Introduction

Predation was once among the paradigmatic violations of §2 of the Sherman Act[1] and one of the most controversial parts of antitrust law.[2] In the 1970s, as the consumer welfare revolution in antitrust began to overthrow an old order of competition policy seeking intellectual cover in flawed legal and economic theories—an allegation that perhaps not unsurprisingly is now projected on the revolution itself[3]—reformulating a predation doctrine gone badly awry was necessary to protect consumers.[4] With predatory pricing, a rule that once protected even dominant local firms from the “financial pinch” of competition,[5] and condemned successful retail giants like A&P precisely because of their efficiency,[6] gave way to the sensible economic analysis of a broad spectrum of scholars and judges.[7] Among the many reformers, none were more influential than Professors Donald Turner and Phillip Areeda, whose landmark 1975 article articulated what remains the defining statement on predatory pricing law.[8] Their reformation exposed the then existing predation dogmas and would become the foundation for the new order embodied by the Supreme Court in Brooke Group Ltd. v. Brown & Williamson Tobacco Corp.,[9] which remains a bedrock of Sherman §2 jurisprudence.

This modern view of antitrust has been under attack, as the spirit of antitrust counter-reformation grows in the academy,[10] progressive think tanks,[11] and Congress.[12] While the new economic framework of the consumer welfare revolution has always hosted a robust internal debate aimed at properly calibrating particular legal rules with the best and ever-evolving economic learning,[13] the counter-revolutionaries find a casus belli in the rise of large technology companies like Alphabet, Amazon, Apple, and Facebook that, notwithstanding their great benefits in improving life in America and around the world, are said to represent the failure of antitrust law in the digital age.[14] Commensurate with its importance to the success of the economic revolution in antitrust, the modern doctrine of predatory pricing embodied in both Areeda & Turner’s seminal article and the Supreme Court’s Brooke Group decision is now a central object of opprobrium.[15]

There are two main camps of antitrust reactionaries.[16] The first, associated with what has come to be known as the “New Brandeis Movement,”[17] seeks to replace the consumer welfare standard wholesale and return to the old order of “protect[ing] the ‘opportunity’ of the citizen producer.”[18] For predatory pricing, commentators associated with this school suggest eliminating Brooke Group’s requirement that the “predating” firm have a reasonable likelihood of recouping profits lost from below cost pricing.[19] The other cadre of counterrevolutionaries, while retaining the consumer welfare standard, promise to reinvigorate antitrust analysis through the incorporation of “new” economic theories of harm and the recognition of supposedly unique characteristics of digital markets.[20] To address predation, these revisionists suggest softening Brooke Group’s requirement of proving that a firm has priced below cost, which is said to be ill-suited to the so-called digital “platform” markets where the technology giants and many others compete.[21]

Having overcome the sirens’ song of 1960s’ structuralism by tying itself to the Brooke Group mast, predatory pricing law must now steer clear of the Scylla and Charybdis of the neo-Brandeisians and the progressive economists. Indeed, rather than reflect novel approaches to a complex area of antitrust law, these ideas mostly repeat the legal and economic thinking of earlier generations that the economic revolution in antitrust eclipsed both in theory and in practice.[22] Specifically, in digital markets, the recoupment requirement that the neo-Brandeisians would eschew is essential to evaluate predatory pricing and protect consumers.[23] Furthermore, while the progressive economists who question the use of a price-cost test in digital markets raise important issues that may on occasion require nuanced application of the principles already articulated in Brooke Group and Areeda and Turner’s article, the legal and prudential necessities of a strict separation between antitrust law and price regulation—including the need for rules that generalist judges can administer in a system dominated by cases private litigants file—militate against holding firms liable for prices above an appropriate measure of costs.[24]

This chapter proceeds in five parts. The first provides a brief history of the law and economics of predatory pricing doctrine in the United States, and how a revolution in economic and legal thinking spurred by Areeda and Turner’s seminal work led to Brooke Group and replaced the regime typified by the Supreme Court’s troubled decision in Utah Pie Co. v. Continental Baking Co.[25] The second surveys the basic objections to the current consensus on predatory pricing that the two groups of reactionaries have articulated, while the following two parts defend both the recoupment and price-cost prongs as requirements to win predatory pricing claims against digital firms. At bottom, efforts to divorce one prong from the other fail to overcome the powerful and lasting insights not just of Areeda and Turner, but of the very nature of antitrust as a legal regime “passed for the ‘protection of competition, not competitors.’”[26] The last part contains concluding remarks.

I. The Law and Economics of Predatory Pricing

Predatory pricing was a defining antitrust offense when Sherman §2 came of age in Standard Oil Co. v. United States, in which amidst a backdrop of popular outcry[27] the Supreme Court found that John D. Rockefeller’s oil trust had engaged in “local price cutting at the points necessary to suppress competition.”[28] It has also been a consistent concern for those wary of antitrust overreaching.[29] Beginning with United States v. Aluminum Co. of America,[30] which involved predatory overbuying, antitrust policy on predation took a highly interventionist bent, as typified by subsequent decisions against the Great Atlantic and Pacific Tea Company (“A&P”)[31] and in Utah Pie Co. v. Continental Baking Co.[32] This old order, under which liability for above cost pricing could in effect be found without any likelihood that the conduct would increase market power or harm consumer welfare,[33] faced critical commentary from all corners of the law and economics communities,[34] but nowhere with greater influence than in Donald Turner and Phillip Areeda’s landmark article “Predatory Pricing And Related Practices Under Section 2 of the Sherman Act,”[35] now the modern standard for predatory pricing law.[36]

A. Antitrust’s Old Order

Before Alphabet, Amazon, Apple, and Facebook were even a dream, there was A&P—a once great giant in the American economy.[37] As recounted by one commentator,

By 1929, when it became the first retailer to ever sell $1 billion of merchandise in a single year, A&P owned nearly 16,000 grocery stores, 70 factories, and more than 100 warehouses. It was the country’s largest coffee importer, the largest butter buyer, and the second-largest baker. Its sales were more than twice those of any other retailer.[38]

Like today’s high-tech giants, A&P’s pioneering business model leveraging scale, vertical integration, and data-based innovation enabled then unprecedented consumer benefits, including lower prices, widespread availability and choice, and improved nutrition.[39] These good deeds would not go unpunished, as the A&P received a maelstrom of public criticism and government scrutiny commensurate with the degree of its creative disruption of the status quo.

To curb the success of chain stores like A&P, Congress passed the Robinson–Patman Act of 1936 (RPA), originally named “the Wholesale Grocer’s Protection Act.”[40] The Act prohibits selling “commodities of like grade and quality” at different prices to different buyers, with exceptions; for example, a seller may defend such differential pricing to buyers on the ground that it makes “due allowance for differences in the cost of manufacture, sale, or delivery” or is necessary to “meet” competition.[41] The main effect of the Act on A&P and other chain stores was to make it harder for them to obtain goods at lower wholesale prices than their smaller competitors.[42]

Unsatisfied with the RPA, in 1944 the DOJ sued A&P and its key executives for criminal violations of the Sherman Act, including predatory pricing. Notwithstanding the immense value it created for consumers, the company was now lampooned as a “gigantic blood sucker” in part because it “sells food cheaply in its own stores.”[43] Instead of a robust case on the merits, the government vaguely accused A&P of engaging since 1925 in a pricing policy whereby “in meeting competition in certain sections [A&P] has so lowered prices as to result in stores in those sections being operated at a loss” so as “to undersell retail competitors and to off-set losses incurred in selected areas at a profit rate below cost of operation.”[44] After the court of appeals affirmed, the government then sought to dismantle A&P, eventually settling when A&P agreed to close down the Atlantic Commission Company, an affiliate which operated as A&P’s purchasing agent for fresh produce and sold its surplus to third-party grocery stores.[45] A&P began its long decline almost immediately thereafter. Once America’s largest retailer for forty years, today A&P no longer exists.

A few contemporary scholars recognized the antitrust crusade against A&P as the bad law and even worse economics it in fact was. Regarding the predatory pricing claims, MIT economist Morris Adelman explained that “[n]o reasonable and prudent A&P management would have incurred losses to drive out competition because it would have been impossible to claim the pay-off,” because “[e]ntry into the food trade was so cheap and easy that any attempt to raise prices would immediately have resurrected competition.”[46] The government’s allegations regarding A&P’s supposed below-cost pricing were equally specious. As Adelman further highlighted, such findings rested more on accounting tricks than economic realities.[47] Related allegations of predatory buying by A&P, whereby A&P was alleged to have forced suppliers to give it deep discounts so that they raised prices to other competing stores with the effect of having the latter “pay part of the low cost of A&P’s operations,” were also faulty.[48] As Marc Levinson concluded, such a theory nonsensically “implies that manufacturers met their profit targets by raising prices to other stores to compensate for their price breaks to A&P. But why would manufacturers have charged other retailers less if only A&P had paid more?”[49]

Notwithstanding being “so sadly illiterate in economic facts and economic analysis,”[50] the Supreme Court would in effect codify this analysis two decades later in Utah Pie Co. v. Continental Baking Co.[51] The defendants there were several national frozen pie companies that had selectively lowered their prices in Salt Lake City to compete more effectively against plaintiff Utah Pie, a local company that controlled nearly two-thirds of the Salt Lake City pie market.[52] None of these defendants plausibly hoped to gain more than a minority share of the relevant market; still less could any of them expect to drive all other competitors from that market and then raise their own prices to monopoly levels, as Utah Pie retained more than 45 percent of that market despite years of competition from national corporations.[53] The Supreme Court nonetheless upheld jury verdicts against the national pie companies because it was troubled that they had lowered prices in Utah and not elsewhere.[54] That tactic, the Court believed, was unduly hard on the local incumbent, which was family operated and had “only 18 employees.”[55] The Court held that antitrust should protect such small companies, even those with high local market shares, from “the financial pinch” they feel when selective price-cutting by larger competitors forces them to “reduce [their] price[s] to a new all-time low in a market of declining prices.”[56]

Like A&P, the Supreme Court’s decision in Utah Pie immediately received strong criticism from across the antitrust and industrial organization communities. Milton Handler, no Chicago Scholar, aptly remarked:

Isn’t the ultimate goal of antitrust a competitive economy with lower consumer prices? Of course, if a seller lowers prices and then raises them to higher levels after driving his competitors out of business, a classic antitrust violation has occurred. The [Utah Pie] opinion’s implication that discrimination leading to a general price decline may, alone, suffice to spell illegality is troublesome.[57]

Indeed, while Justice Potter Stewart was also no Chicagoan, he made much the same point in his Utah Pie dissent:

[T]he Court has fallen into the error of . . . protecting competitors, instead of competition. . . . [The] cases [on which defendants relied] are said [by the majority] to be inapposite because they involved “no general decline in price structure,” and no “lasting impact upon prices.” But lower prices are the hallmark of intensified competition.[58]

Rather than just rubberstamping the faulty reasoning of A&P, Utah Pie and other Warren Court antitrust decisions reflected a unilateral conduct enforcement norm whereby each firm’s “independence and right to be treated as other firms are treated have become values to be protected as ends in themselves.”[59]

Following Utah Pie, the FTC filed three major cases involving predatory pricing claims, perhaps most notoriously against General Foods (“GF”) for allegedly trying to drive Proctor & Gamble (“P&G”) from various eastern U.S. coffee markets.[60] P&G had purchased a strong regional brand, Folgers, which it sought to expand nationwide, and a pro-consumer price war erupted when it entered the heartland of the strongest eastern firm, GF’s Maxwell House. Nonetheless, the FTC sued GF for responding to P&G’s price cutting, and the staff originally proposed the truly extraordinary remedy of mandatory trademark licensing—ignoring the adverse implications on GF’s property rights.[61] The Commission rejected that remedy but filed the case in 1976 after an internal staff struggle requiring four formal Commission meetings.[62]

B. The Legal and Economic Revolution

Few articles played a more formative role in the legal and economic revolution that would define modern antitrust law than Phillip Areeda and Donald Turner’s classic article on predatory pricing.[63] As with the multivolume treatise they would soon begin to publish, Areeda and Turner wished to develop a sensible rule that generalist judges could administer—especially in a system in which the vast majority of cases involved private litigants, not the government.[64] Criticizing the hitherto vague standards courts used to identify predation, the authors contrasted the rational profit-maximizing firm with the strategic predator who may not engage in short-run profit-maximizing, as when it prices below its marginal costs.[65] As Areeda and Turner emphasize, however, marginal costs can be difficult to identify in practice.[66] While it may differ on occasion from marginal cost, Areeda and Turner proposed average variable cost as a surrogate for determining whether a firm is engaging in profit-maximizing behavior, which can reasonably be determined from actual business records.[67]

By analyzing whether a firm prices below its average variable costs, courts can thus separate legitimate pricing from that which may be anticompetitive. Requiring firms to prove that their pricing falls below their average variable costs thus provides a useful screen for determining when low prices violate the antitrust laws. As Areeda and Turner explain, such a screen functions to protect equally efficient competitors and ensures that firms are not penalized for rational short-run profit maximizing behavior: “[e]xclusion by charging prices equal to average cost is also competition on the merits—only those potential entrants who cannot survive at the efficiency-related price are kept out.”[68] Furthermore, while predicating liability on a requirement that a firm prices below average variable cost creates a risk of false negatives when marginal cost exceeds average variable cost, in this scenario the firm is nearing capacity constraints and predation is unlikely because, as the authors state, “the loss of profits would be most severe and new demand could not be easily absorbed by the predator.”[69]

To be sure, a firm may price above its average variable cost to exclude rivals through what is known as “limit pricing.” In this way, a monopolist in a hard to enter business can rationally maximize its profits in the long-run to prevent entry. Yet, as Areeda and Turner note, like pricing that is short-run profit-maximizing, such a practice lowers prices, as the antitrust laws are meant to encourage.[70] More fundamentally, Areeda and Turner argue that even if limit pricing were not competition on the merits in theory, determining the profit-maximizing price would result in the unadministrable exercise of trying to determine whether the short-run benefits to consumers outweigh the long-run harm from the reduction in entry.[71] That is, a “rule forbidding reversal of a price reduction would impose on enforcement agencies and the courts administrative burdens that are not justified by the speculative benefits such a rule might bring.”[72] In the face of such a regime, firms would engage in a “high-price policy in order to be safe”—the exact opposite behavior of what the antitrust laws should encourage.[73]

The requirement that a firm sacrifice short-run profits by pricing below its average variable or marginal costs was, as Areeda and Turner made clear, only a necessary condition for unlawful predatory pricing. Additionally, predation will only make economic sense if the predator can both drive the rival from the market and successfully recover its losses.[74] These conditions capture the essence of the recoupment requirement that is central to the modern rule—namely, that a predator be able not only to exclude competitors, but also recover its losses and harm consumers in the process. Rather than constitute an article of faith for Robert Bork and the Chicago School, then Judge Breyer in his leading opinion in Barry Wright Corp. v. ITT Grinnell Corp. was one of the first to agree, and quoted Areeda and Turner directly on the issue.[75] As we saw above, both Adelman and Handler—again, neither a Chicagoan—in critiquing A&P and Utah Pie also emphasized the importance of recoupment in proving a predation claim.[76]

While the justification for the average variable cost test sounds primarily in administrability, the wide consensus that existed for also requiring proof of recoupment is rooted in the understanding that antitrust law maximizes consumer welfare while minimizing error costs.[77] In complex areas like predatory pricing, where judges may struggle to distinguish anticompetitive and procompetitive behavior, they must take great caution not to condemn procompetitive behavior, given that the conduct alleged to be predatory inherently involves one of the main benefits to consumers of a market system: low prices.[78] In finding that a firm is merely pricing below its costs, courts thus run the risk of condemning conduct that in fact greatly benefits consumers. Through a recoupment requirement, antitrust law avoids “chill[ing] the very conduct the antitrust laws are designed to protect.”[79]

Whereas the risk of false positives—condemning low prices—is acute, predatory pricing was not seen as an area where false negatives—allowing low prices that harm consumers—are likely to arise. As Areeda and Turner made clear, for a predator subsequently to raise prices it must not only drive its rival from the market, but it must also exercise market power to recoup its losses.[80] And yet, predation is a relatively “expensive”[81] form of exclusion, in large part because a war of attrition will be more costly for the predator than the prey precisely in view of the fact that, to win the war, it must expand its production.[82] Furthermore, ease of entry would seem generally to be symmetrical with ease of exit: the easier it is for a firm to drive rivals out, the easier it will be for new rivals to enter the market and prevent the firm from recovering the losses suffered in its war of attrition; by contrast, if entry is difficult due to the necessity of large specific investments, an incumbent may at the same time have a harder time using predation to drive out existing rivals.[83] Unsurprisingly, the case law has not borne out claims about predation’s frequency.[84]

While Areeda and Turner did not develop recoupment to the same extent as the price-cost requirement, this was not because they ignored its importance.[85] Instead, proving recoupment was likely thought to be easier than it is today, consistent with the lingering structuralist bias of the Harvard School at that time—that is, the once popular but since empirically rejected view that increasing concentration to levels today regarded as not problematic was positively correlated with the reductions in economic welfare that the recoupment prong was meant to measure.[86]

It did not take long for the insights of Areeda and Turner and other critics of pre-1980s predation law to influence the Supreme Court. Following its decision in Matsushita Elec. Indus. Co., Ltd. v. Zenith Radio Corp, where it noted in dicta that “predatory pricing schemes are rarely tried, and even more rarely successful,”[87] in Brooke Group v. Brown & Williamson Tobacco Corp., the Court considered price discrimination allegations against Brown & Williamson, the third largest cigarette manufacturer by market share, by the plaintiff Liggett—which had been acquired by Brooke Group—whose share had declined from 20% to 2% by 1980.[88] To regain share, Liggett introduced an economy priced generic segment of cigarettes with a price point below those of the branded cigarettes offered by the larger oligopolists.[89] In response, Brown & Williamson entered the generic market and offered volume discounts to wholesalers, alleged to be below cost, in an attempt to exclude Liggett and ultimately raise prices to consumers through tacit coordination.[90]

Ruling for Brown & Williamson, the Court articulated a two-pronged test that closely approximated Areeda and Turner’s logic of requiring both short-run profit sacrifice and recoupment to prove predation, effectively overruling Utah Pie. For plaintiffs to succeed on a predatory pricing claim, they must prove both that the pricing was “below an appropriate measure of its rival’s costs” and that the competitor had a “dangerous probability [] of recouping its investment in below-cost prices.”[91] In justifying a recoupment requirement, the Court not only reiterated the dicta in Matsushita about the rarity of predatory pricing, but highlighted the specific importance of preventing false positives, stating that “the costs of an erroneous finding of liability are high.”[92]

II. The Antitrust Counter-Revolution

Criticisms of the modern predation doctrine are old hat. The Areeda-Turner article sparked many responses, beginning with F. M. Scherer,[93] then Director of the FTC‘s Bureau of Economics and author of a leading industrial organization textbook, who had supported the General Foods case, including licensing the trademark of GF’s brand.[94] Judge Easterbrook, author of another major article on the subject,[95] even quipped that the main cost of predatory pricing was the sacrifice of the many trees used to produce the voluminous literature (a criterion that of course otherwise did not factor in to his error cost framework).[96] This century has continued to see criticism of the modern approach,[97] and the leading treatise, which still bears Areeda’s name, now written by Professor Hovenkamp, devotes a full volume, published in 2015, to the technical and legal debate, mostly in defense of the modern status quo.[98] Today, the debate has returned, with critics increasingly using digital markets to argue that predation law needs to be revised. It is to those critics we now turn.

A. Populism Again

The first group, the neo-Brandeisians, would eschew the recoupment requirement as part of their broader rejection of the consumer welfare standard.[99] Consider Lina Khan’s widely cited Yale Law Journal student note in 2017, which argues that the consumer welfare standard, or the economics-based methodology of modern antitrust, has “fail[ed] to capture the architecture of market power in the twenty-first century marketplace.”[100] With respect to predation, the introduction of a recoupment requirement to instantiate the consumer welfare criterion “collapsed the rich set of concerns that had animated earlier critics of predation, including an aversion to large firms that exploit their size and a desire to preserve local control.”[101] By rejecting the consumer welfare standard and the recoupment requirement, the neo-Brandeisians recommend “[r]evising predatory pricing doctrine to reflect the economics of platform markets” vis-à-vis a “presumption of predation for dominant platforms found to be pricing products below cost.”[102]

Some of the neo-Brandeisians’ concerns with the recoupment requirement are severable from their broader critique of the consumer welfare standard, and focus on several large, successful digital companies, some of which have large market shares. For the neo-Brandeisians, the existence of network effects in digital markets creates winner-take-all or winner-take-most environments conducive to a strategy of “predatory growth” whereby firms sacrifice “growth over profits” to “tip” the market in their favor to achieve market dominance.[103] Such a phenomena, it is suggested, “undercuts a central premise of contemporary predatory pricing doctrine, which assumes that predation is irrational precisely because firms prioritize profits over growth.”[104]

For the neo-Brandeisians, these network effects not only raise the specter of dominance in platform contexts, but also constitute high entry barriers that protect the winner.[105] Moreover, in addition to high network barriers to entry—which assure the predator that it can recoup its losses effectively—the neo-Brandeisins identify how digital markets can also have low barriers to exit, and thus incentivize predatory conduct in the first place, making predation in these markets a rational strategy “that Bork, and the courts, failed to consider.”[106] Specifically, for some digital firms, such as those in online retailing, exit is said to be relatively easy given that a firm seeking to buy a distressed rival suffering from predation can easily absorb the rival’s intangibles that Khan suggests comprise much of their value.[107]

Consistent with their political aims, a J’Accuse is indispensable, and without question Amazon is the neo-Brandeisians’ favorite bogeyman.[108] Several allegations are commonly raised. After declining Amazon’s initial purchase offer, Quidsi, an online retailer of baby products that Amazon ultimately acquired and which owned Diapers.com, is alleged to have faced 30% price cuts from Amazon for its retail baby products, as well as spurred the introduction of Amazon Mom, which provided customers with additional discounts.[109] Weary of the price war, Quidsi finally agreed to sell to Amazon, who then allegedly raised its prices and reduced Amazon Mom.[110] For the neo-Brandeisians, the Quidsi example encapsulates the error of requiring proof of recoupment in digital markets: not only do “online retailers like Quidsi face high entry barriers,” but also “relatively low exit costs typical of brick and mortar retailers.”[111] Rather than representing competition on the merits, Amazon’s conduct is said to have “sent a clear message to potential competitors—namely that, unless upstarts have deep pockets that allow them to bleed money in a head-to-head fight with Amazon, it may not be worth entering the market.”[112]

Other reasons for eliminating the recoupment requirement highlight the supposed proclivities of digital firms to “raise prices years after the original predation, or raise prices on unrelated goods, in ways difficult to prove at trial,” as well as “raise prices through personalized pricing or price discrimination, in ways not easily detectable.”[113] Here again, the neo-Brandeisians attack Amazon. Besides its conduct toward Quidsi, Amazon is said to have priced bestselling eBooks below cost, which ultimately led to its domination of the market.[114] While Amazon’s practices escaped scrutiny during the DOJ’s lawsuit against Apple, the neo-Brandeisians suggest that Amazon may have obscured subsequent price hikes through both “rapid, constant price fluctuations and personalized pricing.”[115] Moreover, Amazon is said to have recouped its eBook profits in other markets in ways other than raising prices, including by exacting higher fees from book publishers, which is suggested to be beyond the scope of current antitrust doctrine.[116]

Besides discussing Quidsi and Ebooks, the recently released Report of the Majority Staff in the U.S. House Judiciary’s Subcommittee on Antitrust, Commercial, and Administrative Law’s identifies other instances involving alleged predation by Amazon. The Report claims that Amazon has priced several of its Echo products “below cost in an attempt to corner the market for those devices and adjacent markets,” and appears to find a smoking gun in Amazon’s CEO Jeff Bezos’s statement during the Subcommittee’s hearings that Echo is “often on promotion, and sometimes when its it’s on promotion it may be below cost.”[117] Furthermore, promotional bundles or steep discounts for Alexa, Amazon’s voice assistant, are also implicated in “a predatory pricing strategy to increase its sales of smart home devices by pricing its products below cost.”[118] The Report further notes, without explanation, that Amazon’s alleged predation of smart home devices creates significant barriers to entry, perhaps as a nod to the game-theoretic literature.[119]

The two other predation claims raised in the Report more directly implicate Amazon’s broader retail practices. The Report claims that “[t]he most prominent example of Amazon’s use of strategic losses to lock customers into the platform’s ecosystem is its popular membership program, Amazon Prime.”[120] The Report describes Amazon Prime as a “loss-leader” and references rival complaints that “Amazon is ‘[u]nderpricing Prime to consumers to build a huge and highly targetable share of ecommerce demand.’”[121] The Report also suggests that Amazon’s “Can’t Realize Any Profit” policy was deployed in a predatory manner, including by allegedly pricing below-cost on products including ABCBabyFormula.[122]

B. Rejected Economics, Redux

Whereas the neo-Brandeisians primarily criticize the recoupment requirement and the consumer welfare standard that helped produce it, another cadre of counter-revolutionaries, while remaining within a broader consumer welfare framework, appear to instead focus on eliminating Brooke Group’s requirement that the predator’s pricing be below an appropriate measure of costs before it is proscribed.[123] In a noteworthy report on digital markets from the Stigler Center at the University of Chicago, a group of well-known antitrust commentators find that “[p]redatory pricing law should be modified so that it will be better able to combat anticompetitive pricing by digital platforms and other firms,” lamenting that predation law has “been construed to protect only rivals that are equally efficient at the time of the conduct at issue and thus to disadvantage smaller rivals that have not yet reached efficient scale.”[124] This construction, of course, follows directly from the requirement that a predator’s pricing be below its marginal costs, or a surrogate such as average variable costs, suggesting that these critics would support evaluating predatory pricing under the rule of reason consumer-welfare test found in Section 1 cases.[125]

Some commentators see the economics of platforms as grounds to oppose a price-cost assessment as a necessary condition for finding digital firms liable for predatory pricing. Platforms are typically understood as multi-sided markets that both overcome transaction costs and are characterized by mutual, positive, and indirect network effects—the more buyers that use the platform, the more valuable it is to sellers, and vice versa.[126] For Jason Furman, an economist in the Obama administration, the complexity of platform pricing suggests that the very administrability issues that motivated Areeda and Turner’s price-cost test counsel against its use in these contexts: “Multi-sided markets have prices which are dependent between sides, meaning they may not closely reflect costs on each side of the market. This could appear to suggest either uncompetitively high margins or below cost predatory pricing when in fact neither is the case.”[127] Indeed, platforms can even involve negative prices on one side of the platform, which might be viewed as inherently predatory even though they maximize profits across the platform.[128]

Formulating a price-cost test that reflects these market realities can thus be difficult because a platform’s profitability depends not only on the net price—namely, the sum of the prices on both sides of the market—but also on the price structure, which is the ratio between the two prices.[129] Focusing on the net price only, as Michael Katz explains, “ignores the critical lesson of the research literature that, in multi-sided markets, the price structure, as well as the price levels, matter for competition and welfare.”[130] Furthermore, digital platforms often bifurcate their pricing by charging both “access” and “usage” fees depending on multiple factors, including the difficulty of monitoring usage and the nature and degree of the externalities on the platform.[131] This can exacerbate the difficulties of using a price-cost test to evaluate predation by digital platforms.

The difficulties with using net prices in platform businesses also stem from the fact that “two-sided prices can miss predation by mistaking recoupment for two-sided pricing.”[132] This concern is similar to one highlighted by the neo-Brandeisians. But whereas the neo-Brandeisians critique the traditional predation model out of a concern that digital predators could recoup in a market other than the one in which the predation occurred—a spatial modification—this issue raises the possibility of “simultaneous recoupment”—a temporal modification to the traditional two-stage predation model, where a firm may predate on one-side of platform while recouping on the other side of the market.[133] In measuring whether pricing is below cost by viewing both sides of the market, the concern is that conduct that would otherwise be predatory may appear lawful precisely because the predator’s price includes the exercise of the market power it is recouping, resulting in false negatives.[134]

Notwithstanding these concerns, perhaps the principal issue progressive economists raise with applying a price-cost test to evaluate predation claims against technology platforms concerns a cost structure common in digital markets. It is well known that information goods often involve high fixed costs, with low variable costs of production, given significant economies of scale. While this phenomenon is not new to antitrust analysis, digital goods in some cases are believed to have de minimis or no marginal costs (which would be different than other goods that invariably have some physical cost associated with producing them).[135] For the economists in the Stigler Center Report, the zero marginal cost structure of digital markets thus “makes tests that require prices to be below incremental or variable cost almost impossible for a plaintiff to meet.”[136] Indeed, consistent with the dynamics of zero-pricing, these progressive economists also suggest that digital platforms “might be able to copy rivals’ innovations or otherwise increase the value of their services to consumers without pricing below cost.”[137]

III. Reply to Neo-Brandeisians

The neo-Brandeisian criticisms of the recoupment requirement are unpersuasive. Abandoning the recoupment requirement, as part of a broader rejection of the consumer welfare standard, does not confront the very fundamental, still unanswered objections that have been raised for decades and that motivated the economic revolution. Moreover, recognizing that network effects may lead to platform dominance and entry barriers is not the same as showing predation to be a rational strategy in a way that justifies elimination of the recoupment requirement. To the contrary, the core justifications for a recoupment requirement are not specific to traditional industries, have long been articulated by scholars and commentators, and are all the more necessary in technology markets given these markets’ demonstrable dynamism. Equally important, there is a notable dearth of empirical evidence suggesting anticompetitive predation exists, including the examples offered concerning Amazon.

A. Consumer Welfare and Competition

Each of us have addressed the problems associated with an antitrust policy untethered from a consumer welfare standard.[138] At its most basic level, the consumer welfare standard ensures that business conduct is condemned only when it harms competition, as opposed to merely competitors, so as to avoid the perverse results of earlier cases.[139] While business conduct that increases market concentration invariably harms some competitors, more is needed to find that the practice violates the antitrust laws given that harm to competitors is also an inevitable byproduct of competition on the merits, including efficiency enhancing behavior.[140] The consumer welfare standard remains the best way to separate procompetitive from anticompetitive increases in market concentration, making it essential to a well-functioning antitrust policy. The alternatives of the neo-Brandeisians and their allies—vague public interest standards that incorporate social and political values into everyday antitrust enforcement[141]—would require enforcers to make highly subjective judgements about how to apply controversial and value-laden concepts to particular antitrust cases and, in so doing, undermine what has for decades been a rigorous and economically grounded analysis that provided businesses with reasonable certainty and enforcers with the confidence to engage in sound enforcement.

Because predation claims involve low prices, regulatory humility is especially crucial.[142] While the below-cost pricing requirement ensures that the pricing harms competitors, the recoupment requirement ensures that the low prices also harm competition—that is, consumers—and prevents antitrust law from condemning the very conduct it is supposed to encourage.[143] Divorced from a recoupment requirement, a below-cost pricing test would effectively replace a consumer welfare standard with an equally efficient competitor standard.[144] While it is, to be sure, important that businesses are allowed to compete on the merits, such an approach judges firm conduct based solely on a hypothetical standard—that is, the putative equally efficient competitor—rather than looking at the effects in the actual world, where such a competitor most certainly does not exist—the raison d’etre of the consumer welfare approach. Sole reliance on this cost test, without real world knowledge of the feared effects of predation—likely long-run market power—greatly increases the possibility of judicial mistakes, and deprives consumers of the benefits of low prices.[145]

The neo-Brandeisians’ core argument—that network effects drive winner-take-all market outcomes that make predation a more rational strategy in digital markets—fundamentally overstates the winner-take all nature of so-called platform markets. First, there is no settled definition of what constitutes a platform.[146] On the one hand, platforms appear throughout the economy: newspapers, video games, broadband providers, credit cards, and many other industries have all been called “platforms.” On the other hand, many of the firms often thought of as platforms in the academic literature, such as Amazon, have far less in common with other large digital firms like Alphabet than it does with traditional retailers, like Walmart. Simply put, special treatment for platforms, as contemplated by some, would soon struggle to separate the general antitrust rules from these purported exceptions.

Furthermore, many of these claimed platform markets do not in actuality reflect winner-take-all or winner-take-most environments that pose an inherent risk of enduring dominance through exclusionary strategies.[147] Indeed, while commentators have long recognized that other strategies that do not maximize profits in the short-run—such as limit pricing—may occur, they are typically deployed as arguments against a below-cost pricing prong, not a recoupment requirement.[148] More importantly, while network effects may facilitate certain firms achieving and maintaining a dominant position, this is anything but an economic law of nature of the kind neo-Brandeisians have falsely attributed to the Chicago School.[149] Rather, and even more so relative to older platforms, many digital markets are characterized by consumers engaging in multi-homing, whereby they regularly use multiple competing platforms—increasing competition in the market.[150] In fact, regardless of what the neo-Brandeisians might assume, this practice may have been common for some time in multi-sided markets throughout the economy.[151]

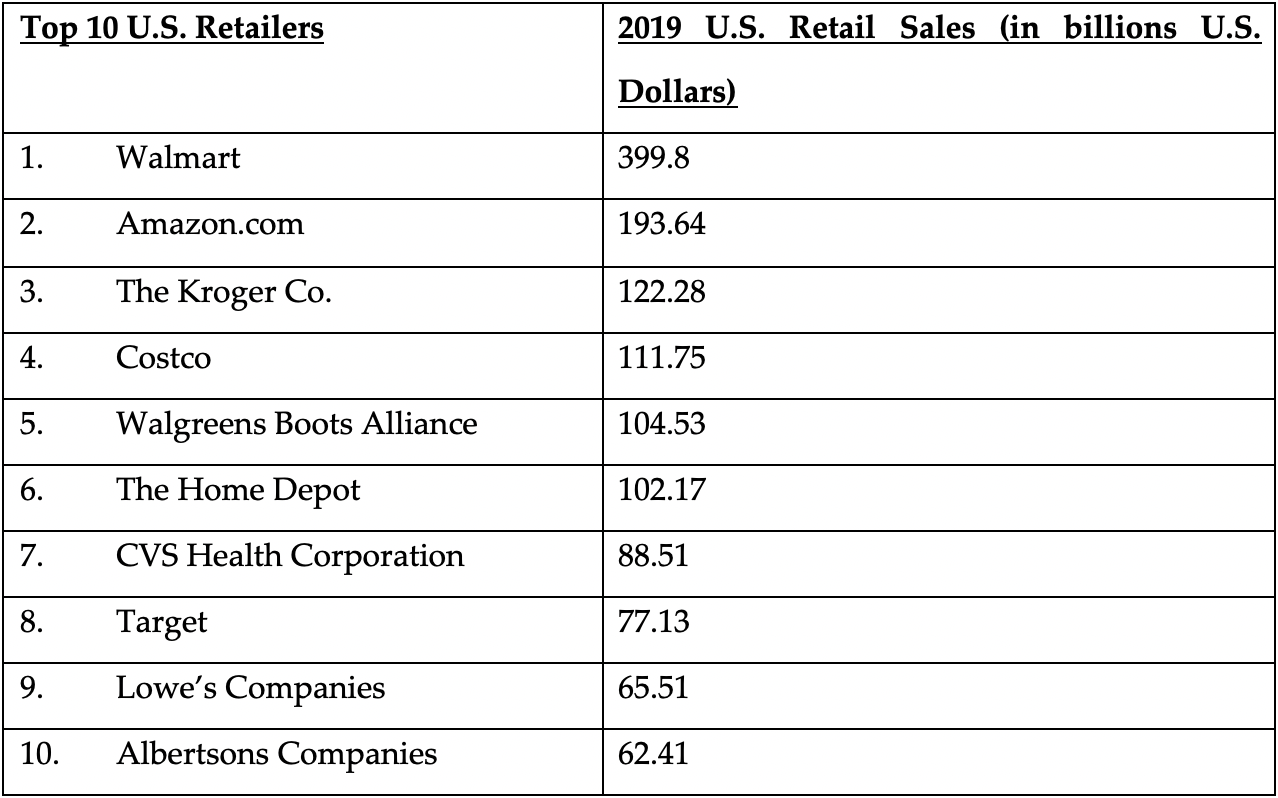

Contrary to the polemics of the neo-Brandeisians, Amazon provides an excellent example of a so-called “platform” that faces intense competition and displays no signs of sliding toward dominance. While for the neo-Brandeisians “Amazon has marched toward monopoly by singing the tune of contemporary antitrust,”[152] in reality Amazon competes in a highly competitive retail market. Even ignoring the numerous local and regional competitors and myriad products involved, there are many large firms nationally. Table 1 presents total sales of the nation’s largest retailers, showing not only how Amazon is still less than half the size of Walmart, but that there are several other retailers selling more than $100 billion last year in the United States.

Table 1[153]

These companies compete both on and off-line, and their presence is growing in both channels. While they do not compete with each other in all product categories, there is more extensive overlap than many realize: for example, the super drug stores have large product offerings, virtually all of which are also sold by Walmart, Costco, Amazon (except for prescription drugs), and Kroger, and a great many by Target.

Even more to the point, the neo-Brandeisians fundamentally misunderstand the nature of competition in platform markets. At least since Schumpeter, it has been well understood that the competitive process includes not just static competition in deconcentrated industries, but dynamic or leapfrog competition between successive, dominant platforms.[154] As one of us explained twenty years ago:

Although the strong network effects theory emphasizes the difficulty that even a superior technology has in replacing a “locked-in” one, evidence of change is everywhere. The 20th century has produced a blizzard of such change, from prominent examples like the automobile replacing the horse and buggy to more simple ones, such as ballpoint replacing fountain pens. More recently, cassettes replaced eight-track tapes, compact discs replaced vinyl records, and video games have witnessed rapid change with Atari, Nintendo, Sony, Sega, and others vying to be the standard.[155]

To infer, therefore, a lack of competitive entry that can discipline a predator from network driven barriers to entry is unwarranted. Indeed, this is particularly so in the very markets of concern to the neo-Brandeisians given that, relative to traditional manufacturing markets, the technology economy embodies even more disruptive and dynamic forms of competitive entry to discipline firms—a fact that might have surprised even Schumpeter, who was unsure about the ability for the “entrepreneurial spirit” to survive in late capitalism:

The success of Microsoft, Apple, Google, Amazon, and Facebook, to name the most prominent American cases, all involve the sort of entrepreneurial spirit that Schumpeter might have thought lost in late capitalism. Rather than disappear, the entrepreneurship embodied in these and other companies took a radically disruptive form, with many of the most valuable technology companies owing their prowess to either challenging powerful established players in traditional industries—such as Amazon—or the first movers in their then-emerging New Economy markets—such as Facebook.[156]

Importantly, in the New Economy, competition among digital firms may not only involve a scrappy startup platform fighting to eclipse an established rival, but also large and highly capitalized rival platforms that are dominant in other markets.[157] For example, Amazon faces competition not only from the incumbent Walmart[158]—competition that has only increased in light of the ongoing COVID-19 pandemic[159]—but also from platform giants like Alphabet, who offer their own shopping services.[160] The upshot is simple: to engage in a successful predation campaign, digital firms must be prepared to overcome not only existing product market competitors and disruptive Schumpeterian startups, but other large platforms at least as well capitalized as themselves and more than able to survive a long, drawn out war of attrition.

B. The Continued Importance of the Recoupment Requirement

While rapid technological change is an understandable reason for wanting to revisit predation rules, changes should be rooted firmly in economic learnings to avoid harming consumers.[161] Nevertheless, there is no firm empirical basis for holding that predation is a rational strategy for digital firms to exclude competitors that would justify elimination of the recoupment requirement.[162] Certainly the allegations against Amazon do not support change. With Quidsi, besides offering no evidence that Amazon priced below its costs, Amazon would have fallen well short of the threshold for monopoly power, even accepting the highly dubious notion that in this case a relevant online market can be properly defined.[163] Amazon had only a 43% share in U.S. online retailing for baby supplies, and a claim for attempted monopolization would have been a longshot at best given the requirement of specific intent and the growing shares of Walmart (23%) and Target (18%)—both of whom had a greater share than Quidsi. Recoupment was thus clearly unlikely.[164] Furthermore, not only was its acquisition of Quidsi cleared by the Federal Trade Commission during the Obama administration,[165] but as AEI’s Jeffrey Eisenach explains:

Far from demonstrating the shortcomings of current antitrust doctrine, the Diapers.com saga shows why focusing on protecting consumers rather than competitors remains the right approach. Consumers benefited twice: first because they were allowed to reap the benefit of Diapers.com’s entry, including lower prices from Amazon; second because Quidsi’s founders were rewarded for their entrepreneurship by the Amazon buyout, which ultimately enabled them to create the platform that is now driving real competition in the online retailing space: Jet.com, aka Walmart. And yes, they do sell diapers.[166]

The neo-Brandeisian allegations regarding eBooks fare little better. As commentators who have studied the issue have concluded, Amazon’s prices for eBooks were not likely below its marginal costs.[167] Rather, just as with A&P decades ago, a predatory pricing violation against Amazon would penalize its dynamic and low-cost business model that challenged old-economy publishers—exactly the kind of business initiative that competition policy should encourage. In fact, the eBooks saga presents an excellent example of competitive dynamics in high-tech markets: namely, how an innovative and high-tech powerhouse like Amazon may face competition from another high-tech juggernaut like Apple to counter what is seen to be predatory behavior—even if, in that case, the courts did not see Apple’s competition as being on the merits.[168]

These two Amazon examples highlight the mutually reinforcing nature that the below-cost and recoupment prongs play within the broader antitrust framework of protecting the competitive process and consumers in a way that generalist judges can administer. In some cases, while the ability to recoup may be questionable, it is evident that the firm is pricing above costs and thus competing on the merits and benefiting from an innovative business model, as in the Amazon e-Books example. In other cases, it may be harder to discern whether a firm is pricing below its costs, but abundantly clear that other competitors make it highly unlikely that recoupment will occur, as in the Quidsi example. However, this does not mean, as some commentators suggest,[169] that the inquiries are logically dependent: that a firm priced below its costs and failed to compete on the merits may say something about its specific intent, but not the ultimate consumer welfare effects; and that a firm stands to gain a monopoly does not tell us about whether it is doing so through anticompetitive means or through competition on the merits.

The summary nature of the other spurious predatory pricing allegations against Amazon raised in the House Report justifies dismissal in a commensurate fashion. First, with respect to Prime and “Can’t Realize Any Profit,” as we note above, Amazon, with half the sales of Walmart, lacks the retail market power necessary to support either a likelihood of recoupment or dangerous probability of monopoly power. Second, with respect to Amazon devices and Alexa, the House Report admits that Amazon does indeed face competition from firms including Apple and Google—who are not going to be intimidated by the prospect of a war of attrition. Moreover, even in the unlikely event that the anecdotal allegations of below-cost pricing the Report attempts to sketch could be corroborated by a preponderance of actual evidence, there is no basis in precedent, policy, or practice to hold such promotional pricing as predatory for which businesses should be held liable.[170]

As noted above, the neo-Brandeisians have offered three additional reasons for eliminating the recoupment requirement. The first is that because “firms may raise prices years after the original predation, or raise prices on unrelated goods, in ways difficult to prove at trial,” the plaintiff’s burden should be eased.[171] Yet, tough proof is exactly what a rational predation rule should require given the benefits to consumers of low prices and the lack of empirical support that predatory pricing is a rational strategy for firms, including large digital ones, to pursue. Nevertheless, even were this not the case, there is nothing unique about this concern when evaluating allegations of predation by digital firms; it is already well recognized by neo-Brandeisians themselves that recoupment makes predation claims difficult regardless of the industry at issue.[172]

Their second argument, that “firms may raise prices through personalized pricing or price discrimination, in ways not easily detectable” suffers from similar problems.[173] It is, of course, no doubt true that the large data many firms possess allows them to engage in numerous efficient business practices, including price discrimination.[174] Nevertheless, to the extent such efficiencies occur—it has been admitted that “[t]here is no public evidence that Amazon is currently engaging in personalized pricing”[175]—it is also hardly unique to digital firms. The information technology revolution that occurred concomitant with the economic revolution in antitrust and public policy has extended throughout the economy, with the distinction between digital platforms and other businesses now almost entirely irrelevant with respect to the ability to use consumer data efficiently and charge different prices. Indeed, in its day, A&P was accused of the same.[176]

Finally, the neo-Brandeisians contend that “predation can lead to a host of market harms even if the firm does not raise consumer prices,” with the assumption that such harms are not cognizable under the recoupment requirement. [177] And yet, properly applied, the consumer welfare standard is a broad concept that analyzes a range of competitive dimensionalities, such as quality vis-à-vis quality-adjusted pricing metrics.[178] The consumer welfare standard also accounts for “variety” and “innovation,” with the 2010 Horizontal Merger Guidelines featuring an entire subsection entitled “Innovation and Product Variety,”[179] and the government has long brought monopolization cases alleging harm to innovation or potential competition.[180] And despite criticisms based on a literalistic misunderstanding of the term, the “consumer welfare standard” prevents inefficient allocation of resources by shielding suppliers against anticompetitive buyer actions that inefficiently suppress output of the kind incorrectly leveled against Amazon.[181] Moreover, while it is true that the consumer welfare standard does not directly consider “lower income and wages for employees, lower rates of new business creation, lower rates of local ownership, and outsized political and economic control in the hands of a few,”[182] this is for better, not worse: as noted above, asking enforcers subjectively to balance and effectively apply such a wide range of goals would erode sound antitrust enforcement, not facilitate it.[183]

IV. Reply to Progressive Economists

Notwithstanding the important concerns raised about price-cost tests when analyzing predation claims against digital firms, requiring that a firm sacrificed profits by evaluating whether it priced below an “appropriate measure of costs” remains necessary to assess predatory pricing claims by large digital firms. Although applying a price-cost test to these companies may present additional—albeit surmountable—analytical issues for courts and enforcers, abandoning this test entirely could lead antitrust law to devolve into de facto price regulation that dampens innovation and threatens the recognized right of a firm to price above its costs without fear of liability, as would an exploitative excessive pricing offense. In fact, the justifications for a rule of per se legality for above-cost pricing may even be more compelling when evaluating the behavior of technology companies relative to that of firms in traditional industries.

A. Administrability and Minimizing Legal Error

The fundamental concern with the price-cost test to evaluate predation claims in digital markets attempts to turn Areeda and Turner’s administrability argument on its head: namely that, in these markets, price-cost tests will result in both false negatives—such as effective per se legality given the low variable costs of high tech firms—and even false positives—such as by confusing a low price on one side of the platform with an overall predatory platform price.[184] While possible in theory, as discussed above there remains as a threshold matter little evidence that harmful digital predation actually exists, thus providing no justification for modifying the current standard to avoid false negatives.[185] Furthermore, some commentators have even suggested that courts can adequately deal with predation in platform market cases without having to engage in complex two-sided arithmetic, as evidenced by Judge Easterbrook’s decision in Wallace v. IBM.[186]

Not all judges are as sophisticated economically as Frank Easterbrook, and it is thus important to ensure that courts have the incentive and ability to evaluate both sides of the platform to determine whether a price is predatory to avoid error. In fact, the Supreme Court’s Ohio v. American Express Co. decision requires courts to consider both sides of the platform when evaluating whether conduct is anticompetitive,[187] and therefore, by implication, when applying a price-cost test.[188] Indeed, among the many scholars who have addressed related issues of market definition in two-sided markets, Behringer and Filistrucchi outline a model to apply the Areeda-Turner test to account for the economics of platforms—specifically, the relative price structure between both sides of the market—through weighted price levels and average variable costs.[189] Simply put, there is nothing inherently problematic about expecting courts and enforcers to account for the multi-sided nature of platform markets when considering predatory pricing claims to avoid legal error.

Of course, while two-sided arithmetic may test generalist judges—but, importantly, much less so the economists at the antitrust agencies or those employed in private practice and used as experts—applying the price-cost test in two sided-markets in principle imposes no burden on antitrust law greater than that which already exists elsewhere. Consider the Horizontal Merger Guidelines’ hypothetical monopolist test which, like Areeda and Turner’s price-cost test, at bottom can require a quantitative comparison of prices with a competitive benchmark as a precondition to analyzing welfare effects.[190] While mechanically applying the test to two-sided markets can cause mistakes, this does not make the market definition exercise either unnecessary or hopelessly complex as a practical matter. Generally speaking, to define the relevant market courts and enforcers may look to adopt either modified versions of the test that have been set out by commentators,[191] or more qualitative factors.[192]

Similarly, Brooke Group’s exhortation that “a jury may not infer competitive injury from price and output data absent some evidence that tends to prove that output was restricted above a competitive level” is no bar to considering properly complex issues like simultaneous recoupment.[193] Market definition is again a useful analogy: concerns that market power may obfuscate competitive price levels are not only as old as the “cellophane fallacy” in U.S. v. E.I. du Pont de Nemours,[194] but ubiquitous in the real world of imperfect competition. As such, in the presumably rare case where there is reason to believe simultaneous recoupment is occurring, just as courts have long been required to account for pre-existing market power in determining a competitive price level for the purpose of market definition, so too must a court determine an individual firm’s price while also accounting for the exercise of market power it may be simultaneously recouping.

The final, perhaps most compelling, argument for eliminating use of the Areeda-Turner average variable cost test in digital markets, concerns the low, if not zero, marginal costs some digital platforms enjoy. Brooke Group, however, contains no requirement that enforcers woodenly analyze short-run average variable costs—but only an “appropriate measure of its rivals’ costs.”[195] That is, consistent with the general nature of antitrust law as a common law statute adaptable to diverse economic environments, courts may consider alternative measures of costs in applying the price cost test.[196] And, while average total costs—although not precluded by law—face what are probably prohibitive policy concerns, long run measures of incremental cost may be a viable substitute when evaluating predatory pricing claims in markets that embody high fixed and low marginal costs, such as digital platforms.[197]

Rather than represent a merely aspirational approach, this is exactly what courts have done when confronted with predation claims in network industries. Here, the telecommunications industry is instructive. In MCI Commc’ns Corp. v. AT&T, the Seventh Circuit considered whether AT&T engaged in predatory pricing for its local service, subsidized by raising the price of its long-distance service. [198] Recognizing the difficulties with average variable cost, and after considering and rejecting both the older intent-based standards and the brave new world of determining whether AT&T’s price was welfare-maximizing, the court employed a long-run incremental cost measure and made clear that its choice was “not an economist’s quibble or a theoretical musing,” but rather “a principled analysis and practical reality in the market place.”[199] Indeed, the court was explicit that “[h]ow practically to compute LRIC . . . is a matter which we believe to be quite manageable and capable of development on an ongoing basis.”[200] In other words, it rightly came to exactly the opposite conclusion of today’s progressive economists and affirmed the wisdom of Areeda and Turner: administrability concerns favor modifying the price-cost test, rather than abandoning it.

B. The Continued Importance of the Price-Cost Test

Rather than make the price-cost test a relic of a bygone age, the legal and policy arguments in favor of the test continue to apply with equal, if not more, force in digital platform markets. Of these, no policy is more important than preventing antitrust law, which governs the competitive process by maximizing consumer welfare, from engaging in rate regulation, particularly in light of the innovation competition that characterizes rivalry in so much of the digital economy.[201] By eliminating a price-cost test, a quasi-regulatory regime is exactly what antitrust law could become—empowering agencies and courts to determine what level of pricing maximizes consumer welfare or the public interest rather than protect the competitive process, which would bring huge uncertainty and unnecessary risk to the business community.[202]

And the Supreme Court has of course so cautioned. As the Court made clear in Verizon Communications v. Law Offices of Curtis V. Trinko, LLP, a Section 2 case, above-cost pricing by itself is per se lawful regardless of any exclusionary effects:

The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system. The opportunity to charge monopoly prices—at least for a short period— is what attracts “business acumen” in the first place; it induces risk taking that produces innovation and economic growth.[203]

Predatory strategies involving limit pricing as a means of exclusion—rather than price hikes or exploitation—are of course no exception to antitrust law’s general aversion to price regulation. On the contrary, the same problems abound with formulating a rule to proscribe limit pricing strategies:

First, what price should be ordered? Should the firm be ordered to charge its short-run profit-maximizing price, even though a lower price might incur new entry? A price merely high enough to permit the plaintiff (or one particular firm) to enter? Might there be others than the plaintiff who could enter at lower prices? Must the order continue even after the plaintiff becomes established? Would cost changes justifying subsequent price changes have to be continually reviewed by the tribunal? In sum, such an order would place the courts in the ironic and indefensible position not only of having to order firms to charge monopoly prices, but also to regulate—undoubtedly on an ongoing basis—the price that is charged. They would effectively turn the limit pricer into a kind of public utility and force it to charge a high price in order to induce entry.[204]

Indeed, even if these administrability problems could begin to be resolved, a fundamental problem identified by Areeda and Turner of a rule against limit pricing—sacrificing definite short-term consumer benefits for speculative long-run benefits—is plainly more acute in technology platform markets, given their inherent dynamism relative to more traditional old economy markets, and thus exacerbates the difficulties of the already dynamic analysis captured by the recoupment requirement.[205] Simply put, the anticompetitive effects of limit pricing on entry are not only harder to predict in digital platforms, but also can be less likely. Moreover, as commentators have noted, there may not be any general reason that protecting less efficient entrants from possibly exclusionary above-cost pricing will necessarily produce long-run gains through entry.[206]

The reasons to permit above-cost pricing are even stronger the more one steps outside of the technocratic and welfare maximizing framework common to both modern antitrust and the ideal world of the progressive economists. On a Hayekian perspective, for example, above cost pricing is itself part of the competitive discovery process whereby information is communicated and optimal outcomes are achieved through spontaneous order.[207] Moreover, for enforcers to act in the way that the progressive economists suggest—that is, determining the pricing level that maximizes welfare—they must confront Hayek’s famous knowledge problem, whereby regulators face an inherent difficulty in aggregating the diverse and dynamic information needed to make such judgments properly.[208] For Hayek, attempts like those of the progressive economists “to control prices . . . deprives competition of its power of bringing about an effective co-ordination of individual efforts, because price changes then cease to register all the relevant changes in circumstances and no longer provide a reliable guide for the individual’s actions.”[209]

Recent experience confirms that attempts to police pricing in innovative and networked industries are bad policy. Among the many industries stifled by regulation,[210] the telecommunications industry is again perhaps most enlightening for our purposes. Not only was the rate regulation of the 1934 Telecommunications Act widely criticized, but the interconnection provisions in the reform-minded 1996 Telecommunications Act that enabled competitive local exchange carriers to interconnect with incumbent local exchange carriers for reasonable intercarrier compensation implicate the same concern of policing pricing conduct to prevent exclusionary conduct as does predatory pricing. As our colleague Jon Nuechterlein and Phil Weiser have argued, the law determining proper intercarrier fees remains unclear,[211] with the relevant determinations well beyond the comfort of the same generalist judges who apply antitrust law.[212] If antitrust law is to heed Santayana’s adage that those who forget history may be condemned to repeat it, calls to prohibit above-cost pricing as a way to tame digital platforms should be rejected.[213]

Conclusion

When Areeda and Turner wrote, antitrust law—and especially predatory pricing—was at its anti-consumer nadir. Areeda and Turner’s views were transformative, first adopted by then Judge Breyer in 1983 in Barry Wright Corp., and then by the Supreme Court in Matsushita and Brooke Group within the next ten years. They remain today the law of the land. From the start, critics attacked their article as simplistic and under inclusive, among a plethora of other sins.

A new generation has renewed these criticisms, with the neo-Brandeisians, as part of their condemnation of the consumer welfare standard, wanting to abandon the recoupment requirement to satisfy concerns like fairness or preserving democracy, which they find pressing in light of the new successful digital giants.[214] This program leads to the pre-Areeda and Turner anti-consumer policies of Robinson-Patman, Utah Pie, and the jihad against the A&P—all lessons to large firms that they should be wary of price cutting, even when there was no realistic chance of achieving monopoly power. The neo-Brandeisian war on low prices is anti-consumer, as Professor Hovenkamp, successor to Areeda in the leading antitrust treatise, admirably concludes:

The neo-Brandeisian attack on low prices as a central antitrust goal is going to hurt consumers, but it is going to hurt vulnerable consumers the most. . . . As a result, to the extent that it is communicated in advance, it could spell political suicide. Setting aside economic markets, a neo-Brandeis approach whose goals were honestly communicated could never win in an electoral market, just as it has never won in traditional markets.[215]

Moreover, technocratic critics today appear comfortable with abandoning current price-cost tests for a more far-reaching inquiry into whether above-cost pricing causes long-run consumer harm. For decades, economists’ models have posited similar theories, and although these modern commentators raise important questions about the application of the price-cost test in digital markets, abandonment of the price-cost test in its entirety would be wrongheaded. Transposing a consumer-welfare balancing framework into predatory pricing doctrine could easily put generalist judges in the position of de facto price regulators, a role antitrust has long and rightly eschewed, and which in digital contexts would often entail an even more complicated analysis than required in less complex industries.

Although the two groups of critics primarily take issue with different prongs of Areeda and Turner’s test, one can imagine circumstances where they join forces, again with the effect of resurrecting a regime like that which reigned pre-Areeda and Turner. In fact, it would not be the first time that populists and progressive economists have found common cause. In the 1970s, those who opposed concentration out of a concern for protecting small businesses joined forces with the economists who favored the then dominant simple concentration doctrine, which raised concerns about increases in concentration levels that today would be regarded as unproblematic.[216] This coalition supported aggressive enforcement not only involving mergers but, as we have seen, even predatory pricing.

The result was substantial regulatory hubris. Consider again the General Foods case— support for the case by those concerned with competitor protection was easy to understand, as the titanic struggle between General Foods and Proctor & Gamble in fact harmed smaller competitors. While at first glance the support of the economists might seem unlikely given the large benefits to consumers of the price war, their devotion to deconcentration explained their support—they also believed that consumer goods markets were overly concentrated, in significant part from “excessive” advertising. For this transgression, they proposed allowing new entrants to use General Foods’ Maxwell House trademark, ignoring that multiple owners of a single brand would have decreased incentives to maintain quality. In the first of the four meetings over two years, after the FTC Commissioners unanimously and quickly rejected the trademark license remedy, the economists remained in support of the case, apparently as a way to tell leading firms not to cut prices in the face of such entry.

In antitrust, the but-for world is crucial. Suppose that the critics had their way, and Areeda and Turner’s article was but a minor footnote in the history of antitrust law and economics.[217] What impact would the old predatory pricing regime have had on the economy had it continued in the decades that followed? Would it be that when newcomers, such as Amazon or any of the other large digital firms, had grown beyond a certain size, their lawyers would have urged them to be cautious about low prices, lest they face antitrust liability for disadvantaging less-efficient rivals? The role of sound antitrust principles, including the import of Areeda-Turner, in enabling American companies to emerge as the global leaders in innovation should neither be overlooked, nor forgotten.

The lesson is simple. The consumer welfare standard has already proven many times that technology giants are not above modern antitrust law, with two of the largest and most significant of such companies—AT&T and Microsoft—being found to have run afoul of Section 2 under that standard.[218] As we write, the antitrust agencies are using the consumer welfare standard to assess their conduct, with the DOJ having filed a long-anticipated lawsuit against Google and expectations that another may soon find itself in court.[219] Most importantly, the modern antitrust regime has supported unprecedented gains in economic growth and technological progress, including the emergence of digital firms that remain the envy of the world.[220] Sound antitrust law has served us well for decades, including application of the then revolutionary Areeda-Turner test. For the sake of American consumers, may such rules continue.

Footnotes

* Foundation Professor of Law, Antonin Scalia Law School at George Mason University; Senior Counsel at Sidley Austin LLP. Professor Muris previously served as the Director of the Bureau of Consumer Protection (1981-83), the Director of the Bureau of Competition (1983-85), and as Chairman of the Federal Trade Commission (2001-04).

** Associate at Sidley Austin LLP. We thank Bruce Kobayashi for helpful comments and the Global Antitrust Institute for editorial support.

[1] See, e.g., Standard Oil Co. of New Jersey v. United States, 221 U.S. 1 (1911); United States v. Aluminum Co. of America, 148 F.2d 416 (2d. Cir. 1945).

[2] See Terry Calvani & James M. Lynch, Predatory Pricing Under The Robinson-Patman and Sherman Acts: An Introduction, 51 Antitrust L.J. 375 (1982) (“Perhaps the most controversial antitrust issue today in both the literature and case law is that of ‘predatory pricing.’”).

[3] See, e.g., Barry C. Lynn, No Free Parking for Monopoly Players: Time to Revive Anti-Trust Law, The Nation (June 8, 2011) (“A generation ago, when a small crew within the Reagan administration set out to clear the way for a radical reconcentration of power, they did so not by openly assailing our anti-monopoly laws but by altering the intellectual frames that guide how we enforce them. . . .”).

[4] See generally Bruce H. Kobayashi & Timothy J. Muris, Chicago, Post-Chicago, and Beyond: Time To Let Go Of the 20th Century, 78 Antitrust L.J. 147 (2012) (discussing the importance of predatory pricing to the Chicago School and other reformers).

[5] Utah Pie Co. v. Continental Baking Co., 386 U.S. 685, 700 (1967).

[6] See Timothy J. Muris & Jonathan E. Nuechterlein, Antitrust in the Internet Era: The Legacy of United States v. A&P, 54 Rev. Ind. Organ. 651, 662 (2019) (“Ultimately, the government’s case had nothing to do with any genuine theory of consumer harm and everything to do with protecting companies at all levels of the grocery business from A&P’s disruptive efficiency—no matter what the ensuing cost to consumers.”).

[7] See id. at 671-72; see also William Kovacic, The Intellectual DNA of Modern U.S. Competition Law for Dominant Firm Conduct: The Chicago/Harvard Double Helix, 2007 Colum. Bus. L. Rev. 1, 42-50 (highlighting the role of both Chicago and Harvard scholars in reforming predation doctrine).

[8] Phillip Areeda & Donald F. Turner, Predatory Pricing and Related Practices Under Section 2 of the Sherman Act, 88 Harv. L. Rev. 697 (1975); see Kovacic, supra note 7, at 6-7 (“[T]wo Harvard School scholars, Phillip Areeda and Donald Turner, spurred the rethinking of modern predatory pricing doctrine with their proposal in 1975 that a dominant firm can ordinarily be presumed to be acting legally under the U.S. antitrust laws when it sets its prices at or above its average variable costs. . . . Areeda and Turner, more than any other commentators, catalyzed the retrenchment of liability standards and motivated a more general and fundamental reassessment of U.S. doctrine governing dominant firms.”) (footnote omitted).

[9] 509 U.S. 209 (1993).

[10] See, e.g., Maurice E. Stucke & Ariel Ezrachi, Competition Overdose: How Free Market Mythology Transformed Us from Citizen Kings to Market Servants (2020); Ganesh Sitaraman, How to Regulate Tech Platforms, The American Prospect (Nov. 8, 2018); Tim Wu, The Curse of Bigness: Antitrust in the New Gilded Age (2018); Mark Glick, The Unsound Theory Behind the Consumer (and Total) Welfare Goal in Antitrust, 63 Antitrust Bull. 455 (2018).

[11] See, e.g., Fiona Scott Morton, Washington Center for Equitable Growth, Reforming U.S. Antitrust Enforcement and Competition Policy (2020); The New Center, Take on Big Tech: Promoting Competition (2019); Open Markets Institute, America’s Concentration Crisis: An Open Markets Institute Report (2018); Marshall Steinbaum, Eric Harris Bernstein & John Strum, Roosevelt Inst., Powerless: How Lax Antitrust and Concentrated Market Power Rig the Economy Against American Workers, Consumers, and Communities (2018); Marc Jarsulic, et al., Center for American Progress, Reviving Antitrust: Why Our Economy Needs a Progressive Competition Policy (2016).

[12] Congressional interest has included a series of well-publicized hearings on antitrust issues associated with tech platforms. See Online Platforms and Market Power, Part 1: The Free and Diverse Press: Before the H. Comm. on the Judiciary (June 11, 2019); Hearings: Online Platforms and Market Power, Part 2: Innovation and Entrepreneurship, Before the H. Comm. on the Judiciary (July 16, 2019); Hearings: Online Platforms and Market Power, Part 3: The Role of Data and Privacy in Competition, Before the H. Comm. on the Judiciary (Sept. 12, 2019); Hearings: Online Platforms and Market Power, Part 4: Perspectives of the Antitrust Agencies, Before the H. Comm. on the Judiciary (Nov. 13, 2019); Hearings: Online Platforms and Market Power, Part 5: Competitors in the Digital Economy, Before the H. Comm. on the Judiciary (Jan. 17, 2020); Hearings: Online Platforms and Market Power, Part 6: Examining the Dominance of Amazon, Apple, Facebook, and Google, Before the H. Comm. on the Judiciary (July 29, 2020). The hearings and surrounding investigation culminated in a recently released report with recommendations for congressional action, which is an exemplar of the neo-Brandeisian line of critique discussed below. See Staff of H. Comm. on the Judiciary, 116th Cong., Investigation of Competition of Digital Markets: Majority Staff Report and Recommendations (Comm. Print 2020) [hereinafter House Report].

[13] See generally Kobayashi & Muris, supra note 4, at 159-166 (highlighting internal debates between Chicagoan scholars and their anticipation of many “post-Chicago” critiques).