Introduction

Network effects, which arise when the value of a product or service increases with the number of people using it, represent one of the most influential concepts in industrial organization over the past half century. Although the concept was invoked during the early twentieth century,[1] serious academic study of the phenomenon did not begin until publication of Jeffrey Rohlfs’s seminal paper in 1974.[2] Starting in the mid-1980s, a vibrant theoretical literature emerged exploring how network effects can affect competition.[3] The result was a rich and nuanced body of economic theory.[4]

Over time, network effects began to influence antitrust enforcement policy, forming the basis for the U.S. government’s cases against Microsoft[5] and playing a prominent role in early antitrust cases against social networking sites.[6] Although recent high-profile reports on digital platforms have recognized the ambiguity of the impact of network effects, they have generally placed greater emphasis on their tendency to create winner-take-all markets that can provide first movers with a source of market power.[7]

Even the most casual examination of the history of digital industries reveals that the dynamics must be more complex. Google was founded in 1998, long after Altavista and Yahoo! had established themselves as market leaders. Facebook successfully overcame the early advantages enjoyed by Myspace. The market for travel sites consists of numerous players all vigorously competing with one another without collapsing into monopoly. Uber’s first-mover advantage was unable to prevent the emergence of Lyft as a serious competitor.

These examples underscore the inappropriateness of simply equating the presence of network effects with market concentration or entry barriers. Instead, they illustrate the importance of understanding the full range of the dynamics of markets subject to network effects. Even when potential theoretical harms have been identified, anticompetitive effects cannot simply be asserted. Instead, proper application of competition law principles requires that they be validated and quantified empirically.

This Chapter fills this gap by laying out the dynamics underlying network effects and how they have been applied in antitrust and regulatory proceedings. It begins by examining and exploring the theoretical and empirical limits of the possible bases of network effects, paying particular attention to the most commonly cited framework known as Metcalfe’s Law. It continues by exploring the concept of network externalities, defined as the positive external consumption benefits that the decision to join a network creates for the other members of the network,[8] which is more ambiguous than commonly realized. It then reviews the structural factors needed for models based on network effects to have anticompetitive effects and identifies other factors that can dissipate those effects. Finally, it identifies alternative institutional forms that can eliminate or mitigate the impact of network effects.

I. Theoretical Sources of Network Effects

Network effects exist when the primary determinant of a network’s value is the number of other users connected to the network.[9] The more people that an individual subscriber can reach through the network, the more valuable the network becomes even when the nature of the service and the price paid for it remains the same.[10] The classic example is the telephone system, since the value of a telephone network is largely determined by the number of people with whom one can communicate through that network.[11]

A critical question is how quickly value grows with network size. Rapid increases would make the demand-side economies of scale associated with network effects extremely influential. More modest increases would render the effects of network size less consequential. In addition, the law of diminishing marginal returns dictates that such increases in value are unlikely to persist indefinitely. A proper appreciation of network effects thus depends on understanding their theoretical foundations, as well as their theoretical limits, and the emerging empirical literature attempting to validate which of the various models best describes actual network behavior.

A. Metcalfe’s Law and Other Theories of the Relationship Between Network Size and Value

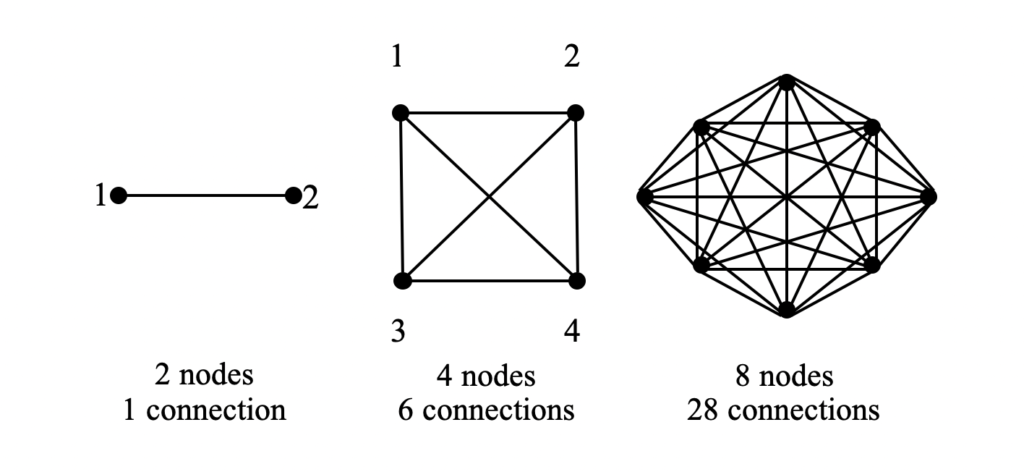

One of the most common ways to model the rapid increase in value associated with network size is known as Metcalfe’s Law, first articulated in the early 1980s by Bob Metcalfe, the inventor of the Ethernet,[12] and later named in his honor by George Gilder.[13] Metcalfe’s Law is based on the mathematical concept that the number of potential pairwise connections increases quadratically with the number of nodes. Stated more generally, if the number of nodes equals n, the number of potential connections equals (n2 – n)/2. The relationship is illustrated by the examples portrayed in Figure 1. In each case, doubling the number of nodes more than quadruples the number of potential connections.[14]

Figure 1: The Relationship Between the Number of Nodes and the Number of Potential Connections

Source: Yoo, supra note 9, at 92 fig.1.

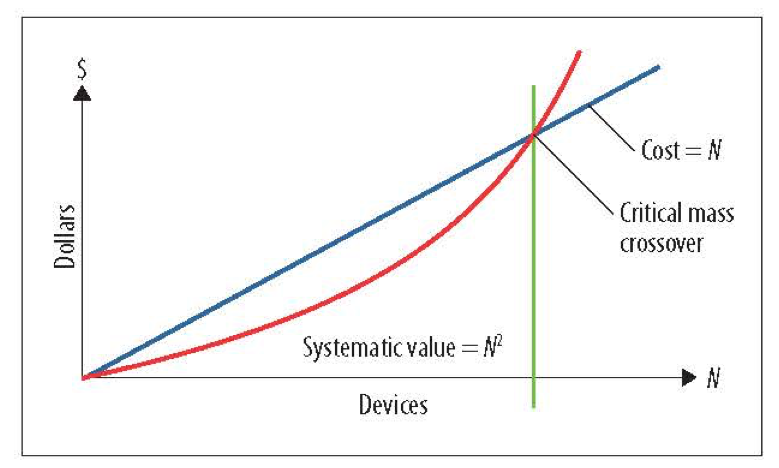

If each potential connection increases the value of the network by an equal amount, increases in the number of nodes lead to a quadratic increase in network value. At the same time, the cost of adding nodes is likely to increase linearly with the number of nodes. The relationship between the two effects is depicted in Figure 2, which Metcalfe used during the early 1980s to emphasize the importance of networks quickly reaching critical mass.

Figure 2: Metcalfe’s Law and the Systemic Value of the Network

Source: Bob Metcalfe, Metcalfe’s Law After 40 Years of Ethernet, Computer, Dec. 2013, at 26, 28 fig. 2.

Metcalfe’s Law provides a demand-side explanation for the success of the Ethernet, Internet service providers (ISPs), and Internet-based companies such as America Online,[15] although some have suggested that the recent experiences of eBay and Facebook raise questions about the relationship.[16] By valuing all internal connections, it is best suited to two-way communications networks.

Quadratic growth is not the only way to model the way the value of a network may increase with size. Some are more modest, such as Sarnoff’s Law, which asserts that the value of a network increases linearly with network size, as befits advertising networks. Another commonly posited relationship, known as Reed’s Law, is more aggressive, positing exponential growth in value at the rate of 2n.[17] A more recent candidate known as Zipf’s Law falls somewhere between Metcalfe and Sarnoff, presuming that if some large collection of elements is ordered by value, the second element in the collection will have about half the value of the first one, the third one will have about one-third the value of the first one, and so forth, with the value of the nth item in the collection being 1/n of the first item. The result is a model that projects network value to increase logarithmically, specifically n log(n).[18] The Briscoe, Odlyzko, and Tilley article proposing Zipf’s Law as an alternative spawned a vigorous debate over the merits of Metcalfe’s Law.[19]

All of these models lead to value curves that increase monotonically with network size. That need not be the case, however. Some patterns in the growth of network value (such as 2–n) converge asymptotically to a limited value rather than grow continuously.[20] Models assume that network value follows a logistic curve generating S-shaped growth in value.[21] The results thus depend heavily on the assumptions.

It is unlikely that any one functional form applies to all businesses subject to network effects. The idea that the same returns to scale would apply to search engines, social media, e-commerce, software, streaming media, and companies based on the sharing economy seems impossible.

B. The Theoretical Limits of Metcalfe’s Law

The choice among these models plays a critical role in determining the significance of the role played by network effects. One key factor is the fit between a model’s assumptions and the business model under consideration. For example, the growth in value envisaged by Metcalfe’s Law results from the increase in internal connections among each individual node. This seems appropriate for a two-way communications network such as a telephone network, in which every individual user may wish to contact each other. The value of advertising networks, in contrast, derives from the total number of potential customers that the advertiser can reach through the network and places no value on those potential customers’ ability to connect with each other. This implies a value curve that grows linearly as predicted by Sarnoff’s Law rather than the quadratic growth in value predicted by Metcalfe’s Law.[22]

Moreover, the possibility of unending quadratic increases in network value seems too good to be true, and for good reason. Indeed, Metcalfe himself warned that this relationship was unlikely to hold beyond a certain point.[23] Simply put, models based on inexhaustible geometric progressions are the hallmark of classic pyramid schemes that are mathematically unsustainable. Proper implementation of network effects for competition policy thus depends on an appreciation of the role of diminishing marginal returns resulting from heterogeneity in the value of different connections and potential diseconomies of scale.

1. Differences in the Value of Particular Connections

While it is undeniably true that the number of potential connections increases quadratically with the number of connections, that is not enough to establish the quadratic increase in value implied by Metcalfe’s Law. One must also assume that the additional connections each provide the same amount of additional value.

The literature on Metcalfe’s Law questions the validity of that assumption. For example, Jeffrey Rohlfs points out that if the first users are the ones who place the highest value on the network, one would expect the addition of later users to provide less value.[24] Failure to take this into account is “likely to substantially overstate the value of large networks.”[25] In addition, “small user sets can embody substantial value.”[26] Rohlfs then offers a mathematical formulation that can accommodate a wide range of assumptions about consumer heterogeneity and leads to market concentration only in some cases.[27] Briscoe, Odlyzko, and Tilly’s model based on Zipf’s Law provides a specific example of this dynamic.[28] Network participants who place a particularly high value on a small number of users can realize most of that value simply by clustering on a single network regardless of its size.[29]

If so, end users may not value the total number of potential connections in the abstract as much as they value particular connections. For example, most people’s Internet usage is disproportionately concentrated in a handful of locations, including their email servers, file repositories at work, banks and other financial institutions, utilities for bill payment, and preferred sources of content.[30] These users place a higher value on connectivity to the sites they visit the most than their ability to connect to a large number of other locations.[31]

Differences in the value of particular connections can make larger networks easier to displace. A new competitor need not achieve the same scale as the incumbent in order to succeed. Instead, it can successfully enter by targeting a smaller cluster of users who value each other’s participation particularly highly.[32] For example, customers of ride sharing services care less about the size of the entire network and instead place a high value on a subset of network participants, specifically those located in the same city.[33] Similarly, OpenTable succeeded only after it targeted achieving a critical mass of restaurants in four cities.[34] These examples show how a new entrant can succeed notwithstanding network effects by achieving critical mass with clusters of users who value each other particularly highly.[35]

Perhaps the most extreme version of variations in the value of particular network connections is the phenomenon known as two-sided markets.[36] Two-sided markets involve a particular type of network effects in which the network consists of two different groups of participants and the value to one group is determined not by the size of the entire network, but rather by the size of the other group. Credit card networks represent a classic example of a two-sided market. They consist of two types of participants: merchants and cardholders. The value to merchants is not determined by total network size, but rather by the number of cardholders. Conversely, the networks’ value to cardholders is determined by the number of merchants participating in it. Admittedly, cardholders benefit indirectly from having large numbers of other cardholders in that they encourage the participation of a greater number of merchants. But they would be just as happy if the network could attract a large number of merchants in ways that did not depend on having a large number of cardholders.

Pricing in two-sided markets depends on a wide variety of factors.[37] Perhaps most striking is what Jean-Charles Rochet and Jean Tirole call the “seesaw principle,” in which any factor that tends to increase the profitability of one side of a two-sided market tends to lower prices on the other side, because the increased margin on the first side increases the benefits of increasing participation on the second side.[38] Consistent with this insight, a survey of real-world examples reveals that prices on different sides of two-sided markets tend to be asymmetric, with users on one side often paying little or nothing.[39]

Asymmetry in the value of particular connections can dissipate the impact of network effects and allow a smaller network to survive despite disadvantages in scale. The U.S. Supreme Court’s recent Amex decision[40] provides a useful example: American Express was able to capture more than one quarter of the market for credit card transactions even though it had enrolled 88% fewer cardholders and roughly 30% fewer merchants than had Visa and MasterCard. Rather than compete for the entire market, American Express was able to compensate for its smaller scale by providing higher value services designed to appeal to a subset of the overall population, specifically higher value cardholders.[41]

These examples underscore how differences in the value of particular connections can allow firms to enter and survive in markets with network effects notwithstanding their smaller network size. In so doing, they illustrate that the mere presence of network effects does not necessarily give the largest firm a decisive competitive advantage. The clear implication is that any anticompetitive effects stemming from network effects must be based on evidence in particular cases and not simply asserted.

2. Other Ways Network Size Affects Value

The approach to theorizing about network effects discussed above implicitly presumes that network value is strictly increasing in the number of connections and differ only regarding the rate of increase. Any such model assumes away the existence of factors that can create diseconomies of scale.

The literature has pointed out the possibility of countervailing considerations. For example, several phenomena can cause network value to decrease with scale, including saturation, cacophony, clustering, and search costs.[42] Other relevant factors may include limits on time and capacity,[43] as well as frictional effects and trust costs.[44]

Presuming inexhaustible returns to scale is arguably both unrealistic and risks making market failure more an artifact of the model than reality. Metcalfe himself emphasizes that his point was to underscore the importance of establishing a critical mass, not to prove inexhaustible returns to network size, and that Zipf’s Law also results in inexhaustible returns to scale.[45] The assumptions that all connections have equal value and diseconomies of scale do not exist have the effect of positing inexhaustible benefits to network size that make the bias towards concentration drive the results of these models more than any aspect of actual markets.[46]

C. The Empirical Literature

These critiques underscore the point that simply assuming that all connections contribute equal value represents a potentially fundamental flaw. Empirical studies indicate that people do not value all connections equally. For example, in traditional telephone service, people tend to make frequent calls to a small group of people.[47] The same appears to be true for Internet-based communications, as shown by studies indicating that the average Facebook user actively exchanges personal messages with no more four people per week and six people per month.[48] Furthermore, the fact that the average Facebook user has 150 friends is consistent with Dunbar’s number, which suggests that the human brain can maintain no more than 150 close relationships at any one time.[49]

The debate over the relative merits of Metcalfe’s and Zipf’s Law has led to the first attempts to validate those principles empirically. Metcalfe himself kicked off this line of research by presenting an empirical analysis based on Facebook data finding that value growth more resembled Metcalfe’s Law than Zipf’s Law,[50] a result that other scholars subsequently confirmed.[51] Another empirical study found that seven user capabilities followed Metcalfe’s Law, while two others followed Zipf’s.[52] A subsequent analysis disputed that finding once four correcting factors are taken into account.[53] Still another regression analysis of the market value of thirty-eight public firms suggested that Zipf’s Law performs better than Metcalfe’s.[54]

The nascent state of the empirical literature and the theoretical connection between the type of business model (advertising and Sarnoff’s Law, pairwise communication and Metcalfe’s Law, and group-forming networks and Reed’s Law) underscore the dangers of simply presuming network effects lead to concentrated markets. This is consistent with modern competition policy’s insistence that adverse economic effects must be demonstrated instead of simply being asserted.

II. The Theoretical Ambiguity of Network Externalities

Many of the concerns raised by network effects focus on the theoretical possibility of network externalities.[55] Proponents of this viewpoint suggest that network users’ inability to appropriate all of the benefits generated by their decision to join a new network represents a positive externality that will cause them not to adopt the network even when doing so would be socially beneficial. These theorists also suggest that network externalities can turn network incompatibility into a competitive weapon. Network effects gives users forced to choose among incompatible networks strong incentives to flock to the largest network. This can create a positive feedback loop that confers competitive advantages to first movers and large players.[56]

In addition, other scholars argue that network externalities can cause a related market failure known as technology lock-in, in which markets adhere to previous technology commitments notwithstanding the arrival of new, more efficient network technologies. If users cannot capture all of the benefits created by their decision to adopt a new technology, they may refrain from making a technological change even when doing so would increase total welfare.[57] These interpretations suggest that network industries may be uniquely susceptible to market failures.

A close examination of the foundational literature on network effects reveals that reducing network externalities to the harms to innovation associated with these phenomena is far too simplistic. As Joseph Farrell and Garth Saloner point out in their seminal work, a consumer’s decision to join a new network actually gives rise to not one, but two distinct and countervailing externalities. On the one hand, it enhances the value of the network that the user is joining. As noted earlier, the inability to capture all of the benefits created by his or her adoption decision may make the market reluctant to adopt a new technology, even when doing so is in society’s best interest. This can cause markets to become locked in to obsolete technologies, a phenomenon that Farrell and Saloner refer to as “excess inertia.”[58]

At the same time, the adoption of a new technology also gives rise to a countervailing negative externality that may produce precisely the opposite effect. This is because any decision to adopt a new technology simultaneously lowers the value of the old network by reducing the number of people using it. Just as individuals switching networks do not internalize the increase in value they confer on participants in the new network, they also do not fully internalize the costs they impose on participants in the old network. If the negative externalities exceed the positive externalities, an individual would be willing to adopt a new network even when the net costs to society exceed the net benefits, a situation variously called “excess momentum” or “insufficient friction.”[59] Indeed, under network effects, the departure of a few network participants can touch off a negative feedback cycle that accelerates a network’s decline.

The early literature on network effects has largely overlooked the potential for network externalities to accelerate the decline of incumbents. The history of the digital industry is littered with former market leaders such as America Online, MSN Messenger, Friendster, Myspace, and Orkut that experienced the negative side of network effects.[60]

It is thus theoretically possible that the presence of network economic effects may make markets tend to displace networks more easily or less easily than is socially optimal. The overall effect is largely determined by which of the two opposing externalities dominates the other. This means that network effects cannot simply be invoked as inevitably leading to winner-take-all markets or first-mover advantages that restrict competition. Instead, any market power enjoyed by large networks is properly regarded as an empirical question that must be shown in individual cases instead of simply being asserted.

III. The Dependence on Structural Factors

Both the literature around Metcalfe’s Law and the seminal articles on network effects illustrate that the net impact of network effects is ambiguous as a theoretical matter. In addition, a close examination of the literature reveals that any anticompetitive effects depend on the presence or absence of certain structural factors. The dependence of network effects models on these structural preconditions provide a further reason for rejecting attempts to equate the mere presence of network effects with market failure.

A. Market Structure

Because so much of the literature on network economic effects focuses on the potentially anticompetitive consequences of tipping and lock-in, it is often overlooked that the primary effect of network economic effects is to provide powerful incentives to interconnect.[61] The formal economic models that show how network effects can create market failure depend on the assumption that the relevant markets are either dominated by a single firm or are highly concentrated.[62] In the absence of such market structures, the primary impact of network economic effects is to provide powerful incentives for network owners to make their network compatible and interconnect with one another.[63]

For example, in a market in which five equally sized players are part of a compatible network, any player that opted for incompatibility would put itself at a tremendous competitive disadvantage.[64] In the absence of market concentration, a firm cannot plausibly use its interconnection policies to harm competition.

This conclusion is reflected in the FCC’s policy toward wireless-to-wireless interconnection, in which the FCC declined to intervene because in the absence of a dominant player, competition already provides wireless providers with sufficient incentives to interconnect.[65] The FCC took a similar position with respect to backbone interconnection when approving the Verizon-MCI and SBC-AT&T mergers, concluding that “[s]o long as there is ‘rough equality’ among backbone providers, each has an incentive to peer with the others to provide universal connectivity to the Internet.”[66] It reiterated this position when approving AT&T’s acquisition of BellSouth.[67] Conversely, in approving WorldCom’s acquisition of MCI, the FCC was concerned that the merged company would have a sufficiently dominant market share to harm competition in the backbone market. Consequently, the FCC made divestiture of MCI’s backbone business a condition to its approval of the merger. At the same time, the FCC declined to mandate interconnection as a separate merger condition. The divestiture of MCI’s backbone business ensured that the market would remain sufficiently competitive to make direct regulation of interconnection unnecessary.[68]

The theoretical literature does identify one scenario in which participants in a market without a dominant player may nonetheless refuse to interconnect. If the market consists of two players of equal size, they may reject compatibility and instead engage in a race for the market. Interestingly, though, this type of competition does not necessarily lead to the delays in technology adoption and supracompetitive returns associated with refusals to interconnect by dominant firms.[69] It also has the virtue of promoting the rapid buildout of new network technologies and yields substantial consumer benefits while the race is ongoing.[70]

Indeed, this appears to be what was occurring between 1893 and 1907, when the Bell System and the independent telephone systems engaged in what amounted to a race for the market by investing heavily in providing service to the smaller cities, suburbs, and rural areas that the Bell System’s focus on long distance commercial traffic had caused it to bypass.[71] This competition emerged even though patent protection allowed the Bell System to enjoy a large initial lead.

Even if one large firm emerges, smaller groups can compensate by cooperating to form a network of equal or larger size. Customers that are reluctant to leave themselves vulnerable to being exploited by an emerging monopolist have additional reasons to adopt the network supported by the consortium.[72] Many scholars believe that this dynamic played a key role in the battle between Betamax and VHS to become the standard for video cassette recorders. What is sometimes forgotten is that Betamax launched first and was able to capture a large in initial lead. The simplistic vision of network effects would conclude that the larger size of its network would create a competitive advantage that later standards could not match. JVC countered by using licensing to recruit a large consortium of equipment manufacturers willing to support VHS.[73] In this way, smaller players can cooperate to counterbalance disadvantages in size.

This dynamic also puts the lie to the oft-asserted claim that network effects allowed the Bell System to drive its competitors out of business simply by refusing to interconnect with them.[74] A close analysis of the market conditions renders this perspective implausible. Because the independents had captured 51% of the market by 1907,[75] the independents could have defeated whatever advantage the Bell System might have gained from its refusal to interconnect simply by banding together to make a network of equal size.[76] In addition, the independents were the dominant providers of local telephone service in many parts of the Midwest. Given that the vast majority of calling was local, network effects should have given the independents the competitive advantage in those areas.[77]

The traditional account is also belied by the business strategy pursued by the independents. If the Bell System had been in a dominant position, one would have expected the independents to have been clamoring to interconnect with it. In fact, the independents did not want to interconnect with the Bell System any more than the Bell System wanted to interconnect with the independents. In many cases, having been the first to establish connections to surrounding areas and a strong position in regions such as the Midwest, the independents were able to use network economic effects to their advantage. Any suggestion that the Bell System was able to use refusal to interconnect as a competitive weapon is further belied by the fact that the Bell System began to regain its dominance only after it abandoned its policy of refusing to interconnect with the independents.[78]

Instead, the reemergence of the telephone monopoly was driven by a change in strategy in 1907. Recognizing that its attempt to outbuild the independents had failed, the Bell System pursued two classic anticompetitive strategies. First, it sought to merge to monopoly by acquiring independent systems. Second, if the independent refused to be acquired, the Bell System would instead adopt the equally classic anticompetitive practice of dividing the market with the independent by offering to withdraw from the territory in return for the independent’s promise to restrict its activities to a “small and compact” territory and to interconnect exclusively with the Bell System’s long distance network. The biggest problem with the disappearance of competition was pricing. Therefore, the Bell System dropped its previous opposition to government intervention and instead embraced rate regulation as an alternative to competition as a means for reining in price. As part of this regulatory compact, the Bell System insisted on protection against entry.[79] Although the Justice Department initially erected the Kingsbury Commitment to prevent such acquisitions, adherence to sound antitrust principles would disappear when the federal government took over the telephone network during World War I, when Postmaster General Albert Burleson sought to adopt the postal solution to universal service through rate averaging by ensuring each provider enjoyed a monopoly area.[80]

In the end, the regulatory regime created by the Kingsbury Commitment was abolished (with the full support of the independents) by the enactment of the Willis-Graham Act, which shifted responsibility for reviewing telephone mergers from the antitrust authorities to the Interstate Commerce Commission (ICC).[81] The ICC became a rubber stamp that approved essentially all telecommunications mergers.[82] During this period, both the Bell System and the independents also endorsed rate regulation of local telephone services by state public utility commissions.[83]

The eventual emergence of a telephone monopoly was thus the result of classic anticompetitive strategies that were unfortunately condoned by the government because price competition would be replaced by rate regulation. When properly understood, this history shows that the market dominance typically attributed to the use of the refusal to interconnect to leverage network effects was actually the result of other factors.

B. Size of Technical Improvements

Another factor that can enable a new technology to dislodge an incumbent despite network effects is the provision of additional value that exceeds the value derived from the size of the old network.[84] The larger the increase in value, the easier it is to overcome the impact of network effects.[85] This is particularly true given that in sufficiently large networks, the marginal benefit from adding another subscriber is likely to be low, which greatly reduces network economic effects’ marginal impact.[86]

Technical superiority is what allowed Sega to overcome Nintendo’s large preexisting installed base by releasing a 16-bit video game platform that represented a clear advance over Nintendo’s 8-bit technology[87] and helped Xbox enter despite the large scale enjoyed by PlayStation 2.[88] Another example is the role that consumers’ preferences for VHS’s ability to deliver longer playing times over Betamax’s greater portability played a large role in allowing VHS to overcome the fact that Betamax launched one year earlier and established an early lead.[89] Superior quality allowed Excel to displace Lotus 1-2-3, Quicken to displace Managing Your Money, and Word to displace WordStar and WordPerfect, despite being at significant size disadvantages.[90]

An oft-cited supposed counterexample is the QWERTY keyboard, which supposedly represents an obsolete technology locked into place by network effects despite the emergence of a superior technology.[91] This assertion is belied by the fact that QWERTY consistently beat its competitors in typing speed competitions, with the only evidence to the contrary being tests riddled with conflicts of interest conducted by the inventor and chief proponent of a rival keyboard.[92]

Perhaps most importantly for the current debate, the superiority of Google’s PageRank algorithm helped it overcome any advantages given by Altavista’s and Yahoo!’s greater initial network size despite the fact that Google was a relative latecomer to the search engine game.[93] Development of a superior product is also reported to have played a role in Facebook’s success in overcoming the multiyear head start enjoyed by Myspace.[94] The iPhone’s (and later Android’s) superior user interface allowed it to displace Nokia’s dominant Symbian platform notwithstanding Symbian’s dominant market position.

More systematic empirical research confirms the key role of technological superiority. A study of nineteen products and services relating to personal computers found frequent changes in market leadership driven by improvements in quality, a result inconsistent with simple winner-take-all inferences from being the first to market.[95] Furthermore, although both network effects and quality affect market share, quality proves more important. Network effects may delay higher-quality products from taking over the market.[96] Subsequent empirical work has confirmed how product quality can overcome first-mover advantages and network size.[97]

C. Market Growth

Another structural feature that can dissipate the impact of network effects is explosive growth in demand.[98] In growing markets, the number of users who have already made commitments to a particular technology is small compared to the number who will do so in the future. In such cases, the current market shares of particular firms are of little consequence. In short, networks’ value depends on the size they will attain in the future rather the size that they have attained today.[99]

Expectations about future growth played a role in VHS’s ability to overtake the early lead established by Betamax.[100] The importance of rapid market growth also helps explain how late-arriver Google (launched in 1998) was able to displace early market leaders such as Altavista, since it was only in the mid-1990s, following the development of hypertext market language (HTML) and the first graphic-oriented browser (Mosaic), that the number of U.S. Internet users began to take off.[101] The existence of a large percentage of users who had not yet adopted social networking similarly helps explain how Facebook was able to overcome Myspace’s initial market dominance.[102]

D. Variations in Consumer Preferences for Different Network Designs

Much as differences in the value placed on the ability to connect with particular endpoints can dissipate the impact of network effects, so can heterogeneity in consumer preferences in network architecture.[103] As Michael Katz and Carl Shapiro note:

Customer heterogeneity and product differentiation tend to limit tipping and sustain multiple networks. If the rival systems have distinct features sought by certain customers, two or more systems may be able to survive by catering to consumers who care more about product attributes than network size. Here, market equilibrium with multiple incompatible products reflects the social value of variety.[104]

Indeed, if what consumers want from the network is sufficiently heterogeneous, they will derive greater value from using a network better tailored to their preferences than from belonging to a larger network, and the equilibrium and welfare maximizing outcome will be multiple incompatible networks.

The point is demonstrated eloquently by a simple model put forth by Joseph Farrell and Garth Saloner, who wrote some of the pioneering papers on network economic effects. Assume that two different populations of end users each would prefer a slightly different standard and that both would benefit from network economic effects if they were part of the same network. Each group has two options: It can join the other group’s standard, in which case it gains from being part of a larger network, but loses value from adopting a standard that it prefers less. Or it can adhere to its preferred standard, in which case it benefits from consuming its preferred standard, but foregoes the benefits of network economic effects should the other group adhere to its preferred standard as well.[105]

The considerations driving the equilibrium are clear. If the value that either group derives from consuming its preferred standard is sufficiently large, the greater value will induce it to adopt its preferred standard even if it means being part of a smaller network. Any welfare losses from network fragmentation are more than offset by gains in allowing groups of end users to consume a standard that is a better fit with their preferences. Thus, much as monopolistic competition shows how heterogeneity in consumer preferences for different products can allow multiple firms to compete despite the presence of supply-side economies of scale caused by declining average costs, these models show how this same factor can overcome the demand-side economies of scale associated with network effects.

Allowing for the possibility of heterogeneity in consumer preferences for different network architectures can cause the bias towards a single network to disappear and permits stable equilibria with multiple networks each serving a subsegment of the overall market. The classic example is the co-existence of IBM and Apple as manufacturers of personal computers (PCs) during the 1980s and 1990s notwithstanding the presence of network effects and IBM’s significantly larger scale. The same dynamics appear to be allowing iOS to survive despite Android’s larger installed base.

E. Large Customers

The presence of large customers and suppliers can alleviate the impact of network effects. Firms that occupy a large proportion of a particular network may make that network less susceptible to becoming locked into any particular technology because their sheer size allows them to internalize a large proportion of the benefits of their network adoption decisions.[106] The existence of large players thus represents one way in which the problems of network externalities may be circumvented. A prime example is how quickly the standards battle between Blu-ray and HD-DVD ended after Walmart committed to Blu-ray.[107]

* * *

The theory and empirics on network effects, thus, reinforce the idea that certain structural preconditions must be satisfied before network effects can harm competition. Network effects cannot be simply equated with market concentration and market failure without the development of a detailed factual record, as required by traditional antitrust principles.

IV. Alternative Institutional Forms

Even in cases where the structure of network effects, the size of the countervailing externalities, and the structural conditions can support plausible claims that the presence of network effects can lead to market failure, a complete analysis requires consideration of whether alternative institutional forms exist that can counteract or mitigate these problems. Indeed, many networks contain institutional features that provide other ways to offset the impact of network effects.

A. Classic Responses to Positive Externalities

1. Coasean Markets

As noted earlier, a major source of potential problems is the presence of positive network externalities that confer benefits on others that the actor joining the network does not internalize. Positive externalities can lead to activity levels that fall below welfare-maximizing levels.

One classic solution to positive network externalities follows from Coase.[108] In response to Pigou’s claim that all positive externalities should be subsidized by the government, Coase showed how private parties can bargain around externalities so long as sufficient markets exist to enable them to do so.[109]

This suggests a straightforward solution to positive network externalities. Network owners can allow users who are joining a new network to internalize all of the benefits of their adoption decision simply by giving those users a discount equal to the benefits they are conferring on existing network participants.[110] The fact that the benefits resulting from any increase in the network’s value would accrue directly to the network owner effectively aligns social benefits with private benefits. Such introductory pricing schemes are legion.

2. Vertical Integration and Restraints

Although Coasean markets work for direct network effects, which arise when value is determined by the number of people who have adopted the same technology, other solutions are possible when the network effects are indirect, which arise when value is determined by the number of people who have adopted complementary goods and services.[111] The literature on network effects emphasizes how vertical integration can incentivize production of both the primary and complementary products.[112] The literature on General Purpose Technologies (GPTs), a related concept that also focuses on technologies that generate positive externalities, similarly indicates that vertical integration can allow the producers of the platform technology to internalize more of the positive externalities they generate for complementary products.[113]

This argument fits into a long tradition of theories exploring how the degree of vertical integration varies over the course of an industry’s life cycle. The best-known theory was offered by Nobel laureate George Stigler. Stigler argues that vertical integration in an industry follows a “U” shape over time, beginning as vertically integrated, transitioning to vertically disintegrated as the industry matures, and then returning once again to vertically integrated as the industry declines. Because young industries often employ new materials and technologies that are typically unavailable on the open market, firms operating in these industries must produce all of their key inputs themselves. As demand for the product becomes better established, production becomes sufficiently large, and risk drops to the point where third parties have strong incentives to begin providing these inputs. When the industry enters its decline phase, the decline in sales volume causes third-party input providers to disappear, and firms operating in this industry must once again provide these inputs for themselves.[114] Indeed, two-sided markets that require the simultaneous development of complementary products often rely on a single, vertically integrated player to get both sides on board.[115]

History has many examples of this dynamic. The broadcasting and cable industries relied on vertical integration to meet the need for expanded content during their early years.[116] Other examples include the fact that Apple relied on its proprietary software provider Claris to produce the first generation of software for the Macintosh.[117] Such practices are likely to benefit consumers. Several recent surveys of the empirical literature of vertical integration and restraints found that the overwhelming majority of studies found the practice to be neutral or welfare enhancing.[118]

B. Multihoming and Gateways

Another oft-overlooked consideration that can mitigate the problems associated with network effects is the presence of gateways between networks (also sometimes called adapters or converters).[119] Indeed, one of the seminal articles on network effects by Katz and Shapiro conclude that if gateways allow perfect compatibility, all anticompetitive effects disappear.[120] Carmen Matutes and Pierre Regibeau similarly find that if gateways exist that allow different actors to decide unilaterally whether their components are compatible with other systems by building gateways, “compatibility arises and is always socially optimal provided that there are no costs to achieving standardization.”[121] Paul David and Julie Bunn likewise conclude that “initial technical incompatibilities between variant formulations of such technologies . . . can have their economic importance mitigated as a result of the ex post introduction of gateway innovations.”[122] In effect, perfect gateways obviate the need to choose one network or the other by turning all component networks into one large network.

Even imperfect gateways can provide improved economic welfare. Joseph Farrell and Garth Saloner present a model that enables them to explore the implications of imperfect gateways. After confirming Katz and Shapiro’s conclusion that costless and perfect gateways eliminate any adverse impact of network effects, Farrell and Saloner demonstrate that the welfare impact is ambiguous when gateways are imperfect.[123]

Multihoming is a related practice that allows individual users to belong to multiple networks at the same time. For example, many users maintain accounts with both Uber and Lyft instead of choosing between them. Much like gateways, multihoming prevents network adoption from being an either-or decision. Eliminating the potential for winner-takes-all dynamics reduces any one network’s ability to exercise market power.[124] The dynamics can be complex. For example, independent decision-making about multihoming can actually make the decisionmaker worse off.[125]

There is a long history of gateways helping to dissipate the impact of network effects. For example, the ability to read WordPerfect files facilitated the entry of Word.[126] Excel’s capacity to read Lotus 1-2-3 files helped enable it to overcome Lotus’s large advantage in installed base.[127] The functionality of Apple computers to read DOS-formatted floppy disks helped its adoption, as did the inclusion of chips that allowed them to run software created for Windows.[128] Similarly, multihoming prevented Uber from forestalling the emergence of Lyft.[129] The ability of users to subscribe to multiple messaging services simultaneously prevented America Online from dominating the market.[130] The ability for users to maintain multiple zero-cost browsers and media players undercut the winner-take-all dynamics that lay at the heart of the Microsoft cases.[131]

Together these analyses suggest that creating gateways and multihoming can dissipate any monopoly power enjoyed by large networks. They provide another reason that competition law cases require more than the mere assertion of the presence network effects.

Conclusion

Despite attempts by recent reports to equate network effects with market failure, an examination of both the theoretical and empirical literature make clear that the relationship between network effects and market failure is more complex. Indeed, history is littered with once-leading digital companies that can attest to the reality that network effects are not sufficient by themselves to protect the dominance of early-market leaders. Considerations such as variation in the value of connections and the existence of countervailing externalities make the relationship between network effects and market failure ambiguous. In addition, network-effects based theories depend on the satisfaction of structural preconditions that must be shown in individual cases. Even when those preconditions are met, alternative institutional solutions exist that can mitigate or even dissipate the impact of network effects. All of this is informed by the history of antitrust and regulatory enforcement along with an emerging empirical literature showing that network effects can lead to a wide range of results.

Antitrust law has long required plaintiffs to produce a clear theory supported by evidence sufficient to show that a particular practice is likely to harm consumers. The literature and enforcement history make clear that the mere presence of network effects is not by itself sufficient to establish the presence of entry barriers, market dominance, or harm to competition. Enforcement officials should resist the temptation to treat the mere assertion of network effects as the basis for an enforcement action and should continue to rely on the traditional tools of competition law. Doing so requires doing the hard work to build cases, but that is nothing new and is necessary if antitrust law is to fulfill its responsibility of promoting the welfare of consumers.

Footnotes

* John H. Chestnut Professor of Law, Communication, and Computer & Information Science and Founding Director of the Center for Technology, Innovation and Competition at the University of Pennsylvania.

[1] See, e.g., Am. Tel. & Tel. Co., Annual Report 21–22 (1908).

[2] See generally Jeffrey Rohlfs, A Theory of Interdependent Demand for a Communications Service, 5 Bell J. Econ. & Mgmt. Sci. 16 (1974).

[3] See, e.g., W. Brian Arthur, Competing Technologies, Increasing Returns and Lock-in by Historical Events, 99 Econ. J. 116 (1989); Paul A. David, Clio and the Economics of QWERTY, 75 Am. Econ. Rev. (Papers & Proc.) 332 (1985); Joseph Farrell & Garth Saloner, Standardization, Compatibility, and Innovation, 16 RAND J. Econ. 70 (1985); Michael L. Katz & Carl Shapiro, Network Externalities, Competition, and Compatibility, 75 Am. Econ. Rev. 424 (1985).

[4] For recent surveys, see Daniel Birke, The Economics of Networks: A Survey of the Empirical Literature, 23 J. Econ. Surveys 762 (2009); Joseph Farrell & Paul Klemperer, Coordination and Lock-In: Competition with Switching Costs and Network Effects, in 3 Handbook of Industrial Organization 1967, 1971, 1974–76, 2055 (Mark Armstrong & Robert Porter eds., 2007); Oz Shy, A Short Survey of Network Economics, 38 Rev. Indus. Org. 119 (2011).

[5] United States v. Microsoft Corp., 253 F.3d 34, 49-50, 55-56 (D.C. Cir. 2001); United States v. Microsoft Corp., 147 F.3d 935, 939, 953 (D.C. Cir. 1998).

[6] See LiveUniverse, Inc. v. MySpace, Inc., No. CV 06-6994 AHM (RZx), 2007 WL 6865852, at *8–10 (C.D. Cal. June 4, 2007), aff’d, 304 Fed. Appx. 554 (9th Cir. 2008).

[7] See Australian Competition & Consumer Commission, Digital Platforms Inquiry: Final Report 66–68 (2019), available at https://www.accc.gov.au/system/files/Digital%20platforms%20inquiry%20-%20final%20report.pdf; Digital Competition Expert Panel, Unlocking Digital Competition: Report of the Digital Competition Expert Panel 35 (2019), available at https://assets.

publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/785547/unlocking_digital_competition_furman_review_web.pdf; Jacques Crémer, Yves-Alexandre de Montjoye, & Heike Schweitzer, Competition Policy in the Digital Era: Final Report 20–24 (2019), available at https://ec.europa.eu/competition/publications/reports/kd0419345enn.pdf; Stigler Ctr. for the Study of the Econ. and the State, Stigler Committee on Digital Platforms 38–39 (2019), available at https://research.chicagobooth.edu/-/media/research/stigler/pdfs/digital-platforms—committee-report—stigler-center.pdf.

[8] Michael L. Katz & Carl Shapiro, Technology Adoption in the Presence of Network Externalities, 94 J. Pol. Econ. 822, 823 (1986).

[9] This discussion draws on work previously published as Christopher S. Yoo, Moore’s Law, Metcalfe’s Law, and Optimal Interoperability, 14 Colo. Tech. L.J. 87, 91-94, 96-102 (2015).

[10] Daniel F. Spulber & Christopher S. Yoo, Access to Networks: Economic and Constitutional Considerations, 88 Cornell L. Rev. 885, 922 (2003).

[11] See, e.g., Neil Gandal, Compatibility, Standardization, and Network Effects: Some Policy Implications, 18 Oxford Rev. Econ. Pol. 80, 80–81 (2002); Katz & Shapiro, supra note 8, at 823 (1986); S.J. Liebowitz & Stephen E. Margolis, Network Externality: An Uncommon Tragedy, 8 J. Econ. Persp. 133, 139-40 (1994).

[12] Bob Metcalfe, Metcalfe’s Law After 40 Years of Ethernet, 46 Computer 26, 26-28 (2013).

[13] George Gilder, Metcalfe’s Law and Legacy, Forbes ASAP, Sept. 13, 1993, at 158.

[14] Bob Metcalfe, Metcalfe’s Law: A Network Becomes More Valuable as It Reaches More Users, InfoWorld, Oct. 2, 1995, at 53.

[15] Metcalfe¸ supra note 12, at 27-28; Paul Festa, Andreesen Preaches AOL Religion, CNet (Jan. 2, 2002, 4:43 PM), http://www.cnet.com/news/andreessen-preaches-aol-religion; Gilder, supra note 13.

[16] Anthony Wing Kosner, Facebook Values Itself Based on Metcalfe’s Law, But the Market Is Using Zipf’s, Forbes Tech (May 31, 2012, 1:14 PM), http://www.forbes.com/sites/anthonykosner/2012/05/31/facebook-values-itself-based-on-metcalfes-law-but-the-market-is-using-zipfs/; Om Malik, Metcalfe’s Law, Meet Market Reality, GigaOm (Jan. 21, 2015, 3:14 AM), https://gigaom.com/2005/01/21/metcalfes-law-meet-market-reality/.

[17] David P. Reed, The Law of the Pack, Harv. Bus. Rev., Feb. 2001, at 23.

[18] Bob Briscoe, Andrew Odlyzko, & Benjamin Tilly, Metcalfe’s Law Is Wrong, IEEE Spectrum, July 2006, at 34, 38.

[19] See Metcalfe’s Law: Right? Wrong?, IEEE Spectrum, Nov. 2006, at 10, http://spectrum.ieee.org

/computing/networks/metcalfes-law-right-wrong/; Simeon Simeonov, Metcalfe’s Law: More Misunderstood than Wrong?, High Contrast (July 26, 2006), http://blog.simeonov.com/2006/07/26/metcalfes-law-more-misunderstood-than-wrong/.

[20] Joe Weinman, Is Metcalfe’s Law Way Too Optimistic?, Bus. Comm. Rev., Aug. 2007, at 18, 19-20.

[21] See G.M. Peter Swann, The Functional Form of Network Effects, 14 Info. Econ. & Pol’y 417, 423-25 (2002).

[22] Christopher S. Yoo, Free or Fee?: The Economics of Advertising Support vs. Direct Payments for Media Content, in Media Markets and Competition Law: Multinational Perspectives 59, __ (Antonio Bavasso, David S. Evans, & Douglas H. Ginsburg eds., 2019).

[23] Metcalfe, supra note 14, at 53 (“OK, Metcalfe’s Law might overstate the value of a network for a very large N. A user equipped to communicate with 50 million other users might not have all that much to talk about with each of them. So maybe the growth of systemic network value rolls off after some N.”); Andrew McAfee & François-Xavier Oliveau, Confronting the Limits of Networks, Sloan Mgmt. Rev., July 2002, at 86, http://sloanreview.mit.edu/article/confronting-the-limits-of-networks/ (quoting Metcalfe as recognizing in 1998, “The law may be optimistic as the number of people on a network gets very large.”).

[24] Jeffrey H. Rohlfs, Bandwagon Effects in High Technology Industries 29 (2001).

[25] Id. at 55, 195.

[26] Id. at 85.

[27] Id. at 211-16.

[28] Briscoe et al., supra note 18, at 37.

[29] McAfee & Oliveau, supra note 23, at 86.

[30] Christopher S. Yoo, Wickard for the Internet?: Network Neutrality After Verizon v. FCC, 66 Fed. Comm. L.J. 415, 439 (2014).

[31] Id.

[32] Feng Zhu et al., Network Interconnectivity and Entry into Platform Markets 4–5 (Harv. Bus. Sch. Working Paper 19-062, 2019), https://www.hbs.edu/faculty/Publication%20Files/19-062_ca94ef8a-6589-4210-a598-90900bd772e5.pdf.

[33] Feng Zhu & Marco Iansiti, Why Some Platforms Thrive and Others Don’t, Harv. Bus. Rev., Jan.–Feb. 2019, at 118, 121.

[34] David S. Evans & Richard Schmalensee, Matchmakers: The New Economics of Multisided Platforms 13-14 (2016).

[35] David S. Evans & Richard Schmalensee, Debunking the “Network Effects” Bogeyman, Regulation, Winter 2017-2018, at 36, 38; Zhu & Iansiti, supra note 33, at 122.

[36] This discussion draws on work previously published as Christopher S. Yoo, Network Neutrality, Consumers, and Innovation, 2008 U. Chi. Legal F. 179, 222–27.

[37] David S. Evans & Richard Schmalensee, The Industrial Organization of Markets with Two-Sided Platforms, Competition Pol’y Int’l, Spring 2007, at 11, https://www.law.berkeley.edu/wp-content

/uploads/2015/04/Evans-Schmalensee-The-Industrial-Organization-of-Markets-with-Two-Sided-Platforms-2007.pdf; Jean-Charles Rochet & Jean Tirole, Two-Sided Markets: A Progress Report, 37 RAND J. Econ. 645, 658–61 (2006).

[38] Id. at 659.

[39] Jean-Charles Rochet & Jean Tirole, Platform Competition in Two-Sided Markets, 1 J. Eur. Econ. Ass’n 990, 1013-17 (2003).

[40] Ohio v. Am. Express Co., 138 S. Ct. 2274 (2018).

[41] Id. at 2282, 2288.

[42] McAfee & Oliveau, supra note 23, at 86.

[43] See Weinman, supra note 20, at 20.

[44] Samuel M. Smith, Meta-Platforms and Cooperative Network-of-Network Effects, SelfRule (Mar. 25, 2019), https://medium.com/selfrule/meta-platforms-and-cooperative-network-of-networks-effects-6e61eb15c586; Simeon Simeonov, Metcalfe’s Law: More Misunderstood than Wrong?, HighContrast (July 26, 2006), http://blog.simeonov.com/2006/07/26/metcalfes-law-more-misunderstood-than-wrong/.

[45] Metcalfe¸ supra note 12, at 29; Bob Metcalfe, Metcalfe’s Law Recurses Down the Long Tail of Social Networking, VCMike’s Blog (Aug. 18, 2006), https://vcmike.wordpress.com/2006/08/18/metcalfe-social-networks/.

[46] S.J. Liebowitz & Stephen E. Margolis, Are Network Externalities a New Source of Market Failure?, 17 Res. Law & Econ. 1, 14–15 (1995).

[47] Douglas Galbi, Telephone Social Networks, Purple Motes (Nov. 29, 2009), http://purplemotes

.net/2009/11/29/telephone-social-networks/ (empirically concluding that the average American calls only five people more than once in a given month).

[48] Paul Adams, Grouped: How Small Groups of Friends Are the Key to Influence on the Web 23 (2012).

[49] R.I.M. Dunbar, Coevolution of Neocortex Size, Group Size and Language in Humans, 16 Behav. & Brain Sci. 681, 685-87 (1993).

[50] Metcalfe, supra note 12, at 30.

[51] Xing-Zhou Zhang, Jing-Jie Liu, & Zhi-Wei Xu, Tencent and Facebook Data Validate Metcalfe’s Law, 30 J. Computer Sci. & Tech. 246 (2015); Leo Van Hove, Metcalfe’s Law and Network Quality: An Extension of Zhang et al., 31 J. Computer Sci. & Tech. 117 (2016) (confirming this result when controlling for changes in network quality over time). Interestingly, the Zhang et al. study found that the costs reported in Facebook’s and Tencent’s financial reports grew quadratically with network size instead of linearly as Metcalfe hypothesized, although the authors simply reported this empirical finding without offering any explanation for it. Zhang et al., supra note 51, at 247, 248–49, 250. The surprising nature of this finding calls for further investigation.

[52] António Madureira et al., Empirical Validation of Metcalfe’s Law: How Internet Usage Patterns Have Changed Over Time, 25 Info. Econ. & Pol’y 246 (2013).

[53] Leo Van Hove, Testing Metcalfe’s Law: Pitfalls and Possibilities, 37 Info. Econ. & Pol’y 67 (2016).

[54] Zhou & Marshall van Alstyne, Platform Value and Network Effects 14–15 (2019) (unpublished manuscript), http://questromworld.bu.edu/platformstrategy/files/2019/07/PlatStrat2019_paper_44.pdf.

[55] This discussion draws on work previously published as Christopher S. Yoo, Vertical Integration and Media Regulation in the New Economy, 19 Yale J. on Reg. 171, 278–85 (2002); and Spulber & Yoo, supra note 10, at 921–31.

[56] Joseph Farrell & Garth Saloner, Installed Base and Compatibility: Innovation, Product Preannouncements, and Predation, 76 Am. Econ. Rev. 940 (1986); Michael L. Katz & Carl Shapiro, Systems Competition and Network Effects, 8 J. Econ. Persp. 93, 94–95, 105–06 (1994).

[57] Farrell & Saloner, supra note 56, at 941; Katz & Shapiro, supra note 56, at 100.

[58] Farrell & Saloner, supra note 56, at 941–42.

[59] Compare id. at 942 (defining “excess momentum” as “the inefficient adoption of a new technology”), with Michael L. Katz & Carl Shapiro, Product Introduction with Network Externalities, 40 J. Indus. Econ. 55, 73 (1992) (defining “insufficient friction” as “a bias towards new technology”).

[60] Evans & Schmalensee, supra note 35, at 38.

[61] This discussion draws on work previously published as Daniel F. Spulber & Christopher S. Yoo, Mandating Access to Telecom and the Internet: The Hidden Side of Trinko, 107 Colum. L. Rev. 1822, 1889–96 (2007).

[62] Stanley M. Besen & Joseph Farrell, Choosing How to Compete: Strategies and Tactics in Standardization, 8 J. Econ. Persp. 117, 119–29 (1994); Jacques Crémer, Patrick Rey & Jean Tirole, Connectivity in the Commercial Internet, 48 J. Indus. Econ. 433, 444 (2000); Katz & Shapiro, supra note 11, at 839–40; Rohlfs, supra note 2, at 32.

[63] Katz & Shapiro, supra note 56, at 109.

[64] Gerald R. Faulhaber, Bottlenecks and Bandwagons: Access Policy in the New Telecommunications, in 2 Handbook of Telecommunications Economics 487, 501–02 (Sumit K. Majumdar et al. eds., 2005); see also Nicholas Economides, The Economics of the Internet Backbone, in 2 Handbook of Telecommunications Economics, supra note 64, at 373, 390 (recognizing that network economic effects give firms strong incentives to interconnect); Katz & Shapiro, supra note 3, at 429 (noting that “[a]s the number of firms becomes increasingly large,” equilibrium in which all firms interconnect converges to perfectly competitive equilibrium); Katz & Shapiro, supra note 56, at 105 (noting that “[i]n markets with network effects, there is natural tendency toward de facto standardization . . .”).

[65] Interconnection & Resale Obligations Pertaining to Commercial Mobile Radio Services, Fourth Report and Order, 15 FCC Rcd. 13523, 13534 ¶ 28 (2000).

[66] Verizon Communications, Inc. and MCI, Inc. Applications for Approval of Transfer of Control, Memorandum Opinion and Order, 20 FCC Rcd. 18433, 18496 ¶ 118 (2005); SBC Communications, Inc. and AT&T Corp. Applications for Approval of Transfer of Control, Memorandum Opinion and Order, 20 FCC Rcd. 18290, 18354 ¶ 117 (2005).

[67] AT&T Inc. and BellSouth Corp. Application for Transfer of Control, Memorandum Opinion and Order, 22 FCC Rcd. 5662, 5731 ¶ 129, 5734-36 ¶¶ 140–144 (2007).

[68] Application of WorldCom, Inc. and MCI Communications Corp. for Transfer of Control of MCI Communications Corp. to WorldCom, Inc., Memorandum Opinion and Order, 13 FCC Rcd. 18025, 18108–11 ¶¶ 150-151, 18115 ¶ 155 (1998).

[69] Besen & Farrell, supra note 62, at 119-20, 122–24 (noting how competition between incompatible networks can accelerate as well as delay market growth, may dissipate any supracompetitive returns, and may lead to penetration pricing and long-term commitments to lower prices)

[70] Thomas W. Hazlett, Private Monopoly and the Public Interest: An Economic Analysis of the Cable Television Franchise, 134 U. Pa. L. Rev. 1335, 1351–55 (1986).

[71] Milton L. Mueller, Jr., Universal Service 39–42, 55–60, 70–71, 74–75 (1997); Richard Gabel, The Early Competitive Era in Telephone Communications, 1893-1920, 34 Law & Contemp. Probs. 340, 344–45 (1969).

[72] Smith, supra note 44.

[73] Michael A. Cusumano, Yiorgis Mylonadis, & Richard S. Rosenbloom, Strategic Maneuvering and Mass-Market Dynamics: The Triumph of VHS over Beta, 66 Bus. Hist. Rev. 51, 72–76 (1992); Masaaki Kotabe, Arvind Sahay, & Preet S. Aulakh, Emerging Role of Technology Licensing in the Development of Global Product Strategy: Conceptual Framework and Research Propositions, 69 J. Marketing 73, 77 (1996).

[74] See, e.g., Mark A. Lemley, Antitrust and the Internet Standardization Problem, 28 Conn. L. Rev. 1041, 1046 n.19 (1996) (arguing that refusing to interconnect with its smaller rivals allowed the Bell System to acquire nearly 90% of the market by 1920); Howard A. Shelanski & J. Gregory Sidak, Antitrust Divestiture in Network Industries, 68 U. Chi. L. Rev. 1, 8 (2001) (pointing to AT&T’s refusal to interconnect with independent competitors during the early twentieth century as an example of how network effects can lead to monopoly).

[75] Robert Bornholz & David S. Evans, The Early History of Competition in the Telephone Industry, in Breaking Up Bell: Essays on Industrial Organization and Regulation 7, 13 (David S. Evans ed., 1983); see also Gabel, supra note 71, at 344 (reporting 3.0 million independent lines in 1907, compared with 3.1 million Bell lines).

[76] Roger G. Noll & Bruce M. Owen, The Anticompetitive Uses of Regulation: United States v. AT&T, in The Antitrust Revolution 290, 292 (John E. Kwoka, Jr. & Lawrence J. White eds., 1989).

[77] Peter Decherney, Nathan Ensmenger, & Christopher S. Yoo, Are Those Who Ignore History Doomed to Repeat It?, 78 U. Chi. L. Rev. 1627, 1632–33 (2011).

[78] Mueller, supra note 71, at 10, 51, 55–60, 72–80, 107–10, 115–17, 121–22; Bornholz & Evans, supra note 75, at 25–27; Gabel, supra note 71, at 353–54; David F. Weiman & Richard C. Levin, Preying for Monopoly? The Case of Southern Bell Telephone Company, 1894-1912, 102 J. Pol. Econ. 103, 115, 118 (1994).

[79] Mueller, supra note 71, at 78, 99–100, 107–13, 127–28; Gabel, supra note 71, at 355–58; Weiman & Levin, supra note 78, at 118, 120–25.

[80] Michael A. Janson & Christopher S. Yoo, The Wires Go to War: The U.S. Experiment with Government Ownership of the Telephone System During World War I, 91 Tex. L. Rev. 983, 1013–17 (2013).

[81] Ch. 20, 42 Stat. 27 (1921).

[82] Bureau of Statistics, Interstate Commerce Comm’n, Interstate Commerce Commission Activities, 1887-1937, at 201 (1937); Glen O. Robinson, The Federal Communications Act: An Essay on Origins and Regulatory Purpose, in A Legislative History of the Communications Act of 1934, at 3, 8 n.25 (Max D. Paglin ed., 1989).

[83] Mueller, supra note 71, at 99–100; Gabel, supra note 71, at 357; Robinson, supra note 82, at 6–7.

[84] This discussion draws on work previously published as Spulber & Yoo, supra note 10, at 928, 931.

[85] Katz & Shapiro, supra note 56, at 106 (observing that new, incompatible standards may emerge despite the presence of network externalities if “consumers . . . care more about product attributes than network size.”); S.J. Liebowitz & Stephen E. Margolis, The Fable of the Keys, 33 J.L. & Econ. 1, 4 (1990) (“The greater the gap in performance between two standards, . . . the more likely that a move to the efficient standard will take place.”).

[86] Bridger M. Mitchell & Ingo Vogelsang, Telecommunications Pricing: Theory and Practice 55 (1991); A. de Fontenay & J.T. Lee, B.C./Alberta Long Distance Calling, in Economic Analysis of Telecommunications: Theory and Applications 199, 207-09 (Léon Courville et al. eds. 1983); G. Yarrow, Dealing with Social Obligations in Telecoms, in Regulating Utilities: A Time for Change? 67 (S. Sayer et al. eds., 1996).

[87] Robert Pitofsky, Chairman, Fed. Trade Comm’n, Antitrust Analysis in High-Tech Industries: A 19th Century Discipline Addresses 21st Century Problems, Remarks before American Bar Association Section of Antitrust Law’s Antitrust Issues in High-Tech Industries Workshop (Feb. 25, 1999) (transcript available at http://www.ftc.gov/speeches/pitofsky/hitch.htm).

[88] Feng Zhu & Marco Iansiti, Entry into Platform Markets, 33 Strategic Mgmt. J. 88, 98–100 (2012).

[89] S.J. Liebowitz & Stephen E. Margolis, Path Dependence, Lock-In, and History, 11 J.L. Econ. & Org. 205, 218–20 (1995). But see Hiroshi Ohashi, The Role of Network Effects in the US VCR Market, 1978-1986, 12 J. Econ. & Mgmt. Strategy 447, 475 (2003) (attributing VHS’s success to its superiority in the characteristics domain through 1982, but finding that network effects during late years); Sangin Park, Quantitative Analysis of Network Externalities in Competing Technologies, The VCR Case, 86 Rev. Econ. & Stat. 937, 944 (2004) (same).

[90] Gerald J. Tellis, Eden Yin, & Rakesh Niraj, Does Quality Win? Network Effects Versus Quality in High-Tech Markets, 44 J. Mktg. Res. 135, 140–43 (2009).

[91] David, supra note 3.

[92] Liebowitz & Margolis, supra note 85, at 8–21; Neil M. Kay, Rerun the Tape of History and QWERTY Always Wins, 42 Res Pol’y 1175 (2013).

[93] Justus Haucap & Ulrich Heimeshoff, Google, Facebook, Amazon, eBay: Is the Internet Driving Competition or Marketplace Monopolization?, 11 Int’l Econ. & Econ. Pol’y 49, 55 (2014).

[94] Alexia Tsotsis, Sean Parker on Why Myspace Lost to Facebook, TechCrunch (June 28, 2011, 7:42 PM EDT), https://techcrunch.com/2011/06/28/sean-parker-on-why-myspace-lost-to-facebook/.

[95] Tellis et al., supra note 90, at 147.

[96] Id.

[97] David P. McIntyre, In a Network Industry, Does Product Quality Matter?, 28 J. Product Innovation Mgmt. 99 (2011); Zhu & Iansiti, supra 88.

[98] This discussion draws on work previously published as Yoo, supra note 55, at 280.

[99] Katz & Shapiro, supra note 59, at 67, 73; S.J. Liebowitz & Stephen E. Margolis, Should Technology Choice Be a Concern of Antitrust Policy?, 9 Harv. J.L. & Tech. 283, 292, 312 (1996); Carl Shapiro, Aftermarkets and Consumer Welfare: Making Sense of Kodak, 63 Antitrust L.J. 483, 490 (1995).

[100] Park, supra note 89, at 944.

[101] Christopher S. Yoo, The Dynamic Internet: How Technology, Users, and Businesses Are Transforming the Network 21 (2012).

[102] Gil Press, Why Facebook Triumphed Over All Other Social Networks, Forbes (Apr. 8, 2018, 4:11 PM EDT), https://www.forbes.com/sites/gilpress/2018/04/08/why-facebook-triumphed-over-all-other-social-networks/#2afa2ffe6e91.

[103] This discussion draws on work previously published as Yoo, supra note 55, at 280–81; and Christopher S. Yoo, Beyond Network Neutrality, 19 Harv. J.L. & Tech. 1, 34–36 (2005).

[104] Katz & Shapiro, supra note 56, at 106; Liebowitz & Margolis, supra note 99, at 292 (“Where there are differences in preference regarding alternative standards, coexistence of standards is a likely outcome.”).

[105] Joseph Farrell & Garth Saloner, Standardization and Variety, 20 Econ. Letters 71 (1986).

[106] Katz & Shapiro, supra note 56, at 102–03.

[107] Raju Mudhar, The Terminal Cost of Failing to Launch, Toronto Star, June 30, 2015, at S6.

[108] This discussion draws on work previously published as Christopher S. Yoo, Network Neutrality and the Economics of Congestion, 94 Geo. L.J. 1847, 1891 (2006).

[109] R.H. Coase, The Problem of Social Cost, 3 J.L. & Econ. 1 (1960).

[110] Liebowitz & Margolis, supra note 46, at 11-13; Liebowitz & Margolis, supra note 11, at 137.

[111] This discussion draws on work previously published as Christopher S. Yoo, Is There a Role for Common Carriage in an Internet-Based World?, 51 Hous. L. Rev. 545, 557–58 (2013); Yoo, supra note 77, at 1668–70; and Christopher S. Yoo, Technological Determinism and Its Discontents, 127 Harv. L. Rev. 914, 942 (2014).

[112] Katz & Shapiro, supra note 56, at 103–04.

[113]Timothy F. Bresnahan & M. Trajtenberg, General Purpose Technologies: “Engines of Growth”?, 65 J. Econometrics 83, 94-96 (1995).

[114] George Stigler, The Division of Labor Is Limited by the Extent of the Market, 59 J. Pol. Econ. 185, 190 (1951).

[115] Bernard Caillaud & Bruno Jullien, Chicken & Egg: Competition among Intermediation Service Providers, 34 RAND J. Econ. 309, 310–11, 322–23 (2003); Rochet & Tirole, supra note 39, at 990, 1013, 1018.

[116] Ithiel de Sola Pool, Technologies of Freedom 35 (1983); Bruce M. Owen & Gregory L. Rosston, Local Broadband Access: Primum Non Nocere or Primum Processi? A Property Rights Approach, in Net Neutrality or Net Neutering: Should Broadband Internet Services Be Regulated? 163, 164–65 (Thomas M. Lenard and Randolph J. May eds, 2006); Alfred E. Kahn, A Democratic Voice of Caution on Net Neutrality 3 (Progress Snapshot, Release 2.24, Oct. 2006)).

[117] Claris Corporation, Presenting Claris 1.0, InfoWorld, Sept. 26, 1988, at S8-S9.

[118] James C. Cooper et al., Vertical Antitrust Policy as a Problem of Inference, 23 Int’l J. Indus. Org. 639, 648–58 (2005); Francine Lafontaine & Margaret Slade, Exclusive Contracts and Vertical Restraints: Empirical Evidence and Public Policy, in Handbook of Antitrust Economics 391, 408–09 (Paolo Buccirossi ed., 2008); Francine Lafontaine & Margaret Slade, Vertical Integration and Firm Boundaries: The Evidence, 45 J. Econ. Lit. 629, 680 (2007).

[119] This discussion draws on work previously published as Christopher S. Yoo, When Antitrust Met Facebook, 19 Geo. Mason L. Rev. 1147, 1153–54 (2012).

[120] Katz & Shapiro, supra note 3, at 435-36, 439.

[121] Carmen Matutes & Pierre Regibeau, “Mix and Match”: Product Compatibility Without Network Externalities, 19 RAND J. Econ. 221, 232 (1988).

[122] Paul A. David & Julie Ann Bunn, The Economics of Gateway Technologies and Network Evolution: Lessons from Electricity Supply Industry, 3 Info. Econ. & Pol’y 165, 197 (1988).

[123] Joseph Farrell & Garth Saloner, Converters, Compatibility, and the Control of Interfaces, 40 J. Indus. Econ. 9, 32 (1992).

[124] Bernard Caillaud & Bruno Julien, Chicken and Egg: Competing Matchmakers, 34 Rand J. Econ. 309 (2003); Zhu & Iansiti, supra note 35, at 124–25.

[125] Benjamin E. Hermalin & Michael L. Katz, Your Network or Mine? The Economics of Routing Rules, 37 RAND J. Econ. 692 (2006).

[126] Farrell & Saloner, supra note 123, at 10.

[127] Neil Gandal, Hedonic Price Indexes for Spreadsheets and an Empirical Test for Network Externalities, 25 RAND J. Econ. 160, 168–69 (1994).

[128] Thomas R. Eisenmann, Geoffrey Parker, & Marshall Van Alstyne, Opening Platforms: How, When, and Why?, in Platforms, Markets and Innovation 131, 138 (Annabelle Gawer ed., 2009); Carl Shapiro & Hal Varian, Information Rules 287 (1999).

[129] Catherine Tucker, Network Effects and Market Power: What Have We Learned in the Last Decade?, Antitrust, Spring 2018, at 77, 78–79; Zhu & Iansiti, supra note 33, at 124.

[130] Toker Godanoglu & Julian Wright, Multihoming and Compatibility, 24 Int’l J. Indus. Org. 45, 58–59 (2006).

[131] Nicholas Petit & Norman Neyrinck, Back to Microsoft I and II: Tying and the Art of Secret Magic, 2 J. Eur. Competition L & Practice 117, 118 (2011).