices owing to compliance costs that the platform passes on to consumers. Owing to complexities in Big Tech markets and consumer heterogeneity regarding what are ideal search results or privacy protections, this can be a difficult task.

Another form of non-price regulation is regulating the content provided by a dominant platform. For example, one might be concerned that a dominant firm is attempting to use its market power to skew customers toward its own products or services (e.g., self-preferencing by Google or Amazon in displaying search results). The economic issues here are similar to those discussed earlier regarding tying, so we now consider the skewing of news, videos, or other content.

To be concrete, imagine that the majority of consumers viewing YouTube videos have distaste for videos featuring people wearing blue suits. As discussed above, a profit-maximizing platform has an incentive to internalize externalities on both sides of the two-sided market it serves, and thus may find it profitable to exclude content that features people in blue suits. While such a policy maximizes platform profits and the welfare of the majority of its consumers, such censorship harms some content providers and consumers—namely, those wishing to create and consume content featuring folks in blue suits. In such circumstances, regulation that forces the platform to display videos of people in blue suits may or may not improve overall welfare. But one can also imagine situations where a monopoly platform censors content for reasons that are not motivated by profits (e.g., political preferences). Clearly in these instances, it is theoretically possible that the regulator might improve social welfare by regulating the platform’s content.

In some instances, it may be feasible for another platform to emerge to provide the disadvantaged parties with a blue-suit venue (e.g., both Fox and CNBC can coexist). In instances where it is not feasible for a new platform to emerge that serves these neglected consumers and content creators,[71] regulatory oversight regarding the content that is and is not allowed on the platform could conceivably improve welfare.

An alternative type of non-price regulation involves property rights, where a regulator attempts to improve welfare by eliminating a platform’s property rights over certain elements of its business. By way of example, Big Data are an important feature of many large platforms’ business models. As a matter of economic theory, it is possible to improve consumer welfare by forcing a dominant platform to share its data with competitors. For instance, if Big Data is essential for providing relevant search results and relevant ads to consumers, one could mandate that Google and/or Amazon share its data with competitors. To the extent this enhances competition, consumers may benefit from better search results and advertisers benefit from lower advertising fees.

On the other hand, owing to the complexity of digital and two-sided platforms, it is also possible that such a mandate harms consumers. For example, eliminating the platform’s property rights over data could adversely affect its incentives to collect and protect the data in the first place. Furthermore, forcing the platform to share data with competitors could result in the platform having to charge consumers for services that would otherwise be free (e.g., internet search, Google Maps, YouTube videos). As discussed earlier, cross-subsidization is a common feature of two-sided markets.

5. Maintain the Status Quo

We conclude by noting that in some instances, consumers and competition may be better served by a laissez-faire approach rather than attempting regulatory intervention. As discussed below, one potential advantage of a laissez-faire approach is that it allows for competition and the incentives of potentially better-informed market participants rather than bureaucrats to guide decisions, and the evolution of markets to discipline or supplant the products and services of firms that may be exercising market power. Our discussion includes the dynamic nature of technology markets, incentives of platforms in two-sided markets, incentives of regulators, the complexity of digital platforms, and unintended consequences of regulations.

Dynamic Considerations. It is well-established that technology markets are highly dynamic (e.g., Moore’s Law[72]). While it may be tempting to intervene in an attempt to remedy an immediate concern, history suggests that competition often permits new and superior technologies to supplant entrenched ones. We recognize that policymakers often operate on two, four, or six-year time horizons, but the long-run disciplining forces of dynamic competition may well be superior to regulatory intervention.[73]

By way of example, consider the putative monopoly power of an internet service provider (ISP). There are numerous “possibility theorems” regarding how an unrestrained monopoly ISP might harm consumers or competition. For instance, there are scenarios in which (a) the monopolist can profitably tie its ISP services with online content to weaken or foreclose competition with content providers such as Netflix,[74] (b) the monopolist can profitably bundle its ISP services with content to extract additional surplus by forcing consumers to make “all-or-none” decisions,[75] or (c) the monopolist is unable to profitably use these or any other strategies to harm consumers or competition.[76]

Concerns such as these are not new; twenty years ago, an important policy question was whether ISPs could leverage their market power to harm consumers. A retrospective look at the ISP industry in the U.S. demonstrates that the dynamic nature of technology markets largely protected consumers and competition from harmful possibilities such as (a) and (b) above—regardless of whether industry conditions satisfied the assumptions of a particular possibility theorem at some static point in time. At the dawn of the 21st Century, the vast majority of U.S. households connected to the internet using a dial-up connection. According to the FTC, at the time America Online (AOL) was “. . . the leading provider of narrowband internet access, with a share of approximately 50 percent of narrowband subscribers [and was] positioned and likely to become the leading provider of broadband internet access as well.”[77] Despite its significant first mover advantage—and the huge arsenal of content it acquired through its merger with Time Warner in 2001 (including motion picture production capabilities, television programming, home video distribution, traditional and online magazines, and book publishing)—AOL-Time Warner was a non-player by 2003 when it announced the largest corporate loss in U.S. history for the year ended December 31st, 2002.[78]

This does not imply that prospectively, it is foolish to worry about possibilities of harm. This episode is simply a reminder that the competitive landscape can turn on a dime, especially in Big Tech. The evolution in the ISP market continues; today households in most locales have numerous options for internet connectivity, including cable, DSL, satellite, and mobile. Any of these options offers vastly superior reliability and bandwidth compared to AOL’s “dominant” position in dial-up (narrow band) internet. Additionally, the identities of the dominant players have also changed over the past twenty years. Over the next decade, additional technological advances are likely to lead to new and better options for consumers—and potentially new competitors. Complementary enhancements in compression technologies are likely to further narrow the gap users experience associated with using various methods of connecting. While many consumers have only one option for a top-end internet connection (e.g., Gigabit fiber cable), it is an empirical question whether—now and in the future as technology continues to evolve—consumers could defeat price increases imposed by a Gigabit service provider by substituting toward alternative (non-fiber) connections. Even in the future, empirical evidence will be necessary to determine whether novel lower-priced, lower-quality (compared to Gigabit fiber optic) connection technologies (e.g., 5G, low-orbit satellite) are close substitutes for existing home internet technologies. It is important that such empirical evidence is based on data reflecting currently available options and not technologies that have been, or are being, supplanted.[79]

Finally, it is well-established that there are economic limits on the ability of any organization to grow without bound.[80] It is therefore prudent to account for the impact of organizational costs on a firm’s incentive to grow when estimating the future size of a digital platform, and not simply to assume linear or exponential growth.[81]

Platform Incentives. As we have already noted, the welfare effects arising from a platform’s relative or absolute size depend on industry fundamentals and the nature of its conduct, so one must be leery of generalizations and recognize that platforms often serve two or more sides of putative markets. Sound public policy accounts for the welfare of all platform participants—not just those on one side.

To illustrate, consider the Baye-Morgan model of a two-sided market.[82] Initially, consumers are domiciled in geographically separate towns served by local monopolists. Transportation costs prevent consumers from purchasing from stores in other locations, so they have no option but to pay monopoly prices. An entrepreneur invests a sizeable sum to create an online shopping platform that expands the options of consumers and merchants. Each local merchant can now pay the platform a fee to advertise its product on the platform and potentially gain access to consumers in distant towns. Likewise, consumers can pay to access the platform’s website. This provides them with an option to purchase a product from a merchant in a distant town if it offers a better price than their local monopolist. If the platform is free to charge customers on each side of its two-sided market whatever fees it wishes, what fees will it set and how does this impact the welfare of its customers (e.g., consumers and merchants)?

Baye and Morgan show that the platform maximizes its profits by attracting consumers via low (potentially zero or even negative) access fees. This creates a virtuous circle, whereby merchants are willing to pay the platform for the privilege of advertising their prices in an attempt to attract consumers located far from their physical stores. The platform’s pricing strategy induces more and more consumers to shop on its platform, providing firms stronger and stronger incentives to advertise on the platform to reach these consumers. Even though this strategy may ultimately (and naturally) result in a single or dominant online shopping platform, consumers are the unambiguous beneficiaries: They pay lower average prices and enjoy greater consumer surplus. Merchants, on the other hand, are unambiguously worse off; absent the platform, each merchant could charge monopoly prices to their local customers.

The Baye-Morgan model highlights that a platform’s business decisions can have quite different effects on the welfare of customers on different sides of the market it serves: The creation of the platform benefits consumers and harms merchants. It follows that intervention policies can also have disparate effects in two-sided markets. For instance, banning the platform would benefit merchants but harm consumers. Expressed differently, policies enacted to protect businesses from the tactics of a dominant platform may harm consumers.

In contrast to policymakers who may solely focus on the welfare of customers on a single side of a two-sided market, platforms make business decisions that take into account the preferences and incentives of all its customers. In fact, in some instances, platform incentives are aligned with the total surplus of all platform participants, not merely a particular type of customer. To illustrate, consider the Baye-Sappington model of an online shopping platform.[83] The platform may choose to keep data on consumer transactions (e.g., their willingness to pay for a product) private, or not. Sophisticated consumers recognize that, absent privacy, a merchant might use prior transactions data to infer their reservation price. Unsophisticated consumers are naïve and do not take this into account. Baye and Sappington examine the unique perfect Bayesian equilibrium pricing strategies that arise in signaling equilibria with and without privacy. They conclude that “. . . total welfare, platform profits, and the welfare of sophisticated consumers are maximized when the platform provides transactions data to third parties. Consequently, under a laissez-faire policy that permits the platform to implement its preferred privacy policy, the platform will adopt the privacy policy that maximizes the welfare of sophisticated consumers. This privacy policy is not ideal for unsophisticated consumers, however. It is also not the best policy for all merchants.”

This illustrates that a dominant platform’s incentives may be more closely aligned with total welfare than the welfare of a particular individual or a group of participants (who may engage in rent-seeking or rent-protecting activities to influence policy). This is because two-sided platforms internalize externalities on the other side of the market.

Regulatory Incentives. In instances where platform incentives are not aligned with social welfare, one could in principle supplant platform incentives with regulation. It is important to recognize, however, that regulators are themselves economic actors and have preferences that may not perfectly align with social welfare. This raises the question “Quis custodiet ipsos custodes?” or “Who regulates the regulator?” Consider our example where a regulator imposes rules regarding the ability of a platform to display videos featuring people in blue suits. If the regulator dislikes content featuring people in red suits, what prevents her from censoring that content? Or, if the regulator is driven by other motivations—such as political success or campaign contributions—this could drive her to cater policies to the preferences of her median voter or median contributor rather than the preferences of all market participants.

Complexity. It goes without saying that the data, algorithms, and computer programs that underlie Big Tech markets are highly complex. This may make it difficult for elected officials and regulators with laudable intentions to: (a) identify and implement feasible remedies or regulations, (b) to identify problems worthy of scarce regulatory resources, and (c) to ensure that harm from unintended consequences does not outweigh potential benefits of regulation.

By way of example, Section 1 of the Sherman Act states that “[e]very contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is declared to be illegal.”[84] As a matter of economics, any useful contract necessarily constrains behavior in one way or another, thus rendering all of them illegal with a literal interpretation of the Sherman Act. It has taken years for courts to attempt to remedy this through various interpretations. As another example, it is well documented that airline regulation (stemming from concerns regarding the dominance of large carriers and their cost advantages over potential entrants) provided incumbents with incentives to compete in non-price attributes (free drinks, playing cards) that consumers did not value as much as lower fares.[85] Similarly, rate regulation of public utilities resulted in well documented distortions in their incentives to invest in capital equipment.[86]

B. Other Regulatory Considerations

1. Heterogeneous Impact

While it is often convenient to couch policy in terms of “consumer welfare” or harm to competition, it is important to recognize that policies may have a heterogeneous impact on different market participants. Regulatory policy, therefore, often makes normative judgments regarding which consumers benefit and which are harmed by regulation. We conclude this section with two examples.

Consider first privacy regulation. As discussed earlier, the Baye-Sappington model predicts that a privacy policy that precludes a platform from sharing (or selling) transactions data to third parties harms sophisticated consumers while benefiting unsophisticated consumers. A laissez-faire policy results in the platform maximizing its profits by selling transactions data to third parties, and in-so-doing maximizes social welfare. Sophisticated consumers prefer this policy to intervention, while unsophisticated consumers fare better under regulation. While this result is specific to transactions privacy, it illustrates that some consumers may win while others lose as a result of a well-intentioned privacy policy. Likewise, their results imply that privacy policies may benefit some merchants at the expense of other merchants.

As another example, consider horizontal mergers. An et al. (2017) estimate a structural model of price competition on a platform and provide empirical evidence that competition differentially impacts different types of consumers.[87] Their results imply, among other things, that blocking mergers short of monopoly may benefit some consumers, but at the expense of others.

As discussed below, these and other aspects of regulatory decisions may result in policies that benefit some market participants, at the expense of other market participants and social welfare as a whole.

2. Rent Seeking and Regulatory Capture

Heterogeneous impact of regulatory policies provides incentives for individuals who benefit or are harmed by business or regulatory decisions to engage in lobbying and/or rent-seeking to enhance their own welfare at the expense of others. For example, the Baye-Sappington model is an example of an environment where certain merchants and/or consumers have an incentive to lobby or otherwise engage in rent seeking activities to promote privacy regulation prohibiting a platform from selling transactions data to third parties. Even ignoring the fact that expenditures on such efforts are socially inefficient, in their model such a policy not only reduces social welfare but harms other merchants and consumers.

In addition to rent seeking, regulatory capture is also potentially a concern. That is, regulators may themselves become dominated or reflect preferences of certain market participants rather than the “public interest.” While it is common to view regulatory capture as an industry “capturing” regulatory power, this need not be the case. Regulatory capture could occur regardless of whether one appoints the CEO of Arch Coal or the executive director of Greenpeace as the administrator of the EPA if their regulatory decisions reflect their own preferences rather than the public interest.

Regulatory capture may result in incumbents advocating for regulation to protect themselves from competition. For example, an incumbent with an inferior technology and/or data may advocate for technology- or data-sharing policies to protect their rents rather than to protect consumers. Or, an incumbent with superior data and/or technology may advocate for regulation to protect itself from competition by an innovator.[88] It is not always obvious that a regulator’s behavior is designed to protect only a subset of market participants; because regulatory compliance is costly, policies that appear to protect consumers may actually be designed to disadvantage rivals. For example, to the extent that it is more difficult for small firms to comply with privacy regulations, seemingly desirable regulations may merely be a guise to protect large incumbents by preventing entry or driving smaller firms out of the market.[89]

3. Opportunism and Other Effects

Regulation can also result in distortions that stem from firms’ incentives to exploit information asymmetries. For example, price regulation may be socially efficient when economies of scale or scope result in a single efficient producer, but subsidies may be required to induce efficient levels of output. Efficient price regulation and subsidies require information about firm costs, which, owing to the complexities discussed earlier that arise in Big Tech markets, may be difficult to obtain. Additionally, price regulated firms may reduce quality or distort costs in an attempt to enhance their profits or to increase subsidies. Economic theory predicts these distortions may arise because of moral hazard stemming from asymmetric information regarding actual demand and costs. [90]

Distortions stemming from asymmetric information can also impact innovation. Because the regulator—not the firm—captures profits associated with innovation (either cost-saving or quality-enhancing), regulation may distort a firm’s innovation incentives.

IV. Make an Evidence-Based Decision

This chapter has highlighted a plethora of factors which, as a matter of economic theory, may rationalize regulatory intervention or laissez-faire policies in Big Tech markets. It would be a mistake to simply cherry-pick theoretical possibilities supporting a particular approach. The issues underlying Big Tech industries are highly complex. Qualitatively, some factors (e.g., cost complementarities and economies of scope) may support a more hands-off approach, while others (e.g., naked attempts to enhance market power) may support intervention. Ultimately, it is necessary to quantify these qualitative factors to determine whether a specific type of intervention is likely to benefit or harm consumers and competition.[91] It is also important to recognize that—owing to the complex nature of network effects in two-sided markets—quantifying all of these effects may be difficult. By way of example, if a qualitative problem on one side of a two-sided market is quantified, the associated remedy (e.g., divestiture or price regulation) may adversely impact participants on the other side of the market and/or unrelated markets served by the platform. Failure to include these effects in the quantitative calculus may result in unintended harm.

Likewise, it is important to recognize that intervention need not be a binary decision. By way of example, owing to economies of scale and scope, as well as complex network effects in two-sided markets, quantitative evidence may suggest that breaking up a large platform would ultimately harm rather than help consumers after aggregating across all products and services provided by the platform. Quantitative evidence might also inform whether regulators are likely to have the information required to engage in efficient price regulation. In these instances, quantitative evidence might indicate that a softer form of intervention (possibly requiring the platform to provide certain data to competitors at certain prices) would improve consumer welfare. Or, the quantitative evidence might indicate that it would not. Ultimately, protecting consumers and competition requires evidence-based decisions rather than decisions based on possibility theorems.

Footnotes

* Kelley School of Business, Indiana University. We are grateful to Holly Brueggman, Marihah Idroos, Hyun Ji Joo, and Kevin Wang for research assistance and numerous coauthors and colleagues for valuable insights as well as comments on earlier drafts.

[1] See, e.g., Charles Duhigg, The Case Against Google, N.Y. Times Mag. (Feb. 20, 2018), https://www.nytimes.

com/2018/02/20/magazine/the-case-against-google.html.

[2] Robert Epstein, To Break Google’s Monopoly on Search, Make Its Index Public, Bloomberg (July 15, 2019), https://www.bloomberg.com/news/articles/2019-07-15/to-break-google-s-monopoly-on-search-make-its-index-public (“Google is especially worrisome because it has maintained an unopposed monopoly on search worldwide for nearly a decade. It controls 92 percent of search, with the next largest competitor, Microsoft’s Bing, drawing only 2.5%.”).

[3] Lina Khan, Amazon’s Antitrust Paradox, 126 Yale L.J. 710, 770 (2017) (“Through its purchase of Quidsi, Amazon eliminated a leading competitor in the online sale of baby products. Amazon achieved this by slashing prices and bleeding money, losses that its investors have given it a free pass to incur—and that a smaller and newer venture like Quidsi, by contrast, could not maintain.”).

[4] Eugene Kim, Amazon Has Been Promoting Its Own Products at the Bottom of Competitors’ Listings, CNBC (Oct. 2, 2018), https://www.cnbc.com/2018/10/02/amazon-is-testing-a-new-feature-that-promotes-its-private-label-brands-inside-a-competitors-product-listing.html (“‘If you’ve got Amazon brands competing against you, it’s just become that much more difficult to be competitive in the marketplace,’ said Jeff Cohen, the marketing chief of Seller Labs, a company that helps sellers advertise on Amazon.”).

[5] See, e.g., Gilad Edelman, Why the FTC Wants to Revisit Hundreds of Deals by Big Tech, Wired (Feb. 12, 2020), https://www.wired.com/story/ftc-special-order-review-big-tech-killer-acquisitions/; Brian Fung, FTC probing Big Tech’s Past Acquisitions, CNN (Feb. 11, 2020), https://www.cnn.com/2020/02/11/tech/ftc-tech-acquisitions/index.html.

[6] Annie Palmer, Amazon Uses Data from Third-Party Sellers To Develop Its Own Products, WSJ Investigation Finds, CNBC (Apr. 23, 2020), https://www.cnbc.com/2020/04/23/wsj- amazon-uses-data-from-third-party-sellers-to-develop-its-own-products.html (“Amazon uses data from its vast network of third-party sellers to determine what new products it will create . . . some Amazon executives had access to seller data that was then used to discover bestselling items they might want to compete against.”).

[7] See, e.g., Christopher Carbone, DC Sues Facebook over Cambridge Analytica Privacy Scandal,” Fox News (Dec. 19, 2018), https://www.foxnews.com/tech/dc-sues-facebook-over-cambridge-analytica-privacy-scandal; Olivia Solon & Cyrus Farivar, Mark Zuckerberg Leveraged Facebook User Data to Fight Rivals and Help Friends, Leaked Documents Show, NBC News (Apr. 16, 2019), https://www.nbcnews.com/tech/social-media/mark-zuckerberg-leveraged-facebook-user-data-fight-rivals-help-friends-n994706.

[8] Len Sherman, Why Facebook Will Never Change Its Business Model, Forbes (Apr. 16, 2018), https://www.forbes.com/sites/lensherman/2018/04/16/why-facebook-will- never-change-its-business-model/#3dfe1a5964a7 (“. . . the price advertisers are willing to pay Facebook to invade users’ privacy is vastly greater than the price most consumers would be willing to pay Facebook to protect their privacy.”).

[9] See, e.g., Tara Lachapell, For Streamers, the Great Unbundling Was Too Good to Be True, Wash. Post (Nov. 13, 2019), https://www.washingtonpost.com/business/for-streamers-the-great-unbundling-was-too-good-to-betrue/2019/11/13/9bd6bd82-0615-11ea-9118-25d6bd37dfb1_story.html; Jacob Kastrenakes & Nilay Patel, Google Will Start Charging Android Device Makers a Fee for Using Its Apps in Europe, The Verge (Oct. 16, 2018), https://www.theverge.com/2018/10/16/17984074/google-eu-android-licensing-bundle-chrome-search/; Annie Palmer, Apple Reportedly Planning a Bundled Digital Media Subscription Plan Launching as Soon as Next Year, CNBC (Nov. 14, 2019), https://www.cnbc.com/2019/11/14/apple-said-to-plan-bundled-services- subscription-plan-for-2020.html.